The process of locating and purchasing for sale by owner (FSBO) properties can be a complex endeavor for investors. However, FSBO properties are financially attractive for investors expanding their real estate portfolio. This process involves multiple stages, starting with identifying an FSBO listing to securing appropriate financing and completing the closing procedures. We’ve identified six steps for how to find for sale by owner homes, along with the advantages and disadvantages of navigating the FSBO process without a real estate agent involved.

1. Select Your Target Area

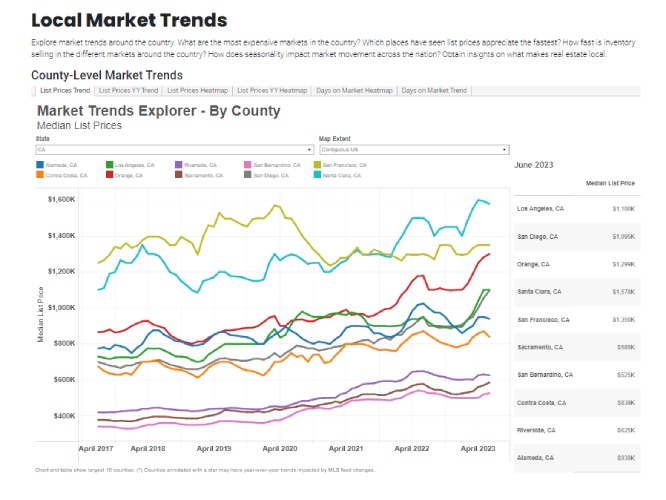

The location of an FSBO property is a significant factor to consider when starting the buying process. During this time, investors should evaluate neighborhood factors, such as location, price, amenities, and educational rankings, that add to the area’s general aesthetics.

To assess the neighborhood, investors can utilize online property databases such as Zillow or Realtor.com because they have vast amounts of neighborhood data that is easily accessible. Investors should then proceed to narrow down neighborhood choices to a couple of regions where they believe a purchase would be most advantageous.

Market trends report (Source: Realtor.com)

The following are neighborhood attributes to consider and how they might positively influence property value:

- Proximity to amenities: Homes near shopping centers, parks, and recreational areas often have higher value due to convenience and leisure options.

- Public transportation: Easy access to public transit can increase tenant demand, especially in urban areas, which can also enhance property value.

- Curb appeal and green spaces: Areas with aesthetic appeal, tree-lined streets, and green spaces tend to have properties with a premium value.

- Future development projects: Upcoming infrastructure or commercial projects can lead to increased demand and property appreciation in the near future.

- Low noise and pollution levels: Quiet neighborhoods with good air quality are often preferred, resulting in a potential uptick in property values.

2. Understand the Different Ways to Find FSBO Listings

Investors must take a multifaceted approach when identifying potential properties to purchase, especially when figuring out how to find for sale by owner homes. Understanding the best way to search for FSBO listings can guide investors toward the most beneficial opportunities.

Online platforms have become a predominant way for finding these listings. There are websites dedicated to FSBO properties, allowing sellers to list their properties directly. In addition to the digital realm, investors can purchase leads from companies that specialize in compiling FSBO data. Here are a few FSBO sites investors should consider when going the online route:

Site | ||||

|---|---|---|---|---|

Best For | Direct seller listings | Ability to tap into listings from a diverse audience | Localized property listings | Robust property insights and resources |

Key Features |

|

|

|

|

Starting Price | Free; paid plan costs $495 (one-time fee) | Free | Free | $95 (flat fee) |

Learn More |

To read more about these options and explore others, visit our article Best FSBO Sites.

Beyond online databases, attending open houses and driving around targeted neighborhoods offers an on-the-ground perspective. Observing the area firsthand can reveal nuances not captured in online listings, like the property’s actual condition, immediate surroundings, or the neighborhood’s general ambiance. In addition, traditional mediums like newspapers, especially the classified sections, continue to be a repository of FSBO listings. This is helpful in certain local or regional markets where print media still retains its influence.

3. Engage With FSBO Property Owners

Upon identifying FSBO homes that align with your investment criteria, investors should connect directly with the owners to schedule a property tour. This offers investors a unique advantage because bypassing intermediaries can lead to more transparent and quicker communication. When you engage directly with homeowners, you gather firsthand information about the property’s history, maintenance, potential issues, and the real motivation behind the sale.

As you explore the property, arm yourself with pertinent inquiries about the residence, including:

- Are there any liens, easements, or other encumbrances on the property?

- What are the average monthly utilities and maintenance costs?

- If applicable, can you provide details about the property’s rental history, including occupancy rates, rental income, and tenant feedback?

- Have there been any significant developments or changes in the neighborhood since you bought the property?

- Are there any current offers or interests from other potential buyers?

- Have there ever been issues, such as water damage, pest infestations, or foundation problems, with the property?

This direct communication can be beneficial, but it’s crucial to approach these discussions with preparation.

Investors should be aware that homeowners might have an emotional attachment to the property, which can influence their valuation and willingness to negotiate. It’s also essential to verify all information provided by the homeowner with proper due diligence to ensure your investment decision is well-informed and data-backed.

Keep in mind that sellers may have their own obligations and checklists for selling their property. Some FSBO sellers may only want to sell the property “as-is” without demanding extensive repairs if the property has known issues. Investors may also run into sellers in a rush to close due to a job relocation, personal circumstances, or other pressing factors, while others may have the flexibility to wait for the right offer. Understanding their needs will increase your chances of closing the deal.

4. Secure Funding

When considering how to find homes for sale by owner, securing the necessary funds becomes a pivotal step in acquiring investment properties. How an investor funds their projects should resonate with their financial status, long-term goals, and the nature of the property. Various financing options exist for FSBO properties, like traditional mortgages, hard money loans, and private investors. It’s crucial to evaluate the cost, flexibility, and duration of each option. Aligning the financing method with the property type, like a short-term rehab or a long-term rental, can optimize the investment’s potential returns and minimize financial strains.

Short-term FSBO financing is ideal for investors who are navigating how to find for sale by owner homes and wish to acquire, renovate, and sell a property within a brief period. Often employed for swift turnaround projects, long-term investors occasionally use this type of financing to enhance or stabilize an FSBO property before transitioning to refinancing. Such financing allows investors a competitive edge similar to cash buyer timelines.

Options for short-term FSBO financing include:

- Hard money loans: These loans are tailored to investors to help facilitate the purchase of properties with the intent for immediate resale or eventual refinancing.

- Bridge loans: Primarily used for commercial assets to aid in residential property acquisition so investors don’t miss out on lucrative opportunities.

- Rehab loans: Specifically designed to finance both the purchase and renovation of under-maintained properties.

- Investment property lines of credit: Dependent on an investor’s property equity, this credit line is suitable for property acquisition or rehabilitation.

- Home equity lines of credit (HELOCs): Drawing from the equity of a primary residence, this loan can fund both property purchases and renovations.

Long-term FSBO financing caters primarily to those who seek ownership without an immediate intention to resell or investors keen on maintaining a property as a sustained investment. The emphasis on long-term financing usually includes obtaining competitive, lasting rates, particularly for properties that are mostly move-in ready and need minimal renovations.

Options for long-term FSBO financing:

- Portfolio loans: Targeted at both investors and potential homeowners, these loans don’t adhere to Federal Housing Administration (FHA) guidelines and are typically retained on the lender’s books.

- Conforming loans: A loan that provides competitive FHA rates and is mainly tailored for individuals looking to occupy the purchased property.

- FHA 203(k) loans: Designed for homeowners to facilitate the acquisition and subsequent refurbishment of a property necessitating improvements.

- Blanket mortgages: Ideal for investors aiming to finance several FSBO properties collectively by leveraging a single loan through a process termed cross-collateralization.

- Homestyle renovation mortgages: These government-endorsed loans are suitable for homeowners eyeing one- to four-unit residences or investors keen on acquiring a standalone secondary property.

This approach enables buyers to acquire real estate without relying on traditional mortgage lenders. Seller financing emerges as an option when conventional mortgage avenues are inaccessible due to the buyer’s credit status or the prospective property’s condition. This method caters to a broad spectrum of properties, from commercial real estate to undeveloped land.

In this arrangement, the seller effectively assumes the role of the financier. The seller will offer financial flexibility that’s often unmatched by regulation in most long-term and short-term loans. However, both parties should understand that formal documentation still remains essential, like promissory notes, trust deeds, and mortgages. Both parties must also agree on purchasing requirements like loan interest rate, down payment amount, income requirement, employment, etc.

5. Make an Offer & Perform Property Assessments

Once a property is identified and financing is established, investors should proceed with presenting an offer to the seller. The optimal offer for an FSBO property should take into consideration a comparable report of sale prices of similar properties in the locality within the last six months, also known as a comparative market analysis (CMA). Offers should be presented to the buyer via a legal contract. An attorney should be hired to review the offer because each state has different buying requirements.

If your offer is accepted, the next step would be to perform a property inspection and appraisal. A certified property inspector will scrutinize the FSBO home to provide both parties with insights regarding its present condition and areas that need repairs. Buyers will typically shoulder the cost of home inspections, which range from $300 to $500. Any necessary repairs suggested should be discussed between buyer and seller, and the work must be completed by a licensed repair person.

Home inspection checklist (Source: Zillow)

During the purchase process, there can be something called an inspection contingency period. It’s a designated time frame within a real estate contract that allows the buyer to conduct a thorough examination of the property. If significant issues are found, the buyer can renegotiate terms with the seller, request repairs, or even withdraw from the sale without penalties. Each state has its own laws on the contingency period. For example, in Florida, a buyer can terminate a purchase for any reason during the inspection period, which is usually 15 days, even if no issues were found.

Most financing lenders will require an appraisal before releasing funds for the purchase. For lenders to approve the financing, the buying price of the home should be equal to or less than the property’s appraised value. Appraisals are optional if the purchase is made with no financing. Appraisal fees usually range from $375 to $450, and the lender will generally coordinate the appraisal on the buyer’s behalf.

6. Finalize the Purchase

The closing process is the final and crucial phase in acquiring an FSBO property. Some lenders will require investors to obtain insurance before the closing process. This is to safeguard the lender’s interest in the property, ensuring that their investment is protected against unforeseen events like fire, theft, or natural disasters. Purchasing vacant home insurance is especially important for investors if they are planning to leave the home empty while setting up their next steps.

At this final stage, both the buyer and seller come together to finalize the transaction. All necessary paperwork, including the deed, transfer of ownership, and settlement statement, is reviewed and signed by both parties. Additionally, the purchase price and closing costs are exchanged, typically using an escrow service. The property’s title is formally transferred from the seller to the buyer, and the buyer will receive keys and access to the property.

Advantages & Disadvantages of FSBO Transactions

FSBO transactions bring about a set of unique intricacies that differ from traditional real estate transactions. By obtaining an FSBO property without a real estate agent involved, investors can save on the overall property price. According to the National Association of Realtors (NAR), in 2022, most FSBO homes sold for $225,000, compared to $345,000 for a home sale with a real estate agent. That’s a significant discount, especially if purchasing multiple properties.

Aside from the cost benefits of for sale by owner properties, the buying process can demand a larger time commitment from both buyers and sellers. Without an intermediary agent, all aspects of the buying process, from communications to paperwork, are managed directly by the parties involved. Additionally, accurately determining the property’s market value can be challenging. While traditional transactions benefit from the expertise of real estate agents, FSBO participants must independently analyze local sales data to determine a competitive price.

Here are more pros and cons when starting the journey of how to find homes for sale by owner:

| PROS | CONS |

|---|---|

| There is no need to pay real estate agent commissions | Discovering listings can be challenging because they aren't listed on most listing websites |

| There is greater control over negotiations and sale terms | Owners' homes can be priced above market value without the guidance of an agent |

| There will be opportunities for investors to acquire properties at below-market rates | Investors might have to shoulder the responsibility of drafting contracts |

| FSBO properties tend to attract fewer competing bids, reducing overall competition | FSBO sellers might not be well-versed in the nuances of property transactions, which can lead to miscommunications or drawn-out negotiations |

Frequently Asked Questions (FAQs)

To help determine if an FSBO property is competitively priced, investors should conduct a comparative market analysis (CMA). This analysis entails reviewing recent sale prices of properties with similar characteristics and in the same vicinity. An appraisal by a certified professional can also provide an accurate valuation. Investors could also leverage online real estate platforms and local property records to give insights into market trends and property values, which will help investors make an informed decision on the purchase price.

Acquiring an FSBO property can carry certain risks compared to traditional transactions. Since sellers may not always be familiar with all the legal and procedural nuances of property selling, there’s potential for oversight or lack of disclosures about the property’s condition. Without a realtor’s guidance, crucial steps like performing an inspection might be missed. Therefore, it’s essential for investors to practice due diligence, including obtaining comprehensive property inspections and seeking legal advice to review contracts to ensure a smooth transaction.

Negotiating an FSBO deal can differ from properties listed with agents. When dealing directly with homeowners, negotiations may become more personal as sellers have an emotional connection to their property. While this can sometimes lead to more flexibility, it’s crucial to approach discussions tactfully. Without intermediaries, direct communication is key. However, investors should remain objective and focus on property value and market conditions rather than personal aspects. It’s also beneficial to be well-prepared with market data to support your position during negotiations.

Bottom Line

Learning how to find for sale by owner homes requires due diligence and strategic planning. FSBO properties can become a lucrative investment strategy for experienced and aspiring investors. By following the six steps above, both buyers and sellers can understand the FSBO process, have an opportunity for cost savings, and have a more streamlined buying experience.