Bench and Bookkeeper.com are both online bookkeeping services. They allow you to perform the majority of your own bookkeeping while giving you the assurance that your books are accurate.

Bench, which is the more affordable option but isn’t as customizable to your business, excels with its bundles that include both unlimited bookkeeping support and tax services. Meanwhile, Bookkeeper.com offers more add-on services and flexibility than Bench—similar to traditional brick-and-mortar certified public accountant (CPA) firms. We feel that Bench is the better option for the majority of small businesses, but some businesses will be served well by Bookkeeper.com’s customized approach:

- Bench: Optimal for most small businesses looking for both bookkeeping and tax services

- Bookkeeper.com: Best for small businesses needing a full range of customized accounting services or general business consulting

Many small business owners prefer to do their own bookkeeping to save money. QuickBooks Online is our top recommendation in this case:

- QuickBooks Online: Best do-it-yourself (DIY) small business accounting software

The Fit Small Business editorial policy is rooted in the company’s mission, which is to deliver the best answers to people’s questions. This serves as the foundation for all content, demonstrating a clear dedication to providing valuable and reliable information. Our team leverages its expertise and extensive research capabilities to identify and address the specific questions our audience has—and this ensures that our content is rooted in knowledge and accuracy.

In addition, we employ a comprehensive editorial process that involves expert writers. This process ensures that articles are well-researched and organized, offering in-depth insights and recommendations. Fit Small Business maintains stringent parameters for determining the “best” answers, including accuracy, clarity, authority, objectivity, and accessibility, and these see to it that our content is trustworthy, easy to understand, and unbiased.

| ||

|---|---|---|

4.46 ★ | 3.75 ★ | |

Monthly Pricing | $299 or $499 | $399 to $799 |

Service Frequency | Monthly | Monthly, semimonthly, or weekly |

Free Trial | Two free months for Fit Small Business readers | ✕ |

Accounting Software Supported | Bench’s proprietary software and FreshBooks | QuickBooks Online and QuickBooks Desktop (not required) |

Dedicated Bookkeeper | ✓ | ✓ |

Catch-up Bookkeeping | Starts at $299 per month | Undisclosed |

Tax Advisory & Filing | ✓ | ✓ |

Key Features |

|

|

What’s Missing | Chief financial officer (CFO) and business consulting services | Mobile app |

Mobile App | iOS | N/A |

Ease of Use | Easy | Easy |

Average Rating on Third-party Sites | 4.3[1][2][3] | N/A |

Use Cases and Pros & Cons

User Reviews: Bench Wins

| ||

|---|---|---|

Average Rating on Third-party Sites | 4.3[1][2][3] | N/A |

Users Like |

| We were unable to find user reviews for Bookkeeeper.com. |

Users Dislike |

|

We cannot compare Bench and Bookkeeper.com in terms of user reviews given that we couldn’t find any for the latter on third-party websites. Reviewers seem to agree with our evaluation of Bench, as they commended its affordable tax services and unlimited year-end tax advisory.

Bench users like that its service is affordable and that it offers a free trial of one month of bookkeeping, but Fit Small Business readers can get two months of bookkeeping for free. Another bonus is that Bench offers unlimited customer support and unlimited year-round tax advisory services. However, users wished that an Android app were available and that there were support for multiple currencies. Another desired service is CFO advisory services.

Bench earned the following average scores on popular review sites:

- Software Advice[1]: 4.7 out of 5 based on around 300 reviews

- G2.com[2]: 4.3 out of 5 based on about 75 reviews

- Trustpilot[3]: 4.2 out of 5 based on around 950 reviews

Pricing: Bench Wins

| ||

|---|---|---|

Pricing Plans |

| $399 to $799 per month, depending on the number of monthly transactions |

Catch-up Bookkeeping | Starts at $299 per month | Undisclosed |

Invoicing | Starts at $100 per hour for A/R tracking | Additional fee |

Bill Pay | Starts at $100 per hour for A/P tracking | Plus & Advanced, or additional fee |

Tax Services | Included in Premium plan ($499 per month for support and filing) | Additional fee |

CFO Services | N/A | Plus & Advanced |

Free Trial | One prior month of bookkeeping or 2 months free for Fit Small Business readers | ✕ |

Comparing Bench vs Bookkeeper.com when it comes to pricing, we chose Bench as the winner in this category not only because it is the less expensive option, but also because it offers extra services with published prices that can be useful to small businesses such as catch-up bookkeeping. Another benefit of using Bench is the access to unlimited tax advisory and tax strategy planning. We also like that it offers a free trial, while Bookkeeper.com does not.

Unlike most other bookkeeping services we’ve reviewed—including Bookkeeper.com—Bench does not vary its pricing depending on the size of your company. The difference in its two bundles offered is the services provided, with the major difference being that the Premium plan includes tax planning and filing services.

Essential | Premium | |

|---|---|---|

Monthly Contract (Price per Month) | $299 | $499 |

Annual Contract (Price per Month) | $249 | $399 |

Monthly Bookkeeping | ✓ | ✓ |

Access to a Dedicated Bookkeeping Team | ✓ | ✓ |

Year-end Reporting | ✓ | ✓ |

Unlimited Communication with Bench’s Research Team | ✓ | ✓ |

Unlimited Tax Advisory Services | ✕ | ✓ |

One-on-One Tax Strategy Planning | ✕ | ✓ |

Annual Tax Filing for Businesses Like S-corps, C-corps & Partnerships | ✕ | ✓ |

Annual Tax Filing for Sole Proprietors, including Schedule C & 1099-MISC | ✕ | ✓ |

Add-ons

- Historical bookkeeping: Starts at $299 per month

- Specialized bookkeeping: Starts at $100 per month

- Business owner’s individual return filing add-on: $69 per month for one partner or shareholder when billed monthly and $59 per month when billed annually

Bookkeeper.com offers four subscription plans that, unlike Bench, vary in price depending on the number of monthly transactions or frequency of service. Bookkeeper.com also doesn’t provide a predefined pricing plan for companies with over $1,000,000 in gross revenue. Companies exceeding that amount must request a customized quote. For any additional services, such as payroll or tax preparation, you can request a customized quote. Unfortunately, there’s no free trial available.

Small Business | Small Business Plus | Small Business Advanced | Custom | |

|---|---|---|---|---|

Monthly Cost | $399 | $599 | $799 | Custom pricing |

Monthly Expense Cap | 100 monthly transactions | 200 monthly transactions | 300 monthly transactions | Custom |

Annual Gross Revenue Cap | $500,000 | $750,000 | $1 million | $1 million-plus |

Service Level | Monthly | Semimonthly | Weekly | Weekly |

Onboarding | 1 to 2 weeks | 2 to 3 weeks | 3 to 4 weeks | 3 to 4 weeks |

Monthly Bill Payments | N/A | 20 included | 40 included | Custom |

Dedicated Bookkeeper & Account Manager | ✓ | ✓ | ✓ | ✓ |

Month-end Close With Bank & Credit Card Reconciliation | ✓ | ✓ | ✓ | ✓ |

Cash or Accrual | ✓ | ✓ | ✓ | ✓ |

Online Support | Limited | Unlimited | Unlimited | Unlimited |

Monthly Scheduled Meetings | ✕ | 30 minutes | 45 minutes | ✓ |

Lite CFO & Advisory Services | ✕ | ✕ | ✕ | ✓ |

Track by Class, Location & Department | ✕ | ✕ | ✕ | ✓ |

Features: Bookkeeper.com Wins

| ||

|---|---|---|

Categorize Transactions | ✓ | ✓ |

Reconcile Accounts | ✓ | ✓ |

Provide Financial Statements | ✓ | ✓ |

Prepare Business Tax Return | ✓ | ✓ |

Historical Bookkeeping | ✓ | ✕ |

Customizable Services | ✕ | ✓ |

Business Consulting | ✕ | ✓ |

Bench can be considered a “lightweight” bookkeeping service because it’s intended more for businesses that prefer to manage their own day-to-day bookkeeping tasks but want someone to handle the bigger picture, such as reconciling accounts and preparing financial statements. You have the option of upgrading to a Premium plan, which also gives you unlimited access to a tax advisor who’ll assist with planning and filing your returns.

In contrast, Bookkeeper.com is best thought of as a full-service online accounting firm, which is why we feel it is better than Bench in this category. Bench does have many attractive features, such as catch-up bookkeeping, unlimited support, and a robust mobile app. And while Bookkeeper.com may lack a mobile app, it more than makes up for it with its secure portal and host of add-on services, such as payroll management.

Historical Bookkeeping: Bench Wins

For $299 a month, Bench’s bookkeepers will provide historical bookkeeping services, depending on how far you’ve fallen behind on your books. If you’re less than two years behind on your bookkeeping, you’ll need the catch-up bookkeeping add-on. If you’re more than two years behind on your books, Bench offers a special program called BenchRetro, which is priced via custom quote.

While it’s likely that Bookkeeper.com will perform catch-up bookkeeping as part of its customizable services, it doesn’t provide any pricing for such services.

Customizable Services: Bookkeeper.com Wins

Bookkeeper.com is ideal for businesses looking for the flexibility of customizing their own package and a service that can scale as you grow. It’s both online and cloud-based, and it’s interesting to note that it offers more services to QuickBooks Online users than its competitor, QuickBooks Live. Also, both Bench and Bookkeeper.com offer a dedicated bookkeeper who’ll provide you with financial statements on a monthly basis, but Bookkeeper.com allows you to customize the types of reports that you receive.

Business Consulting: Bookkeeper.com Wins

Bookkeeper.com offers general business consulting, strategic and tax planning, and training if needed. Fractional CFO services are also available in Plus and Advanced as well as with its custom plans—and these features aren’t offered by Bench.

Ease of Use: Tie

| ||

|---|---|---|

Overall Ease of Use | Easy | Easy |

Accessibility | Cloud | Cloud |

Online Help Section | ✓ | ✓ |

User-friendly Dashboard | ✓ | ✓ |

Bench and Bookkeeper.com’s process of working with your bookkeeper is similar, and we determined this category to be a tie—although you’ll be assigned a team of three bookkeepers with Bench, as opposed to one with Bookkeeper.com. The major difference between the two is that you’re able to get a better sense of Bench’s service with its free one-month bookkeeping trial. Bookkeeper.com doesn’t have a comparable trial, but it does offer free bookkeeping advice and software training once you’re subscribed.

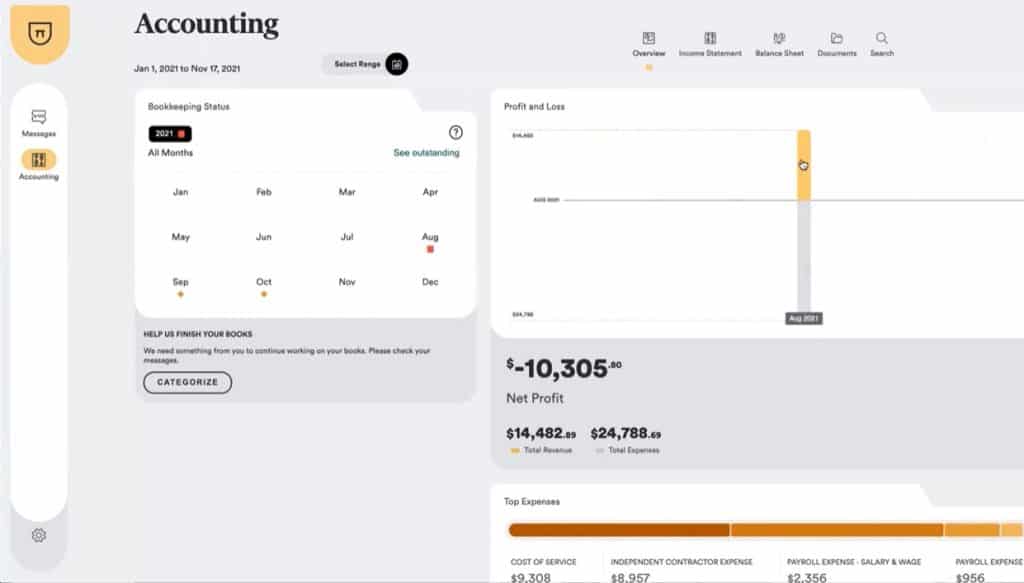

Upon enrollment with Bench, you’ll be assigned a team of three bookkeepers, one of whom will assist with the onboarding process and learn more about your business, helping you customize your account for accurate expense tracking. Your bookkeeper uses Bench’s proprietary software to track your income and expenses, and you both can leave notes on transactions in case any questions come up. You can also view the status of what has been completed, what’s in progress, and what’s still outstanding.

Bench Accounting Status page (Source: Bench)

Once you sign up for Bookkeeper.com, you’ll be assigned a dedicated bookkeeper. While you’ll grant them access to your QuickBooks account, you’ll still maintain access so that you can still use your QuickBooks account to invoice clients and pay bills. During the onboarding process, your bookkeeper will assist with connecting your bank and credit card accounts to QuickBooks (if this hasn’t been done previously), and they’ll download your statements and classify them for you.

Bookkeeper.com Client Portal (Source: Bookkeeper.com)

Integrations: Tie

| ||

|---|---|---|

Built-in Integrations | 0 | 0 |

Third-party Integrations | 10 | 2 |

Bookkeeper.com doesn’t appear to integrate with any other programs besides QuickBooks while Bench has 10 integrations:

- Bench integrations: Gusto, FreshBooks, Stripe, Square, Shopify, Attune, Keap, Brex, PayPal, and Clio

- Bookkeeper.com integrations: QuickBooks Online and QuickBooks Desktop

Of course, since Bookkeeper.com is based on QuickBooks Online, you’ll have access to the huge library of QuickBooks integrations.

Mobile App: Bench Wins

| ||

|---|---|---|

Mobile App | ✓ | ✕ |

Availability | iOS | Via Xero or QuickBooks |

Real-time Cash Flow Updates | ✓ | ✕ |

Report Access | ✓ | ✕ |

View Accounts | ✓ | ✕ |

Check Spending Categories | ✓ | ✕ |

Share Documents With Bookkeeper | ✓ | ✕ |

Schedule Appointments | ✓ | ✕ |

Correspond With Bookkeeper | ✓ | ✕ |

Due Date Reminders | ✕ | ✕ |

Bench takes the lead when we compare Bench and Bookkeeper.com because Bookkeeper.com doesn’t have a mobile app, whereas Bench has a full-featured one. Available for iOS, the Bench mobile app allows you to upload digital copies of bills and receipts to the Bench software for your bookkeeper to review. You can also communicate with your bookkeeper through the app or check your accounts, vendors, spending categories, and more.

Customer Support: Tie

| ||

|---|---|---|

Unlimited Support | ✓ | ✓ |

Email Support | ✓ | ✓ |

Phone Support | ✓ | ✓ |

Community Support | ✓ | ✕ |

One-way Video Chat | ✕ | ✕ |

Live Chat Support | ✕ | ✓ |

Searchable Knowledge Base | ✓ | ✕ |

Free Software Training | ✕ | ✓ |

Free Financial Advice | ✕ | ✓ |

Online Help Resources | ✓ | ✓ |

The providers are equally strong in this area, so we call it a tie. You can contact your Bench bookkeeper at any time to schedule a call via the app, email, or a direct message on the Bench website. There’s no extra fee or hourly charges for support, and you’re welcome to reach out whenever you have a question.

Meanwhile, you’ll use a secure online portal to communicate with your Bookkeeper.com bookkeeper, and you can also exchange documents as needed. You’ll be able to view your company’s transactions and request an appointment with your bookkeeper through the client portal. As part of its package, Bookkeeper.com offers free bookkeeping advice and software training. We suggest that you take advantage of both features.

For assistance with selecting the best online bookkeeping service for your business, check out our article on how to choose a virtual bookkeeper.

How We Evaluated Bench vs Bookkeeper.com

We evaluated Bench vs Bookkeeper.com based on the following criteria:

35% of Overall Score

Because each plan depends on many factors, we looked at the value provided in terms of the time and potential money that you’re saving by using the service.

20% of Overall Score

You should be able to access a dedicated bookkeeper for any questions or advice and one-on-one assistance.

15% of Overall Score

The best online bookkeeping service should offer a wide range of bookkeeping solutions, including catch-up bookkeeping, invoicing, bill pay, bank reconciliation, payroll, and tax filing.

10% of Overall Score

We evaluated whether the online bookkeeping service offered tax and consulting, and the scope of those services.

20% of Overall Score

We consider the opinions of users and the service’s ratings on various review sites. These criteria were disregarded for providers where no reviews were found.

Frequently Asked Questions (FAQs)

No, Bench uses its own proprietary software and doesn’t sync with commonly used accounting software like QuickBooks Online or Xero.

Bookkeeper.com has four subscription levels, which depend on the number of monthly transactions and frequency of service. Prices range from $399 to $799 monthly, plus the option of customizing a package that suits your needs.

Yes, Bench is ideal for businesses that have basic bookkeeping needs and want the option of tax filing and consulting services. For an additional fee, it also offers historical bookkeeping services and specialized bookkeeping, such as accounts receivable tracking and segment-level bookkeeping.

Bottom Line

Along with its one-stop assortment of services, Bookkeeper.com is well suited to businesses seeking a helping hand with tasks that go beyond standard bookkeeping. Although it’s more expensive than Bench, it’s a good value for your money if you want reliable service and accurate books.

Bench offers straightforward bookkeeping and tax services―along with a mobile app―and an option to add services, such as catch-up bookkeeping. While we recommend Bench as the plan for most small businesses, the solution for you is the one that best fits your business’s specific needs.

User review references:

1 Software Advice

2 G2.com

3 Trustpilot