Real estate agent tax deductions are essential to reducing your annual tax obligations and enhancing profits. As most agents work independently, commissions are typically received without taxes withheld, although income tax and a 15.3% self-employment tax need to be accounted for. Properly documenting ordinary business expenses like mileage, education, meals, office supplies, phone bills, marketing, and insurance is critical to qualify for deductions. We’ve identified 18 realtor tax deductions to help you save money and boost your financial bottom line.

Track Your Expenses Spreadsheet

Organize your expenses with an accounting application like QuickBooks, or keep track of your finances through a simple spreadsheet. Download our free real estate agent tax deductions worksheet below to start quickly.

Thank you for downloading!

Quick Tip:

QuickBooks is cloud-based accounting software designed for small businesses that require advanced features, such as inventory management and profit and loss (P&L) tracking by class, location, and project. QuickBooks Online is available in four plans, ranging in price from $30 to $200 a month, depending on the number of users and features desired.

For additional tips for saving money on your tax, visit 13 Essential Tax Savings Tips for Small Business Owners.

1. License Expenses

If you’ve wondered, “Are real estate agent fees tax deductible?” you’ll be happy to learn that all licensing fees are considered necessary and ordinary realtor business expenses. These real estate costs are governed by state licensing boards and agencies, allowing you to continue to practice. These realtor tax deductions include license renewals and additional charges for business licenses, application fees, renewal fees for LLCs, or any licensing costs to practice business in another jurisdiction.

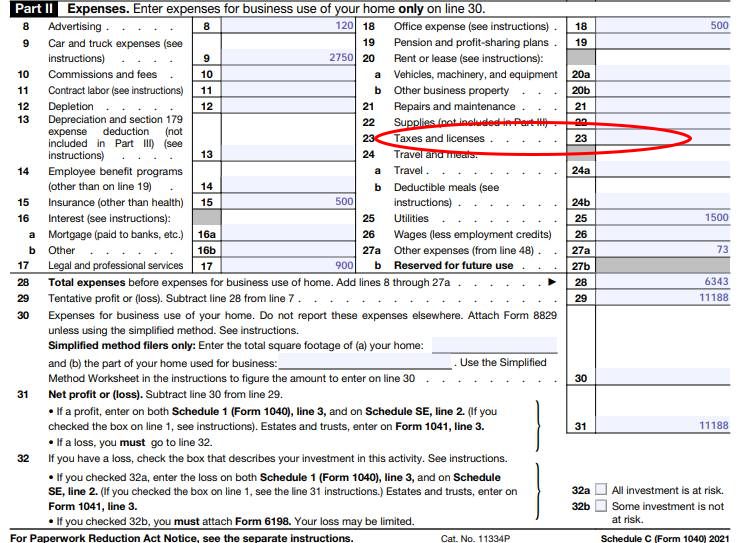

Part 2 of Schedule C is where to enter your expenses. (Source: IRS.gov)

IRS Schedule C is used to report how much money agents make (or lose) in their practices. The license deductions are itemized on your Schedule C form in Part II, Line 23: Taxes and Licenses. Most license costs are paid on a schedule after you become an agent, so once you get your license, you must track real estate agent expenses of what fees are due and when. Use a spreadsheet or software and include the total costs when calculating your real estate agent tax deductions.

2. Software Fees

Running a successful real estate practice requires real estate software and tools to manage different aspects of your business. These costs can add up to a large portion of your annual expenses. The good news is they are fully deductible, so don’t forget to enter them in your Schedule C, Line 18.

Here are some fully tax deductible software and services expenses that can streamline tasks, from staying organized to lead generation:

- Client relationship management (CRM) software

- Lead generation companies

- Document and transaction management

- Database software

- Real estate marketing companies

- Website builders

- Social media marketing companies

- Accounting and bookkeeping software

To keep track of your technology stack, agents should document yearly and monthly expenses as well as any additional one-time purchases for quick reference.

3. Gifts

The Internal Revenue Service (IRS) business expense categories cap business gifts at $25 per person, per year. Agents can give gifts of higher value, but they’ll have to cap their tax deduction at $25. Gifts can include closing gifts, holiday baskets, or referral gifts. Depending on the purpose of the gift, agents may be able to deduct more. For example, a gift containing an agent’s branding information could be considered a marketing expense instead.

A sample of EvaBot customizable pet gifts. (Source: EvaBot)

Custom gifts are an effective way to nurture relationships with past and current clients. EvaBot automates the gift-giving process using artificial intelligence to speak with individual clients to discover their interests. Then, it will send them a custom gift that appeals to them and is within your price range.

4. Deductible Meals

Developing relationships with your clients and network is part of growing your business. Your network can include suppliers, agents, advisers, lenders, lawyers, partners, assistants, and employees. In 2023, agents can deduct 50% of applicable meal expenses.

To help keep track of meal costs, use a single credit card that you dedicate to business expenses so it will be easier to differentiate business meals from personal meals. You can export your annual charges from credit card websites to give to your accountant or tax preparer.

Our article, Can I Claim the Meals & Entertainment Deduction?, will help you better understand and identify which business-related meals and entertainment activities you can claim for deduction to lower your tax liability.

5. Marketing & Advertising Expenses

Real estate agents rely heavily on marketing and advertising to promote their businesses. So, what can you write off? These expenses include business cards, print materials, radio or magazine advertisements, social ads, sponsorships, and property listings. Agents should keep detailed receipts of each marketing expense paid throughout the year. All costs should accompany a physical receipt or invoice saved in a folder for easy access. Enter them in your Schedule C, Line 8.

Pro tip: Most businesses provide emailed receipts rather than paper receipts. Keep a separate folder in your email or Google Drive account to save these receipts rather than organizing and filing paper copies. If you receive paper receipts, take a picture and keep them instead.

Real estate marketing automation (Source: Market Leader)

A provider like Market Leader can help you create print and digital marketing materials, set up marketing automation, and organize your contacts with a comprehensive client relationship management (CRM) system. The software streamlines agent’s marketing efforts and client management, making it easier to track and claim relevant tax deductions. With Market Leader, you can optimize your business operations while ensuring you’re well-prepared for tax season.

If you haven’t started thinking about your marketing expenses and need to budget them into your real estate business, read through our article Real Estate Marketing Plan Template & Strategy Guide. It includes a template, tools, and software to start your real estate marketing.

6. Deductible Auto Expenses

Real estate agents can write off certain expenses from a car purchase or lease. They can take a deduction if they use their car for work, like looking at properties, showings, and travel for closings. Select standard mileage or the actual expenses when claiming a real estate agent car for a tax deduction. Add to Schedule C, Line 9.

There are two ways to deduct automobile expenses:

- Standard mileage rate deduction: For 2023, the standard mileage rate is 65.5 cents per mile driven when used for business. An agent driving 10,000 miles could deduct $6,560 for their vehicle ($0.656 x 10,000).

- Actual expenses: This is a more complex way to calculate costs associated with vehicle maintenance. Agents must add vehicle maintenance costs, gas, car washes, tires, and depreciation.

Regardless of the method chosen, agents can also deduct vehicle taxes, a portion of loan interest, car washes, and parking fees directly related to business. Note that standard mileage must be selected for the first year of the vehicle’s use and cannot be switched to standard after the vehicle has been used.

Introduction to MileageWise (Source: YouTube)

MileageWise is an app for tracking your mileage that prioritizes adherence to IRS regulations. It emphasizes functionalities that assist users in preventing IRS-related penalties and issues when claiming mileage deductions. It incorporates an integrated IRS auditor that meticulously examines all mileage records for any discrepancies. Try MileageWise for 14 days with its free trial and low-priced subscription plans

Review our article 5 Best Mileage Tracker Apps for Small Businesses for details on top-recommended options like Hurdlr and other mileage-tracking apps for your business.

7. Office Supplies & Business Equipment

If real estate agents use office supplies as part of their business, they can write them off on Schedule C, Line 18. These supplies include things like pens, paper, printer ink, and folders. To keep track of office supplies expenses, agents can use an Amazon business account dedicated to business-related supplies. Personal items should be purchased under a separate personal account.

Similar to office supplies, business equipment like cell phones, computers, printers, and cameras are fully deductible in the year purchased by completing a section 179 election. This also includes furniture like office chairs, desks, or bookshelves.

The caveat to the equipment write-off is you must use it for more than 50% of your real estate business. For example, if you purchase a printer and only use it 51% of the time for personal printing instead of work, you cannot write it off. However, you can depreciate 49% of the cost of the useful life of the printer using MACRS depreciation.

If you buy expensive equipment like a drone, camera, and photo editing software, you may need to depreciate these over a few years. Consult your tax accountant to see which method is more beneficial for your circumstances.

8. Education & Training

Your continuing education (CE), professional development, certifications, and designations give you a competitive edge. Education fees, materials, training, and education-related travel are all valid real estate professional tax deductions. Document these expenses on Schedule C, Line 27a.

Since CE is a requirement for license renewal, the costs of classes taken are also tax-deductible. However, any education expense that helps you in a new profession is not tax-deductible on your real estate return. It has to be related to your real estate profession. If you started a separate business, you’d include professional education and training costs on a separate Schedule C for that business.

Real estate education course chapters (Source: McKissock Learning)

Many real estate school options exist for in-person and online real estate education to satisfy CE hours and get professional development. McKissock Learning offers required coursework in all 50 states in full packages or customizable individual classes. Choose courses that align with your business goals to improve your knowledge and increase your business.

9. E&O & Other Insurance Expenses

Some states, like Rhode Island and Colorado, require real estate agents to have errors and omissions (E&O) insurance for a valid license. For broker-owners, maintaining workers’ compensation insurance for their team is often mandatory and deductible. Insurance policy expenses can be tracked by recording payments provided to the insurance provider. The good news is insurance expenses, including general business and E&O, are reasonable real estate agent tax deductions on Schedule C, Line 15.

You may also deduct family health insurance premiums if you and your spouse lack employer-sponsored coverage, including medical, dental, and long-term care. While deductible, these premiums are not shown on Schedule C, but rather on Form 1040, Schedule 1, Part II, Line 17.

10. Phone & Internet Bills

Performing real estate duties requires telephone and internet. These modest monthly charges can add up quickly. Suppose agents or brokers have an office with internet and a landline for receiving incoming and outgoing business calls. In that case, they can deduct the annual cost of the internet bill and landline on Line 25 (Internet) and Line 27a (Phone bill) of Schedule C.

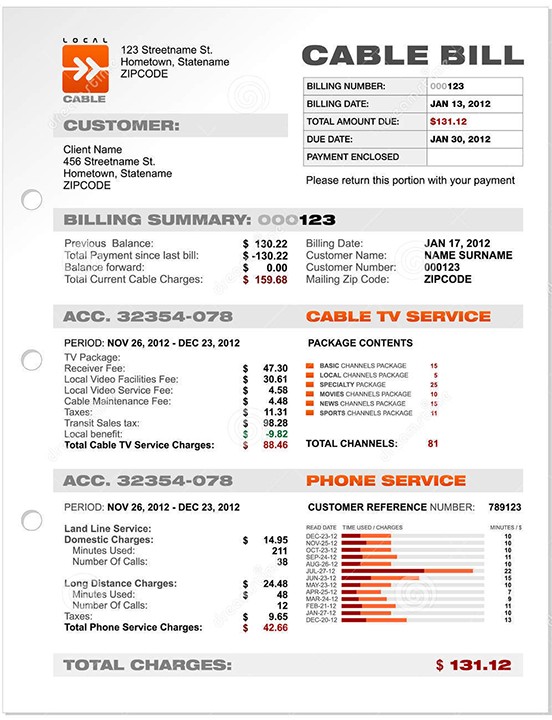

Example utility bill (Source: Dreamstime.com)

For cell phones, agents can deduct a percentage of their monthly bill for business as one of the tax write-offs for real estate agents. Track the number of calls through your cell phone provider bills and take a percentage of the monthly cost.

For example, assume your monthly account is $100, you made 100 calls, and 95 were for business. Then, you can include $95 (.95 x $100) in your monthly cell phone bill real estate tax write-offs.

You can also deduct the cost of a new cell phone if you purchased it for business. Some agents have two cell phones to keep their business and personal calls separate and the costs straightforward.

11. Business-related Travel

If agents attend business-related events or conferences, most travel expenses are tax-deductible. These tax deductions for realtors include airfare and lodging. Travel meals are 50% deductible. However, if an agent extends their stay for personal reasons, traveling to and from the destination is non-deductible. Business travel is documented on Schedule C, Line 24a.

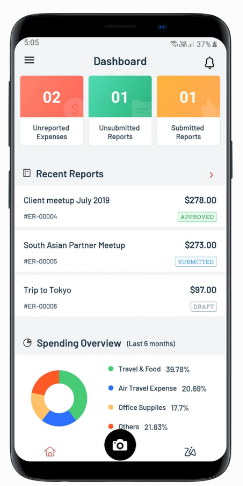

Expense app dashboard (Source: Zoho)

To help keep track of travel and daily expenses, use an expense tracker like Zoho Expense or QuickBooks Online. For using rideshare apps like Uber on your business trip, set up a business profile to keep track of your travel between locations and link those charges to a business credit card.

For more business expense trackers that help organize your money, check out our article, 6 Best Business Expense Tracker Apps.

12. Legal & Professional Services

Professional services for your real estate business, like attorneys, CPAs, bookkeepers, consultants, and third-party marketing and advertising vendors or individuals, are 100% deductible. You may also deduct legal expenses for unreimbursed costs that you paid on your client’s behalf and are related to their property, like title searches or attorney closing fees. These deductions go in Schedule C, Line 17.

Sometimes, attorneys help you with personal and business matters. To ensure you comply with IRS regulations, have your attorney bill you separately for business and personal issues. You can only deduct business-related legal costs.

13. Commissions Paid

A real estate agent’s salary is earned through commissions from closed sales. If agents pay other agents (like a buyer’s agent or referring agent) from their commission, they can deduct the amount paid on Schedule C, Line 10 of the tax form.

For example, Agent Jackson needs someone to manage her listing while she’s at a conference. Jones agrees to pay Agent Kapoor 30% of the selling side of the commission if Kapoor handles the showings and sales while Jones is away. Agent Jackson can deduct the 30% commission she paid to Agent Kapoor on her tax return.

Pro tip: Keep track of payable commissions and fees closely because the costs can add up fast depending on the number of deals you close. You also want to ensure you’re paying the right commission splits to all parties involved.

14. Association Dues

To comply with your broker’s and real estate board’s requirements, you must pay annual dues to associations and organizations, like the National Association of Realtors (NAR), multiple listing service (MLS), and state and local boards. These dues are deductible business expenses, even for part-time agents. However, if portions of your dues support political lobbying, those portions are not deductible.

Some dues are paid annually, so agents can record the recurring deductions yearly unless any fee changes or additional associations are added, thus raising costs. This can be documented in Schedule C, Line 27a. If agents use accounting software to set up recurring expenses, like QuickBooks, these should be coded as “dues.”

15. Retirement Plan Contributions

Since agents are independent contractors, they usually purchase their retirement plans or contribute to a SEP IRA. If agents contribute to a retirement plan each year, they should consider maxing out the contribution to get the maximum tax savings. A few plans agents can choose from:

- Self-employment Pension (SEP) IRA: Agents can contribute the lesser of 25% of Schedule C income or $66,000 in 2023. Read about Keogh plans and other SEP IRA plans.

- Traditional IRAs: The maximum you can contribute to your IRA is $6,500 if you’re younger than 50, or you can add an extra $1,000 per year after 50 to max out the annual contribution at $7,500.

- Solo 401(k): Must be a business with no employees. The maximum contribution limit is $66,000 in 2023, and you can add $7,500 annually if you are 50 or older. Look at the 6 Best Solo 401(k) Providers for 2023 to choose the best option.

The tax benefits of contributing to a retirement plan reduce your overall taxable income, which may lower your tax bracket, resulting in paying lower taxes. To track retirement savings and investment choices, agents can use a personal finance app like Personal Capital to track annual retirement contributions. It’s important to note that your Solo 401(k) is not deducted on Schedule C. Deduct it on Form 1040, Schedule 1, Part II, Line 16.

16. Employee Payroll & Payroll Taxes

It is not uncommon for agents to hire administrative support or for brokers to hire employees when starting a brokerage. All hourly and salary employee wages and employer payroll taxes like the Federal Insurance Contributions Act (FICA) and State Unemployment Taxes are deductible and should be written on Line 10 of Schedule C in the tax form.

Wages may be classified as salaries, bonuses, commissions, and other taxable compensation payments. Do not misclassify your employees as independent contractors to avoid any IRS mistakes. Doing so can create years of back taxes.

Tip: Forming a single-member LLC vs a sole proprietorship is often a good idea for agents with employees. The LLC allows you to minimize liability for the actions of your employees and provides you with a choice of either filing taxes on Schedule C or filing Form 1120S as an S-corporation—which can often result in lower taxes.

17. Home Office

A home office can be one of the most substantial real estate agent tax write-offs. Real estate professionals who use a part of their home for business can write off mortgage interest, rent, utilities, taxes, repairs, and maintenance per Schedule C instructions on Line 30.

There are two methods for realtors to calculate a home office:

- Simple method: Multiply the room’s square footage by $5, with a maximum amount of $1,500 (300-square-foot cap). If you use a 300-square-foot room exclusively for business purposes, you can multiply 300 by $5 to give you a total of $1,500 you can deduct for your home office.

- Complex method: Itemize all costs related to your home and multiply that by the percentage of the house used for business purposes. Costs can include mortgage or rent, insurance, repairs, or utilities. For example, if the total cost for your home is $4,000 and you use 15% of your home for business, then you can deduct $600 for your home office.

An important requirement of a home office is that it is used exclusively for business—it cannot double as a space used for any sort of personal activity. It’s also important to keep detailed receipts of all expenses related to the home if you take this deduction in the event the IRS audits you. It’s also best practice to take a photo of the space so you can have a visual idea of the square footage.

18. Brokerage Desk Fees

Some brokerages charge realtors or real estate agents a desk fee, which is a monthly flat fee to work in the broker’s office or under their license. Some brokers charge this fee to cover expenses related to training, resources, and tools provided to the agent.

Desk fees also may cover insurance, legal costs, office supplies, or leads. These latter expenses are usually tax-deductible if an agent pays out of pocket. If these are included in the desk fee, agents can total it as an annual cost and use that as one of their realtor tax deductions. It should be documented on Schedule C, Line 10. Brokerages should provide a desk fee agreement, which agents should keep a copy of for their records.

Frequently Asked Questions (FAQs)

Yes, realtors may deduct food expenses from their taxes if they meet certain criteria. Generally, food expenses while traveling for business purposes, entertaining clients, or attending business meetings may be partially deductible. However, these deductions are subject to specific rules and limitations and usually require detailed recordkeeping.

Dry cleaning expenses are generally not valid real estate agent tax deductions for your personal clothing unless you are on a business trip. In addition, if you have uniforms or work-related attire that require dry cleaning and are not suitable for everyday wear, these expenses may be deductible as unreimbursed business expenses. Talk to your accountant or tax preparer to see if your real estate attire dry cleaning may be deducted.

Clothing, makeup, and haircuts are typically not deductible expenses for real estate agents. The IRS generally considers them personal grooming and attire costs. However, if specific attire is required by the employer and not suitable for everyday wear, it may be deductible. Consult a tax professional for guidance on individual circumstances and potential deductions.

Bottom Line

Save thousands of dollars by lowering your taxable income with real estate agent tax deductions. To maintain the required documentation for expenses, agents should consider using accounting software to track expenses. Keep receipts for at least three years if the IRS wants to perform an audit. The tax law can be complicated and ever-changing, so consult a certified public accountant (CPA) to assist with navigating tax deductions for real estate agents.