Aatrix offers a suite of payroll and tax filing solutions that is ideal for budget-conscious Mac users, although it also has a Windows version. Its payroll tools for Mac include direct deposits, an automatic tax table updater, and a “Timecard” program for capturing clock-ins/outs. Aatrix’s payroll software is available for download if you subscribe to its tax table service, which costs $259.95 per year; its tax filing services range from 49 cents to $2.19 per employee, per filing.

What We Like

- Mac- and Windows-compatible

- Flat-fee pricing

- Integrates with QuickBooks accounting

- Access to free time tracking software

What's Missing

- Not cloud-based; you can only access the system on the computer it was installed on

- Interface looks dated

- Lacks onboarding tools and doesn’t remit/file payroll taxes for you

- Not compatible with Mac OS 10.15 Catalina and Windows XP (as of this writing)

Deciding Factors

- Ease of use: Interface is relatively simple to learn and use, although you need to have basic knowledge on how to run payroll

- Pricing: For an annual fee of $259.95, you get its tax table update services, time tracking tools, and a downloadable payroll software

- Add-on solutions

- Payroll tax filings (via a self-service “eFile Center”): 49 cents to $2.19 per employee, per filing; has a minimum spend requirement of $24.95

- “Print & Mail Payroll Reports” solution: $79.95 per year

- System requirements

- For Mac: Requires Mac OS 10.7 and later (except Mac OS 10.15 Catalina)

- For Windows: Requires at least Windows Vista SP 2

What We Recommend Aatrix For

Aatrix is simple to use but does not provide a complete human resources (HR) solution for managing recruitment, onboarding, and performance reviews. It primarily offers tools for processing payroll. While its system calculates payroll taxes, deductions, and employee payments, it doesn’t send out paychecks and file tax forms for you.

In short, Aatrix is best for:

- Budget-conscious companies looking for a Mac-compatible payroll solution: Aatrix is one of our recommended Mac payroll software, specifically for budget-conscious business owners who prefer downloadable systems because it’s one of the only options we found that offers a low-cost payroll and tax package. You can download its payroll software at no extra cost if you subscribe to Aatrix’s tab table update service ($259.95 per year or around $22 per month). This is unlike many cloud-based systems that charge base monthly and per-employee fees, costing around $50 per employee monthly.

- Mom-and-pop businesses with simple payroll needs: While this software can help calculate taxes and payroll, it lacks the basic HR tools that cloud-based payroll systems typically offer, such as online onboarding. If you simply need to know how much to pay in taxes and how much to pay your employees, it may work for you, although you have to print paper checks yourself and work with your bank on sending direct deposits.

When Aatrix Would Not Be a Good Fit

- Midsize to large companies that need advanced HR capabilities: Aatrix provides only basic payment processing and time-tracking features. It can’t help you with recruiting employees, tracking applicants, and managing staff documents. We recommended Rippling if you want a full-featured HR payroll system. You can also read our guide to the best HR information system (HRIS) software to find a solution that fits your HR needs.

- Businesses seeking an online payroll solution: The payroll software offered by Aatrix is downloadable for Mac and Windows computers. You cannot access the software through an online interface, and it does not provide mobile apps for managers or employees. Check out our top online payroll service picks for more suitable options.

- Employers looking for paycheck stuffing and delivery services: While Aatrix has check printing capabilities, you have to actually print and distribute the paychecks yourself. For paycheck services that include stuffing checks into envelopes and delivering these to your office so that you can hand them out to employees on paydays, consider ADP Run. It even offers paychecks with 10 advanced fraud protection features.

Top Aatrix Alternatives At a Glance

Best for: Small businesses needing full-service payroll and solid HR tools | Best for: QuickBooks accounting small business customers | Best for: Restaurants and retail shops that use Square POS |

Base monthly fee from: $39 | Base monthly fee from: $45 | Base monthly fee from: $35 |

Per-employee monthly fee from: $6 | Per-employee fee from: $6 | Per-employee fee from: $6 |

Are you still trying to decide what payroll software is best? Follow our step-by-guide to choose the right payroll solution.

Aatrix Pricing

Since our last update:

Aatrix has increased the fees for some of its “eFile Center” services, specifically its complete W2, 1099, and ACA e-filing packages—from $1.99 to $2.19 per employee, per filing. We also go into more detail on Aatrix’s add-on services, such as its customer support plans.

Aatrix’s pricing is pretty affordable as it charges only an annual subscription fee, regardless of how many employees you have. It offers two solutions: Top Pay and Ultimate Payroll. The main difference between the two is access to additional features, such as managing large employee lists and freeform reports.

Top Pay | Ultimate Payroll | |

|---|---|---|

Pricing ($/Year) | $259.95 per year | $259.95 per year |

Unlimited Employees and Departments | ✔ | ✔ |

Paid Time Off (PTO) Tracking | ✔ | ✔ |

Automatic Deduction Calculations | ✔ | ✔ |

Liability Payments | ✔ | ✔ |

‘TimeCard’ Access for Tracking Staff Attendance | ✔ | ✔ |

Automatic Tax Table Updater | ✔ | ✔ |

One-click Payroll Postings to QuickBooks* | ✔ | ✕ |

Large Employee Lists | ✕ | ✔ |

Freeform Reports | ✕ | ✔ |

*Requires integration and a separate software subscription with QuickBooks Accounting.

If you want a payroll reporting tool, then you can purchase Aatrix’s “Print & Mail Payroll Reports” module, which costs $79.95 per year. Apart from completing federal and state-required forms automatically, the tool includes access to more than 300 withholding, unemployment, and new hire forms.

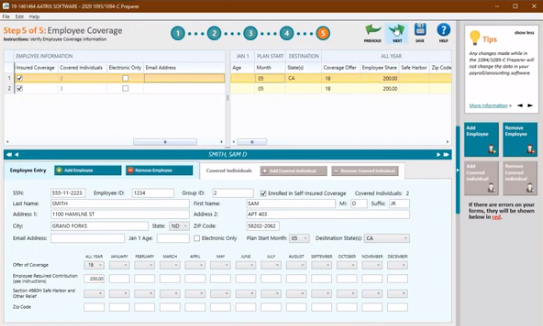

With Aatrix, you can print the accomplished forms and then mail those to applicable government agencies. However, if you subscribe to Aatrix’s e-filing services, you can electronically file W2, 1099, and Affordable Care Act (ACA) 1095 forms through its “eFile Center.” Fees vary depending on the type of form. The service also requires a minimum spend of $24.95.

If you require one-on-one customer support, Aatrix offers a variety of support plans that include prepaid and annual paid options. While all plans include phone support, subscribing to its annual tiers lets you send queries via email and grants you access to its “Aatrix Care system” that comes with a searchable knowledge base.

If you don’t want to subscribe to either its prepaid or annual plans, Aatrix offers phone and email support on an ala carte basis. You can buy 10 minutes of phone support for $40―plus $4 for each additional minute―and one email query for $15.

Aatrix Features

Since our last update:

We go into more detail on Aatrix’s payroll processing and tax reporting features.

Aatrix may not have a wide solution suite that includes HR solutions for managing the entire employee lifecycle, but it does have solid payroll tools to help you pay employees and contractors. Let’s look at some of its essential features to help you determine whether it fits your business requirements.

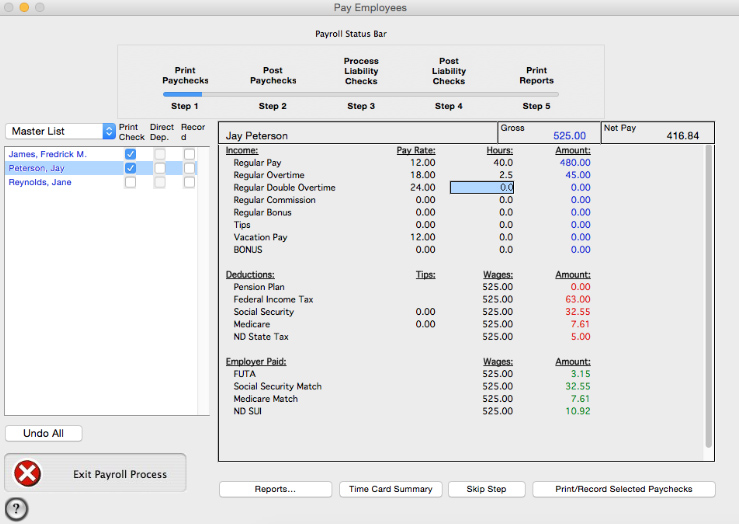

Aatrix’s payroll processing tool supports an unlimited number of employees/contractors and departments. It calculates deductions and creates liability payments automatically. Plus, you can use it to track employer-paid contributions, create and assign deductions, and monitor PTO accrual balances.

You can pay employees either through paychecks or direct deposits. Although, you have to print and distribute the paychecks yourself. For direct deposits, you have to work with your preferred bank if you want to send payments directly to the employees’ accounts.

A screenshot of Aatrix’s payroll module

(Source: Aatrix)

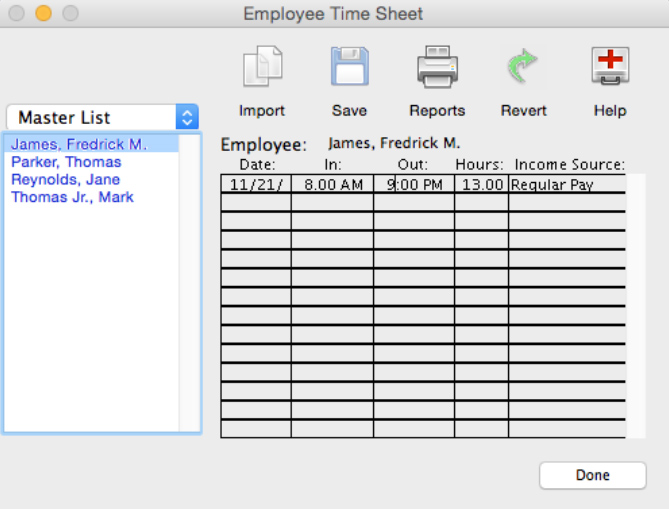

Included in Aatrix’s tax table subscription and payroll software is its “TimeCard” program, which your employees can use to clock in and out for work. It can be installed in one computer that can serve as your time clock kiosk.

Employees can clock in/out by using a computer mouse and clicking their name on the screen. You can also configure the system to require employees to enter the last four digits of their Social Security number on a keyboard to clock in/out. It even lets you choose whether clock in/outs should be done using a computer mouse click, PIN code entry via a keyboard, or both.

Aside from recording and tracking staff attendance, this tool totals the employees’ work hours automatically so that you can easily import the data into Aatrix’s payroll module for pay processing. You can also adjust clock in/out times either from the “TimeCard” system or Aatrix’s payroll tool.

Aatrix lets you view and edit employee time sheets directly from its payroll module.

(Source: Aatrix)

While it can process payroll taxes and create the required federal and state tax reports, it doesn’t file tax forms for you. You can, however, subscribe to its e-filing services―fees range from 49 cents to $2.19 per employee, per filing―which allows you to electronically send tax forms to government agencies via its “eFile Center.”

Apart from tax forms, Aatrix’s “eFile Center” can help you file ACA reports electronically.

(Source: Aatrix)

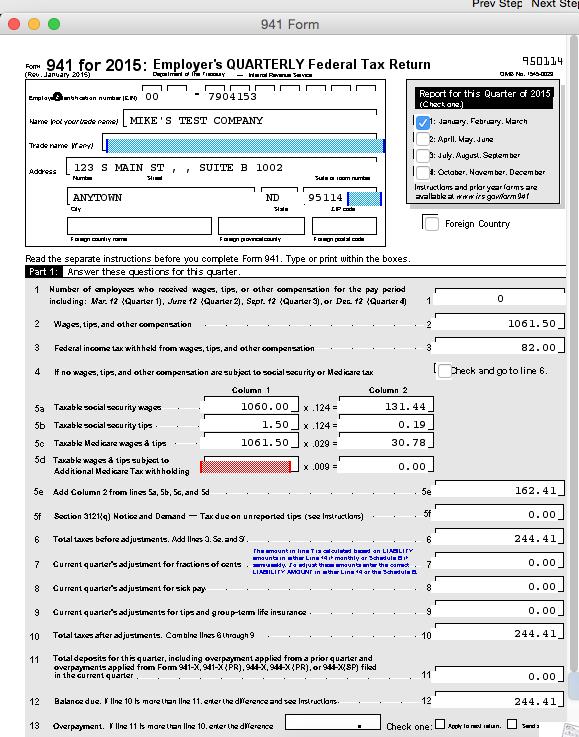

Keeping track of tax table changes is an important part of payroll. This ensures that you remain compliant with the latest tax regulations and that your employees’ paychecks are accurate. What’s great about Aatrix is that it updates tax tables automatically whenever there are changes. You have to click its “Automatic Updater” tool and its system will update the tax table data and forms as applicable.

While you can manually accomplish state and federal forms, such as new hire, unemployment, and withholding reports, Aatrix can complete it automatically for you with its “Print & Mail Payroll Reports” solution. Although you have to pay $79.95 annually for this service, the additional cost is worth it as it makes quarterly and annual reporting easier for business owners and payroll administrators. Plus, you get a comprehensive reporting tool with a library of more than 330 federal and state payroll reports.

Aatrix can create and print 941 IRS Forms for quarterly tax payments.

(Source: Aatrix)

Aatrix Ease of Use

- Relatively easy to use

- Online knowledge base

- Paid support plans available

- Seamless integration with QuickBooks for payroll postings

- Supports more than 300 payroll and state/federal reports

- Updates tax tables automatically

- Electronic tax filings

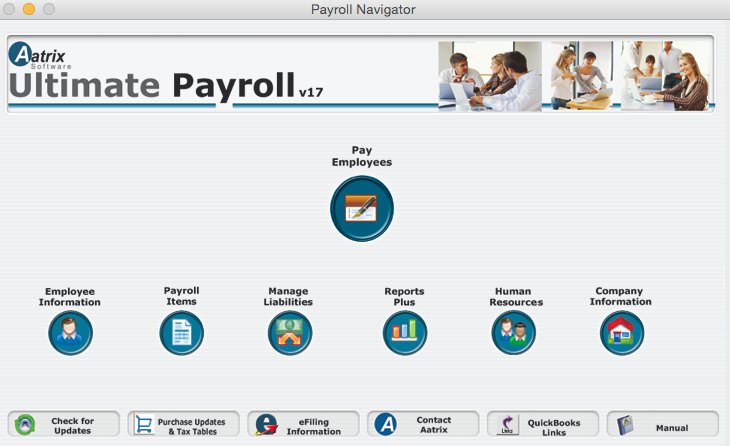

Aatrix’s “Payroll Navigator” dashboard lets you process payroll, generate reports, and more.

(Source: Aatrix)

While Aatrix is simple to use, the interface is dated. Plus, the software is installed directly on a computer via a download rather than being fully hosted online. To save time when filing payroll tax forms, it allows users to complete state and federal tax documents and then submit it via Aatrix’s “eFile Center.”

Aatrix also supports integrations through its partner systems, such as Acumatica, Sage, QuickBooks, Microsoft Dynamics, and CenterPoint. In total, it includes more than 60 partnerships with accounting and payroll software. Custom integrations can even be created in fewer than 40 hours of development time.

What Users Think About Aatrix

Although Aatrix has been around since 1986, you’ll find few reviews for this product online. At the time of publication, Aatrix only has three reviews published on G2 with an overall rating of 4 out of 5.

Those who left feedback like that it is simple to install and fairly easy to use. However, one user said that printing tax forms via its platform isn’t an intuitive process as it requires several test printouts and adjustments to make the W2/1099 form fit inside special-sized envelopes.

Bottom Line

Aatrix is great for small businesses looking for downloadable payroll software that’s compatible with Mac and Windows computers. While you can’t access its features online or while on the go, it provides all the tools you need to pay employees, track deductions, and even monitor employee attendance. If you primarily need help with payroll calculations and have an in-house payroll administrator who can handle tax filings for a few employees, Aatrix may work for you.

Sign up for its tax table update subscription and download Aatrix’s payroll software today.