ReconArt is an entirely web-based reconciliation solution that allows you to leverage the best practices involved with all aspects of reconciliation. It automates data imports/exports, complex matching rules, and multisided reconciliation and is packaged in a highly intuitive, user-friendly platform that offers speed, scale, and audit readiness.

Although it may be considered too expensive for many small businesses with its starting price of $1,700 monthly, ReconArt editions will work with any enterprise resource planning (ERP) software, accounting system, and external data source. Users who left a ReconArt review praised its end-to-end automation and approval workflows, but its limited customer support could be considered a drawback.

The Fit Small Business editorial policy is rooted in the company’s mission, which is to deliver the best answers to people’s questions. This serves as the foundation for all content, demonstrating a clear dedication to providing valuable and reliable information. Our team leverages its expertise and extensive research capabilities to identify and address the specific questions our audience has—and this ensures that our content is rooted in knowledge and accuracy.

In addition, we employ a comprehensive editorial process that involves expert writers. This process ensures that articles are well-researched and organized, offering in-depth insights and recommendations. Fit Small Business maintains stringent parameters for determining the “best” answers, including accuracy, clarity, authority, objectivity, and accessibility, and these see to it that our content is trustworthy, easy to understand, and unbiased.

ReconArt Alternatives & Comparison

ReconArt Reviews From Users

| Users Like | Users Dislike |

|---|---|

| Automated complex reconciliations | Lack of intuitiveness for new users |

| Customizability of software | Some matching rules are difficult to create and matching transactions can be challenging |

| Can import data from many sources | Difficulty with pulling back imported data when errors occur or items cleared incorrectly |

There are limited third-party sites with a ReconArt review, but overall, users appreciate the platform’s ability to automate complex reconciliations and import data from many sources. Reviewers also praised the provider’s flexibility in designing a system to meet a company’s specific requirements.

The biggest complaints are about the solution’s lack of intuitiveness for new users and the difficulty in pulling back imported data if there were errors or items cleared incorrectly. Others found that some matching rules are difficult to create, and it was a challenge to match transactions successfully.

ReconArt has earned the following average scores on popular review sites:

- Featured Customers[1]: 4.7 out of 5 based on about 2,400 reviews

- G2.com[2]: 3.3 out of 5 based on around five reviews

ReconArt Pricing

ReconArt offers five different pricing plans, which vary depending on the features and number of users. They are all web-based and work with any enterprise resource planning (ERP) system, accounting software, and external data sources. All plans include ongoing support and maintenance:

- Essentials: $1,700 per month for five users; includes up to 25 million transactions per year, full transaction matching functionality, exceptions management, full process automation, and reports.

- Certify: $1,700 per month for 10 users; includes period-end balance sheet reconciliation and certification, configurable approval workflow, complete audit trail, full process automation, and reports.

- Plus: $3,400 per month for 10 users, includes the Essentials and Certify modules

- Close: $2,800 per month for 20 users

- Enterprise: Custom pricing

ReconArt Features

ReconArt offers several features that will assist you with all aspects of the reconciliation lifecycle. This includes financial close management, variance analysis, and high-volume transaction matching. It also provides a comprehensive workflow around journal entry posting.

ReconArt provides a centralized location for all of the month-end close activities. Its robust features help ensure regulatory compliance, improved visibility, audit readiness, and a streamlined close process. The period-end certification process is automated, which ultimately saves time. Checklists are also provided for any closing activities, and you can generate variance analyses of key period-end balances against previous periods.

Example of financial close management in ReconArt (Source: ReconArt)

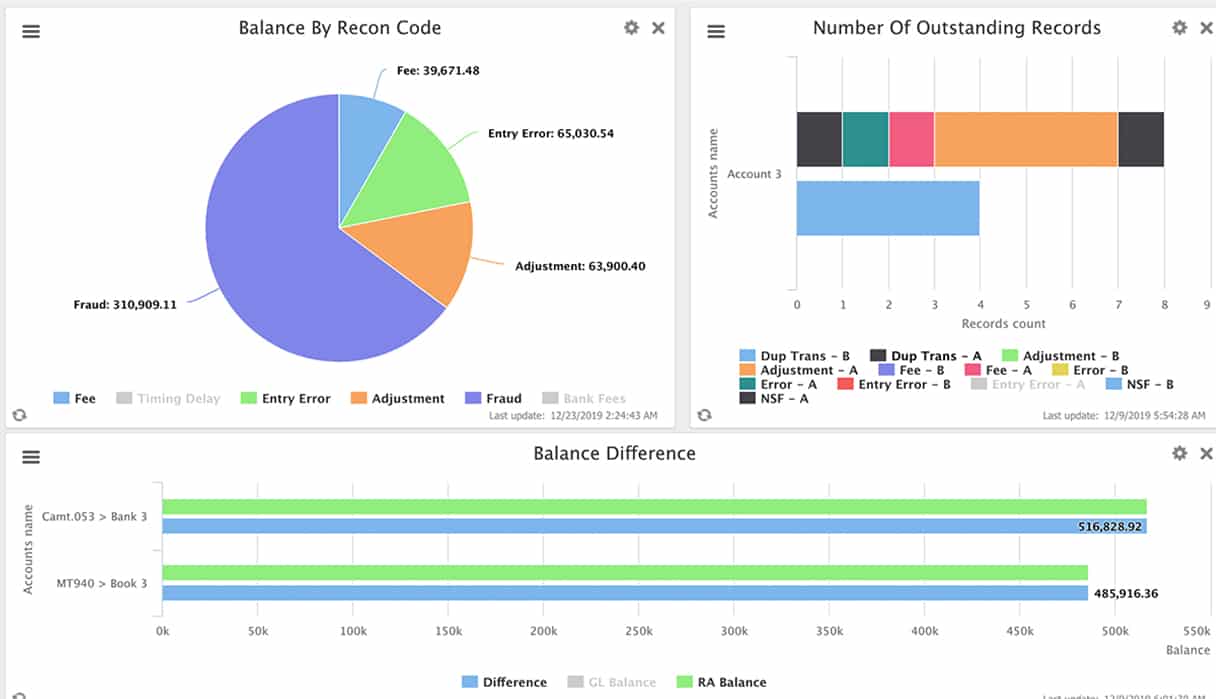

You can reconcile any account type, not only bank accounts. These include credit card, accounts receivable (A/R), accounts payable (A/P), general ledger (GL)/suspense, intercompany, balance sheet, ledger to subledger, and trades and positions. The software is very flexible and lets you reconcile and report nonfinancial data. Because it is edition-based, you can pay for these features based on your needs.

Example of ReconArt bank reconciliation (Source: ReconArt)

ReconArt ensures that all journal entries posting to the GL are accurate and that there is a controlled and audit-proof journal entry posting process. It contains a fully configurable workflow around journal entry postings, allowing you to automatically collect these items, push them through an approval workflow based on their amount threshold, and prepare them for automatic posting to any enterprise resource planning (ERP), GL, or other downstream system.

You can even generate journal entries not just from exception transactions but also from matched items or items that are not part of the reconciliation process itself.

Example of journal entries in ReconArt (Source: ReconArt)

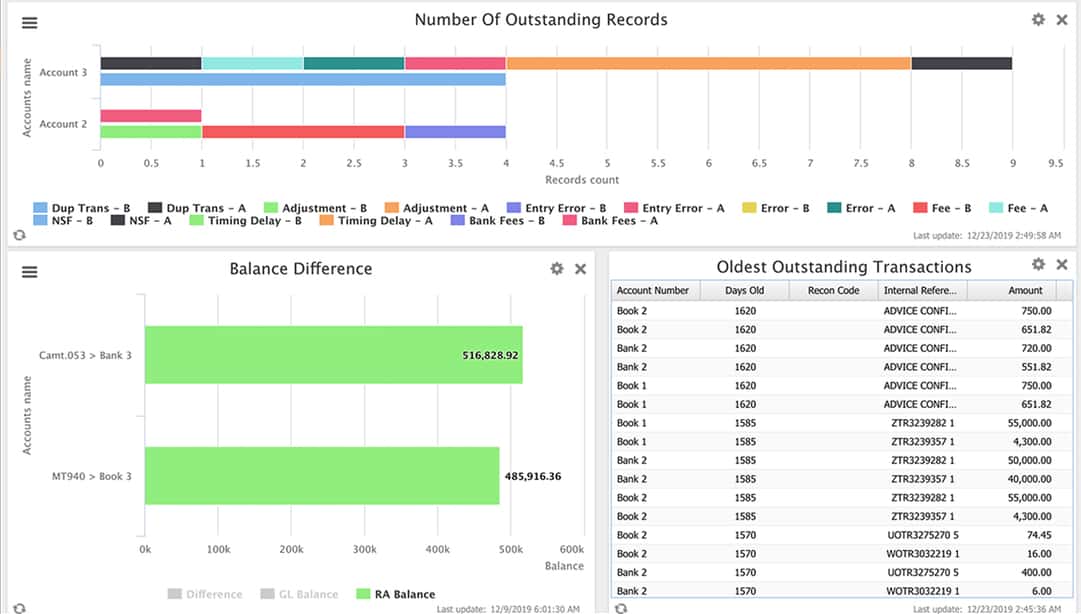

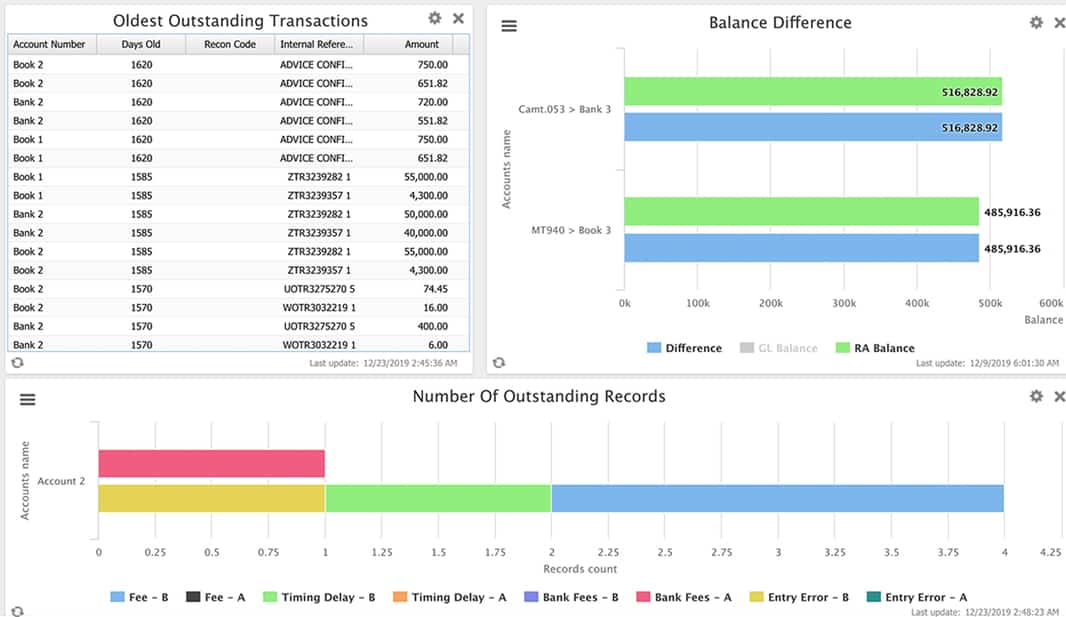

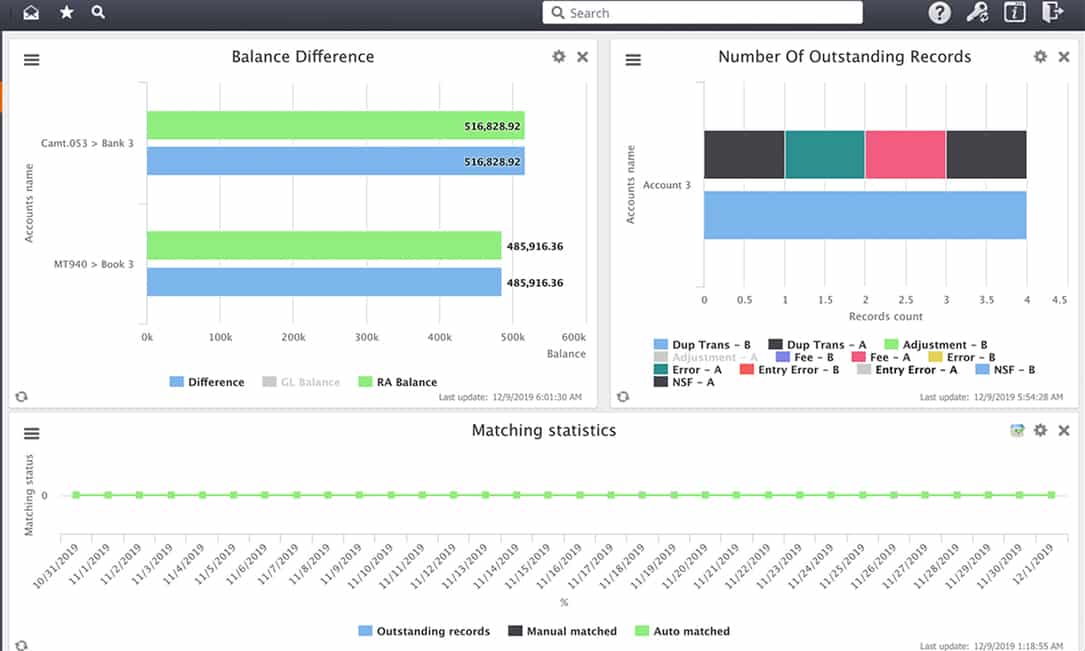

ReconArt is an excellent choice for businesses looking to automate high-volume transaction management and exception management. It allows you to tackle common matching challenges, such as repetitive and time-consuming manual tasks and different or changing data formats.

This allows you to analyze differences in account activities, facilitate performance measurement, uncover the patterns of deviations, and improve control. You can set acceptable threshold amounts or percentages to flag larger variances and also assign analysts or approvers to collaborate on explaining fluctuations. This can become a significant component of continuous accounting methods.

Example of variance analysis in ReconArt (Source: ReconArt)

While ReconArt can integrate with any ERP and accounting system, its team designed and developed a communication bridge that integrates with NetSuite, allowing for a deeper and more seamless experience than with other software. This integration incorporates all stages of the lifecycle into one tool that enhances the reconciliation process.

ReconArt Customer Service & Ease of Use

ReconArt states that its software is ready for deployment out of the box, without a need for custom development or technology-based resources. It provides collaborative implementation sessions remotely with screen sharing technology, and tasks associated with implementation are tracked with project management tools. The software is intuitive and user-friendly, making it easy to navigate once it has been implemented.

Ongoing support is provided for all editions in the form of a 24/7 support portal, and all of your support activity is tracked in its internal ticketing system. The support portal also has product-related announcements and user help guides. You can also receive future upgrades at no additional cost.

Frequently Asked Questions (FAQs)

ReconArt offers ongoing support for all editions in the form of a 24/7 support portal, where you file a trouble ticket that is tracked in the system.

ReconArt offers five different pricing plans, which vary depending on the features and number of users. The prices range from $1,700 to $3,400 per month. Custom pricing is also available.

No, ReconArt doesn’t currently have a mobile app.

Bottom Line

ReconArt is a single-solution technology company that provides a fully web-based reconciliation platform. Its adaptive approach allows it to cater to a global client base of all industries and sizes, and it offers a variety of functions to ensure an optimized experience.

The main features include high-volume transaction matching between any bank statement and GL, out-of-the-box support for typical bank formats, automation of data import, and fully configurable matching rules. It can even integrate with your current ERP and accounting software, with a more comprehensive integration available for NetSuite.