Baselane is an all-in-one banking and financial platform that was built for independent landlords. It aims to simplify financial management by providing tools for accounting, bookkeeping, payments, and real-time reporting. It offers features, such as automated rent collection, automated property reporting metrics, and expense tracking.

Its banking is built for landlords, with checking accounts that offer high-yield interest to grow savings. Baselane also offers loans and insurance products tailored to landlords.

Pros

- Rent collection tools simplify financial management

- Offers a dedicated bank account

- Core services are free

- Integrates with property management software

Cons

- No mobile app

- Not suitable for property management companies

- No accountant access

- No applicant tracking system (ATS) or tenant screening

- Independent landlords who need cash flow management tools: Baselane, one of our leading online rent payment services, can help businesses manage their cash flow by providing real-time insights into cash inflows and outflows. This includes the ability to set spending limits and make cash flow projections. You can also integrate with Baselane’s bookkeeping, reporting analytics, and rent collection tools seamlessly.

- Novice real estate investors: Baselane is ideal for novice real estate investors because of its unique tools like Property Metrics, which lets you input the information for each of your properties and look at key performance metrics, such as asset value and appreciation. You can also tag transactions easily by property and Schedule E categories to stay organized. Baselane is even one of our best banks for real estate investors, specifically for those wanting real estate investor banking with commercial real estate (CRE) loan products.

- Independent landlords who want access to free checking: Baselane Banking offers a free checking account for landlords, with no account fees or minimum balances and the ability to set up multiple accounts per property. You can also earn up to 5% cash back on purchases. To learn more about the benefits of opening a free checking account, read our review of Baselane Business Checking.

- Property management firms seeking all-in-one software: If you’re managing multiple properties and are seeking an all-in-one software, then Buildium, which we ranked as one of the top real estate accounting software, is an excellent option. It also includes tenant management tools, such as the ability to screen tenants. Read our review of Buildium for more information about its features.

- Landlords who combine personal finances and property: If you have three or fewer properties and are in need of bookkeeping software that lets you manage everything in one place, Quicken is a good choice. The Home & Business edition allows you to manage both property-related documents and rental information like agreements and security deposits. Our review of Quicken discusses its property-specific features in-depth.

- Landlords seeking remote features: One feature that Baselane is lacking is a mobile app, so if you often work remotely, then you may want to consider QuickBooks Online, our overall best small business accounting software. It not only has excellent general bookkeeping features, but it also has a mobile app with mileage tracking and receipt capture. You can learn more about the solution through our QuickBooks Online review.

If you’re seeking other free bookkeeping options, we suggest checking out our guide to the best free accounting software.

Baselane Bookkeeping Deciding Factors

Supported Business Types | Independent landlords and novice real estate investors |

Pricing | Free |

Standout Features |

|

Customer Support | Telephone, live chat, and email |

Baselane Bookkeeping Alternatives

Best for: Property management firms that need all-in-one software | Best for: Landlords who combine personal finances and property | Best for: Landlords seeking remote features |

Cost: $55 to $375 per month | Cost: Home & Business is $9.99 per month | Cost: $30 to $200 per month |

For even more alternatives to Baselane, see our roundup of the best real estate accounting software.

Baselane Bookkeeping New Features 2023

Baselane has introduced features to simplify and improve your rent collection:

- Edit active rent collection: Whether you need to renew or extend a rent collection, update monthly recurring rent charges, or change late fee schedules, the new edit active rent collection feature provides you with added flexibility.

- Improved rent collection summary: Baselane has simplified the process of viewing your rent collection payments by showing payments that are completed, processed, unpaid, overdue, and failed. You can quickly double-click to view all invoices across different payment statuses.

- Faster and streamlined tenant activation: Baselane has improved the tenant activation experience, making it quicker for tenants to activate their accounts and start paying rent.

- Monthly user digest email: Each monthly user digest email provides a snapshot of your Baselane activity from the previous month, allowing you to stay updated on all of your activity.

Baselane Bookkeeping Pricing

Baselane’s core services are free for landlords, and it is free to use for tenants. ACH payments are free, but Baselane charges a 2.99% convenience fee for rent payments made by debit or credit card.

Baselane Bookkeeping Features

Baselane offers many features that are beneficial to independent landlords and their tenants, such as free banking, reporting and analytics, rent collection, and property metrics.

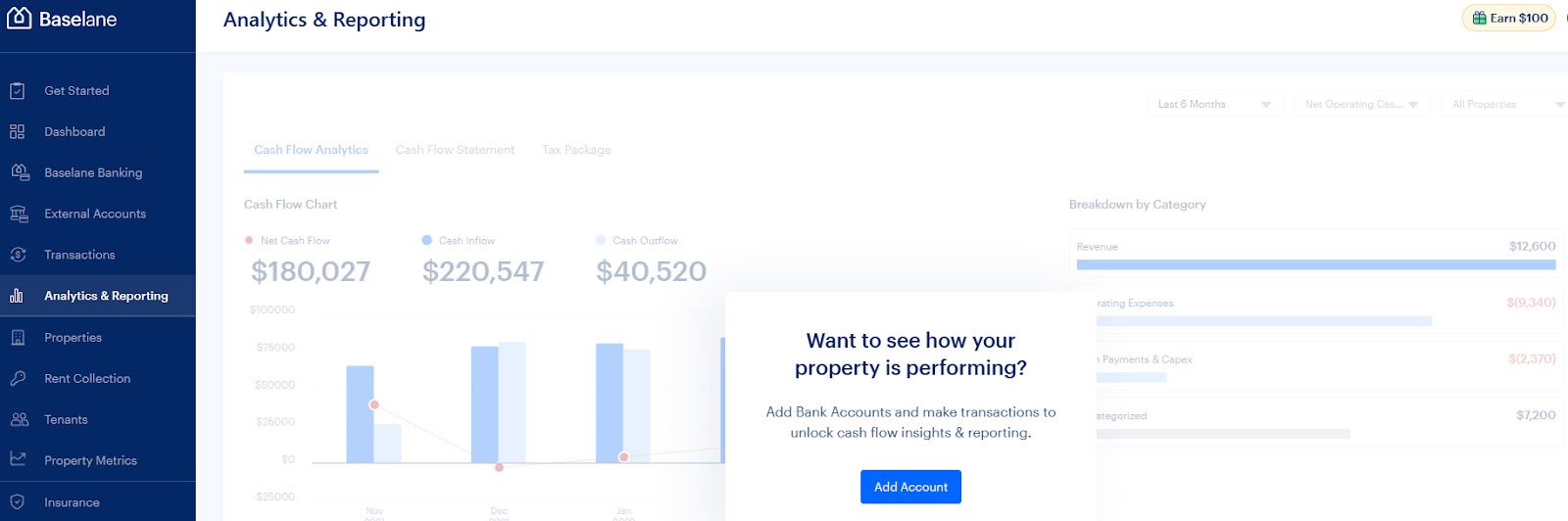

Baselane’s platform automatically analyzes your transaction history from all of your accounts and properties in one centralized dashboard. You can drill down expense detail by category and property, and you’ll have access to unlimited monthly reports. Baselane offers both income statements and cash flow analytics by property and portfolio.

Baselane Analytics & Reporting

(Source: Baselane)

On the Analytics & Reporting page, you can view cash flow metrics, such as net cash flow and net operating income, and break down your cash flow with preset and custom filters. You’ll also be able to generate and download CSV statements of any present and custom filters by property and timeframe.

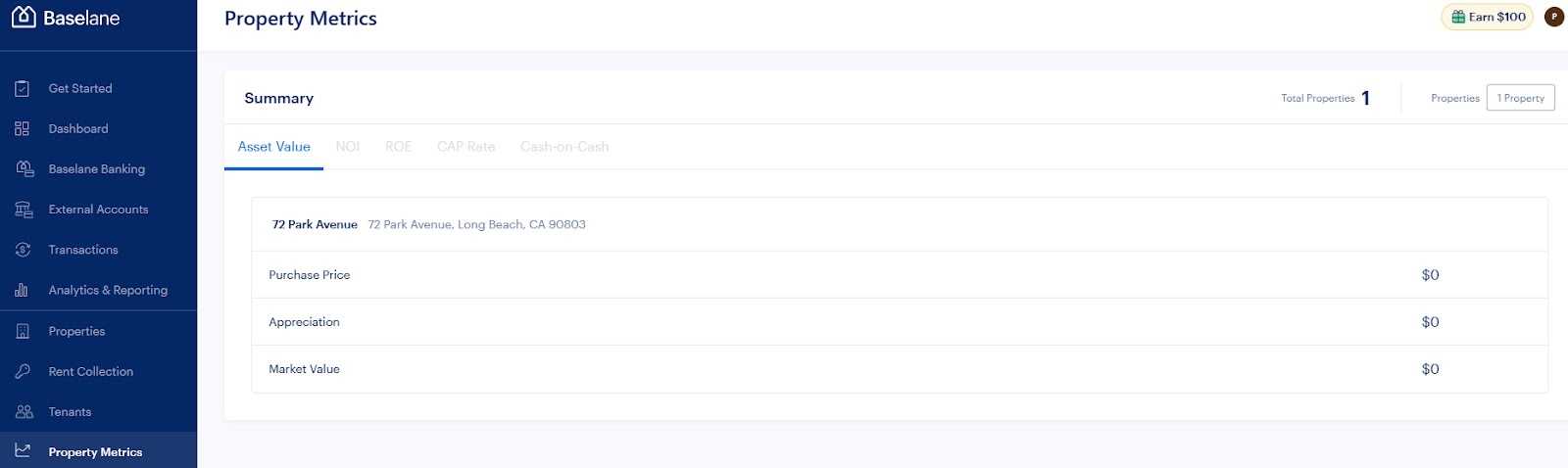

On the Property Metrics page, Baselane enables you to keep track of the most important metrics across your portfolio easily. All metrics can be viewed on either a per-property basis or in aggregate across your portfolio. They can be shown for different periods, and a summary view is also shown on your dashboard.

Baselane Property Metrics

(Source: Baselane)

While only the first key performance metric is currently available, Baselane will soon be implementing a total of five key performance metrics:

- Asset value and appreciation: This is measured by your initial inputs of purchase price and current market value. Baselane automatically integrates data from Zillow, which you can use for inputting data on the property page.

- Net Operating Income (NOI): This metric is determined by the total revenue (rental income and other fees) less total operating expenses. This metric is key to understanding the profitability of your rentals and is an important contributing factor for other metrics.

- Return on Equity (ROE): This is measured by calculating your total return relative to your equity stake in your properties. ROE is an important measure of performance relative to the equity you invested.

- Cash-on-Cash Return: Similar to Return on Equity, this tracks your performance relative to your initial investment. However, cash-on-cash return looks only at cash return and takes into account all initial cash outlays.

- Cap Rate: Cap rate tracks your property’s performance relative to the current asset value. It is calculated by dividing your property’s NOI by its current asset value. The cap rate is a quick way to understand the yield on your investment and compare it to other similar properties in the same geography.

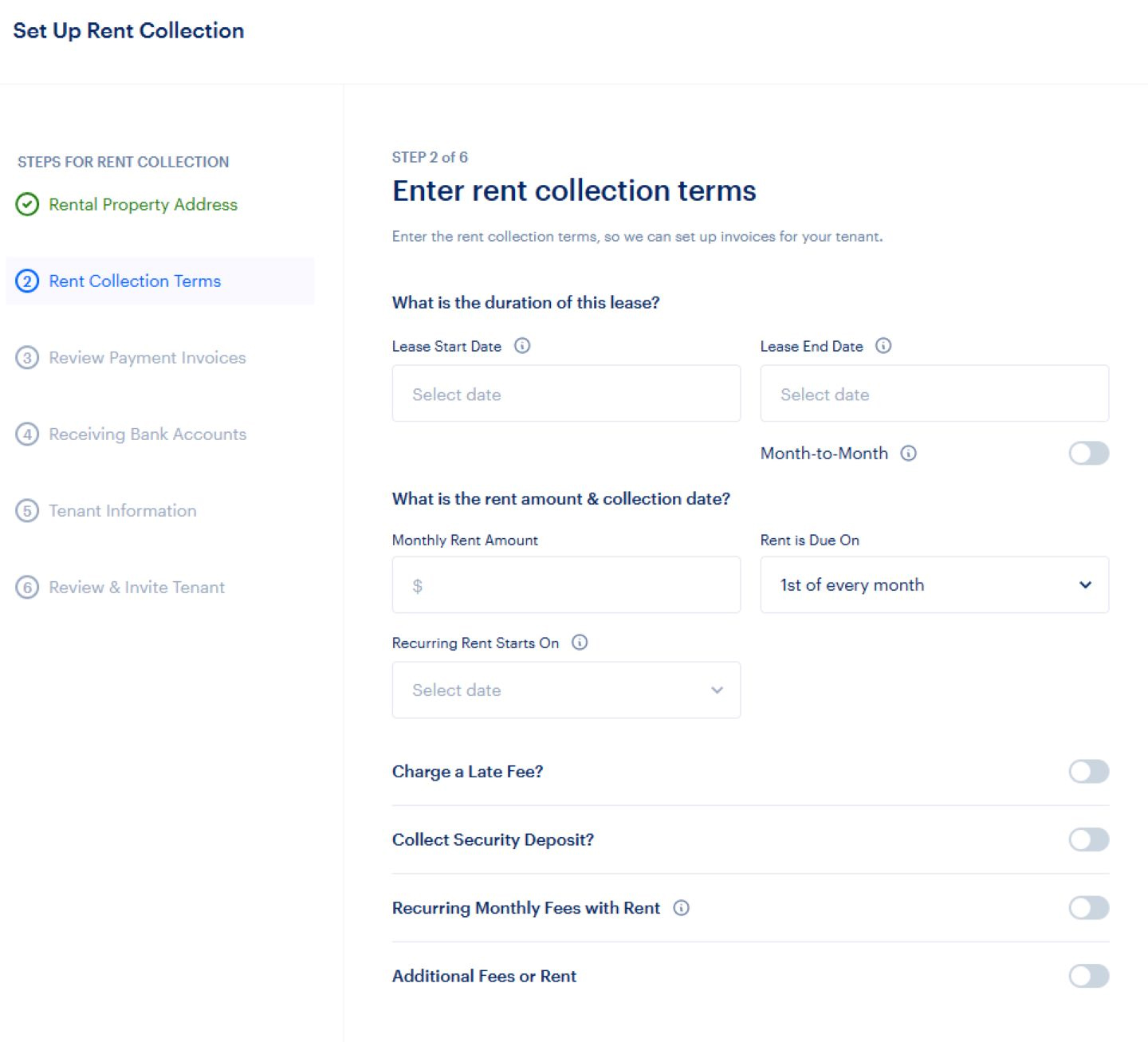

The tenant portal streamlines the process of paying rent and rent collection. After creating an account, tenants are able to pay rent by connecting a bank or credit card account as well as optionally enroll in Auto Pay. Baselane makes it possible to view and manage past payments, view rent collection details, and landlord contact information.

Baselane Rent Collection

(Source: Baselane)

Available on the Analytics & Reporting tab, Tax Package is a consolidated report of your property financials that can be easily shared with a tax preparer, lender, investing partner, or anyone requesting your financials. The package includes a Net Operating Cashflow report and a ledger of transactions in CSV format.

Baselane doesn’t have any integrations with accounting software since it has its own bookkeeping features. You can, however, download custom statements from your Baselane profile as well as all of your transactions from the Transaction tab, to import them into another software.

Interested in evaluating other accounting software? Our guide to the best small business accounting software includes many options that are ideal for landlords and novice real estate investors to manage their bookkeeping and accounting.

Other Features

Baselane Banking is tailor-made for landlords, with useful features like subaccounts, spend controls, and the opportunity to earn rewards. It is completely free—there are no monthly fees or minimum balances, and the objective is to focus on how the landlord banks.

Baselane Banking

(Source: Baselane)

Each customer of Baselane Banking has both a main account and the ability to set up virtual accounts that can track items like security deposits or maintenance reserves. Each virtual account is a true account, with its own account number separate from the main account.

The difference between the main and virtual accounts is that you attach your debit card to the main account. You can create virtual debit cards and establish a spending limit on a daily or monthly basis. It’s also possible to connect an external account through Plaid.

Baselane doesn’t currently offer a mobile app. However, the platform is accessible through any web browser, so landlords can access their accounts and manage their properties from their mobile devices.

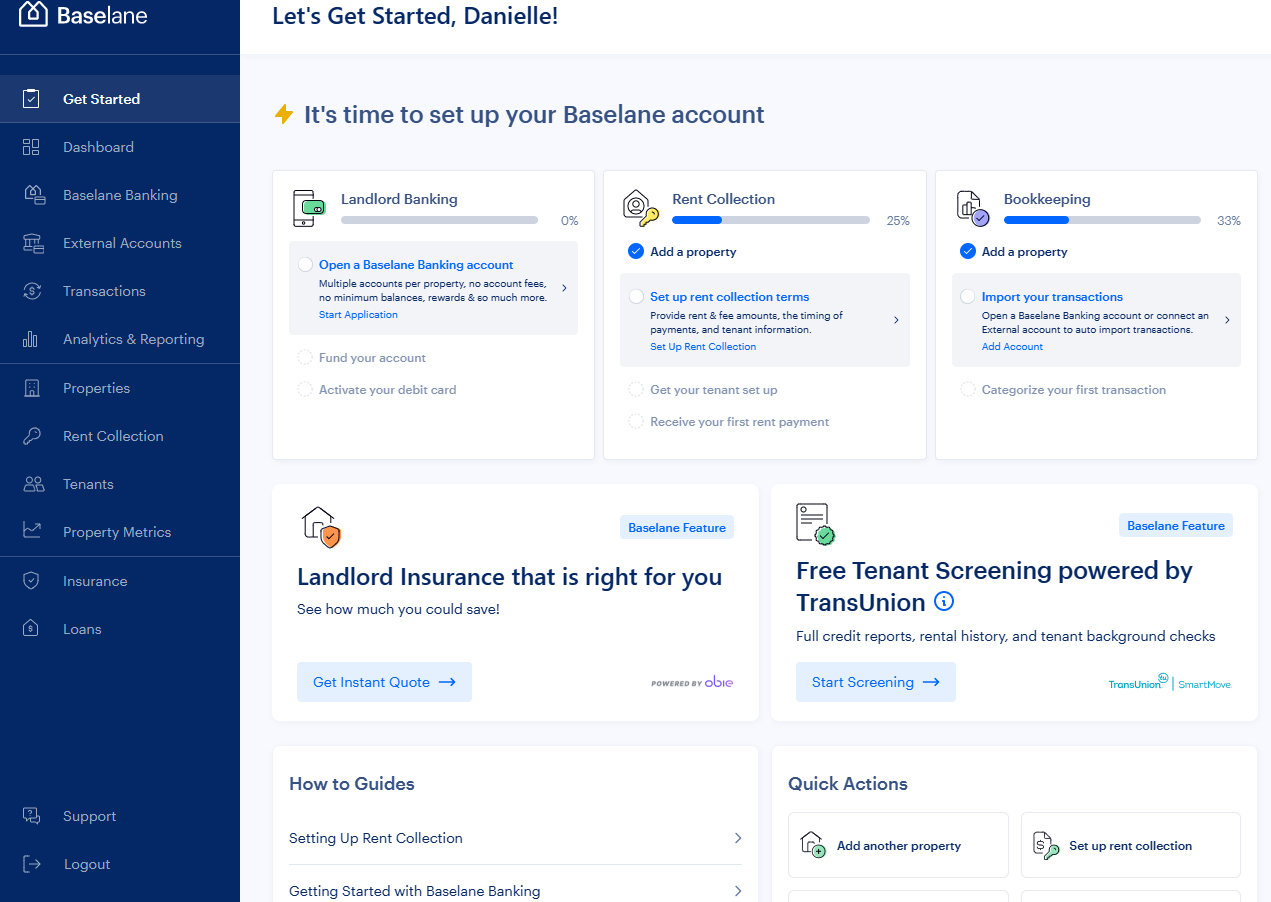

Baselane Customer Service & Ease of Use

There are a few different ways to contact Baselane, which are all available via the dashboard: live chat or schedule a call via its in-app messenger, schedule a live video demo with its onboarding experts, email, or call. Baselane’s office hours are Monday through Friday, 7 am to 5 pm EST.

Baselane Dashboard

(Source: Baselane)

You’ll find that Baselane’s dashboard is uncluttered and easy to use, with intuitive navigation. You can use the navigation bar on the left to find your desired section, and there are also shortcuts on the main dashboard.

Baselane Assisted Bookkeeping Options

Unlike software providers like QuickBooks Online or Xero, Baselane doesn’t currently offer assisted bookkeeping options, and we’re unaware of any bookkeeping firms that specialize in Baselane. You might consider an alternative software if you want professional assistance, and you can see our list of the top online bookkeeping services for options.

Frequently Asked Questions (FAQs)

Baselane gives you access to metrics related to your property’s performance, such as your net cash flow. You can also view core real estate metrics like cap rate, return on equity, and cash-on-cash return.

As a renter, there are no fees to pay rent from a linked bank account via automated clearing house (ACH) or bank transfer. If you choose to pay using a debit or credit card, you’ll incur a 2.99% convenience fee that will be added to your payment.

You’ll invite tenants to Baselane as part of the Rent Collection set-up process. Once you have finalized and submitted a new rent collection for your unit, Baselane will automatically invite your tenant to create a Baselane account. From there, they will view their rent details and pay rent.

Bottom Line

Baselane dramatically simplifies the process of managing your rental property finances. Instead of using a series of separate financial services and tools to manage your banking, bookkeeping, cash flow and performance analytics, and rent collection, Baselane centralizes everything in one place. It helps you to increase your property returns through better insights to empower the key investments decisions you make.