The Real Estate Settlement Procedures Act (RESPA) was established in 1974 by the U.S. Congress as a protection against unfair business practices and unnecessarily high costs associated with homeownership. RESPA strives to eliminate unethical practices like kickbacks, fees, and errors and ensures disclosures are provided to buyers and sellers while obtaining a mortgage. By knowing RESPA offenses, laws, and regulations, all parties involved can avoid penalties and unethical business practices.

Let us dive into what is RESPA in real estate, common RESPA violation examples, penalties for violating RESPA, and how real estate professionals can avoid them.

What Is RESPA in Real Estate: History & Coverage

History of RESPA

- 1974: The Real Estate Settlement Procedures Act (RESPA) was passed into law

- 1983: RESPA amended to extend coverage to controlled business arrangements

- 1990: Section 6 mortgage servicing requirements were added

- 1992: RESPA extended to all residential mortgage loans with a lien, disclosures in writing for an agent to mortgage referrals, and computer loan originations

- 1996: HUD removed compensation for referrals to affiliate companies and stricter payment rules

- 2002: Revised RESPA has greater disclosure, more consumer choices, and limited fees

- 2008: Implemented a standardized GFE (good faith estimate) for consumer costs

- 2010: Dodd-Frank Act mandated RESPA to shorten time limits, increase penalties, and provide amendments

- 2011: The Consumer Financial Protection Bureau (CFPB) took over RESPA regulatory duties

- 2012: New mortgage disclosure forms implemented

- 2020: Updated frequently asked questions addressing gifts and promotional activities

Why RESPA Started

RESPA violation penalties were implemented because individuals and companies associated with real estate transactions, like lenders, agents, and construction and insurance companies, were receiving undisclosed kickbacks and referral fees for recommending a settlement service provider.

Kickbacks and increased fees resulted in ultimately higher costs paid by the homebuyer. RESPA seeks to ensure homebuyers have all the information about their transactions to make an educated decision on the vendors they choose to work with.

Who RESPA Involves

Unlike the rules listed in the Fair Housing Act, which seeks to prevent discrimination against those buying, renting, or selling homes, RESPA applies to all real estate settlement services. Real estate settlement services can be defined as agent services, services rendered by an attorney, origination of a mortgage loan, and settlement or closing process.

The act oversees all activities of a person or entity involved in the home purchasing, improvement, and closing process when a federally related mortgage loan is involved for one to four residential units. Although RESPA primarily seeks to protect consumers seeking to become eligible to obtain a federally insured mortgage loan, it benefits other parties involved. The required disclosures and honesty about upfront costs and fees provide benefits for the following parties:

- Sellers: They don’t have to decide which title insurance agency should be used.

- Real estate agents: Clients are treated fairly for smoother and faster transactions.

- Buyers: They understand all reasonable upfront costs involved in the buying process.

- Loan servicers: RESPA eliminates some competition, and clients can choose who they want to work with based on their personal evaluations.

What RESPA Does Not Cover

Real estate statistics indicate a seller’s market, where homes are selling quickly. Before rushing to close deals, knowing which real estate purchasing scenarios should or should not fall under RESPA violations is essential. Transactions involving all-cash sales, rental transactions, and loans obtained by real estate for business purposes aren’t covered. Additionally, loans obtained to purchase vacant land are not covered as long as no proceeds from the loan are used to build any residential property.

6 Most Common RESPA Violations

The Consumer Financial Protection Bureau enforces RESPA violations. It ensures all federally regulated mortgage loans, including purchase loans, refinances, home improvement loans, land contracts, and home equity lines of credit, are administered following RESPA guidelines.

To avoid most violations, the general rule of thumb is to make sure all payments and fees are charged for services performed. The RESPA violation statute of limitations is one year from the date of the violation. If a consumer believes you have violated their rights under RESPA, they have one year to file a claim.

To help you avoid penalties, we’ve listed six common RESPA violations:

1. Kickbacks & Referral Fees

Section 8a of RESPA prohibits giving or receiving any referral fees, kickbacks, or anything of value being exchanged for referral of business involving a federally related mortgage loan. The violation applies to verbal, written, or established conduct of such referral agreements. The items considered of value in exchange for business can be discounts, increased equity, trips, and even stock options.

Section 8b of RESPA prohibits giving or receiving any portion or percentage of a fee received for real estate settlement services unless it’s for services actually performed. These fees must be split between two or more persons for it to be a direct violation of the law.

Example

John, the mortgage broker, has developed an extensive network of real estate agents who have referred business to him throughout the years. John begins a competition with his network and gives out nice prizes for the agent who referred the most buyers to him. This is a direct violation of RESPA, as no party should receive anything of value for referring a business for a residential mortgage loan.

Penalty

The penalty for violating section 8 of RESPA is a fine of up to $10,000 and possibly one year of jail time. In some cases, the RESPA violator may also be charged in a private lawsuit to pay the borrower up to three times the charge for settlement services.

How to Avoid

Clients may ask you for your opinion on settlement service providers, and you can provide them with recommendations as long as it’s not under the condition that you receive anything in return from the vendor you recommend. A couple of tips include:

- Sharing a list of several trustworthy vendors, but allowing the client to make their own decision about who to work with.

- Include a written disclaimer in the vendor document that it’s the borrower’s responsibility to review vendors and select the best one that fits their needs.

- Suggest to clients that they interview each vendor before deciding who they work with.

- Be honest with clients and provide them with an Affiliated Business Arrangement Disclosure disclosing that you receive a promotional fee in return for referring the business.

2. Requiring Excessively Large Escrow Accounts Balances

Section 10 of RESPA provides rules and regulations to protect borrowers with escrow accounts. This section limits the amount of money a borrower may be required to keep in the escrow account to cover payments for things like taxes, flood insurance, private mortgage insurance, and other costs related to the property. While not every borrower will be required to have an escrow account, if they do, it is limited to approximately two months of escrow payments.

Example

Jamie is a lender involved in a federally related mortgage loan for a young couple. Jamie establishes an escrow account to pay the couple’s taxes and insurance. The escrow account is funded through a portion of the couple’s mortgage payment. Jamie determines their escrow amount by taking a monthly average of their anticipated insurance and taxes for the year.

After one year, their insurance premiums were reduced, but Jamie kept withdrawing the same amount without analyzing the account. By the end of the second year, the couple’s escrow account has an excess of four months of escrow payments. Jamie needs to perform an annual analysis of the escrow account and return any amount exceeding two months of escrow payments to the couple, or he will be in violation.

Penalty

For loan servicers who violated section 10 of RESPA, penalties are up to $110 for each violation. The law does impose a maximum amount of $130,000 for violations within 12 months.

How to Avoid

Lenders should understand the nuances associated with escrow accounts. A cushion within an escrow account may not exceed one-sixth of the amount that needs to be disbursed for the year. A lender must also analyze the escrow account once a year and notify borrowers if any shortages are present. If there are excess funds in the account of more than $50, then that must be returned to the borrower.

3. Responding to Loan Servicing Complaints

Section 6 of the RESPA protects borrowers with consumer protection rights concerning their mortgage loans. If a borrower has an issue with their servicer, they can contact their servicer in writing. The servicer must acknowledge the complaint within 20 days of receipt, and within 60 days, they must resolve the complaint. To resolve the complaint, they must do so with either a correction or a statement providing reasons for its defense.

Example

Jenny had an escrow account with a mortgage lender and noticed that she was charged a late fee for a payment that she believed was not sent in late. Jenny sends a written notice to her lender that includes her name, loan account information, and a written explanation of the error she believes was incorrect.

The mortgage lender receives her notice and responds to her within 20 days of receiving notice of the possible error. The mortgage lender noticed it was an accounting error and removed the late fee from her account. This is a violation of RESPA because the mortgage lender must reply to Jenny within five days of the correction in writing to let her know it has been fixed.

Penalty

Borrowers can file a private lawsuit for violating this section of RESPA within three years and may be awarded damages in court.

How to Avoid

Loan servicers should have strong processes to ensure all written requests are opened and addressed within the required time. Here are a few tips to ensure responses are made promptly:

- All incoming letters and packages should be time-stamped with the date of receipt and scanned into internal customer relationship management (CRM) software.

- When logging paperwork into the CRM, each staff member should be assigned a task requiring them to complete an acknowledgment receipt along with a final date for responding to the error.

- Once response letters are mailed, the lender should mark the tasks as complete to add additional electronic time stamps if the dates are disputed in the future.

It’s also important to note that within the 60 days provided to resolve the claim, the loan servicer cannot provide information to a credit reporting agency with any overdue payments if they exist during the period of a written request.

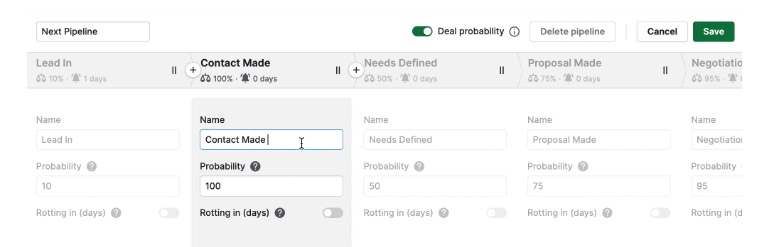

Pipedrive customizing pipeline (Source: Pipedrive)

A CRM that can assist professionals with this time-sensitive process is Pipedrive. Pipedrive allows you to create tasks, send automatic reminders and emails, and has built-in digital signature and document tracking features. These features will ensure you prioritize everyone in your pipeline and remain compliant with RESPA laws.

4. Inflating Costs

In section 4 of RESPA, mortgage lenders and brokers are unable to charge clients an inflated cost of third-party services beyond the original cost of service. This violation is specific to settlement costs itemized in HUD-1 and HUD-1A settlement statements, where costs cannot exceed the amount received by the settlement service.

Example

A mortgage broker told Jo, the buyer, that pulling their credit would cost $30. When Jo received the settlement statement, they noticed that there was an additional charge of $20 for the credit report because of third-party administrative services. This is a violation of RESPA because the mortgage broker is unable to charge the client any amount above the stated $30 for the credit report.

Penalty

The United States Department of Housing and Urban Development is the agency that will typically issue the violation when notified. Companies that violate this rule can be fined as much as a few hundred thousand dollars in damages.

How to Avoid

To avoid violations for inflated costs, ensure proper bookkeeping of fees paid for service and bill clients appropriately. If possible, you can develop relationships with your third-party vendor to set a standard amount for specific services based on your volume of clients, so there are no discrepancies in the amount paid and the amount charged. However, be careful not to ask for monetary kickbacks in return from your vendors if you’re getting a bulk discount.

5. Not Disclosing Estimated Settlement Costs

Mortgage lenders and brokers are required to provide an itemized statement of settlement costs to your clients. These costs are presented in a Good Faith Estimate (GFE) form. The form shows the estimated cost the borrower should incur during the mortgage settlement process, like origination fees, estimates for services, title insurance, escrow deposits, and insurance costs.

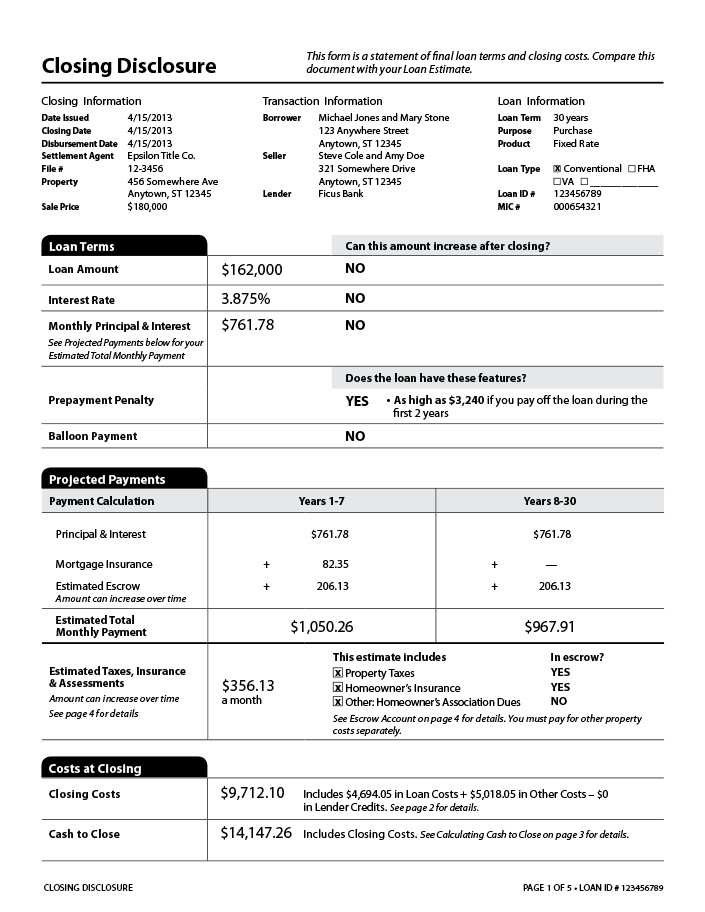

Example Closing Disclosure (Source: Consumer Financial Protection Bureau)

Example

A lender receives an application from John, the potential borrower. The lender must give John a GFE by hand delivery, mail, or electronic form no later than three days after receiving the application. The lender cannot charge John for any fees other than for the cost of a credit report until John accepts the GFE and indicates he wants to proceed with the loan.

Penalty

The fine for violation of this RESPA law is $94 for an accidental violation but can increase to a few hundred thousand for intentional violations.

How to Avoid

Lenders should provide estimated costs to the borrower within three days of their application by hand delivery, mail, fax, or other electronic avenues. If a document is mailed, ensure it has signature tracking and make sure the applicant received the costs within three days after it was mailed to avoid any penalty.

However, lenders do not have to provide the estimation of fees if the lender denies the application or if the borrower withdraws their application. In the GFE, lenders may not charge any additional fees until the borrower has received the estimation and indicates they want to proceed.

6. Demanding Title Insurance

Under RESPA section 9 violations, sellers of a property that is purchased with a federally related mortgage loan cannot require, directly or indirectly, that the buyer purchase title insurance from a particular company. Sellers should not list this as a condition of the sale of a property.

Example of title insurance (Source: Andrew Robb RE/MAX Fine Properties)

Example

Becky is a real estate agent, and her sister just started a job at a title agency. Becky wants to give her sister as much business as possible to get her end-of-year bonus. For all her sellers, Becky decides to include in the condition of the sale that they must get title insurance from Becky’s sister’s title agency for an offer to be accepted. This is a direct violation of RESPA.

Penalty

If this section of RESPA is violated, buyers may bring a lawsuit against the seller for up to three times the charges for the cost of title insurance.

How to Avoid

There are a few scenarios where you can avoid this penalty. Sellers should not list a title company as a property sale condition. If a title company is suggested, ensure you are providing multiple options and fine print for buyers to do their own research. However, sellers can pay for the title insurance at no cost to the buyer if those costs are not added to other fees.

Frequently Asked Questions (FAQ)

All federally regulated mortgage loans are covered by RESPA, including purchase and home improvement loans, land contracts, refinances, and home equity lines of credit (HELOCs).

RESPA Section 8(c) specifies acceptable payments and arrangements, including attorney fees for services rendered, fees paid by a title firm covering services executed, and fees paid by a mortgage lender covering services performed.

Bottom Line

RESPA was created to ensure homebuyers and sellers receive fair and honest treatment during the real estate process. Even the newest real estate agents should understand what is RESPA in real estate and its nuances to avoid accidentally receiving a violation. Although each party involved in settlement services is not responsible for each other’s RESPA violations, by understanding all forms of RESPA violations, you can help protect your client’s interest while also ensuring you’re involved in ethical business practices.