QuickBooks Live and Merritt Bookkeeping both offer basic bookkeeping services, including categorizing your transactions, reconciling your accounts, and providing monthly financial statements. While both use QuickBooks Online for your bookkeeping, a major difference is that with QuickBooks Live, you can still access your QuickBooks file if you need to invoice or pay bills. With Merritt Bookkeeping, you can’t access your QuickBooks file.

We don’t declare an overall winner in this comparison of QuickBooks Live vs Merritt Bookkeeping. This is because the best choice for your small business depends on whether you need access to your QuickBooks account for invoicing or paying bills:

- QuickBooks Live: Best for those who want to use their QuickBooks account to issue invoices and track bills

- Merritt Bookkeeping: Optimal for freelancers and 1099 employees (independent contractors) who want to only track income and expenses

The Fit Small Business editorial policy is rooted in the company’s mission, which is to deliver the best answers to people’s questions. This serves as the foundation for all content, demonstrating a clear dedication to providing valuable and reliable information. Our team leverages its expertise and extensive research capabilities to identify and address the specific questions our audience has—and this ensures that our content is rooted in knowledge and accuracy.

In addition, we employ a comprehensive editorial process that involves expert writers. This process ensures that articles are well-researched and organized, offering in-depth insights and recommendations. Fit Small Business maintains stringent parameters for determining the “best” answers, including accuracy, clarity, authority, objectivity, and accessibility, and these see to it that our content is trustworthy, easy to understand, and unbiased.

Neither QuickBooks Live nor Merritt Bookkeeping provide tax services. If you would like your tax return bundled with your bookkeeping, you should consider Bench, which you can learn about through our review of Bench.

| |||

|---|---|---|---|

3.70 ★ | 3.95 ★ | 4.46★ | |

Monthly Pricing | $300 to $700 | $190 for any size business | $299 or $499 |

Service Frequency | Monthly | Monthly | Monthly |

Free Trial | ✕ | ✕ | 2 months free exclusively for Fit Small Business readers |

100% Accurate Books Guarantee | ✓ | ✕ | ✕ |

90-day Money-back Guarantee | ✕ | ✓ | ✕ |

Accounting Software Supported | QuickBooks Online (required) | QuickBooks Online | Proprietary software and FreshBooks |

Dedicated Bookkeeper | ✓ | ✕ | ✓ |

Catch-up Bookkeeping | Back to last tax return with customized pricing | $70 to $140 per month | Starts at $299 per month |

Invoicing & Bill Pay | ✕ | ✕ | ✕ |

Tax Advisory & Filing | ✕ | ✕ | ✓ |

Key Features |

|

|

|

What’s Missing | Invoicing, bill pay, chief financial officer (CFO), and tax services | Invoicing, bill pay, CFO, and tax services | CFO advisory services |

Mobile App | iOS and Android (QuickBooks Online) | N/A | iOS |

Ease of Use | Easy | Easy | Easy |

User Review Ratings (Out of 5) | 4.4 | 4.98 | 4.3 |

Use Cases and Pros & Cons

User Reviews: Merritt Bookkeeping Wins

| ||

|---|---|---|

Average Rating on Third-party Sites | 4.4[1][2] | 4.98[3][4] |

Users Like |

|

|

Users Dislike |

|

|

Both QuickBooks Live and Merritt Bookkeeping received positive user reviews, but Merritt Bookkeeping received perfect scores from two review sites, which is a testament to the satisfaction of its users. QuickBooks Live users praised its strong customer support and ease of use while Merritt Bookkeeping users appreciated its affordable flat-rate pricing.

QuickBooks Live received high praise from users who appreciated the responsiveness and knowledge of the customer support team. They also appreciated that the fees are affordable and that the service is easy to use. Common complaints are that there aren’t any bill pay or invoicing and income tax filing or advisory services available. Additionally, many wished that they could try QuickBooks Live for free before committing.

QuickBooks Live earned the following average scores on popular review sites:

- Capterra[1]: 4.5 out of 5 based on about 70 reviews

- G2.com[2]: 4.0 out of 5 based on around 80 reviews

Merritt Bookkeeping received exceptional customer reviews, with users commending the service’s attention to detail and outstanding customer service. The affordable flat rate is also praised by many, as is its in-depth reporting and consistency with bookkeepers. The only complaint we found is that the user interface could be made more interactive. Overall, customers love this provider.

Merritt Bookkeeping earned the following average scores on popular review sites:

- Yelp[3]: 4.8 out of 5 based on over 30 reviews

- Google[4]: 5.0 out of 5 based on around 80 reviews

- G2.com[5]: 4.0 out of 5 based on less than 5 reviews

Pricing: Merritt Bookkeeping Wins

| ||

|---|---|---|

Monthly Pricing | $300 to $700 (depending on monthly expenses), plus $30 to $200 for a QuickBooks Online subscription | Flat rate of $190 for all businesses |

Onboarding Fee | Contact provider | ✕ |

Catch-up Bookkeeping | Back to last tax return with customized pricing | $140 per month |

Invoicing | Unavailable | Unavailable |

Bill Pay | Unavailable | Unavailable |

Tax Services | Unavailable | Unavailable |

CFO Services | Unavailable | Unavailable |

90-day Money-back Guarantee | ✕ | ✓ |

There’s a distinct difference in pricing when we compare QuickBooks Live and Merritt Bookkeeping. While QuickBooks Live’s pricing is determined by a company’s monthly expenses, Merritt Bookkeeping charges a flat monthly rate of $190, which is the cheapest we have encountered for online bookkeeping services.

Also, Merritt guarantees the quality of its services with its 90-day money-back guarantee. QuickBooks Live doesn’t offer the same, but it does have a 100% Accurate Books Guarantee, which allows you to request a free audit of your books at any time.

There are three tiers with QuickBooks Live, and they vary in price depending on the amount of monthly expenses. The first month of service includes onboarding and will cost more than the normal monthly price. This monthly cost used to be $500, but QuickBooks Live doesn’t publish the price anymore, so you’ll need to contact the provider to get your first month’s cost.

Note that a subscription to QuickBooks Online is required to work with QuickBooks Live. Prices start at $30 a month for Simple Start.

Low Volume | Medium Volume | High Volume | |

|---|---|---|---|

First Month (Onboarding) | Custom priced for all plans | ||

Monthly Cost | $300 | $500 | $700 |

Monthly Expense Cap | Up to $10,000 | $10,000 to $50,000 | Over $50,000 |

Annual Gross Revenue Cap | None | ||

Merritt charges a flat rate of $190 per month for bookkeeping services—and the price is the same regardless of business size, monthly expenses, accounts, transactions, or number of employees. It also provides catch-up bookkeeping services at a rate of $140 monthly for each month it works on. Months that require fewer than 10 transactions to be entered will be discounted to $70 monthly.

Features: QuickBooks Live Wins

| ||

|---|---|---|

Enhanced Communication | ✓ | ✕ |

Dedicated Bookkeeper | ✓ | ✕ |

100% Accurate Books Guarantee | ✓ | ✕ |

QuickBooks Live has the edge in this category, with the added benefit of a dedicated bookkeeper that is a certified QuickBooks ProAdvisor. It also offers more customer support options, including the ability to communicate via one-way video chat. What’s more, QuickBooks Live’s 100% Accuracy Guarantee gives you the ability to request an audit of your books at any time.

While QuickBooks Live does have additional ways to communicate with a dedicated bookkeeper, user reviews of Merritt Bookkeeping indicate that their customers are very satisfied with the customer service and communication.

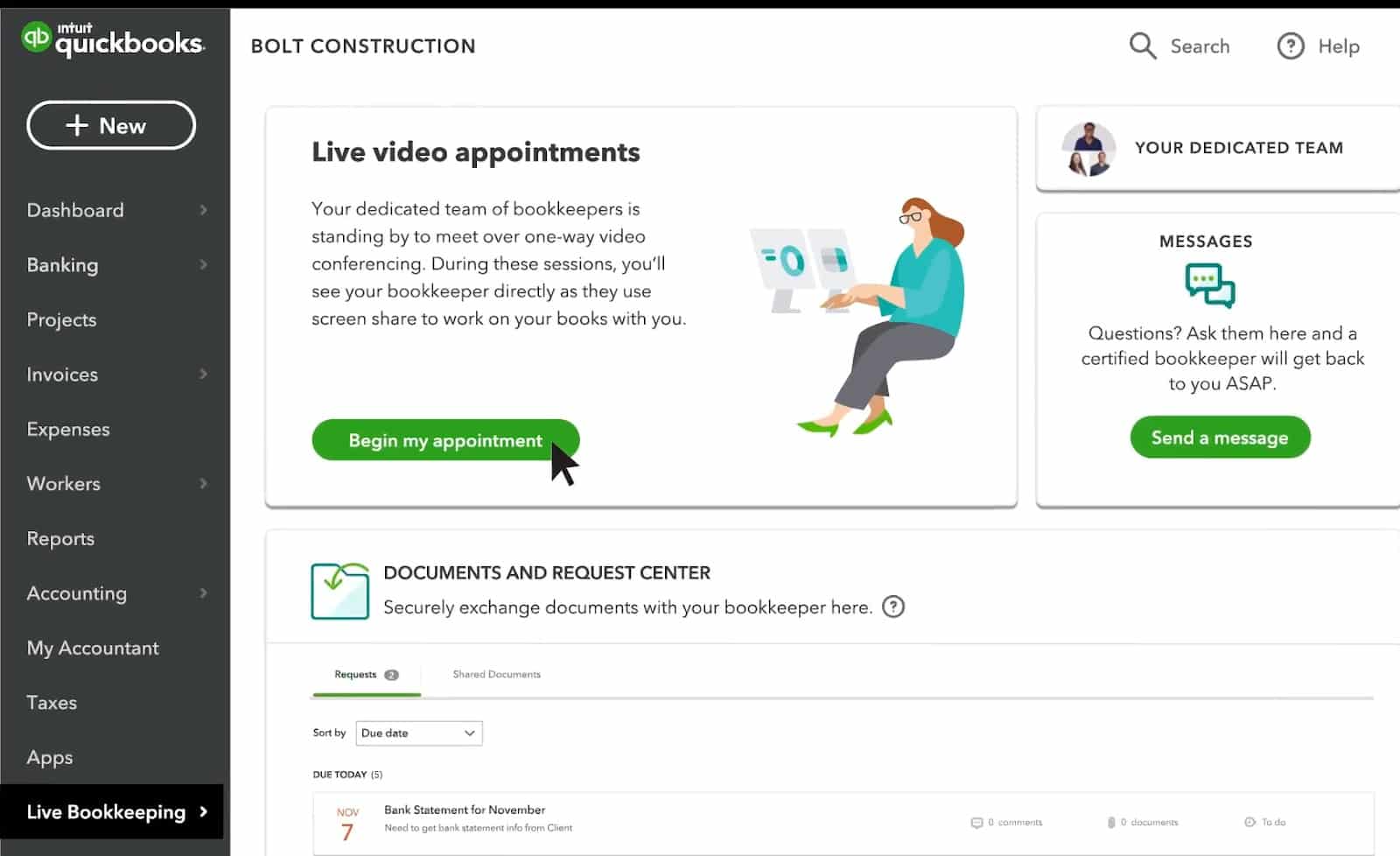

Enhanced Communication: QuickBooks Live Wins

Merritt Bookkeeping is limited to email and phone support while with QuickBooks Live, you can meet with your bookkeeper via one-way video chat, so you can see them but they can’t see you. This makes it easier to share documents. Whether you’re a new user or have an established account, QuickBooks Live will assist you with cleanup and setup. It will also provide monthly reports, with the ability to discuss the reports if you have questions.

Dedicated Bookkeeper: QuickBooks Live Wins

QuickBooks Online is the software of choice for both QuickBooks Live and Merritt Bookkeeping, but they approach the bookkeeping differently. QuickBooks Live provides assistance to QuickBooks users while Merritt does all the bookkeeping and doesn’t allow the business owner direct access to the QuickBooks Online account.

Merritt Bookkeeping’s approach is simple, but it’s problematic if you want to use QuickBooks for paying your bills or sending customer invoices. You also won’t receive your own dedicated bookkeeper, as the work is outsourced to virtual bookkeepers.

100% Accurate Books Guarantee: QuickBooks Live Wins

QuickBooks Live has a feature that is unique to the service, its 100% Accurate Books Guarantee. This guarantee enables you to request an audit of your books at any time and is not something that Merritt Bookkeeping offers.

Ease of Use: Tie

| ||

|---|---|---|

Overall Ease of Use | Easy | Easy |

Accessibility | Cloud | Cloud |

Online Help Section | ✓ | ✕ |

User-friendly Dashboard | ✓ | ✓ |

Both QuickBooks Live and Merritt Bookkeeping are extremely easy to use, which is why we call this category a tie. Your QuickBooks Live bookkeeper will connect with you via one-way video chat, and they’ll assist you with connecting your bank and credit card accounts. You’ll then receive access to the QuickBooks Live Hub, your own secure space on the site.

You’ll receive monthly financial statements that you can review with your bookkeeper, and you can monitor your bookkeeper’s progress with a task list that is updated in real time as items are completed. You can also view related documents and access your bookkeeper’s schedule so that you can make an appointment for a video chat.

QuickBooks Live Hub (Source: QuickBooks)

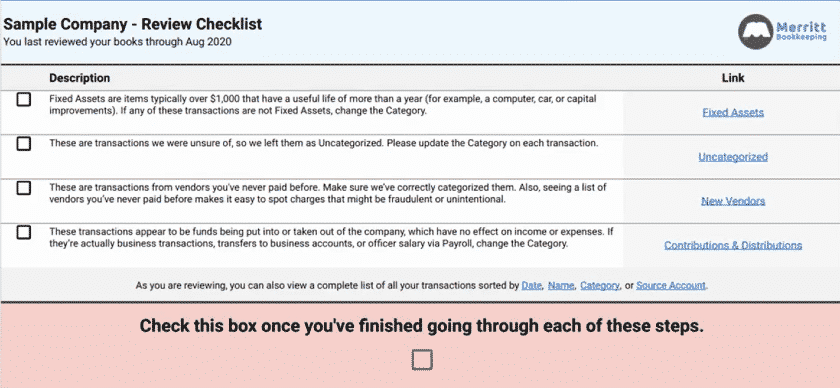

Upon enrollment with Merritt Bookkeeping, your finances will be managed with QuickBooks Online, but you won’t have personal access to your QuickBooks files. After set-up, contact will be limited. You’ll receive a link to your Dashboard each month, where you can access financial reports and transaction details. If you spot any inaccuracies, you must indicate that on the review checklist, a sample of which is shown below.

Example of Merritt’s review checklist (Source: Merritt Bookkeeping)

Integrations: QuickBooks Live Wins

| ||

|---|---|---|

Built-in Integrations | 3 | 0 |

Third-party Integrations | 450+ | 0 |

QuickBooks Live offers three built-in integrations and over 450 third-party integrations while Merritt Bookkeeping doesn’t offer any. Therefore, we selected QuickBooks Live as the winner of this category:

- QuickBooks Live integrations: QuickBooks Payroll, Bill Pay for QuickBooks Online, QuickBooks Time, QuickBooks Payments, Shopify, Fathom, Method:CRM, Insightly, Hubdoc, AutoEntry, TradeGecko, and more

Mobile App: Tie

Neither QuickBooks Live nor Merritt Bookkeeping provide a mobile app to communicate with your bookkeeper and upload information. However, with QuickBooks Live, you’ll have access to the QuickBooks Online app to view and manage your books.

Customer Support: Tie

| ||

|---|---|---|

Email Support | ✓ | ✓ |

Phone Support | ✓ | ✓ |

Live Chat Support | ✓ | ✕ |

Unlimited Support | ✓ | ✕ |

Community Support | ✓ | ✕ |

One-way Video Chat | ✓ | ✕ |

Searchable Knowledge Base | ✓ | ✕ |

Online Help Resources | ✓ | ✕ |

Free Software Training | ✕ | ✕ |

It was hard to choose a winner for this category because QuickBooks Live has additional customer service and resources available to its users—but that doesn’t necessarily mean you’ll have great customer service when you contact them. While Merritt Bookkeeping only has email and phone support, its user reviews clearly indicate that it has exceptional customer service.

You can set up video meetings with your QuickBooks Live bookkeeper on an as-needed basis—as long as they’re scheduled one at a time. During these meetings, you can screen-share documents, allowing you to clarify information more easily. You can also reach out to product support via live chat to answer any software-related questions. QuickBooks Live offers email and phone support, online help resources, community support, and a searchable knowledge base.

Meanwhile, Merritt Bookkeeping has a different approach to its online bookkeeping services—although it’s run by a small team in San Diego, it outsources the actual bookkeeping to several overseas contractors. The San Diego team serves as the point of contact, available to answer questions and provide quality control. If you have any questions, you can contact the provider by email or phone during regular business hours. Unlike QuickBooks Live, Merritt Bookkeeping doesn’t offer video meetings.

How We Evaluated QuickBooks Live vs Merritt Bookkeeping

We compare QuickBooks Live and Merritt Bookkeeping based on the following criteria:

35% of Overall Score

Because each plan depends on many factors, we looked at the value provided in terms of the time and potential money that you’re saving by using the service.

20% of Overall Score

You should be able to access a dedicated bookkeeper for any questions or advice and one-on-one assistance.

15% of Overall Score

The best online bookkeeping service should offer a wide range of bookkeeping solutions, including catch-up bookkeeping, invoicing, bill pay, bank reconciliation, payroll, and tax filing.

10% of Overall Score

We evaluated whether the online bookkeeping service offered tax and consulting, and the scope of those services.

20% of Overall Score

We consider the opinions of users and the service’s ratings on various review sites. These criteria were disregarded for providers where no reviews were found.

Frequently Asked Questions (FAQs)

Your QuickBooks Live bookkeeper will help you connect your bank and credit card accounts and set up your chart of accounts if needed. They’ll also categorize your transactions, reconcile your accounts, and send financial statements on a monthly basis. You can meet with your dedicated bookkeeper via one-way video chat to review reports and ask questions.

Merritt Bookkeeping charges a flat rate of $190 per month for basic bookkeeping services.

Yes, Merritt Bookkeeping allows you to file 1099s.

No, QuickBooks Live bookkeepers don’t provide tax services.

Bottom Line

If you’re on a budget and looking for basic bookkeeping services at a flat monthly rate, then Merritt Bookkeeping could be a good option for you. However, if you want access to your QuickBooks account to issue invoices, pay bills, and perhaps even prepare payroll, then QuickBooks Live will be better. While QuickBooks Live won’t assist with any of these tasks, you will have access to your QuickBooks account to do them yourself.

User review references:

1 Capterra | QuickBooks Live

2 G2.com | QuickBooks Live

3 Yelp | Merritt Bookkeeping

4Google | Merritt Bookkeeping

5 G2.com | Merritt Bookkeeping