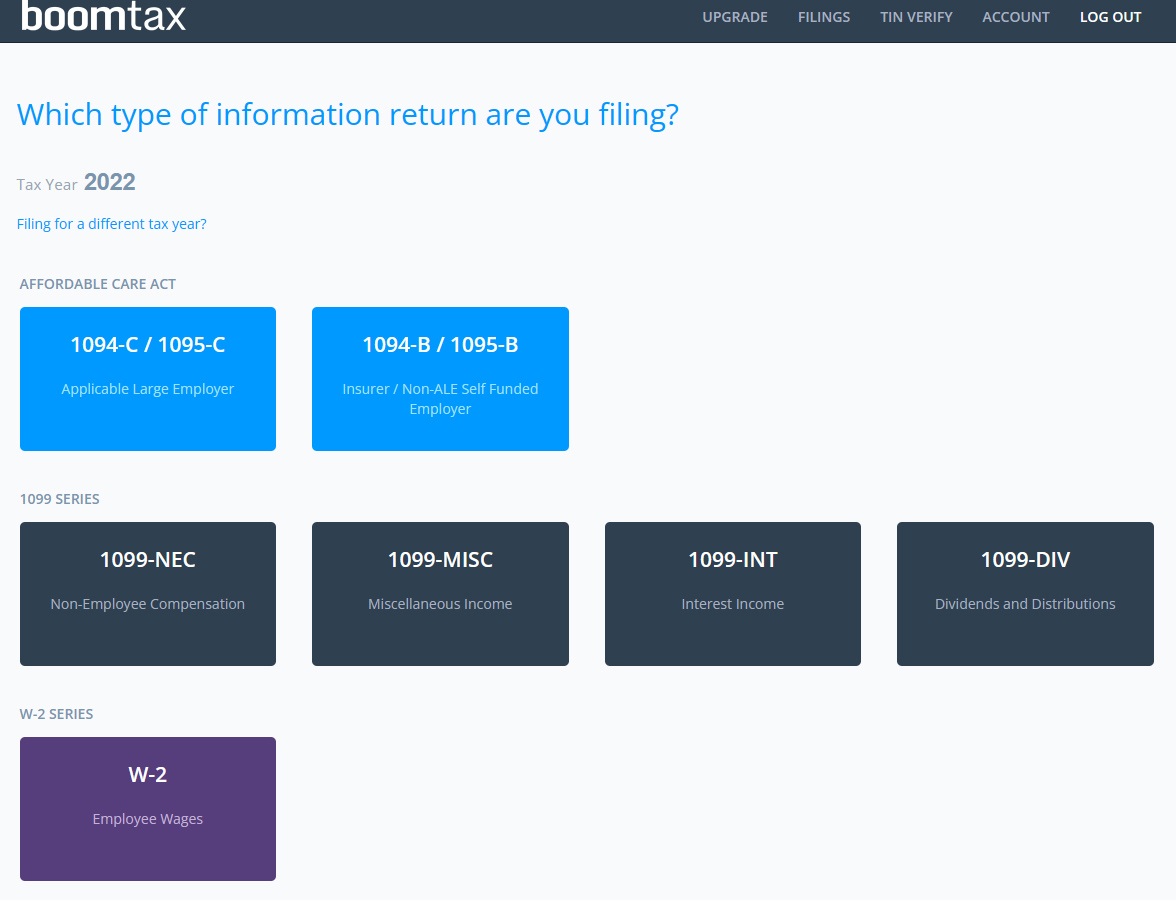

BoomTax is cloud-based software for businesses that offers a simple solution for filing your information returns. It employs a step-by-step approach that allows you to complete forms 1099-NEC, 1099-MISC, 1099-DIV, 1099-INT, 1094-C, 1095-C, 1094-B, and 1095-B easily. With the help of BoomTax, you won’t have to learn any complicated software or undergo specialized training.

Support for Affordable Care Act (ACA) reporting is available for a flat fee of $349 per company for up to 150 employees for the 2023 tax year. Filing for forms 1099 and W-2 start at $39 for 12 forms. Although only one website offers user reviews, BoomTax scored high for its responsive customer support and ease of use. However, reviewers also wished that it included a payroll service, which we view as a sign of how much users like the W-2 service.

Fit Small Business is dedicated to providing high-quality answers to your questions. Our commitment to delivering valuable and reliable information is the basis of all our content. We use our team’s expertise and thorough research to address your specific questions, ensuring our content is based on knowledge and accuracy.

The Fit Small Business editorial process is streamlined, and it involves expert writers who create well-researched and organized articles that provide in-depth insights and recommendations. Fit Small Business adheres to strict standards to determine the “best” answers, taking into account factors such as accuracy, clarity, authority, objectivity, and accessibility, and these ensure that our content is trustworthy, easy to understand, and unbiased.

BoomTax Alternatives & Comparison

BoomTax Reviews From Users

| Users Like | Users Dislike |

|---|---|

| Responsive and accessible customer support | Unable to file individual or business tax returns |

| BoomTax will print and mail your forms | No payroll services |

| Upload data using an Excel template | Desktop software unavailable |

Users who left a BoomTax review said that they appreciate that the software is so easy to use and is affordable. Reviewers also like the fact that they can upload information using the Excel template and have the option to let BoomTax print and mail the forms, which saves a lot of time.

Its biggest drawbacks noted by users are that you can’t file individual or business income tax forms through BoomTax and that payroll services aren’t provided. While we agree payroll services would nicely complement its W-2 service, business income tax filing is not very closely related to W-2s, so we think it’s a bit of a stretch for users to expect that service.

User reviews are limited, but BoomTax earned the following average score on this popular review site:

- Trustpilot[1]: 4.5 out of 5 based on almost 20 reviews

BoomTax Pricing

BoomTax offers a pay-as-you-go service for the 1099 series and/or W-2 forms. The first 12 forms are $39, and then pricing shifts to per-form after that. For example, 15 forms are $2.87 per form, whereas 100 forms are $2.13 per form.

For ACA filing, you can select between two plans, and both offer unlimited corrections and email and phone support.

- Premium: $349 per company for up to 150 employees, email and phone support, and unlimited corrections; state reporting for New Jersey, Rhode Island, and California, as well as Washington, D.C., is also available

- Enterprise: Custom quote; includes unlimited companies and employees, priority email and phone support, and unlimited corrections

Optional fees:

- ACA Form Mailing: $1.99 per form

- ACA Form E-Delivery: 30 cents per form

- 1099 Form Mailing: $1.99 per form

- 1099 Form E-Delivery: 30 cents per form

- W-2 Form Mailing: $1.99 per form

- W-2 Form E-Delivery: 25 cents per form

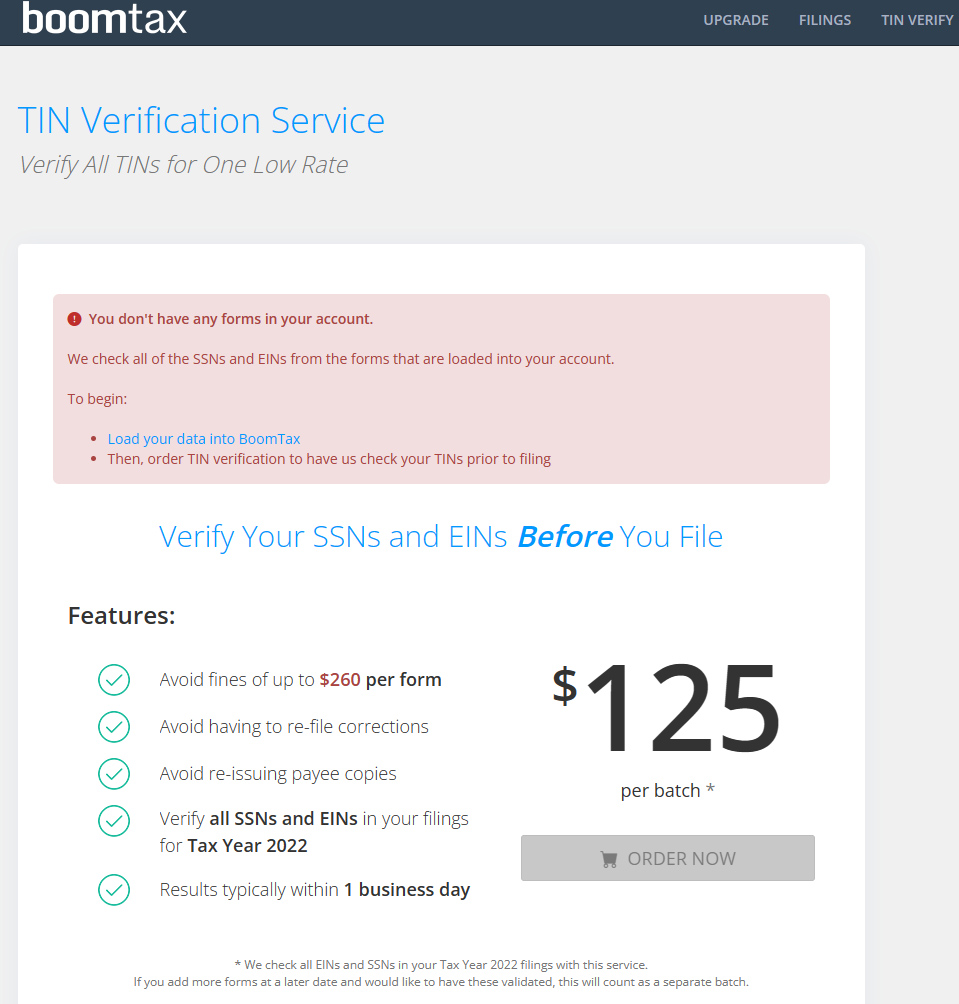

- TIN Verification Service: $125 per batch

If you don’t want to pay extra for form delivery, you can download the forms in a PDF file and arrange the delivery yourself.

BoomTax Features

BoomTax has several useful features for businesses, including a seamless way to e-file, IRS-compliant e-delivery, a tax identification number (TIN) verification service, and support for ACA filing. It also offers a couple of useful add-ons, such as a print and mail service.

BoomTax doesn’t require you to have an IRS account, Transmitter Control Code (TCC), or coding skills—select “E-file” when filing and it will handle the e-file process from start to finish. BoomTax will check on the status of your filing and send you updates as the IRS or Social Security Administration processes your forms. If you need to make changes to your forms after filing, BoomTax offers free unlimited corrections.

ACA filing can be confusing, especially for new filers. BoomTax aims to simplify this task by providing resources that can help. These resources include a Form 1095-C Guide and several other articles that break down the intricacies of the latest tax laws.

IRS guidelines require that you have a process in place prior to emailing forms to your recipients, and it involves gathering consent. BoomTax will handle this process for you completely, ensuring that you follow the proper protocol.

With TINCorrect, BoomTax makes payee verification easy. No credit card is required to sign up, and you can try 10 searches for free when you register.

There are three ways to verify: on-demand, by bulk, where up to 100,000 TINs can be verified at once, or via modern application programming interface (API), which is compatible with all programming languages. BoomTax charges $125 per batch for this service.

BoomTax’s TIN verification service

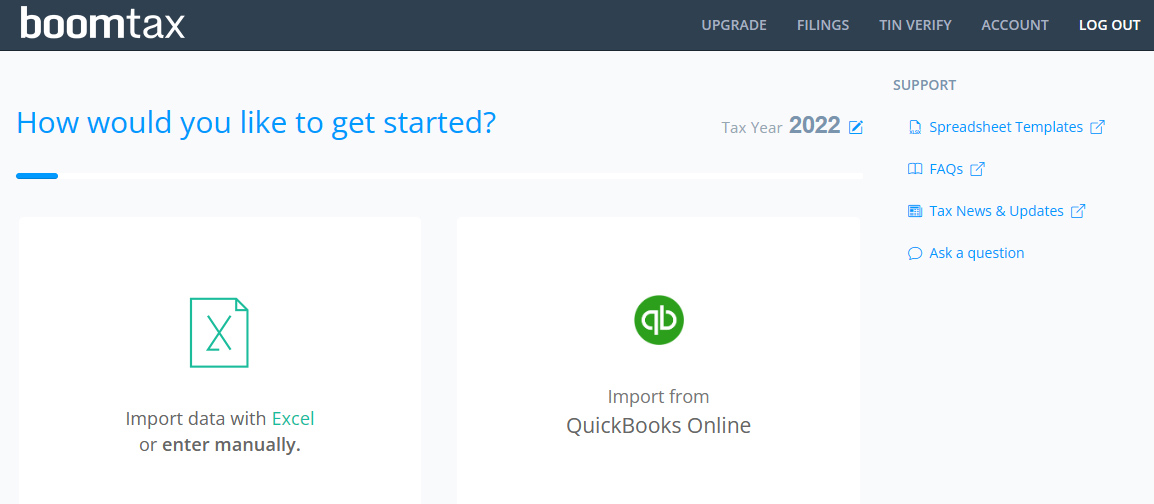

BoomTax supports many data formats, including Excel, and popular payroll providers including ADP, Sage, and UltiPro. You can also import data directly from QuickBooks Online or upload your IRS ACA files into BoomTax. This will make it much easier to file your forms come tax time.

Importing data into BoomTax

BoomTax will print and mail all of your forms from a Health Insurance Portability and Accountability Act (HIPAA)-compliant facility, which includes 2D barcode tracking to ensure every form is mailed properly and on time. The cost for print and mail service depends on the type of form, but it ranges from $1.65 to $1.99 per form. You can also elect to print your forms directly to PDF to distribute on your end.

BoomTax Customer Service & Ease of Use

BoomTax Support can be contacted by phone, email, or chat. Regular business hours are between 10 a.m. and 7 p.m. Eastern time, with extended hours during tax season. An extensive knowledge base is also available, with articles related to e-filing, making corrections, and understanding ACA tax forms.

The provider also offers how-tos and frequently asked questions (FAQs). Additionally, spreadsheet templates are available for you to download, and Boom Post, the BoomTax blog, provides tax news and updates.

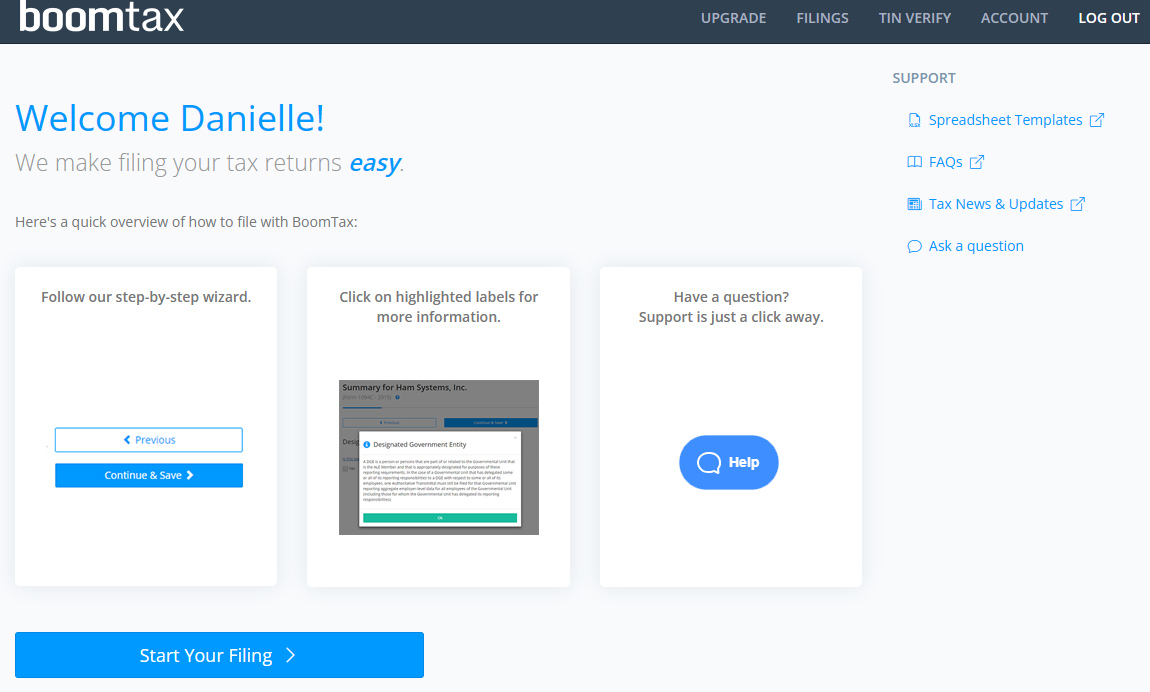

BoomTax Dashboard

Navigating the BoomTax website is easy—as soon as you set up your free account, you can immediately jump into creating the desired forms. The dashboard is clean and user-friendly, and support is readily available should you run into any issues.

BoomTax Form Filing

BoomTax provides a visual display of each form, with a description of each. Once you select the form, you can import the data or enter it manually. BoomTax allows you to import files from Excel, payroll providers like ADP, or directly from QuickBooks Online.

Frequently Asked Questions (FAQs)

BoomTax charges $349 per company for up to 150 employees, email and phone support, and unlimited corrections. State reporting for New Jersey, Rhode Island, and California, as well as Washington, D.C., is also available. For over 150 employees, you can contact BoomTax for a custom quote.

No, BoomTax doesn’t currently offer a mobile app.

Yes, you can import data from QuickBooks Online directly into BoomTax.

Bottom Line

BoomTax is an affordable and easy way to process W-2s, 1099s, and forms related to ACA filing. The user-friendly cloud-based software will ultimately save you time and money by letting you focus on just the forms you need.

1Trustpilot