Paycheck Manager is self-service payroll software with a simple-to-use interface for processing employee pay. It is best suited for small businesses and features unlimited pay runs, payroll tax calculations (federal and state), paycheck printing, and real-time tax form updates. Paycheck Manager also offers a free online paycheck calculator and managed payroll services, including automated tax deposits and filings.

Paycheck Manager Overview

Pros

- Unlimited payroll runs

- Affordably priced

- The free trial period runs for three months

- Maintains access to previous period salary information for year-to-date comparisons and accurate computations

- Its Basic Service plan doesn’t have a setup fee

Cons

- Payroll tax deposit and filing services are limited to a small number of states

- Creates and prints paychecks one employee at a time

- Charges a setup fee for its managed payroll service

- Doesn’t handle contractor payments

- State tax computations are limited to the employer’s home state only

Deciding Factors

- Monthly Pricing

- Basic Service:

- Monthly – As much as $6 per employee; fee is lower as number of employees increase

- Annual – Starts at $59 per account for 1-3 employees

- Managed Service: $12 base fee plus $2 per employee with a $10 setup fee for new clients

- Basic Service:

- Basic Service Features:

- Print checks

- Calculate federal and state taxes

- Add earning and deduction items

- Receive real-time updates on tax processes

- Managed Service Features:

- Paycheck Manager handles payroll processes for you

- Get all Basic Service tools

- Generate tax forms 941, 940, W-2 and W-3

- Deposit and file taxes for you

- Set reminders for deposits

What We Recommend Paycheck Manager For

Paycheck Manager provides both do-it-yourself (DIY) and managed payroll solutions for processing employee salaries accurately and efficiently. With an interface that’s simple to learn and use, you can create paychecks in a matter of minutes. Its software and managed payroll services are affordably priced, allowing you to invest in an online payroll tool without having to break your budget. New users can even sign up for a three-month free trial.

Paycheck Manager can calculate federal and state payroll taxes and generate the applicable tax forms. However, its DIY option doesn’t include tax deposits and filings. You have to handle these transactions yourself, or you can upgrade to its premium service.

Note: Paycheck Manager’s managed tax filings and payments only cover a small number of US states as of this writing (California, Florida, Georgia, Illinois, New York, Pennsylvania, Texas, and Virginia).

In short, Paycheck Manager is best for:

- Mom-and-pop businesses with a handful of employees: Paycheck Manager offers a low-priced payroll solution, with fees that start at $6 per employee monthly (for its Basic service, wherein pricing decreases as your employee count increases). Although the DIY option doesn’t cost much, since you have to file and pay your own taxes, it’s only suitable for businesses with a few employees.

- Self-employed entrepreneurs who need to pay themselves: Aside from Paycheck Manager’s basic DIY service, it has a free-to-use online calculator to help you compute payroll (i.e., deductions, earnings, and taxes) and print paychecks on a per-employee basis.

When Paycheck Manager Would Not Be a Good Fit

- Business owners who need a payroll solution with HR tools and support: Unlike popular payroll software like Gusto and QuickBooks Payroll, Paycheck Manager doesn’t have basic HR functionalities for onboarding new hires, managing benefits, and tracking employee attendance. There is also limited live phone support and no dedicated representative. Read our HR payroll software guide if you want more suitable options.

- Companies with remote employees in different states: While Paycheck Manager can calculate payroll taxes for all states, its system is limited to only reporting in the state the employer is located. If you need more flexible solutions, check out our top picks for payroll services.

- Employers who employ mostly contractors: Paycheck Manager can only handle pay processing for W-2 employees. If you need an online solution to pay both employees and contractors, consider any of the providers on our best payroll software for contractors list.

- Small businesses needing a free forever payroll solution: While it has an online payroll calculator you can use for free, it can only handle pay computations one employee at a time. Paycheck Manager’s monthly plans are affordable and come with a three-month free trial for new users, but its Basic plan will still cost you between $1.50 to $6 per employee (depending on the number of employees you have). Our best free payroll software guide has some good options if you’re looking for a free-forever solution.

Not sure how to decide if Paycheck Manager or one of its competitors is right for you? Check out our guide on finding the right payroll solution for a step-by-step walkthrough on how you should navigate the process.

How Paycheck Manager Compares With Alternatives

Best for | Solopreneurs and very small businesses | Small businesses wanting full-service payroll | QuickBooks accounting small business users | Solopreneurs and employers needing dedicated payroll support |

Monthly fees | Basic: $6 per employee Managed: $12 base fee plus $2 per employee | Starts at $40 plus $6 per employee | Starts at $45 plus $6 per employee | Starts at $39 plus $5 per employee |

Ease of Use (based on rubric) | 2.25 / 5 | 4.5 / 5 | 4.68 / 5 | 4.75 / 5 |

Read Our Reviews |

Paycheck Pricing

Since Our Last Update: Paycheck’s pricing has remained the same, although it added one more state to its tax and filing services coverage. This service is now also available to the state of Georgia.

Basic Service | Managed Service | |

|---|---|---|

Monthly Pricing | Starts at $6 per employee* | $12 plus $2 per employee |

Setup Fee | None | $10 |

Type of Payroll Processing | DIY payroll | Managed payroll |

Unlimited Pay Runs | ✓ | ✓ |

Manual Paycheck Printing and Direct Deposit Options | ✓ | ✓ |

Calculate and Track Federal and State Taxes | ✓ | ✓ |

Add Earnings and Deductions like tips, 401(k), and child support | ✓ | ✓ |

Real-time Updates of Taxes and Tax Forms | ✓ | ✓ |

Electronic IRS and State Tax Payments | Self-managed; available as paid add-ons | Payroll tax filing services in eight states** |

Mail or E-file State Payroll Forms & Forms 941, 940, W-2, and W-3 | Self-managed; available as paid add-ons | Payroll tax filing services in eight states** |

*Basic’s pricing starts at $6 per employee monthly but can go as low as $1.50 depending on your employee count.

**As of this writing, Paycheck Manager’s tax deposit and filing services are available only in California, Florida, Georgia, Illinois, New York, Pennsylvania, Texas, and Virginia.

Paycheck Manager Add-ons

If you select the Basic Service option, you can add the following solutions and self-managed services to your plan:

- Federal tax e-payments (direct ACH to IRS): $25 per year

- State tax e-payments (if and where available): $25 per year

- E-file Forms 941, 940, and 944: $30 per year

- E-file State forms (if and where available): $4.95 per form

- E-file Forms W-2 and W-3: $5 plus $2 per employee

- Print and mail W-2s to employees (include envelope and stamp): $2 per employee

Paycheck Manager Features

Paycheck Manager is an online payroll software that makes processing employee salaries simple and affordable. Apart from unlimited pay runs and payroll tax calculations, it provides real-time tax updates and managed payroll services.

Let’s look at some of its essential features to help you identify whether it fits your business’s requirements.

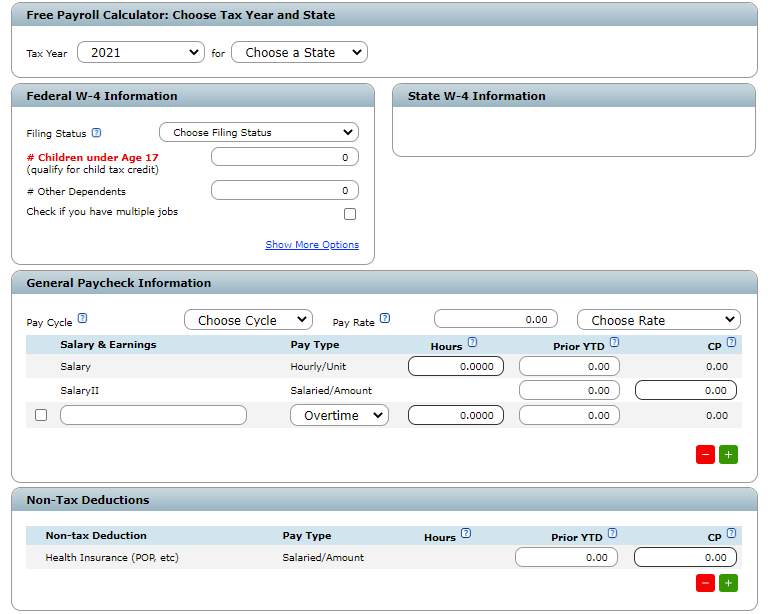

Paycheck Manager provides a free payroll tax calculator that you can access online. Simply input the essential payroll data, such as your state, salary information, pay cycle, marital status, work hours, deductions, and earnings (like bonuses and commissions). If you want accurate computations, enter your year-to-date salary information. The calculator then provides a detailed analysis with estimated payroll taxes and net income.

However, all salary data entered on the free online paycheck calculator will not be saved once you close the webpage. You have to register for a Paycheck Manager account and select a payroll service if you want the system to retain your business’ information.

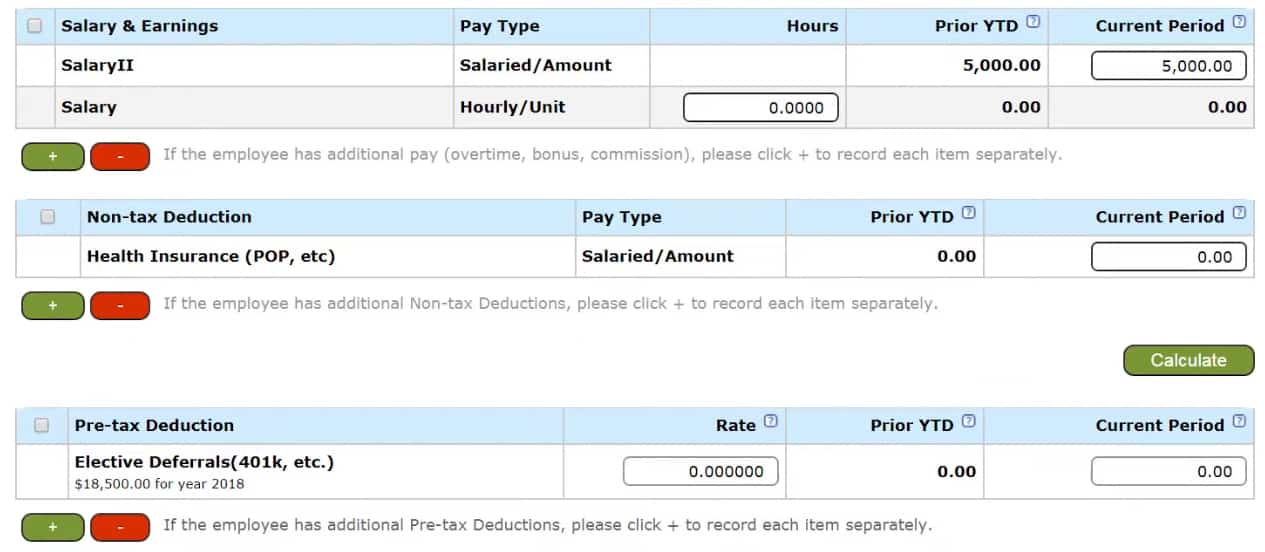

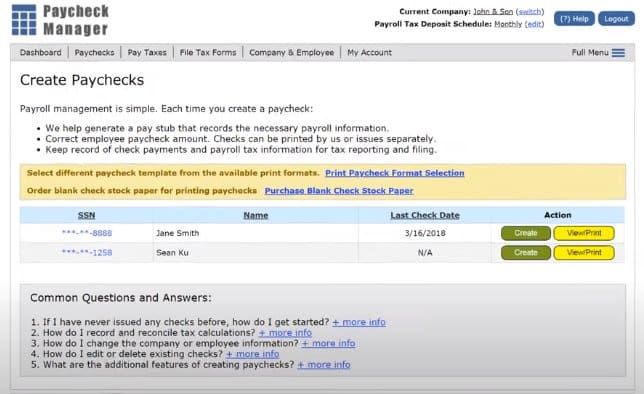

Paycheck Manager offers a complete self-service payroll management software for any user wanting to prepare, view, and print paychecks, payment vouchers, and payroll reports. All information is securely saved for easy payroll management. It can handle child support and tip payments—although you have to manually add an earning item for each type and input the appropriate amounts.

You can even input your previous months’ payroll information or recreate employee paychecks for up to three prior years. Doing so will ensure you get accurate calculations, including correct quarterly and year-end tax forms.

If you want to add earning types and other deductions into Paycheck Manager, click on the “+” and “–” buttons to add and remove items. (Source: Paycheck Manager)

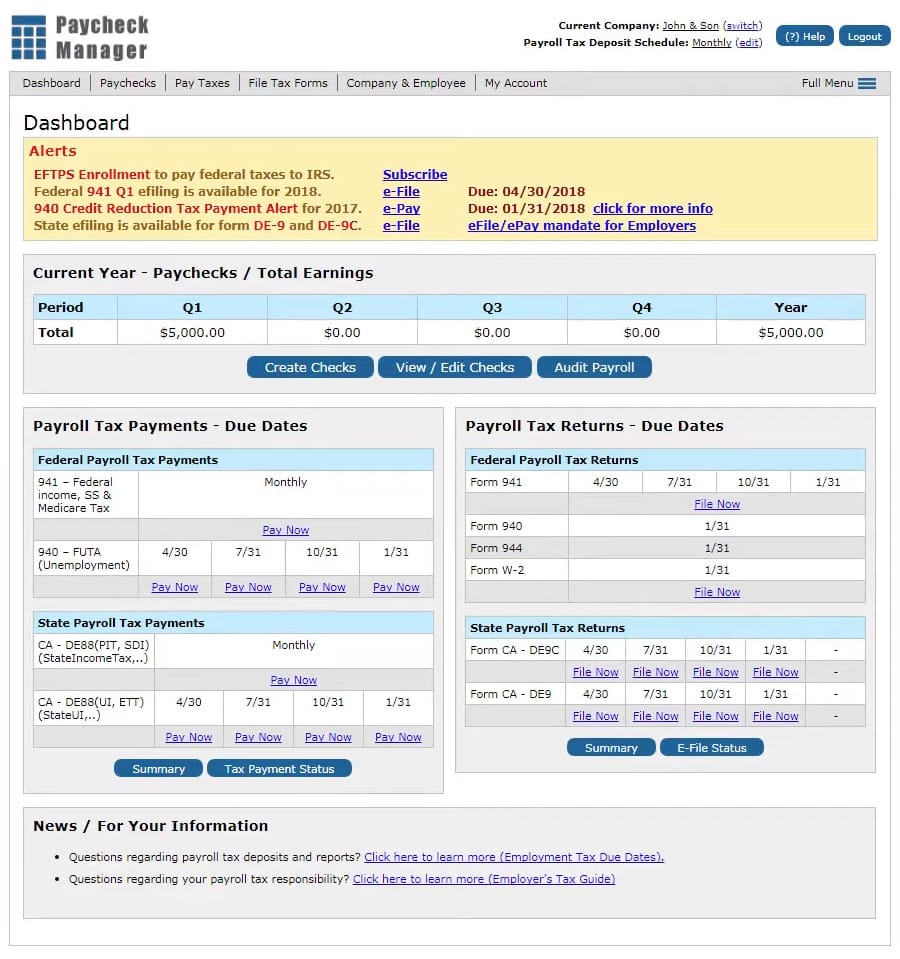

The dashboard shows upcoming payroll deadlines, account alerts, and the total paychecks you have created in the current year. If you selected its Basic Service, you can e-file federal and state tax forms directly from the dashboard—provided you purchase the applicable electronic filing add-ons.

Aside from alerts and helpful guides, the Paycheck Manager dashboard also contains quick links to your payroll tax payment summaries and reports. (Source: Paycheck Manager)

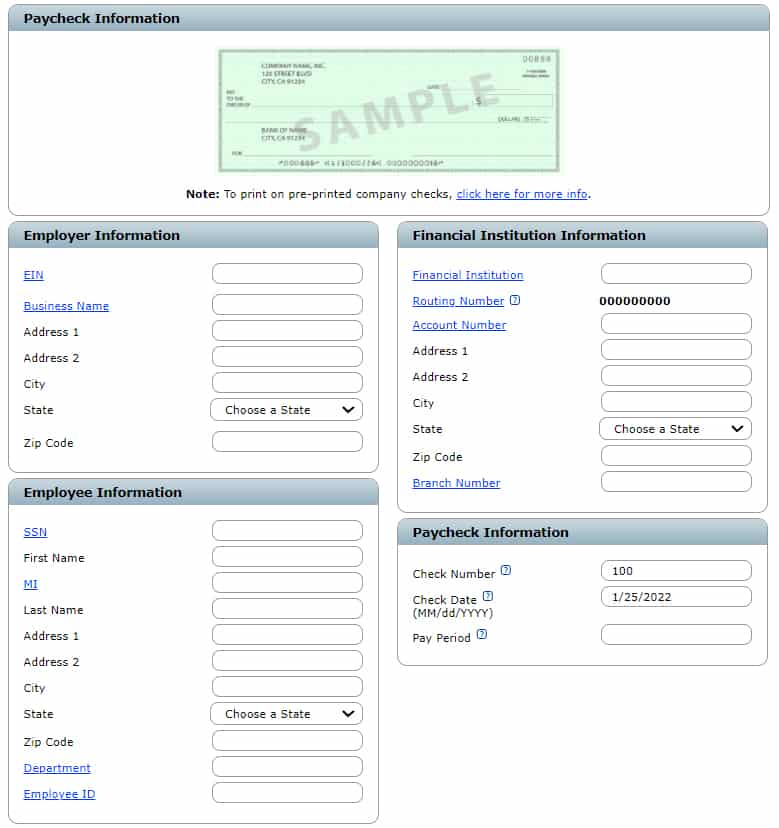

Aside from a blank paper check, you need a laser printer (inkjet/thermal printers won’t work) to print checks via its system. Once you enter the bank information, company name, and employee name, Paycheck Manager prepares the check image in PDF format, and you can save and print it anytime. Adobe Acrobat Reader is also needed to view and print the check.

You can print paychecks on standard three-part blank check stocks. Paycheck Manager also offers blank check papers for a fee. (Source: Paycheck Manager)

Paycheck Manager offers real-time updates on employee payroll taxes and tax forms. The provider even asserts that it can accurately calculate and track federal and state payroll taxes. However, if you have employees working in different states, its system can only handle tax reporting for the state where the employer or business is located.

With its Managed Service option, small businesses get access to online payroll services that include filing of federal forms 941, 940, W-2, and W-3. It also comes with automated payments of payroll taxes. However, its electronic tax deposit and filing services are available only for California, Florida, Georgia, Illinois, New York, Pennsylvania, Texas, and Virginia as of this writing.

If you’re not sure if Paycheck Manager will fit your pay processing requirements, see how it compares with other small business payroll software.

Paycheck Manager Ease of Use

- User-friendly interface

- Easy setup

- In-app help button and how-to guides

- Phone and email support

- Free paycheck calculator

Paycheck Manager’s online payroll software is designed with simplicity in mind. It has a straightforward interface, plus setting it up is fairly easy to do. You just need to register for a Paycheck Manager account, create your company profile, and input your employees’ information. After which, you can run payroll and print paychecks anytime you want.

While the software has a user-friendly interface, you need to have a good understanding of basic payroll requirements and tax withholding, deposits, and reporting guidelines. This will help you use Paycheck Manager’s pay processing tools properly.

If you are unsure how to use a specific feature, you can click on the software’s “help” button. FAQ items are also available both in-app and on the Paycheck Manager’s website. You can even contact the provider’s support team via phone or email, although phone support is limited.

What Users Think About Paycheck Manager

As of this writing, there aren’t a lot of Paycheck Manager reviews available online. A review posted on PAT Research described it as an easy-to-use DIY payroll solution. The third-party site, which uses a proprietary algorithm for rating software products, gave Paycheck Manager an overall editor score of 9.1 out of 10 and an aggregated user rating of 8.9 out of 10. Some of the criteria that received high points included the software’s ease of use, system implementation, and customer support.

Bottom Line

If you’re looking for a cost-effective payroll solution for small businesses, you may want to consider Paycheck Manager. Both its DIY and managed payroll solutions are affordably priced, plus it provides a free paycheck calculator that allows you to print paychecks one at a time. While its electronic tax deposits and filings are available only under the provider’s Managed Service plan, you can pay minimal add-on fees to include those functionalities in your Basic Service subscription.

Sign up with Paycheck Manager for a three-month free trial—no credit card required.