A real estate commission split is the percentage of earnings agents and brokers receive when they assist a buyer, seller, or renter in closing on a property. There are various types and ranges of commission agreements, with standard models paying 60% to 70% to agents and high-split models paying 90% to 100%. The split is heavily influenced by the type of brokerage you choose as well as the market in which you work. Learn which commission structure is ideal for you, and try our free calculator.

How Real Estate Commissions Are Calculated

In a typical transaction, two real estate agents each represent their respective buyer and seller, and each also represents their brokerage. At the closing of a transaction, all commission money is first split between the brokers. Then, each broker splits their portion with the agent based on their brokerage’s agreement.

The illustration above represents a 60/40 split from the sale of a $350,000 home. The commission is 6% of the sales price, which is $21,000. This gross amount is split between the seller and buyer’s agent, with each representative receiving $10,500. Then, the 60/40 split is enacted for each agent, leaving the broker with 40% ($4,200) and the agent with 60% ($6,300).

Our calculator below helps determine how much you’ll put in your pocket after a deal. Input the following information to calculate your commission automatically:

- Sale price of home: The amount of money that the buyer agrees to pay for the seller’s home.

- Percent of the commission collected by an agent from the sale: The percentage of the sale price you are collecting at the close of the transaction.

- Agent commission split with brokerage: Your commission rate is agreed upon between you and your brokerage.

Why Real Estate Commissions Are Split

You must associate yourself with a real estate brokerage when you become a real estate agent. All real estate transactions go through the agent’s broker, and the agent receives a set percentage of the final commission. This commission split is negotiated and agreed on before any transactions are made and is based on the total gross commission before taxes or other deductions.

The real estate broker’s commission is typically used for overhead costs like office expenses and marketing materials but can also be used for other purposes. Depending on the size and type of real estate brokerage, the commission income may go back into the tools and resources provided for agents, like client relationship managers (CRMs) and websites.

Types of Commission Splits

Although commission splits can look very different, they generally fit into three types: fixed, graduated or tiered, and high split. A few agencies are also starting to offer a salary to their agents and have them as employees rather than independent contractors. The most common and traditional model is fixed, but graduated or tiered splits are also common. High split and salary models are relatively new to the industry but offer great options for new and experienced agents.

Fixed real estate commission splits occur when the commission percentage distributed to the agent and broker remains constant (or fixed). Having this split means you will get the same commission percentage for every transaction in the foreseeable future unless your agreement changes. A fixed real estate agent commission rate can come in various amounts, but the most common split is 60/40.

While some agents truly love the predictability of this arrangement, higher producers sometimes feel that a 60/40 split in real estate does not adequately compensate them for their increased sales and transactions. Notably, a fixed real estate broker commission split is often offered by a company that prioritizes its agents’ training and support. In these cases, a large portion of the commission kept by the company goes back into marketing and lead generation tools or mentorship programs for the agents.

In the National Association of Realtors’ (NAR) 2023 Member Profile, 42% of agents chose a fixed commission structure. Only 19% of agents received a graduated split, and only 15% operated with a capped split. After all, the costs of becoming a real estate agent are significant, and being able to generate an income quickly is a high priority. For a new agent who recently spent money on coursework, books, licensing, and getting set up, having a traditional company structure with far more limited fees and some mentorship often works best in giving them a head start.

| PROS | CONS |

|---|---|

| Highly predictable | Lower earning potential |

| Lower risk | Changing the commission agreement requires negotiation or changing brokerages |

| Training, support, and mentorship | No income guarantees |

Graduated or tiered commission splits offer opportunities for agents to increase their splits as they reach production goals. For example, an agent may start with a 50/50 split, then receive 60/40 after reaching a specific commission or deal goal. Graduated splits can then increase even further to 80/20 or even 85/15. Depending on the potential in your area, the ability to keep more of your earnings can be a true incentive to get out there and close deals.

If you’re considering a real estate brokerage offering a graduated commission split, ensure you learn all the rules and specifics before signing an agreement. Many graduated splits have additional detailed rules that can significantly impact your potential real estate salary, like split caps and annual rollbacks.

- Commission caps: Some brokerages offer the graduated real estate commission structure along with a limit, or cap, on the amount of revenue they can collect from an individual agent. After the brokerage has earned a certain amount of revenue from the agent’s sales, the agent receives 100% of their commissions. However, most companies that offer caps also establish a minimal transaction fee that occurs at the time the cap is reached.

- Annual rollbacks: In these arrangements, every agent “rolls back” at the beginning of every calendar year to the initial graduated commission amount—typically a 50/50 or 60/40 split. Brokerages benefit from rollback because agents have an incentive to produce, whereas agents benefit as they are motivated through slower seasons and have greater earn potential in high-volume seasons.

Even with a rollback policy or cap, the graduated commission structure can still give agents the best opportunity to earn more money per transaction. Calculate your potential earnings with a fixed commission vs graduated commission model to stay motivated and maximize your income.

| PROS | CONS |

|---|---|

| Higher earning potential | Lower starting split |

| More incentives to sell | Rules can be confusing |

| Balance of support and autonomy | Must earn high commission percentages each year |

While fixed and graduated split models are the most common and well-known in the industry, some brokerages offer agents the opportunity to keep even more of their hard-earned commission with split arrangements that range from 85/15 to 100%. For instance, virtual brokerages, such as Real, offer an 85/15 split with an annual cap of $12,000. Once you reach this low threshold, you earn 100% of your commissions.

These arrangements can attract agents who want to avoid giving away a large percentage of their commission. However, numerous administrative fees can be costly and confusing to a new real estate agent. Typical fees can include:

- Sign-up fees: This is usually a flat, one-time fee paid when you join the brokerage. It covers onboarding and allows you to access the online brokerage systems.

- Equipment fees: These are usually flat monthly fees that cover offices, phones, and copiers.

- Administrative fees: Like equipment fees, these are typically flat and cover basic elements, such as maintaining transaction records or one-time sign-up charges.

- Transaction fees: A flat fee is added at the time of closing.

- Risk reduction fees: These are usually applied toward errors and omissions insurance that helps to protect you, the brokerage, and your clients.

- Support fees: The support or mentorship you receive from the office may also come at an added cost.

Be objective about your real estate career goals and needs when considering what a high or no-split brokerage offers. Many real estate brokerages that offer a no-split commission model are designed to attract experienced agents and often don’t include training or mentorship programs, technology, or tools for new agents. They also may collect flat monthly expenses or fees to cover costs not covered by the commission.

For new or part-time real estate agents, the limited support and fee schedule may not be feasible. However, agents with an established real estate lead generation system and a pipeline of clients don’t need to sacrifice more of their commission for marketing resources.

| PROS | CONS |

|---|---|

| Highest starting earning potential from commissions | Required monthly fees, regardless of production |

| Commission agreements don’t change, which makes them easier to calculate | Fee structure can be confusing |

| Full autonomy of business | Limited support, training, and mentorship |

The salaried model is the least common in the real estate industry, but many agents prefer it. Instead of being paid solely from commission checks, some real estate companies pay their agents a regular salary and offer opportunities for additional commission and bonuses. Redfin is one of the most well-known real estate companies starting to offer a salaried business model.

Salaried real estate companies usually offer benefits to agents, paid time off, and incentives to earn more money as you make more sales. Their training and mentorship programs are often extensive, and agents receive ready-to-go marketing systems and new real estate leads. One of the main reasons why real estate agents fail is a lack of support, so working with a company that offers a salary and opportunities to grow is an ideal choice for many new or struggling agents.

However, salaried model structures limit an agent’s autonomy and earning potential. Working for a salary would not be a good fit for high-producing realtors who want to generate leads and work with clients uniquely. Many expenses come with working with clients, like car maintenance and home office supplies, that typical real estate agents can include as real estate tax deductions.

| PROS | CONS |

|---|---|

| Most predictable | Limited earning potential |

| Includes benefits packages | Less autonomy in marketing and business decisions |

| Extensive support and training | Fewer tax deductions |

How to Choose the Best Commission Split

When deciding on a commission split for yourself, it’s critical to consider the overall picture. Think about your expected gross commission, overall income targets, market trends, and the production goals you can see yourself achieving. Also, remember that the best strategy depends on your individual situation.

Things to consider when deciding on which split is best for you:

- Earning potential

- Income goals

- Experience level

- Size of client base

- Lead generation and marketing abilities

- Business fees and expenses

For instance, if you’re an experienced agent with a significant sphere of influence and a fair amount of independence, you might desire to negotiate for a higher split. This means you’re confident that you can generate and handle a substantial number of deals yearly. But, if you’re a new agent or one who has recently relocated to a new market, you might be ready to accept a lower split rate in exchange for integrated marketing and lead generation that can help ensure steady income while you’re building a reputation in the area.

4 Tips to Negotiate Your Commission Split

Commission splits are extremely important, but they are only a piece of what helps an agent become successful. There are many different reasons to choose a specific real estate brokerage, even if they don’t offer the most ideal commission structure for your needs.

Many successful agents joined their brokerage when they weren’t sure what a good split in real estate was or weren’t experienced yet, but the existing model no longer benefits them. In these cases, the best choice to maximize your income and continue growing your business is to negotiate a better commission rate with your existing brokerage.

Before you set up the meeting, consider the following four tips:

1. Record & Analyze Your Progress

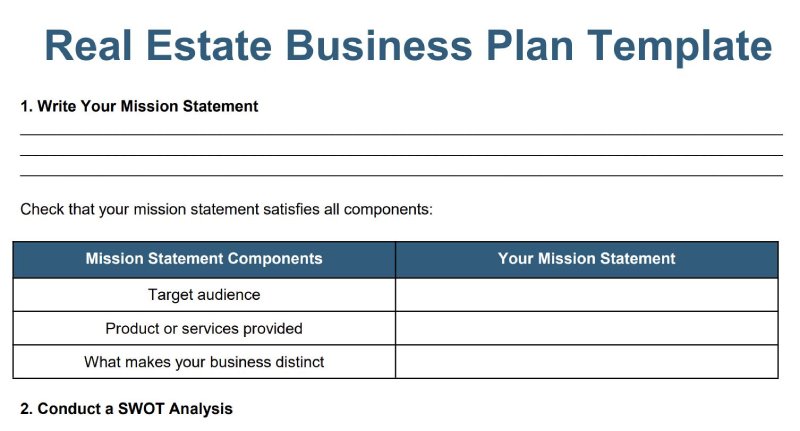

The foundation of every good negotiation is knowledge. If you don’t have a real estate business plan, it’s time to create one. Identify your past sales, income, growth, and progress in lead generation, marketing, or conversions. Analyze areas that need to grow and clearly articulate your goals for the future. Start by downloading and using the free real estate business plan template we provided below to create your own.

Most brokers are happy to support their agents, but there must be an apparent reason for them to change your commission agreement. Their bottom line is the growth of their business, so you need hard numbers and facts to show how changing your commission structure will ultimately help the broker’s business.

Most importantly, calculate your gross income commission (GCI), or total commission earned before expenses and fees, and your net income, which is the total after expenses. With these numbers in hand, approach your broker with clear proof that increasing your commission would ultimately increase the brokerage’s success.

2. Negotiate on Specific Transactions

A real estate agent commission split is an agreement between two parties, not a legal document that can’t be adjusted for special circumstances. Remember that the agreement should mutually benefit both parties, so some scenarios are worth extra attention and discussion.

A real estate client who owns a variety of commercial properties or is just starting a property investment venture is much more likely to bring multiple transactions and profit to a brokerage. If an individual real estate agent builds a strong relationship with a highly valuable client, it’s a perfect opportunity to negotiate a higher commission on all transactions with that particular client. Valuable business relationships take time and effort to nurture, and repeated transactions ultimately help the broker’s business.

Pro tip: Commercial real estate commission splits often work much differently than residential transactions and can vary on each transaction. When you generate commercial real estate leads, set clear expectations and standards with your broker.

3. Refer to Your Goals

For real estate brokers to have a successful business, they need agents passionate about growing their own businesses. As an agent, you may have general goals for yourself, but your real estate broker may not know what you are working toward. By openly sharing your goals and plans to achieve them, your broker may offer more support and show more willingness to adjust your commission agreement.

To create actionable goals, use the following steps:

- Identify your current sales and income data

- Set your financial or sales goal

- Calculate how many deals you’ll need per month to reach your goal

- Create a plan to increase the number of deals

Visit our article How to Write a Real Estate Business Plan: Elements, Examples & Free Template and download our free goal calculator to keep track of the amount of money you earn for yourself and your brokerage.

4. Negotiate Other Factors

As real estate agents quickly learn, commissions aren’t the only element of a successful career or a growing income. If your commission rate is satisfactory or unable to be adjusted, consider negotiating other elements of your business. For example, if you live in a rural area and travel 20 to 30 miles to client showings or listing appointments, you may want to ask for mileage reimbursement.

Another option is presenting a new real estate tool or type of technology to your broker. The right marketing or advertising tool can massively increase your return on investment (ROI), and you can offer your broker an opportunity to be a part of testing and finding more efficient ways to build the business.

For example, Market Leader is a lead generation tool that provides exclusive leads, a customer relationship manager (CRM), customizable websites, and a complete marketing suite. It makes it easy to design professional pieces for both print and digital marketing, plus it comes with a ready-to-send listing marketing package. Negotiating a powerful and versatile tool like Market Leader could be the key to the next phase of scaling your business.

Market Leader agent professional (Source: Market Leader)

Remember that all negotiations should be built on facts, so ensure you are prepared to clearly identify the ROI potential of any new product or technology. Support your claim with information about the brokerage’s clientele, marketing strengths, and weaknesses, and give specific product features that will support your needs.

Bottom Line

While all real estate commission splits have unique pros and cons, it’s essential to understand what a good commission split is in real estate that best fits your situation, how it can work to your advantage, and match your needs. Successful real estate agents must stay informed about the most profitable commission structures for themselves as they begin to build a real estate career.

Frequently Asked Questions (FAQs)

Yes, a 60/40 split can be suitable for real estate agents who value teamwork and collaboration. It can encourage agents to work harder and close more deals. However, it might not be the most profitable option for the listing agent, and it might not be the ideal choice for agents specializing in a specific market or niche. Remember that the commission rate should be agreed upon between the agent and the brokerage, considering the agent’s expertise, the market, and the type of property being sold.

Typical commission splits include 50/50 when the broker and real estate agent split the proceeds equally. But 60/40 and 70/30 split agreements are also commonly used in real estate. In these circumstances, real estate agents receive more proceeds than brokers. This could result from the company’s size and the number of real estate agents a broker is responsible for managing.

Yes, real estate commissions are among the most expensive fees at a typical closing. This fee is paid by sellers, not by buyers. The commission is typically 5% to 6% of the home’s purchase price and is split equally between the seller’s and buyer’s agents.