HomeWork Solutions (HWS) offers household payroll and nanny tax compliance services. It handles tax calculations, including tax payments and filings in all 50 states and across all levels (federal, state, and local). It also manages new hire reporting and helps new household employers set up their tax accounts with the IRS. For its full-service nanny payroll package, pricing starts at $220 per quarter for biweekly pay runs. In our evaluation of the best nanny payroll services, HomeWork Solutions earned an overall score of 3.96 out of 5.

Pros

- Offers a dedicated representative and free HR consultations

- Can manage federal, state, and local tax requirements in all 50 states

- Complete Payroll package includes multiple payroll options (weekly and biweekly pay runs)

- Handles new hire reporting

Cons

- New users have to pay a setup fee

- Initial setup takes anywhere from five to seven days

- Pricing for its Complete Payroll plan includes only one employee; additional per-employee fee gets costly if you have multiple workers

- Preparation of year-end tax reports costs extra

HomeWork Solutions Deciding Factors

Supported Business Types | Household employers needing online tools and services to help them compliantly pay nannies and household employees |

Free Trial | None, but HWS offers free product/service consultations for interested clients |

Pricing | Plans

Add-ons

|

Standout Features |

|

Ease of Use | Beginner-friendly; provides tax setup assistance to new clients—which is great for first-time household employers |

Customer Support | Unlimited support through phone, email, and online contact form; access to a live household tax and labor law expert from Monday to Friday, 8:30 a.m. to 7:00 p.m. Eastern time |

Looking for a general payroll service? Explore our top picks for online payroll services.

Top HomeWork Solutions Alternatives

Best for: Employers looking for affordable nanny payroll and tax services | Best for: Household employers looking for nanny payroll, tax, and basic HR tools | Best for: Employers hiring temporary household workers |

Recurring fees: $49.99 per month | Recurring fees: $75 per month | Recurring fees: $6.25 per paycheck for weekly payroll |

Quarterly tax filing fees: None | Quarterly tax filing fees: None | Quarterly tax filing fees: $80 per quarter |

Year-end tax filing fees: None | Year-end tax filing fees: $100 | Year-end tax filing fees: $150 |

If you’ve narrowed your list down to a few providers but still need help deciding which is the best payroll software for you, follow our step-by-step guide on choosing the right payroll solution.

Since Our Last Update: HomeWork Solutions has increased the additional per-employee fee of its Complete Payroll plan—from $60 to $65 per worker quarterly.

HomeWork Solutions offers two plans: Complete Payroll and Essential Payroll. With Complete Payroll, you can choose to run payroll weekly or biweekly, and HWS will handle the entire process—from calculating earnings/deductions to filing tax forms and paying your employees. On the other hand, Essential Payroll includes only nanny payroll tax payment and filing services, and you have to issue employee payments yourself. Both plans require you to pay a $110 one-time setup fee and a $110 year-end tax report fee per employee.

Note that HomeWork Solutions’ pricing for its Complete Payroll plan is based on a single-employee household. You have to pay an extra $65 per additional employee for every quarter. For example, if you have four employees, you will pay an additional $195 per quarter (the first employee is included in the base pricing).

Essential Payroll | Complete Payroll | |

|---|---|---|

Quarterly Pricing (for one employee) | $165 | Biweekly payroll: $220 Weekly payroll: $245 Additional employees: $65 per worker |

Add-on Fees | Account setup: $110 Year-end tax report prep: $110 per employee | Account setup: $110 Year-end tax report prep: $110 per employee |

Calculates Employee Withholding | ✓ | ✓ |

Prepares Tax Returns and Generates Tax Forms | ✓ | ✓ |

Manages Tax Payments and Filings | ✓ | ✓ |

Handles New Hire Reporting | ✓ | ✓ |

Issues Employee Payments and Maintains Payroll Records | ✕ | ✓ |

Direct Deposit Payment Option | ✕ | ✓ |

Access to Online Pay Stubs | ✕ | ✓ |

Dedicated Payroll Representative | ✕ | ✓ |

If you already paid household employees before signing up for an HWS plan and were unable to remit tax payments, the provider can help with back taxes. For $225 per quarter, it can calculate the previous quarter’s taxes so that you know how much you need to pay.

HomeWork Solutions Pricing Calculator

Not sure which HomeWork Solutions plan will fit your budget? Use our online calculator to compute the estimated quarterly and annual fees.

The provider nearly earned a perfect score in this criterion given its solid nanny payroll tools with automatic pay runs and multiple payment options. It lost points because it charges extra for year-end tax report preparation. Here are some of its payroll features.

Under the Complete Payroll plan, HomeWork Solutions offers weekly and biweekly pay runs. Payments are made through direct deposits, although it can also handle check payments. This plan also includes payroll recordkeeping, online pay stubs for your household employees, and access to a dedicated payroll representative who can answer questions and provide information about past and current employee payments. You even get an “Employer e-Filing Cabinet,” which provides you 24/7 online access to all of your nanny payroll and tax information.

Customers who choose the Essential Payroll plan must pay workers directly and send employee payroll records to HomeWork Solutions quarterly.

HomeWork Solutions handles all quarterly tax calculations, including remittance of taxes. It also completes all the required tax forms and automatically files these to the appropriate agencies. While it can manage federal, state, and local taxes for all 50 states, some states may require service levels included in the Complete Payroll plan. Contact HomeWork Solutions to inquire about the nanny tax requirements in your state and which plan is best for you.

If you owe back taxes for employees who have already been paid but failed to meet tax requirements, HomeWork Solutions will charge a $225 “previous quarter” fee to process back taxes.

Regardless of whether you choose the Essential Payroll or Complete Payroll plan, HomeWork Solutions will prepare payroll tax returns and generate Schedule H and W-2 forms. Relevant tax forms are then visible from the “Employer e-Filing Cabinet” and its simple self-service online portal for employees.

In our evaluation of HomeWork Solutions’ HR functionalities, this provider scored 3.25 out of 5. It would have received a higher score if it provides access to benefit plan options. As of this writing, it only offers workers’ compensation insurance through its insurance partner. Here are some of its key HR features.

HomeWork Solutions’ employee self-service portal lets your household staff view their pay stubs and tax forms online. Your employees will also get text and email notifications for net pay deposit transactions.

While HomeWork Solutions doesn’t offer workers’ compensation plans, it has an insurance partner that can assist you with your household employee insurance needs.

In addition to payroll and tax services, HomeWork Solutions offers background checks through NannyVerify.com. The checks are provided by National Crime Search and involve a search of private databases, including in-court records. Its background screening services cost anywhere from $34.95–$74.95, depending on the package selected.

HomeWork Solutions received a 3.88 out of 5 score in this criterion because of its solid nanny payroll and compliance support, including its tax services and ID setup assistance for new household employers. However, its limited how-to guides and dedicated payroll support that’s available only in its Complete Payroll package cost this provider some points.

- New household employer tax account set up

- Free HR consultations

- Employer and employee online portal

- Dedicated payroll representative

- Online blog and other resources that tackle common household employment issues

- Customer support via phone, email, and online form

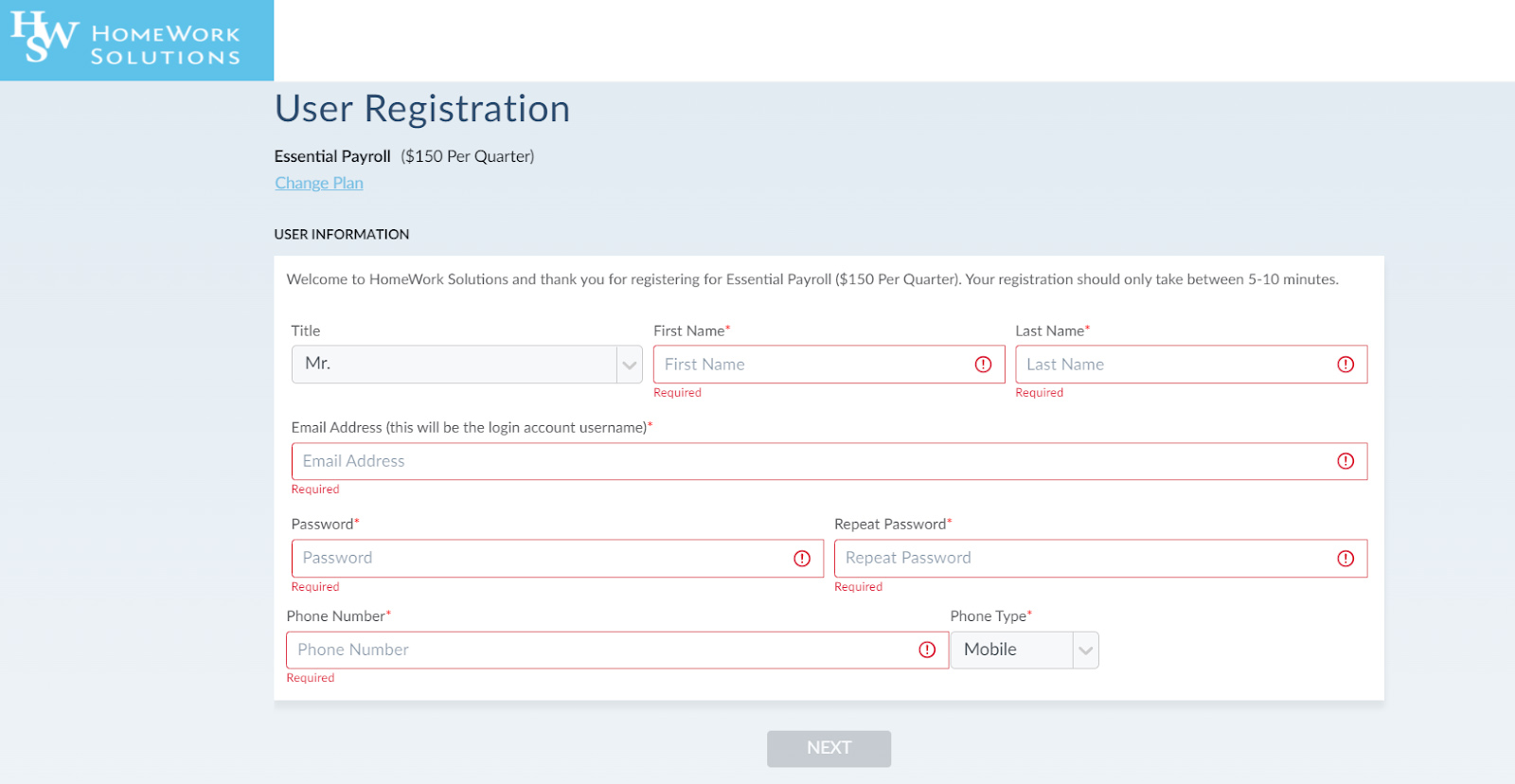

Registering for a HomeWork Solutions account is easy. Simply choose a plan from the HomeWork Solutions website to start the process. It has an online wizard to guide new clients through registration—although there’s also an option for downloading a paper registration form. Keep in mind, however, that account setup takes anywhere from five to seven days to complete from the time HomeWork Solutions receives all of the necessary employer information.

A screenshot of HomeWork Solutions’ user registration wizard (Source: HomeWork Solutions)

As soon as initial enrollment is complete, HomeWork Solutions handles employer account setup with the IRS and relevant state tax authorities. It will even help you manage all correspondence to and from tax agencies.

You also get a dedicated payroll specialist if you subscribe to its Complete Payroll package.

Even if you don’t, HomeWork Solutions offers free HR consultations if you have nanny payroll questions and queries about your household employer obligations. It even provides unlimited support, and you can contact customer service (as well as a nanny payroll tax and labor law expert) Mondays through Fridays, from 8:30 a.m. to 7 p.m. Eastern time.

However, its online “Knowledge Center” has limited how-to guides. While most of the help articles tackle nanny payroll and tax basics, there aren’t a lot of online guides about the provider’s payroll services and tools.

In our expert assessment, HomeWork Solutions earned a perfect score for its robust tax support for household employers. It provides access to a household tax and labor law expert should you need help navigating the complexities of nanny payroll. Signing up for its services is also easy. Plus, its payroll plans are reasonably priced.

However, if you need a more budget-friendly option, consider SurePayroll by Paychex. Unlike HomeWork Solutions, it doesn’t charge on a per-pay run basis. Its nanny payroll service only costs $49.99 per month for one employee and comes with unlimited pay runs and tax filing services. You also don’t have to pay extra for year-end tax form preparation as you would with HomeWork Solutions.

There are very few up-to-date HomeWork Solutions reviews online as of this writing. Those who left feedback on third-party review sites said that its service simplifies the nanny payroll process, making it easy for them to meet state and federal tax requirements. Many commended its support team for excellent service, although some complained about having experienced occasional tax errors, especially when there are tax law updates.

At the time of publication, HomeWork Solutions reviews earned the following scores on these popular user review sites:

- Trustpilot: 4.2 out of 5 stars based on 185+ reviews

- Facebook: 4.4 out of 5 stars based on nearly 20 reviews

How We Evaluated HomeWork Solutions

For this HomeWork Solutions review article, we used the evaluation criteria in our best nanny payroll services guide. We looked at the payroll and HR features that we believe are crucial in managing payments for nannies and household employees. We also considered transparency in pricing, affordability, compliance tools, and customer support. Ease of use is another area that we checked, including the feedback that actual users posted on third-party review sites.

Click through the tabs below for our full evaluation criteria.

30% of Overall Score

We gave priority to those that offer unlimited payroll runs, direct deposit payments with an option to process paper checks, and tax payment and filing services, including year-end tax form submissions (W-2 and Schedule H).

20% of Overall Score

We looked at the monthly costs and setup fees, including whether pricing details are readily available on the provider’s website. Preference was given to those that charge less than $50 monthly for one employee and don’t have setup fees.

20% of Overall Score

Payroll service and software should be easy to access and set up and have a user-friendly interface. We gave points to those that provide a dedicated representative, employer ID and tax set-up assistance, and live phone support that resolves issues promptly.

15% of Overall Score

This criterion reflects how well we think the software works for families in particular as far as price, tax prep, and ease of use.

10% of Overall Score

We favor providers that handle onboarding and include a self-service portal that nannies can use to see payments made, edit information, and/or print forms. It is also better if the provider has workers’ comp and other employee benefits options and access to experts who will advise users on compliance issues.

5% of Overall Score

We considered online user reviews from third-party sites (like G2 and Capterra) based on a 5-star scale, wherein any option with an average of 4+ stars is ideal. Also, software with 1,000 or more reviews on third-party sites is preferred.

Bottom Line

Households with employees like nannies, housekeepers, and senior care providers are often faced with challenging and time-consuming tax and payroll requirements. HomeWork Solutions helps these employers by handling nanny payroll and taxes and keeping track of state and federal reporting and filing requirements.

If you’re ready to get started, enroll online or contact HomeWork Solutions for a one-on-one consultation.