NonProfit+, also stylized as NonProfitPlus, is a cloud-based fund accounting and grant management program that helps nonprofits manage their funds, grants, budgets, and finances. Our NonProfitPlus review discusses its features in restricted funds management, donor management, volunteer management, and an automated audit trail to verify and track all incoming and outgoing cash flow.

For NonProfitPlus pricing information, you’ll need to contact Acumatica, which powers NonProfitPlus. There are only a few user reviews about the software, so we recommend not to rely on the few feedback.

We are driven by the Fit Small Business mission to provide you with the best answers to your small business questions—allowing you to choose the right accounting solution for your needs. Our meticulous evaluation process makes us a trustworthy source for accounting software insights. We don’t just scratch the surface; we immerse ourselves in every platform we review by exploring the features down to the finest nuances.

For our roundup of church accounting software, we created a special rubric that evaluates the features of our chosen providers, which gives our audience—churches and faith-based groups—an unbiased opinion about the software’s capabilities and fit for your organization.

Pros

- Is a robust accounting system with an extensive list of features

- Supports an unlimited number of users

- Has a strong restricted funds management feature

- Includes a free mobile app

Cons

- Is complicated to use

- Has n tools for managing payroll

- Lacks upfront pricing

- Has limited user reviews on review websites

NonProfitPlus Alternatives & Comparisons

Are you looking for something different? For general accounting platforms that can be customized for nonprofits, check out our guide to the best small business accounting software.

NonProfitPlus Reviews From Users

| Users Like | Users Dislike |

|---|---|

| Strong fund accounting features | Issues with software implementation partners |

| Outstanding grant management module | Problems with setting up nonprofit and general ledger (GL) features |

| Excellent reporting features for nonprofit use | |

There are only a handful of NonProfitPlus reviews online. Due to the limited number, we highly encourage you to not rely on them. They are old as well, so they may not accurately reflect the current performance of the software. We recommend connecting with NonProfitPlus to get first-hand information about its software’s capabilities.

- Capterra[1]: 5 out of 5 stars based on around 10 reviews

- Software Connect[2]: 5 out of 5 stars based on about 5 reviews

NonProfitPlus vs Competitors

In this NonProfitPlus review, we compared the software with Aplos and QuickBooks Online Plus.

NonProfit+ vs Competitors FSB Case Study

Touch the graph above to interact Click on the graphs above to interact

-

NonProfit+ Custom Priced

-

Aplos Starts at $79 per month

-

QuickBooks Online Plus Starts at $90 per month

Pricing for NonProfitPlus is unavailable on the website, so we awarded more points to Aplos and QuickBooks because pricing details are published. Aplos is the most affordable option in this set but the price is not too far but it’s not far from QuickBooks Online Plus’ price point. We also don’t see major differences between these three software in terms of accounting features.

For nonprofit features, NonProfitPlus takes the top spot since it has encumbrance accounting features, which Aplos lacks. Meanwhile, since QuickBooks Online Plus isn’t originally intended for nonprofit accounting, it’s not surprising that it got a low score. Users can set up QuickBooks Online for nonprofits, but it’ll take a lot of work.

Overall, we recommend NonProfitPlus for large nonprofits or nonprofits with multiple funds. Pricing can be an issue for NonProfitPlus, so we either recommend exploring Aplos or QuickBooks Online Plus.

NonProfitPlus Pricing

The provider took a hit in our analysis because there is no NonProfitPlus pricing guide online. However, according to user review website Capterra, fees start at $675 per month. If you’re still interested in this software, we highly recommend getting in touch with an Acumatica rep for a custom quote. Since it offers customized plans, we believe that it can provide customizations depending on the user’s needs.

NonProfitPlus Accounting Features

NonProfit+ is a robust accounting and enterprise resource planning (ERP) solution exclusively tailored to nonprofits. It uses the Acumatica financial platform to help nonprofits accomplish essential tasks such as managing and reporting on funds, grants, and programs.

It didn’t get perfect marks because it lacks features in inventory and receipt capture. Although we don’t see inventory as a major feature, having it would be a great benefit, especially if the nonprofit deals with inventory items as part of its services. Another factor that affected the score is payroll. Adding payroll entails additional costs, which could be a turnoff for users on a budget.

Look at some of NonProfitPlus’ core features below.

NonProfit+ includes a flexible GL account and subaccounts that you can configure depending on your needs. You can customize and drill down in your reports by setting up segments, segment lengths, and segment values. Since the GL is integrated with all the other modules, it gives you access to your most critical financial data.

The A/R management system automates payment collections by generating invoices, sending statements, applying payments verifying balances, and tracking commissions. It can also deliver customer reports that can be fully integrated with the other Acumatica modules.

The A/P module manages liabilities and payments for goods and services. It allows users to enter prepayment requests, apply prepayments, assign deferred expense schedules, and approve payments. This module also includes value-added tax (VAT) withholding, 1099 reporting, and multicurrency support.

This feature controls your day-to-day transactions. It gives an overview of your cash balances and fund transfers. It can also be used for bank account reconciliations.

This is particularly useful for those conducting business outside the United States. It computes realized and unrealized gains and losses on currency translations automatically when supporting international subsidiaries, vendors, and customers.

Managers of multiple nonprofit entities can track financials and reports across related companies within an organization. Intercompany accounting centralizes cash management, vendor payments, and customer invoicing while maintaining separate records of income and expenses.

This feature is useful if your organization or business has regular or scheduled services to clients. It can be used to automate recurring billing, payments, and collections.

NonProfitPlus tracks the valuations of assets, including book and tax depreciation. It can create financial reports that can be used to maximize tax benefits and meet compliance requirements. NonProfitPlus also supports IRS Section 179 for reduced first-year depreciable basis and reversals of early asset disposal.

This labor accounting feature tracks the performance of employees, partners, and contractors. It can also be used to pay them and ensure that the client is accurately billed for their services.

Track your available inventory, those in transit, reorder quantities, and inventory costs. It also allows the use of multiple inventory valuation methods, such as standard cost, moving average, specific identification, and first-in, first-out (FIFO). Aside from that, you can track inventories in multiple warehouses.

NonProfitPlus automates requisition requests, authorizes employees to select from a catalog, and limits requests to specific items. It also speeds up the bidding process by emailing the request to multiple vendors.

This tool helps you generate POs automatically based on your stock level. You can also create approval rules for certain order types, vendor information, order amount, and other specific information.

NonProfitPlus includes real-time dashboards and customizable reports available in a wide range of dimensions. You can drill down into your reports by department, product, or any particular unit of your business. You can have your consolidated reports displayed in a monthly, quarterly, or yearly view.

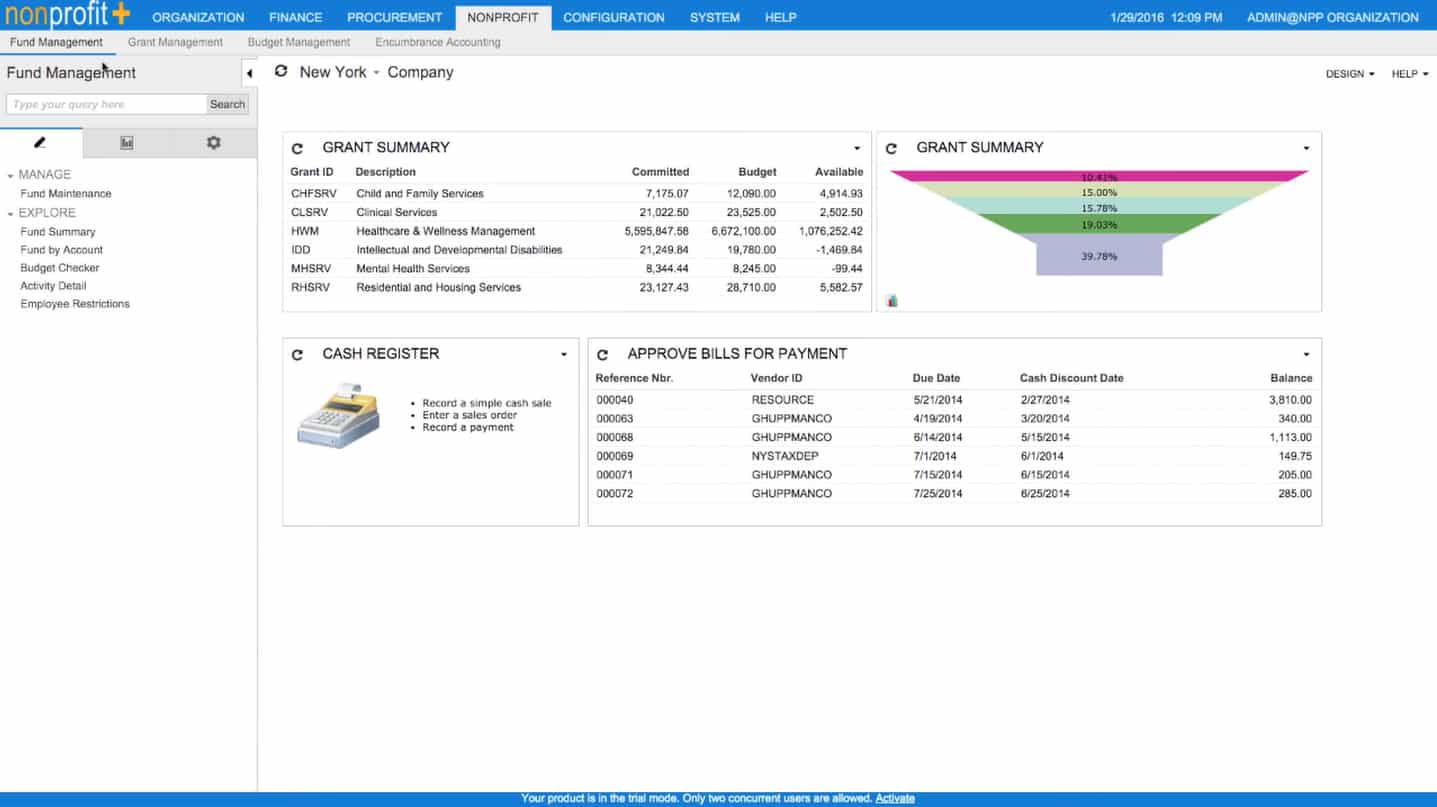

NonProfitPlus Dashboard (Source: NonProfitPlus)

The program generates budget reports, restricted fund reports, donor reports, and encumbrance reports. Aside from specific reports, you can also generate nonprofit financial statements like the Statement of Financial Position (balance sheet), Statement of Activities, Statement of Cash Flows, and Statement of Functional Expenses.

NonProfitPlus can create automated audit trails that can be used by your accountants or controllers. It helps in ensuring that a year is closed properly and efficiently, relieving you of the many headaches caused by legal compliance.

Moreover, to ensure the integrity of transactions, the enhanced audit trail system of NonProfitPlus doesn’t allow the deletion of records. Additionally, error corrections are performed by correcting or reversing entries with appropriate documentation.

When you purchase NonProfitPlus, you’ll get a free iOS or Android mobile application that you can customize to your organization’s needs. You can use it to track your finances, enter and approve time and expenses, and communicate with anyone in the organization.

NonProfitPlus Nonprofit Features

NonProfitPlus scored perfectly in this category because it has all the features we want to see in nonprofit accounting software. You could never go wrong with NonProfitPlus if nonprofit accounting is what you’re after, especially in fund accounting and grant management.

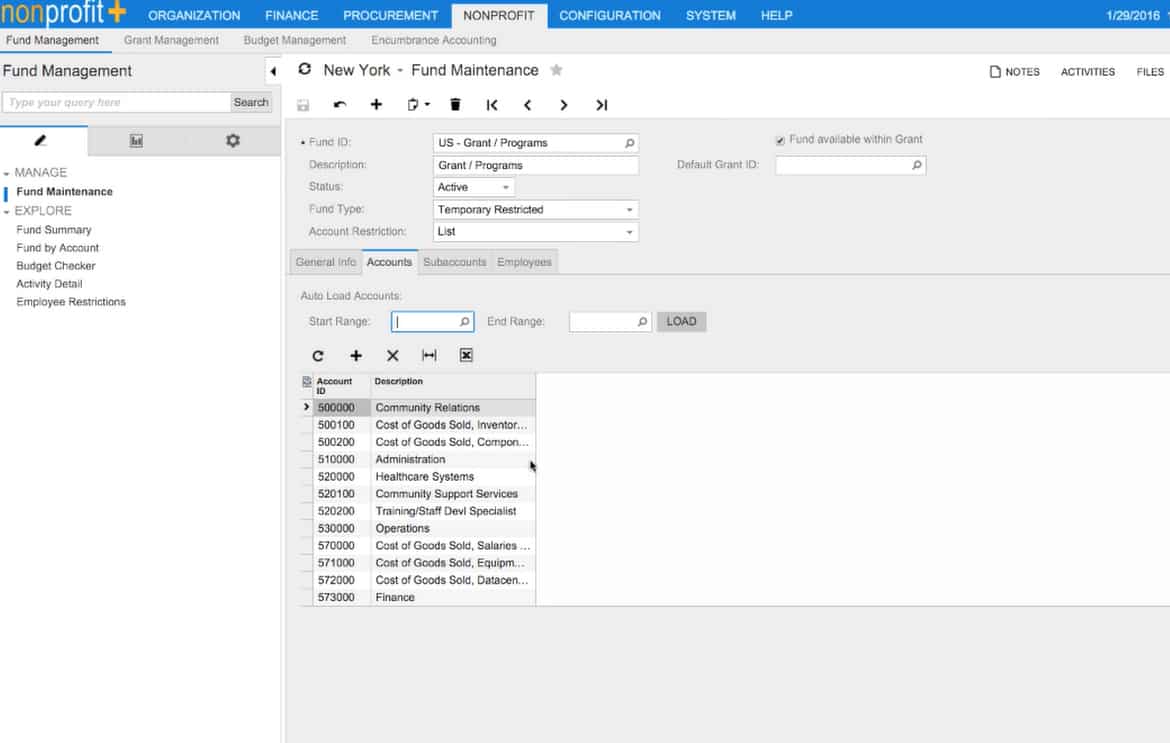

NonProfitPlus has a fund accounting module that lets you track revenues with purpose restrictions against expenditures related to those purposes, helping you ensure that your funds are used according to predefined policies. You can also generate reports on funds to present to your trustees and boards and keep track of major fund groups, such as current funds, loan funds, endowment funds, annuity and life income funds, plant funds, and agency funds.

Donor-imposed conditions can be permanent or temporary. As such, nonprofits receiving conditional donations must properly account for these funds as permanently or temporarily restricted assets and properly recognize revenues as a result of achieving the conditions set by the donor.

NonProfitPlus can help you account properly for conditional donations and ensure that these funds are spent according to the will of the donor. You can also separate restricted gifts from unrestricted donations for accountability and transparency.

Restricted Fund Management (Source: NonProfitPlus)

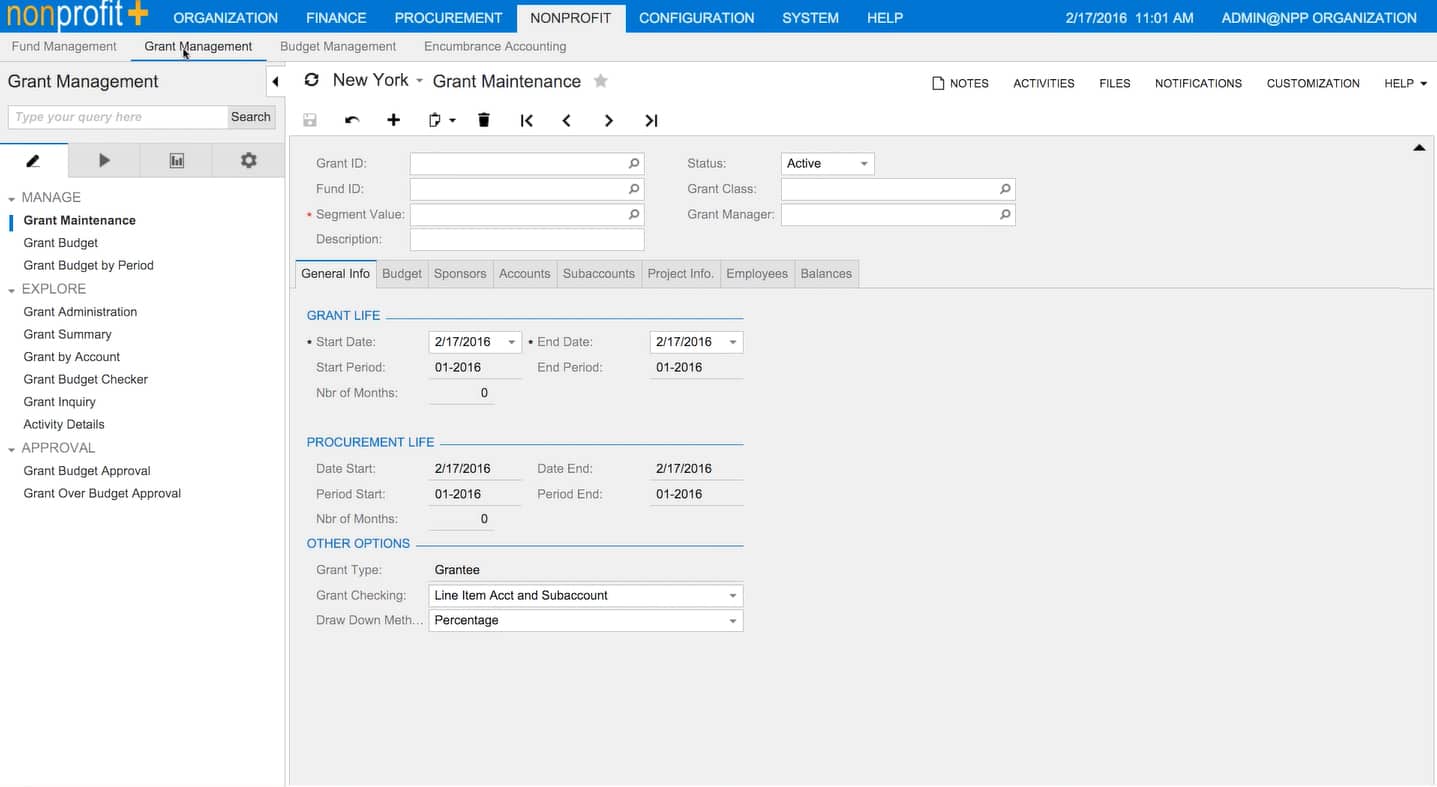

NonProfitPlus enables you to manage, track, and report on grants, regardless of the grant life. It can help in ensuring proper data entry, budget management, and maintaining fund sources.

The grant management module also lets you enter nonfinancial information, such as grant life, procurement life, and sponsors. With this feature, you can keep track of both the financial and nonfinancial aspects of the grant in one application.

Grant Management Module (Source: NonProfitPlus)

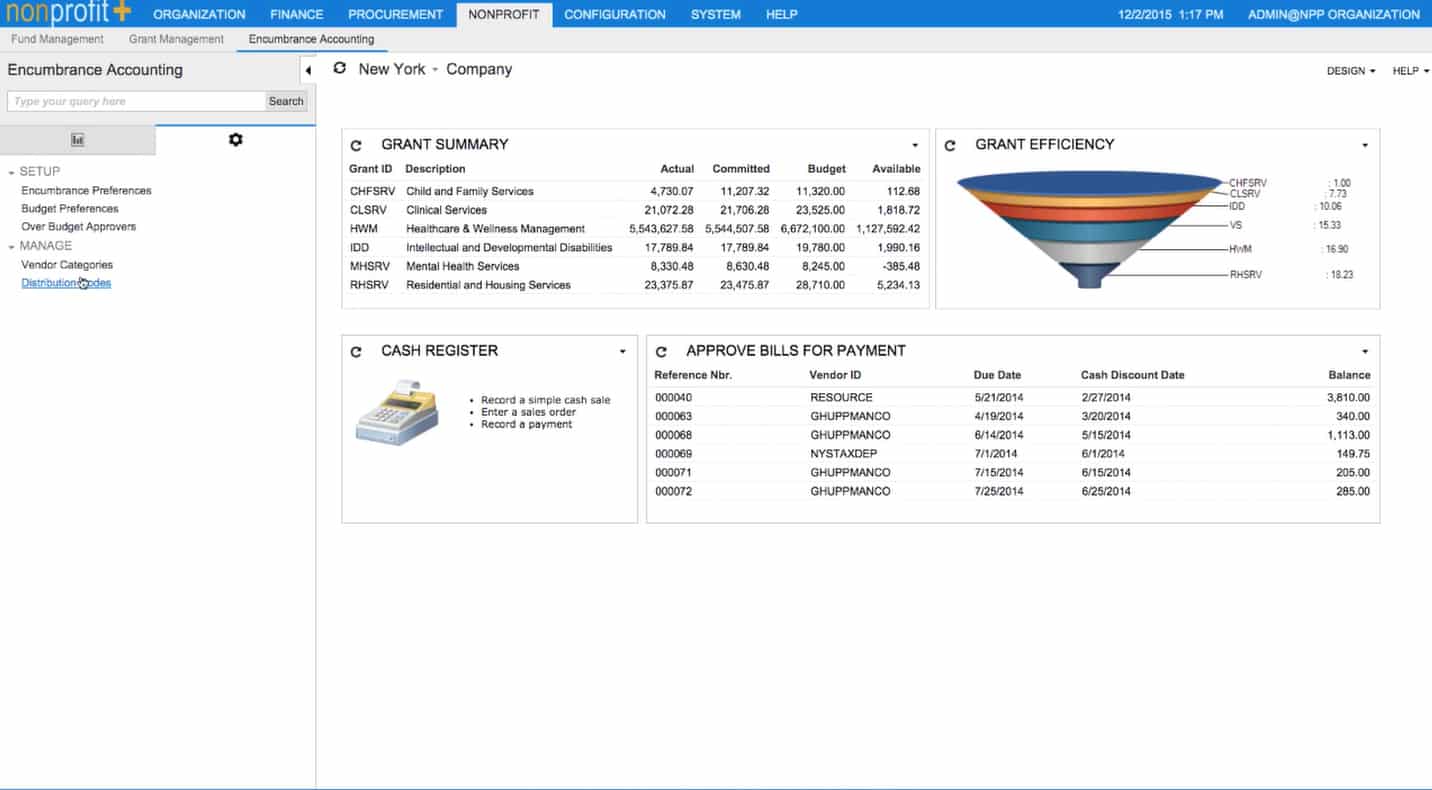

This can help if you need to track items that will become expenditures in the future. You can record pre-expenditures in the general ledger, allowing you to gain additional insight into your financial standing and budget in the future.

The encumbrance accounting module connects directly to the purchases module to account for requisitions in a reserved ledger. Moreover, NonProfitPlus also lets you set encumbrance preferences to ensure that all POs are within the limits set by the board members.

Encumbrance Accounting Module (Source: NonProfit+)

This feature helps you track and manage your donors and their gifts. You can run and present reports to your donors, create donor receipts, and prepare acknowledgment letters.

Administrators and managers can provide board members with access to relevant, useful data concerning budgets, restricted funds, and staffing. Users can also use this module to send reports to board members periodically.

This tool keeps a record of your volunteers and gives them limited access to the platform to track time and submit receipts.

NonProfitPlus Ease of Use

NonProfit+’s user interface isn’t as sleek and modern as similar programs, but it’s fairly simple and functional, with well-arranged modules. If you’re familiar with Microsoft programs, then you can find your way around easily. On the downside, it uses accounting terms and contains some advanced features and modules that can be overwhelming for new users. These are the reasons why it took a hit in our ease of use evaluation.

Moreover, you’ll need to devote some time to learning and be comfortable with NonProfit+. If you need help along the way, you can contact its support team through email, chat, phone support, and help desk. You can also check out its blogs for useful tips and information.

How We Evaluated NonProfitPlus

As part of our roundup of the best nonprofit accounting software, we evaluated NonProfitPlus based on the following criteria:

10% of Overall Score

Accounting software programs for nonprofits come at different price points. That’s why we considered giving price a significant weight to give more credit to account software programs that deliver great nonprofit accounting features at an affordable price.

20% of Overall Score

- Online payments

- Payroll

- Double-entry accounting

- A/P and A/R management

- Mobile app functionality

20% of Overall Score

- Fund accounting

- Grant management

- Donation tracking and management

- Budget management

- Volunteer management

20% of Overall Score

20% of Overall Score

10% of Overall Score

Frequently Asked Questions (FAQs)

Nonprofits and religious organizations use NonProfit+ to track multiple restricted and unrestricted funds as well as grants.

No, NonProfit+ has a steep learning curve, especially for first-time users.

Bottom Line

If you’re willing to pay the cost for a robust fund accounting and grant management program, you’ll find NonProfit+ a great option. Its nonprofit accounting package includes donor management and board management for easy delegation and communication. The financial management suite comes with encumbrance accounting, which helps with your budgeting process. On top of that, it has a strong restricted fund management feature that’s superior to what’s found in similar software.

[1]Capterra

[2]Software Connect