Savvy Nanny Payroll Services offers a full-service solution for paying household employees. It automates your nanny payroll, withholds and deposits payroll taxes, and prepares your year-end tax forms for you. Household workers can receive their salaries via direct deposits or manual checks that you prepare. Its services are available in all 50 states and cost $50 per month (for up to two workers), making it an ideal solution for households that are always on the move and have multiple nannies or caregivers.

While we found Savvy Nanny Payroll Services reasonably priced, it can get expensive given its add-on fees for year-end tax filings and other ad hoc services. It also doesn’t offer new household employer ID setup help, benefits options, new hire reporting, and an employee portal for accessing pay information. These factors prevented Savvy Nanny Payroll from ranking in our list of best nanny payroll services.

Savvy Nanny Payroll Services Overview

Visit Savvy Nanny Payroll Services

Savvy Nanny Payroll Services Is Best For

- Families with multiple household employees: Savvy Nanny Payroll Services charges a flat monthly rate of $50 for two employees (with an add-on fee of $45 plus $5 per employee for year-end tax filings). If you have more than two workers, you only need to pay an additional $6 per employee. Other nanny payroll solutions have either a low base fee but higher per-employee rates or its monthly fee only covers one worker.

- Employers who need a pay-as-you-go payroll solution for a temporary nanny or caregiver: Savvy Nanny Payroll Services doesn’t require you to sign a contract, so you can cancel your account anytime—great when paying temporary household employees. When you cancel, you have two options: pay through the end of the quarter or pay a reduced monthly rate through the end of the year. You just have to choose between the two options and then complete and sign the cancellation form using DocuSign.

- Household employers who prefer a do-it-yourself (DIY) payroll and tax solution: If you are someone who wants to run payroll yourself, Savvy Nanny Payroll Services gives you the option to do it manually. Whether you choose manual or automated pay processing, you’ll receive email reminders from Savvy Nanny about payroll schedules and tax filing deadlines.

Savvy Nanny Payroll Services Is Not Ideal For

- Families with a single household employee: If you only have one household helper, Savvy Nanny will still bill you its flat monthly rate of $50 (which covers two employees). If you don’t plan to hire more household staff and only need to process payments for one employee, consider Paychex. Its payroll services only cost $39 plus $5 per household employee monthly. Check out our Paychex review to see if it fits your pay processing needs.

- Household employers who want to offer benefits plans to their employees: Savvy Nanny Payroll Services doesn’t provide access to benefits plans you can offer to your household staff. If this feature is important to you, we recommend SurePayroll by Paychex, as it has health insurance and retirement plans (via its partner brokers), including a reasonably priced nanny payroll service. Read our SurePayroll by Paychex review to know more about its features.

- Household employers who need to track household employees’ work hours: Savvy Nanny Payroll Services does not have time tracking features to monitor your household employees’ time-in/off. It is also unable to monitor their sick time, vacation leaves, and paid time off (PTO) accruals. If you’re set on using this provider, but still need to track your employee’s time and PTO accruals efficiently, check out our top recommended time clock solutions.

- Families who want to pay employees with paper checks: This provider will only pay household employees via direct deposit. While it has the capability to print paper checks, you’ll have to purchase the materials (check stock, ink, printer) to do it yourself. If you opt to still use Savvy Nanny Payroll Services and need to print paper checks, follow our guide on how to print paychecks for free to help.

Looking for something different? Read our guides to the best payroll services and top payroll software to help you find the payroll service or solution that may work for you.

How Savvy Nanny Payroll Services Compares With Top Alternatives

Best For | Base Fees | Fees for Additional Employees | Our Reviews | |

|---|---|---|---|---|

| Household employers with multiple nannies | $50 monthly for up to two employees | $6 for each additional worker | |

| Employers that want full-service nanny payroll and benefits | $49.99 monthly for one employee | $10 for each additional worker | |

Employers looking for reasonably priced nanny payroll and tax filing services | Starts at $39 plus $5 per employee | Included in base fees | ||

| Families that only need assistance with filing nanny payroll taxes | $245 per quarter for one employee (weekly payroll) | $65 per quarter for each additional worker | |

Want to look at other nanny pay processing options? Our guide to the best nanny payroll services contains our top recommendations.

Savvy Nanny Payroll Services Pricing

The Savvy Nanny Payroll Services pricing plan covers two employees and is priced at $50 per month. It comes with full-service payroll and tax filing services, including year-end tax reporting. While it doesn’t charge setup fees, you have to pay $45 plus $5 per employee, per year for annual tax filings. Also, adding another nanny or household employee to your plan costs $6 monthly per employee for payroll.

Payroll Add-Ons

Apart from the monthly plan and annual tax filing fees, the provider charges extra for direct deposits returned from financial institutions, instances of non-sufficient funds (NSF) to pay employees, tax form corrections, and account or payroll-related errors. Here are its add-on fees.

Add-ons | Pricing |

|---|---|

Missing EIN/State Tax ID Account Number | $50 |

Entity Change | $150 |

Setup Adjustments After First Pay Run | $100 |

Re-run Payroll | $35 |

Phone-in or Fax Payroll | $100 |

Direct Deposit Returns (deposits returned from financial institutions) | $50 |

Direct Deposit Reversals | $50 |

Trace Deposits | $50 |

Non-sufficient Funds | $150 (1st NSF) $250 (2nd NSF) $400 (3 and more NSFs) |

Correct W-2s | $35 |

Amend Quarterly Returns | $150 |

Replace Quarterly/Annual Reports | $35 |

Filing Fees for Reports After Termination | $50 |

Retrieve Data Older Than Two Years | $150 |

Base Fee for Year-end Corrections to State/Federal Forms | $200 (before Feb 28) $300 (after Feb 28) |

Per-hour Fee for Year-end Corrections to State/Federal Forms | $75 |

Per-hour Fee for Government Audit Support | $75 |

Other Adhoc Requests | $75 |

Plan Cancellation

Savvy Nanny Payroll offers a pay-as-you-go solution; you are not bound by a contract and can cancel at any time. However, there are two options to think about before canceling. You can pay through the end of the quarter to complete quarterly tax payments and filings. You can also opt to pay a reduced monthly rate through the end of the year if you want quarterly tax payments/filings, year-end W-2s, and Schedule H reports.

After selecting the cancellation option and informing Savvy Nanny Payroll Services of your choice, the provider will prepare the required forms for you. You simply have to complete the form, electronically sign it (via DocuSign), and send it to Savvy Nanny Payroll.

Savvy Nanny Payroll Services Features

Savvy Nanny Payroll Services doesn’t have built-in payroll software. It partners with a premier payroll solution provider, allowing it to offer comprehensive pay processing and payroll tax filing services for both first-time and experienced household employers. It also provides customer support six days a week for any payroll issues at no extra cost. Here are some of its essential features:

The provider processes payroll for any pay schedule and for both hourly and salaried employees. It supports two hourly rates for the same employee, but it doesn’t track staff attendance and PTO accrual balances. However, you can input the applicable sick and vacation pay, including an employee’s actual hours worked, overtime, allowances, and bonus payments, directly into its system for pay processing.

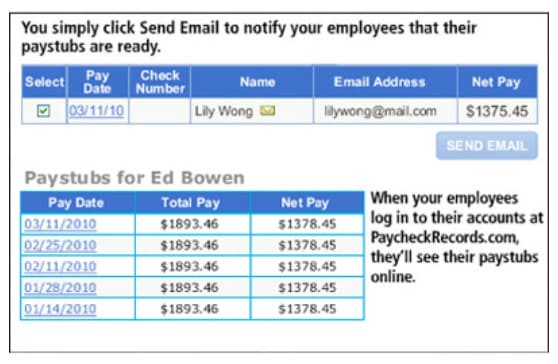

While you can use its system to calculate nanny tax and process payroll yourself, you can also set it to run automatically. Savvy Nanny even sends payroll reminders and employee payslips via email.

Savvy Nanny Payroll’s partnership with PaycheckRecords.com allows it to send online payslips to your household employees via email. (Source: Savvy Nanny Payroll Services)

With Savvy Nanny Payroll Services, you can pay employees via direct deposit, handwritten paychecks from your checkbook, and computer-printed checks you print yourself. When printing paychecks using your printer, you need a three-part voucher check stock with a top portion for the check and the bottom two portions for the paystub.

Aside from payroll computations, the provider calculates, withholds, and deposits your local, state, and federal payroll taxes on time. Also, it can generate and file your quarterly and year-end federal and state tax reports, including preparing W-2 and Schedule H forms, on your behalf.

Its penalty-free guarantee helps ensure you aren’t responsible for payroll tax mistakes its representatives may make—Savvy Nanny Payroll will pay all tax filing penalties. However, when you are responsible for the tax errors, the provider will charge you for it.

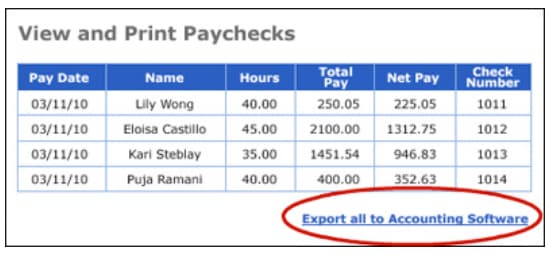

While it has efficient nanny payroll services, Savvy Nanny Payroll doesn’t connect with a wide range of third-party software. As of this writing, it only integrates with QuickBooks. This means you don’t have to input payroll and tax payment details into QuickBooks, eliminating errors from manual data entries.

Savvy Nanny Payroll has an “export” button that lets you send all payroll and tax information to QuickBooks. (Source: Savvy Nanny Payroll Services)

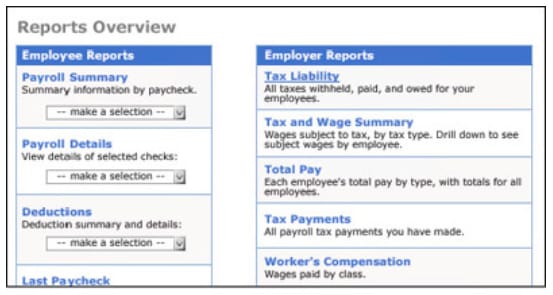

The system has real-time reports that are easy to read and can be exported to Microsoft Excel. While you can’t create a new report directly from the system, it lets you choose any date range when running employee- and employer-related payroll reports.

A screenshot of the reports you can run with Savvy Nanny Payroll. (Source: Savvy Nanny Payroll Services)

Its team of reliable customer support representatives is available six days a week—Mondays to Fridays from 9 a.m. to 7 p.m. Central time and Saturdays from 9 a.m. to 1 p.m. CT. They will assist you in running payroll and anything involving your payroll taxes and filings. You can contact its payroll support team by phone and via email and chat directly from your online Savvy Nanny account.

Savvy Nanny Payroll also has a support team that handles new client enrollments and plan cancellations. Phone support is available from 9 a.m. to 5 p.m. Pacific time, although you can send your enrollment/cancellation queries via email.

Savvy Nanny Payroll Services Ease of Use

- Generally easy to use

- Guided setup for new users

- Intuitive interface

- Email reminders for payroll and tax deadlines

- Support team for account enrollments and cancellations

- Customer support via phone, email, and chat

For new clients, Savvy Nanny Payroll Services has an enrollment support team that can help you with the documents you need to set up your account. However, it won’t assist you in getting your EIN and state account number in case you’re a new household employer. What it provides is an online guide on how to secure these numbers. If you have questions, you can contact its enrollment support team via phone and email—although email has a quicker response turnaround time compared to phone as it may take time to get in touch with a rep.

It is also relatively easy to set up—Savvy Nanny will guide you through all the steps to set up your account and pay your household staff. Plus, it has an intuitive interface that you can get accustomed to easily while it takes care of your payroll and tax filings. It even sends payroll and tax reminders to ensure you don’t miss important deadlines.

Apart from its enrollment support team, it has a payroll services team that offers on-demand support via phone, chat, and email. While you have access to specialists who can answer your payroll and tax questions, it lacks a robust library of how-to guides that most payroll service providers have. And although it has an online FAQ page, the information is limited and only covers general nanny payroll information—none about its services.

What Users Think About Savvy Nanny Payroll Services

There are very few reviews about this service provider online, and the ones we found are a mix of positive and negative comments. Most of the feedback posted on its website are positive, in which reviewers said that its efficient nanny payroll and tax filing services are its best features.

Meanwhile, a Savvy Nanny Payroll Services review on BBB highlighted the provider’s non-remittance of state payroll taxes. It’s about a complaint that Savvy Nanny Payroll refuted, explaining that the client did not provide the required state account number despite the constant system reminders that appeared during pay runs. Other unfavorable Savvy Nanny Payroll reviews are about its website glitches, unclear plan cancellation process, and the support team’s slow or delayed responses.

How We Evaluated Savvy Nanny Payroll Services

For this Savvy Nanny Payroll Services review, we looked at pricing, features, and ease of use. We also checked the customer support options offered and whether it can handle nanny payroll tax filings for you. We even considered the feedback that actual users left on popular user review sites.

Bottom Line

Savvy Nanny Payroll Services is an affordable payroll service for families needing to pay their nannies and household workers. It offers an online tool that helps file and pay all state and federal taxes, process salary payments via direct deposit, and create pay stubs. Taxes are automatically remitted to the appropriate tax agencies after each payroll run instead of on a quarterly schedule, and you even get email reminders when it’s time to pay. Overall, it is a good option for employers who want help managing their household payroll.

Sign up for an account today and streamline the way you pay nannies.