Property managers handle residential and commercial real estate for property owners and investors. Their duties encompass a variety of property management, maintenance, tenant selection, and rent collection tasks. However, the specific responsibilities of a property manager depend on property type, contract terms, and compensation. On average, property managers cost from 8% to 12% of the monthly rent for residential properties and 4% to 12% of the overall rent for commercial properties.

Read on to explore property manager duties, distinctions from property management companies, cost considerations, and expectations.

What Is a Property Manager?

A property manager or management company oversees rental properties, working for landlords and investors to enhance efficiency, save time, and boost returns. Their role involves tenant screening, rent management, maintenance handling, budgeting, and cost-effective rental marketing, benefiting property owners seeking professional management.

Most property managers provide monthly paid services and a la carte options, allowing landlords to choose which landlord duties and responsibilities to outsource and which to do for themselves. A reliable rental property manager demonstrates excellent communication skills when dealing with landlords, tenants, and vendors and has a keen eye for detail to maintain the property and increase its value.

Property Manager vs Property Management Company: Key Differences

Property management companies and property managers generally perform similar tasks unless the manager serves as an on-site employee. Understanding the distinction is crucial for your investment strategy and profitability.

Larger firms handle more extensive property portfolios and employ staff like managers, maintenance workers, administrators, leasing agents, security personnel, advertisers, and accountants. An individual property manager or small company focuses on residential rentals or small office buildings and may have one or two staff, but mostly gives oversight to subcontractors while managing all the duties of your rental property.

Here is a side-by-side comparison of some differences between a property manager and a property management company.

Property Manager | Property Management Company |

|---|---|

An individual who manages rental property for owners. | A team of professionals who collectively manage properties for multiple clients. |

Handles the day-to-day operations of a single property or a small portfolio. Responsibilities include rent collection, background checks, maintenance coordination, tenant communication, and lease enforcement. | Provides a broader range of services in addition to what a property manager does, such as marketing, financial reporting, and legal compliance, and charges higher fees, depending on services. |

Smaller network of contractors, maintenance personnel, and service providers. | Extensive network and access to a broader range of resources. Often has established relationships with contractors, legal experts, and other professionals. |

Suitable for property owners with a single property or a small portfolio. Offers a more personalized, hands-on approach but may need more efficiency of more significant operations. | Handles more extensive portfolios of properties, offering economies of scale and greater efficiency in managing multiple units. |

Typically lower cost than that of hiring a property management company, but it may vary based on the services required and the manager's experience. | May exclusively manage their own portfolio of properties. |

May have limited liability, and the accountability is primarily with the individual property manager. | Typically has greater liability protection and accountability mechanisms in place, providing greater security for property owners. |

Choose a property manager if you own one or just a few properties and want a more personalized relationship. If you want services that will scale with growing your portfolio, or you have multiple investment properties or an apartment complex, a property management company is the better choice.

Property Manager’s Duties & Responsibilities

To answer “what does a property manager do,” you must first determine your needs. Property managers can provide landlords with time-saving services, handling daily tasks and emergencies. Overall, they help save money by reducing tenant turnover, expediting evictions, and optimizing rental income.

The table below demonstrates what property managers do and the potential monthly time savings and associated costs when hiring a property manager. These figures are averages and may vary based on factors like property size and quantity. They serve as a useful initial reference for deciding on property management services.

Property Manager Duty | Time Saved by Landlords (Monthly) | Average Property Manager Fee |

|---|---|---|

Tenant Turnover & Leasing | 4 to 8 hours | $2,038 per unit |

Vendor Management | 4 hours | Included in the monthly fee |

Evictions | 1 to 2 hours | $200 to $500 per eviction |

Repairs & Maintenance | 12 hours | Routine maintenance included; repair reserves of $500 to $1,000 |

Increasing Rental Income | 1 hour | 1% increase in fees |

Tenant Management | 10 to 12 hours | Included in fees |

Financial Management | 6 hours | Included in fees |

The amount of time saved is calculated using the average amount of time landlords spend on various tasks. Consider how much time you spend managing your property to determine your potential time savings. As for the property management fees, they are based on national averages.

Here is a breakdown of typical property management duties:

Property managers rely on market data, property comparisons, location, and amenities to determine appropriate rent prices and increases. Property managers also collect rent from tenants and manage online banking for the property. Maximizing real estate investments also involves strategic rent increases, best when timed during lease renewals or property vacancies.

It’s crucial to provide current tenants advance notice of impending rent hikes, adhering to state-mandated notice periods and landlord-tenant laws, usually 60 to 90 days. This enables tenants to budget and decide whether to stay. Issuing a rent increase letter informs tenants of the change and its effective date, ensuring transparency and compliance with legal requirements.

Property managers increase the rent for the following reasons:

- To keep up with the real estate market

- When the neighborhood transforms into a highly desirable location

- Employment opportunities increase in the area

- When you make improvements to your property

Sending your tenants a rent increase letter will notify them in advance about the rent increase and its date of effectiveness—typically at the end of the lease or in a month-to-month tenancy, with a 30-day notice.

One of the essential duties of a property manager is marketing vacancies in the rental property. Their industry knowledge and experience allow them to know when, how, and where to advertise a vacancy. Managers should also be conscious of when leases expire. If the current tenant is not renewing, they should begin listing the apartment for rent before the end of the current tenant’s lease term. This will minimize vacancies in the building and continue to build profits for the landlord.

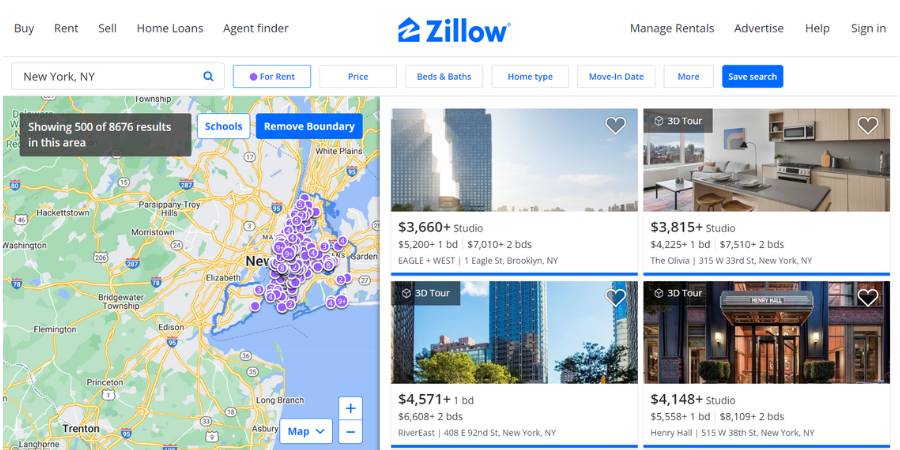

Zillow’s rental listings in New York (Source: Zillow)

To effectively advertise your rental vacancies, follow these marketing strategies:

- Use high-quality professional photos of your property to capture the attention and spark people’s interest.

- Utilize social platforms like Facebook and Instagram to share photos of your property. Post at least twice daily to maximize and maintain an active online presence.

- Order custom signs with essential details, including your contact number, email address, monthly rent, and the number of bathrooms and bedrooms.

- Host an open house to promote your property to a larger audience. Curious passersby can tour the unit and may tell their friends about it, increasing your exposure. An open house is an excellent opportunity to distribute flyers for your other vacancies.

Landlords should use prominent listing platforms like Zillow, Realtor.com, and Apartments.com to maximize property exposure. These platforms can efficiently draw in a high-quality pool of tenants, expediting filling vacancies with ideal renters.

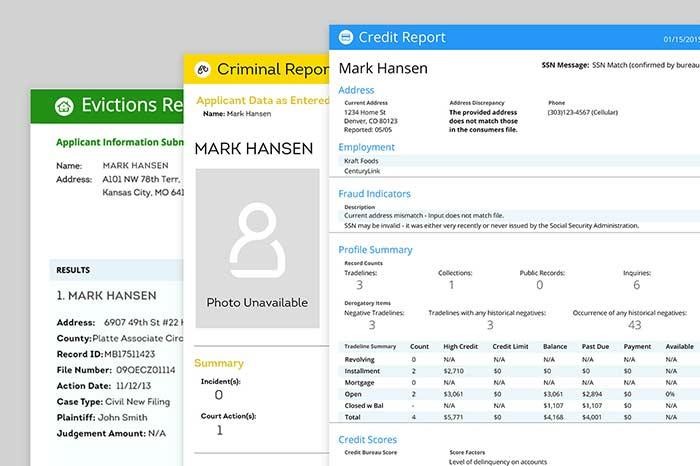

Tenant screening is the process landlords and property managers use to evaluate prospective tenants for rental properties. It involves assessing applicants’ information to determine their suitability and potential risks as tenants. Property managers do a comprehensive review of applicants, including the background check, to make an informed decision over who to rent to, opting for the ideal tenant with a stellar rental history and ample income.

Examples of TransUnion SmartMove tenant screening reports on Baselane (Source: TransUnion)

Before approving a rental application form, a property manager should review and inspect the following:

- Credit score and history

- Proof of income and employment

- Previous addresses, landlords, and eviction history

- Background checks

Check out our list of the top screening software for landlords in our article, 6 Best Tenant Screening Services for Landlords.

Property managers are pivotal in crafting lease terms that protect both the property and owner’s interests, encompassing late rent charges, security deposits, and consequences for violations. The property owner or manager determines lease duration, whether short-term (under a year) or long-term (12 or more months). It’s their responsibility to ensure the lease incorporates crucial information like rent, address, duties, security deposits, and late fees.

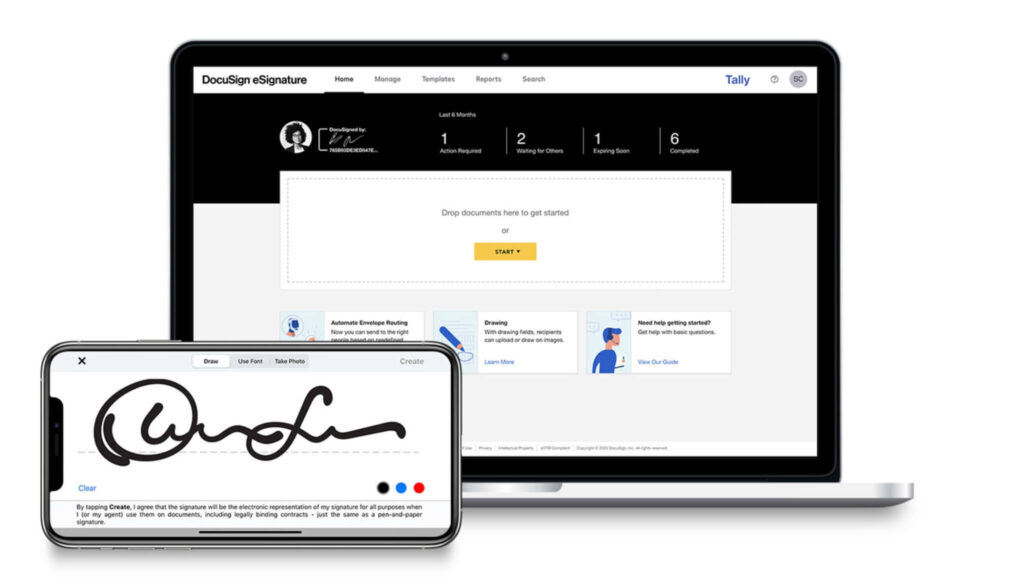

Electronic signatures through DocuSign (Source: DocuSign)

A comprehensive lease must cover amenities, insurance requirements, pet and house regulations, and consequences for violations. The property manager should review the lease with tenants, who sign it first, pay fees, and access the property. Then, the landlord signs to finalize it. Both parties retain original copies for clarity and compliance.

For detailed information on getting signatures on a rental agreement or lease, check out our 6 Best Electronic Signature Software for Real Estate 2023 article.

A proficient property manager handles all property maintenance, including regular upkeep and urgent repairs. They oversee the timely servicing and maintenance of appliances and fixtures. Collaborating with trusted vendors, like handypersons, painters, and plumbers, they ensure swift and professional responses to emergency maintenance needs like leaky faucets or malfunctioning appliances.

Additionally, tenants and capable property managers can suggest and initiate property enhancements, such as repainting or flooring upgrades, to enhance the property’s value.

Read our Rental Property Maintenance Checklist to understand better what is involved in routine, seasonal, and preventative maintenance.

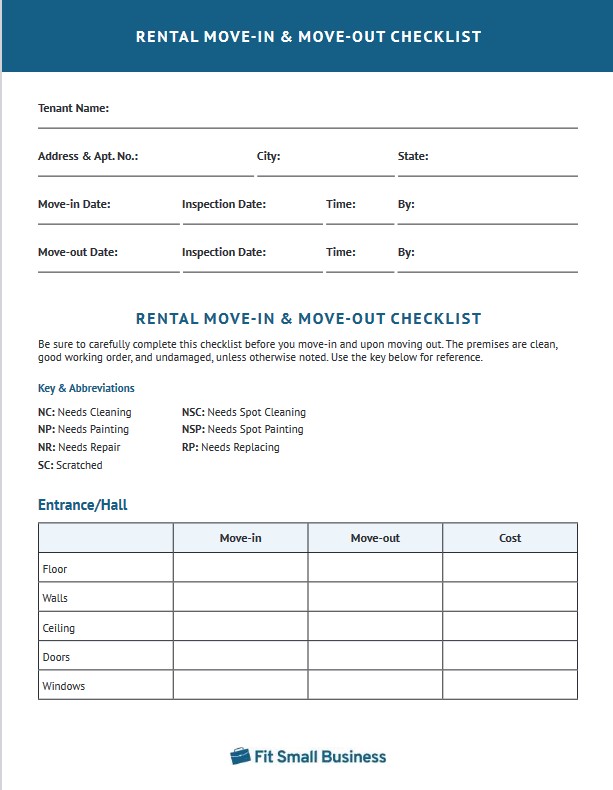

A move-in and move-out inspection entails a landlord walking through a rental property to evaluate its condition. This process serves multiple purposes, including tracking maintenance needs, ensuring proper refunding of security deposits, and documenting any property damage, necessary repairs, and associated costs. Such inspections also help prevent disputes between landlords and tenants regarding security deposit refunds.

Use a checklist to keep track of the unit’s condition.

Landlords must inspect their rental units at the beginning and end of the lease.

- Move-in inspection: Landlords should thoroughly inspect the property before tenant occupancy. This can be done before or in the presence of tenants. Documentation, including photographs and a checklist, should record the property’s condition before the tenant arrives.

- Move-out inspection: Upon a tenant’s departure, landlords should conduct a room-by-room inspection for damage exceeding normal wear and tear. This allows them to compare findings with the move-in inspection records, identifying new damage. Subsequently, landlords can compute repair costs, deducting them from the security deposit or addressing them through financial arrangements with the tenant.

Property managers are experts in legally evicting problematic tenants. They must notify property owners with valid reasons for eviction, like unpaid rent, lease expiration, property damage, or illegal activities. Documenting violations with evidence such as photos, emails, texts, bank statements, or returned checks for potential court use is essential.

In cases where swift eviction is desired without formal proceedings, landlords can offer a “cash for keys” agreement. This voluntary arrangement involves compensating tenants in exchange for vacating the property. To implement it, create a lease termination agreement, ensure tenants sign and fulfill their commitments, and inspect the unit before payment.

Property managers maintain precise and current investment records. These reports encompass property expenses, gross income, maintenance invoices, and receipts. Such records provide valuable insights for landlords and property managers to clarify objectives and monitor property growth and financial health.

These reports provide essential financial insights, including rent collection data, maintenance expenses, and occupancy rates. They help property managers and owners make informed decisions, track performance, and ensure that properties are operating profitably while also identifying areas for improvement and optimizing overall property management strategies.

Analytics in the Baselane dashboard (Source: Baselane)

Property managers and landlords can pay bills with ACH payments and put rent collection on autopilot with Baselane. In addition to its high yield of 4.25% APY on all deposits, Baselane also offers various rent collection features like automated payments, fees, and reminders. Getting started takes less than five minutes for you, your clients, and their tenants, so visit Baselane to sign up today.

How Much Does a Property Manager Cost?

Property manager costs vary but typically range from 8% to 12% of the monthly rent for residential properties. Commercial properties may have different fee structures and could be lower, but generally range from 4% to 12%. Some property managers also charge flat or per-project fees for specific services. The exact cost can depend on the property’s location, the services provided, and the property manager’s experience and reputation.

Here’s an example of how much property management fees can cost (estimated):

Monthly rent for one unit: $1,200

Property management fees: 8% (0.08 as a decimal) for a residential property

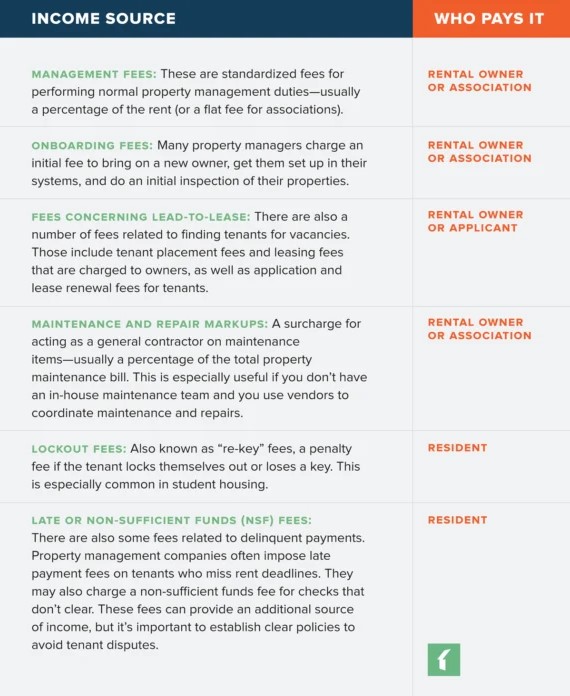

This fee could potentially cover just the base services to hire the property manager or firm. Each unit would be charged the same percentage, but the total cost per unit would differ, unless all units had the same rent. The image below shows additional fees charged by some property managers, such as maintenance and repairs, tenant lock-out fees, and onboarding landlords. These can vary widely.

A breakdown answering “How much does a property manager cost?” (Source: Buildium)

Regarding costs, it’s essential to evaluate your budget and be aware of fees and potential additional expenses associated with hiring a property manager to make an informed decision that aligns with your property management needs and financial constraints.

How Much Do Property Managers Make?

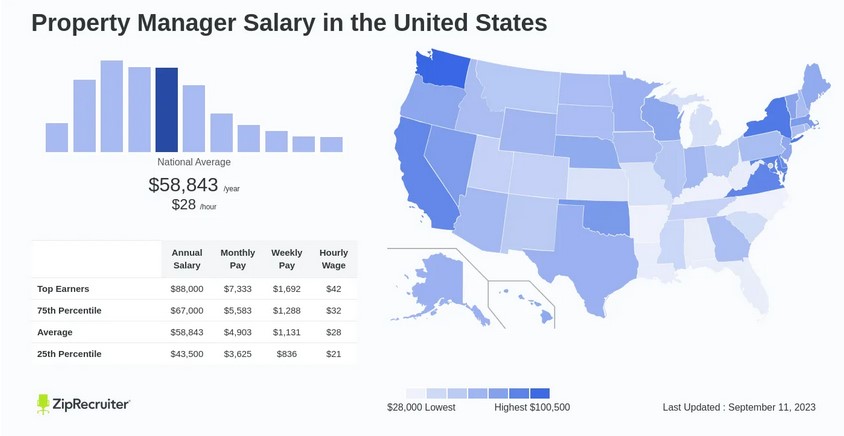

The average property manager’s salary is determined by the type of properties they manage, like residential, commercial, or industrial, the location, and the manager’s years of experience. Residential property managers make an average of $58,843 annually, with salaries ranging from $28,000 to $100,500 (based on the mentioned factors).

Average property manager salary (Source: ZipRecruiter)

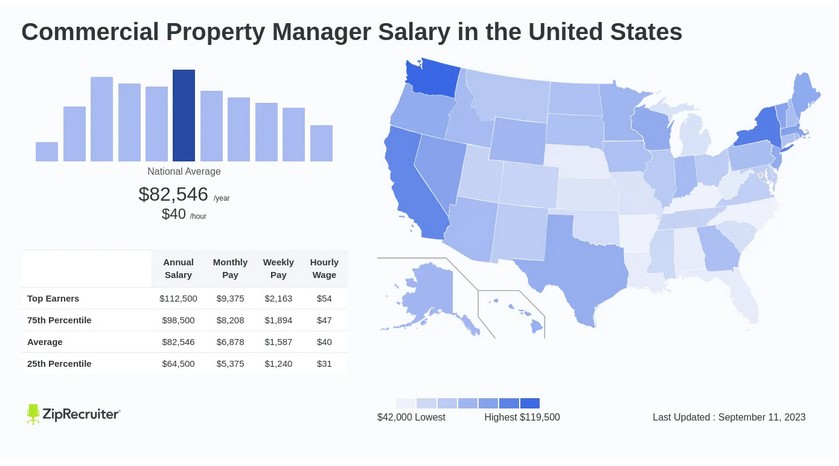

Commercial property managers earn an average yearly salary of $82,546. Most commercial property managers make between $42,000 and $119,500. However, a property manager’s salary can vary widely depending on many important factors, including education, certifications, additional skills, and years in the profession.

Average U.S. commercial property manager salary (Source: ZipRecruiter)

When to Hire a Property Manager

When you have an understanding of the two essential questions, “what does a property manager do?” and “how much does a property manager cost?” it’s time to consider whether you’re ready to hire a property manager for your properties. You want to hire a property manager when you have multiple rental properties or lack the time and expertise to manage them effectively.

A property manager can also be valuable if you live far away from your rental properties or want to avoid the day-to-day responsibilities of handling tenant issues, maintenance, and rent collection. Hiring a property manager should align with your investment goals and personal capacity to manage your real estate portfolio.

Frequently Asked Questions (FAQs)

Hiring a property manager offers benefits such as time savings, reduced tenant turnover, and expertise in managing rental properties. However, it comes with downsides like management fees, which can impact profits, and the potential for conflicts if the manager’s priorities don’t align with the owner’s. Landlords also may not have control over tenant selection or which maintenance providers to use.

The ideal degree for a property manager varies, but typically includes a bachelor’s degree in fields like Business Administration, Real Estate, or Property Management. These programs provide knowledge in finance, property law, marketing, and operations management, which are valuable for the role. However, experience, certifications, and specialized training can also significantly influence a property manager’s qualifications and success. Many states require a property manager to carry a real estate broker’s or property manager’s license.

The most critical job of a property manager is ensuring the efficient and profitable operation of rental properties. This involves various responsibilities, but perhaps the key task is tenant management. Property managers are responsible for finding and screening tenants, setting appropriate rental rates, collecting rent, and promptly addressing tenant concerns or issues. By maintaining high tenant satisfaction, property managers help reduce turnover and vacancy rates, ultimately ensuring consistent rental income for property owners.

Property manager salaries vary widely depending on location, property type, and experience. In the United States, property managers tend to earn higher salaries in metropolitan areas with high real estate values and demand for property management services. Cities like New York, San Francisco, Los Angeles, and Washington, D.C., typically offer some of the highest property manager salaries due to their robust real estate markets and cost of living.

Bottom Line

Hiring a competent property manager can help landlords conserve time and money. Still, before answering “What does a property manager do,” you must consider your needs and budget. Property managers overseeing rental properties handle essential responsibilities, including tenant screening, addressing maintenance concerns, and rent collection, relieving landlords who opt for outsourced property management. Nonetheless, securing a property manager can entail significant costs. It’s advisable to assess your financial situation and investment portfolio to determine if hiring one aligns with your needs and budget.