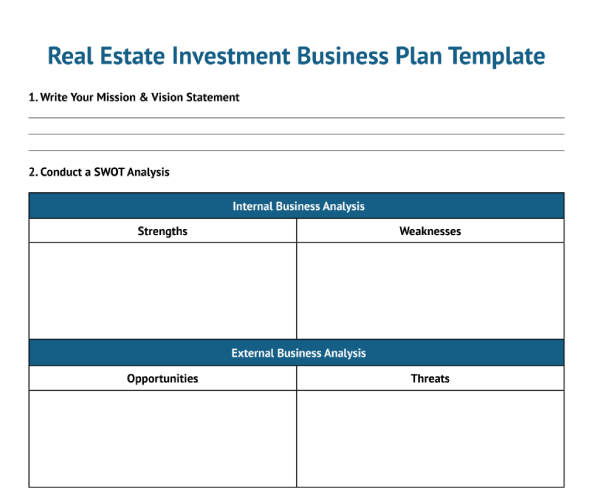

A real estate investment business plan is a guide with actionable steps for determining how you’ll operate your real estate investing business. It also indicates how you’ll measure your business’ success. The plan outlines your mission and vision statement, lets you conduct a strengths, weaknesses, opportunities, and threats (SWOT) analysis, and sets goals in place. It’s similar to a business plan for any business, but the objectives are geared toward how you will manage the business, grow your investment, and secure funding.

We’ve created a free real estate investment business plan template for you to download and use as a guide as you read through the article and learn how to write a business plan for real estate investment:

1. Write Your Mission & Vision Statement

Every real estate investment business plan should begin with a concrete mission statement and vision. A mission statement declares actions and strategies the organization will use—serving as its North Star in achieving its business or investment objectives. A strong mission statement directs a real estate business, keeps teams accountable, inspires customers, and helps you measure success.

Before you compose your mission statement, you need to think about the following questions to do it effectively:

- What exactly is our business? The answer should encompass the essential functions of your real estate organization.

- How are we doing it? The response must explain your real estate goals and methods based on your core principles.

- Who are we doing it for? The response explains who your primary market is.

- What are our guiding principles? The “why” for your real estate company’s existence.

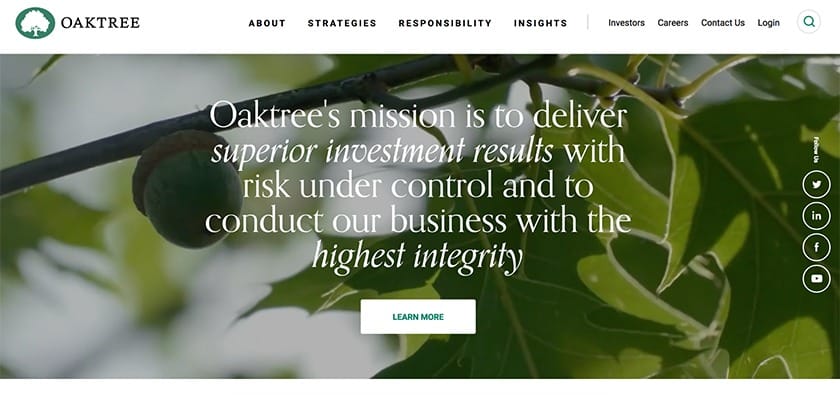

Mission statement example (Source: Oak Tree Capital)

The example above provides the mission statement of Oak Tree Capital. As a real estate investment business, it’s clear what its ultimate business objective is and how it will approach investing with integrity to maximize profit. Essentially, the investment company will drive monetary results—while maintaining its moral principles.

On the other hand, vision statements differ slightly from mission statements. They’re a bit more inspirational and provide some direction for future planning and execution of business investment strategies. Vision statements touch on a company’s desires and purpose beyond day-to-day operational activity. A vision statement outlines what the business desires to be once its mission statement is achieved.

For more mission statement examples, read our 16 Small Business Mission Statement Examples & Why They Inspire article and download our free mission statement template to get started.

If you want to write a vision statement that is truly aspirational and motivating, you should include your significant stakeholders as well as words that describe your products, services, values, initiatives, and goals. It would be best if you also answer the following questions:

- What is the primary goal of your organization?

- What are the key strengths of your business?

- What are the core values of your company?

- How do you aim to change the world as a business?

- What kind of global influence do you want your business to have?

- What needs and wants does your company have?

- How would the world be different if our organization achieved its goals?

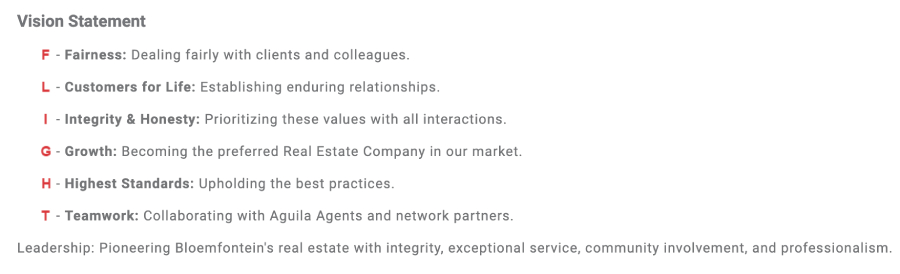

In the example below from Aguila Real Estate, it hopes to be the preferred real estate company in its market.

Example of a vision statement (Source: Aguila Real Estate)

To make it easier, download our free template and follow our steps to create a vision statement for your small business. Take a look also at our 12 Inspiring Vision Statement Examples for Small Businesses in 2023 article to better understand how to create an impactful vision statement.

2. Conduct a SWOT Analysis

A SWOT analysis section of your real estate investing business plan template helps identify a business’ strengths, weaknesses, opportunities, and threats. This tool enables real estate investors to identify internal areas of improvement within their business through their strengths and weaknesses.

The opportunities and threats can assist with motivating a team to take actions that keep them ahead of an ever-changing real estate landscape. For a real estate business investor, the SWOT analysis is aimed at helping grow and protect investments over time.

Specifically for real estate investing, strengths and weaknesses correlate with the investment properties’ success and touch on items that will drive investment growth. The strengths can be the property’s location, condition, available amenities, and decreased vacancy. All of these items contribute to the success of a property.

On the contrary, the weaknesses include small unit sizes, excessive expenditures (finances to repair, upgrade, properties to acquire), low rents, and low cap rates. These weaknesses indicate less money is being collected and a lower overall return on investment (ROI). They are all factors that limit cash flow into the business and are internal factors that an investor can change.

See below for an example of strengths and weaknesses that could be included in a SWOT analysis:

| WEAKNESSES | STRENGTHS |

|---|---|

| Already owns a portfolio of land and residential properties | Rent prices and cap rates are low |

| Familiarity with the geographical area | The average unit size is small |

| Has resources and capabilities that will contribute to the success | High rental vacancy rate in the area |

Opportunities and threats are external factors that can affect an investment business. You don’t have control over these items, but you can maneuver your business to take advantage of the opportunities or mitigate any long-term effects of external threats. Opportunities relating to investment properties can be receiving certification with a city as a preferred development or having excess equity.

However, threats to an investment property do not need to be particularly connected to the property itself. They can be factors that affect your overall business. For example, interest rates may be high, which cuts your profits if you obtain a mortgage during that time frame.

An example of possible opportunities and threats for an investment business could be:

| OPPORTUNITIES | THREATS |

|---|---|

| Future infrastructural development in the area | High interest rates |

| Receiving certification with a city as a preferred development | Poor school district |

| Building transportation (train station) in the area | High taxes |

After creating your SWOT analysis, an investor can use these factors to develop business goals to support your strengths and opportunities while implementing change to combat the weaknesses and threats you anticipate. It also helps investors prioritize what items need to be addressed to succeed. These factors in a SWOT can change as the business grows, so don’t forget to revisit this portion and continuously reevaluate your SWOT.

3. Choose a Real Estate Business Investing Model

The core of real estate investing is to purchase and sell properties for a profit. How to make that profit is a factor in identifying your investment model. Different investing models are beneficial to an investor at different times.

For example, when interest rates are low, you may consider selling your property altogether. When interest rates are high and it is more difficult for people to obtain a mortgage, you may choose to rent out your properties instead. Sometimes, you must try a few models to see what works best for your business, given your area of expertise.

We’ve identified some investment business models to consider:

- Buy and hold: This strategy mainly involves renting out the property and earning regular rental income. This is also considered the BRRRR method: buy, rehab, rent, refinance, and repeat until you have increased your portfolio.

- Flipping properties: Flipping a property entails purchasing, adding value, and selling it higher than the investment costs. Many investors have a set profitability number they would like to hit but should consider market fluctuations on what they can realistically receive during the sale.

- Owner-occupied: Investors can live in the property while renting out extra units to reduce their housing costs and have rental income coming in simultaneously. This model is best if you own multifamily units, especially duplexes, triplexes, or fourplexes. It’s also a great way to understand the complexities of being a landlord. You can transition your unit to another renter when you want to move.

- Turnkey: Buying a turnkey property is the best option for investors who wish to enter the real estate market without having to deal with renovations or tenant management. It’s a practical way for seasoned investors to diversify their portfolios with fewer time commitments.

Investors don’t have to stick to one model, and they can have a few of these investment models within their portfolio, depending on how much effort they would like to put into each property. Before choosing an investment model, consider which will help you meet your investing goals most efficiently.

Read our Investing in Real Estate: The 14-Tip Guide for Beginners article to learn how real estate investment works and other investing business models. Also, if you’re new to real estate investing and are looking for foundational knowledge to get started or seeking information about the best online courses for real estate investing, look at our The 13 Best Real Estate Investing Courses Online 2023 article.

4. Set Specific & Measurable Goals

The next step to completing a real estate investment business plan for real estate investing is to set SMART goals. SMART is an acronym that stands for specific, measurable, achievable, relevant, and time-bound. Creating goals that contain all of the criteria of SMART goals results in extremely specific goals, provides focus, and sets an investor up for achieving the goals. The process of creating these goals takes some experience and continued practice.

An investor’s goals can consist of small short-term goals and more monumental long-term goals. Whether big or small, ideal goals will propel your business forward. For example, your end goal could be having a specific number of properties in your portfolio or setting a particular return on investment (ROI) you want to achieve annually.

Remember that your SMART goals don’t always have to be property-related just because you’re an investor. They can be goals that help you improve your networking or public speaking skills that can also add to a growing business.

Example of improving goals with SMART in mind:

Begin creating SMART goals with an initial goal. Then, take that initial goal and break it down into the different SMART components. SMART goals leave no room for error or confusion. The specific, measurable, and time-bound criteria identify the exact components for success.

However, the relevant and achievable parts of the goal require a little extra work to identify. The relevancy should align with your company’s mission, and extra research must be performed to ensure the goal is attainable.

Initial goal: Receive a 5% return on investment from the property

Smart goal:

- Specific: I want to achieve a 5% return on the 99 Park Place property.

- Measurable: The goal is to sell it for greater than or equal to $499,000.

- Achievable: The current market value for a two-bedroom in Chicago is selling for $500,000 and growing by 1% yearly.

- Relevant: I aim to meet my overall portfolio returns by 20% annually.

- Time-bound: I want to offload this property in the next three years.

5. Write a Company Summary

The company summary section of a business plan for investors is a high-level overview, giving insight into your business, its services, goals, and mission, and how you differentiate yourself from your competition. Other items that can be included in this overview are business legal structure, business location, and business goals. The company summary is beneficial if you want to involve outside investors or partners in your business.

Example company profile from Choueri Real Estate

A company summary is customizable to your target audience. If you’re using this section to recruit high-level executives to your team, center it around business operations and corporate culture. However, if you’re looking to target funding and develop investor relationships for a new project, then you should include investor-specific topics relating to profitability, investment strategy, and company business structure.

Partners and outside investors will want to consider your company’s specific legal business structure to know what types of liabilities are at hand. Legal business structure determines how taxes are charged and paid and what legal entity owns the assets. This information helps determine how the liabilities are separated from personal assets. For example, if a tenant wants to seek legal damages against the landlord and the property is owned by an LLC, personal assets like your personal home will not be at risk.

6. Determine Your Financial Plan

The most essential part of creating a real estate investing business is the financial aspect since much of the business involves purchasing, managing, and selling real estate. To buy real estate initially, you’ll have to determine where funding will come from. Funding can come from your personal assets, a line of credit, or external investors.

A few options are available to real estate investors when obtaining a loan to purchase properties. The lending options available to most real estate investors include the following:

- Mortgage: This is one of the most common means of obtaining financing. A financial institution will provide money based on a borrower’s credit score and ability to repay the loan.

- Federal Housing Authority (FHA) loans: This loan is secured by the FHA to assist with getting you a low down payment or lower closing costs, and sometimes easily obtain credit. There are some restrictions to qualify for this loan—but it could be suitable for newer investors who want to begin investing starting with their primary home.

- Home equity line of credit (HELOC): If you currently have property, obtain a HELOC by using your current property to secure the line of credit and borrow against the equity in your property. As you repay the loan, your available balance on the line of credit gets replenished.

- Private lenders: These are lenders who are not financial institutions. These individual lenders typically have fewer restrictions than traditional lenders and will lend money to individuals who can grow their investments.

- Hard-money loans: This loan requires a hard asset to be leveraged for money. For example, you can put up the home you want to purchase as the asset for cash upfront, and the hard-money loan will be paid back once the home is sold or other funding is secured. This is great for short-term deals due to quick approval and little upfront money.

After funding is obtained to purchase property, financial projections help investors understand their financial standing. These projections can tell you potential income, profits, and when you may need additional funding in the future. Similar to lending options, these calculations are specific to your investing model. If you’re not planning to rent out the property, then calculations like gross rent multiplier are not applicable.

For more information on what is needed to obtain financing, read our articles Investment Property Financing & Requirements and 5 Best Crowdfunding Sites for Investors 2023.

Additional Investment Calculations

In a rental property business plan, it’s important to use a rental property calculator to determine a property’s potential return on investment. The calculator considers various factors, such as purchase price, operating expenses, monthly income, or vacancy rates, to determine whether a property is a good investment.

Click on the tabs below for the other important calculations all investors should be aware of when purchasing and managing rental properties:

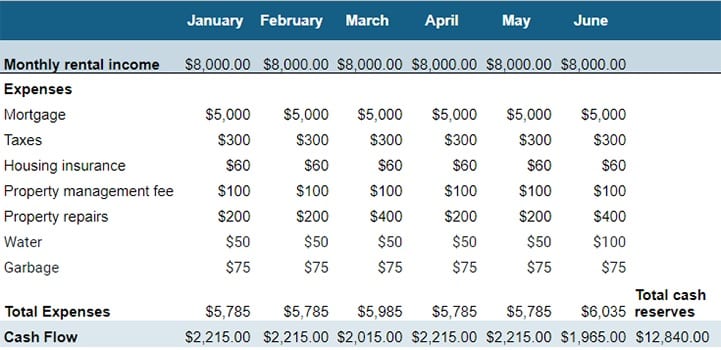

Investors can use their current cash flow to forecast future cash flows, which will give you an idea of how much profit you will see over a specific period. Use past cash flow information to determine if there are any trends. For example, during the summer, your water expenses increase, or possibly every few months, you see an increase in property repairs. Consider these trends when estimating future cash flows and compare actual numbers to determine if your forecasting is accurate.

Use the template below to forecast future cash flow for six months and determine how much cash flow reserves you will have:

Thank you for downloading!

💡 Quick tip:

In addition to the template, investing in property management software like TenantCloud will set you up for success. The free plan from TenantCloud will help you list apartments, collect rent payments, and screen applicants to maximize profits and minimize vacancies.

7. Perform a Rental Market Analysis

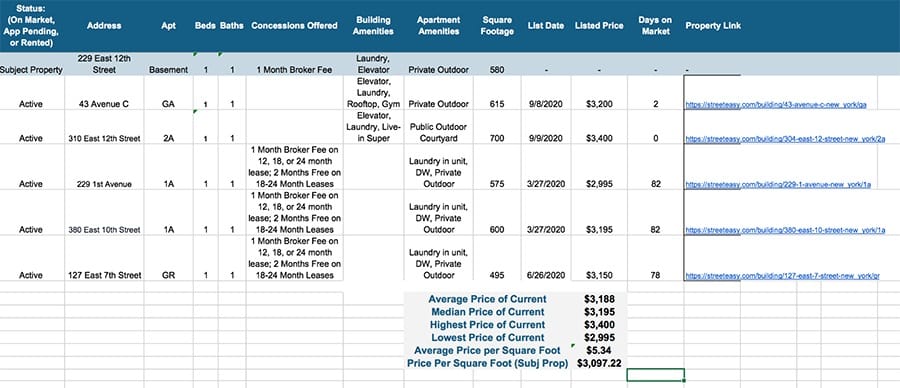

While determining what properties to purchase, investors should perform a rental market analysis (RMA) to gauge the investment potential of a rental property. The RMA consists of running comparables against current units on the market and collecting data that may affect your rental rate to understand if the rental property in question is a solid long-term investment. The analysis helps determine the average rental rate and future rent if you want to make any property upgrades.

Investors can use resources like Zillow to pull comparable property information and gather information on unit layout, building amenities, rental concessions offered, or listing prices. Once the information is gathered, the spreadsheet itemizes the average, median, highest, and lowest rent. When such information is available, it also provides an average price per square foot compared to the subject property. With this information, investors can decide whether the subject property is worth the investment.

Read our 10 Best States to Invest in Real Estate (& 5 Worst) in 2023 article to better understand which states yield a positive cash flow, build equity, and have long-term profitability.

8. Create a Marketing Plan

Once you determine which property to invest in, investors should identify a marketing plan to list the vacant units. Some investors offload the marketing and advertising to real estate agents and brokerages, which will also collect a fee for renting out the property. Refer to some of the best real estate marketing materials to get started, or use our free real estate marketing plan template to lay out your objectives and tactics.

A real estate marketing plan should include your goals, budget, target market, competitors, feasible marketing strategies, and unique selling offers. In addition, it’s crucial to balance your strategy and split your potential marketing plans into categories, like print materials, online ads, email, and social media, so that you can be very specific with your goals and metrics.

Here are some of the real estate marketing mediums to include as you set your marketing goals:

- Real estate website and landing pages

- Email marketing

- SMS and text message marketing

- Real estate ads

- Social media marketing

- Print marketing materials

- Real estate signs

Download our marketing plan template by visiting our article Free Real Estate Marketing Plan Template & Strategy Guide.

9. Build a Team & Implement Systems

As a new investor, you may be unable to hire an entire team of employees to help perform research, run analysis, property management, and accounting duties. It is best to have a list of vendors you can rely on to assist you with purchasing, rehabilitating, and buying or selling your investment properties. Find vendors you trust so you can free yourself from having to micromanage them and know they have your best interest and the interest of your investments in mind.

Here are a few people you want to include on your team:

- Contractors

- Plumbers

- Electricians

- Property managers

- Accountants

- Attorney

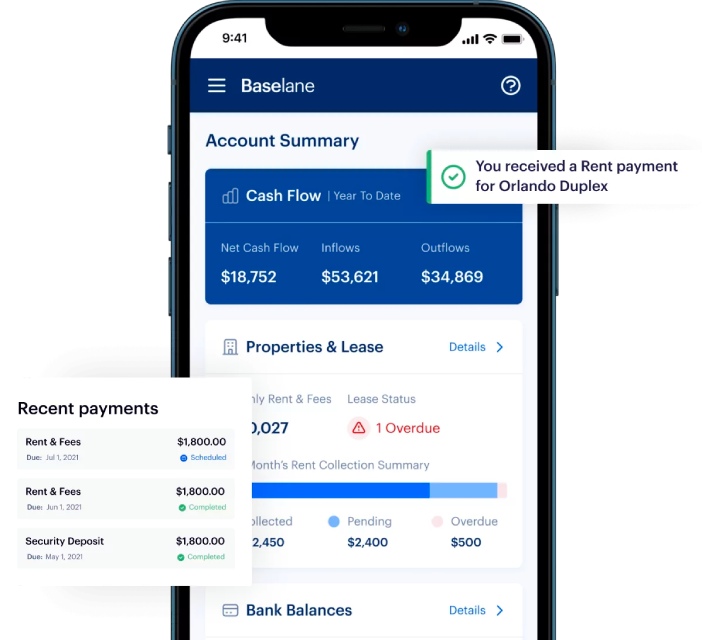

You should also utilize real estate investing apps and property intelligence software like Baselane that relieve you of manually performing daily duties to keep your investments profitable.

Automated rent collection feature (Source: Baselane)

Baselane is an all-in-one solution—from banking to rent collection, bookkeeping, reporting, and analytics. This software will help you efficiently manage your portfolio and eliminate the need for manual tasks. Learn more about how Baselane can make you a better property owner.

If you’re looking for more tools to help you get started, improve your portfolio management, and streamline your operations, read our 6 Best Real Estate Software for Investors 2023 article. We listed the six best software tools available for real estate investing based on affordability, customer reviews, features, and support to assist you in finding the best software that suits your needs.

10. Have an Exit Strategy

Since an investor’s money is tied up in the properties they own until they choose to sell, deciding when to sell or liquidate to get access to your money is part of an investor’s overall real estate exit strategy. The exit strategy for a real estate investment business is a plan for when an investor would like to remove themself from a deal or the business altogether. It helps weigh the different scenarios to minimize business risks and maximize the total return on investments.

A few exit strategy examples are:

Type of Real Estate Exit Strategies | Best For & Explanation |

|---|---|

Real Estate Wholesaling | If you desire a quick sale, then wholesaling is best for you. Also, if your property requires repairs and you don't have the funds to spend on it, selling at a lower price can get you out of it quickly without putting additional money into it. |

Liquidation | When you've significantly raised the value of the assets, a good exit plan to adopt is to sell the entire portfolio as one unit or sell individual properties. This exit strategy is best for buy-and-hold and fix-and-flip investors whose properties have increased in value over time and who have timed their purchase, rehab, and sale for maximum profit. |

Internal Revenue Service (IRS) 1031 Exchange | If you want to reinvest and avoid some taxes, this exit strategy is best for you. You can sell a property and move the money into another investment property without paying capital gains. |

The factors that an investor should consider when devising an exit strategy are minimizing financial loss, recouping as much of their original investment as possible, and avoiding any unseen fees that will cut into profits like tax consequences. An investor’s plan should always be to grow their original investment, but unforeseen circumstances may occur that will require you to plan on when to cut your losses as well.

Bottom Line

Before launching a successful real estate investment business, you must have an efficient business plan, aligning your strategies with your business objectives. Our real estate investment business plan template can help get you started. These plans act as a roadmap so you can focus on the steps required to grow your business. Business plans evolve, so continuously revisit and improve your strategies. There is no right or wrong way to write a real estate investor business plan as long as it is used to achieve your goals.