ChexSystems is a reporting agency that monitors business and consumer deposit account activity. It operates similarly to credit reporting agencies when producing a credit score. If you have negative bank activity—such as bounced checks, overdrawn balances, and fraudulent or suspicious activities—these will appear on a ChexSystems report.

Negative items on a report can keep you from opening a new business bank account. You will have to either clear the items on the report or choose a financial provider that doesn’t use ChexSystems to open an account.

Novo is an excellent online-only bank that doesn’t use ChexSystems. It provides fee-free business banking and refunds all ATM fees at the end of each month. Visit its website for more information or to apply.

How ChexSystems Works

ChexSystems operates under the Fair Credit Reporting Act (FCRA) to provide a report of all negative banking activity associated with a social security number or an employer tax identification number (EIN). It pulls information from banks, credit unions, and retail stores to compile a report that those entities can check.

The following sections explain the information on a ChexSystems Report, what a ChexSystems Consumer Score is, and how to request your score.

Information on a ChexSystems Report

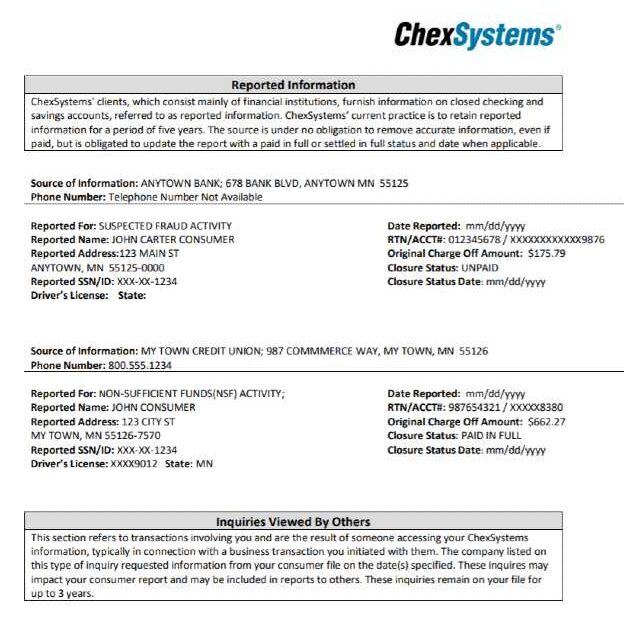

In addition to a ChexSystems Consumer Score, a typical ChexSystems report contains the following information:

- Standard information like name, address, phone number, and email address

- Year and state where Social Security number was issued

- Bounced and returned checks

- Bank accounts closed involuntarily

- Unpaid bank account overdrafts

- Account abuse like too many accounts

- Fraudulent account activity

- Check order abuse

- Identity fraud

While negative items fall off of the report after five years, paying any outstanding debts is the fastest way to clear your report. Inquiries from banks and retailers remain on your report for three years.

ChexSystems Consumer Score

Like a credit score, the ChexSystems Consumer Score assigns a level of risk based on the negative items in the report. The score ranges from 100 to 899, with a higher score indicating a lower risk.

There is no set score that a bank has to use to determine whether to allow a customer to open an account. It depends on the level of risk the bank wants to take and other factors it considers in addition to the score. To be safe, you generally need a score of 581 or higher to be considered low-risk by a financial institution.

However, banks can often ignore the numerical score and instead focus on the items on the report. If a bank can see a justifiable reason for the items on the report, it may approve a business account for an owner with a lower ChexSystems score.

How To Request ChexSystems Consumer Score

You can request your ChexSystems Consumer Score online or via mail once a year. You can fill out the online request on the ChexSystems website or request it by mail by completing and printing the score order form and mailing it to:

Chex Systems, Inc.

Attn: Consumer Relations

PO Box 583399

Minneapolis, MN 55458

There are five instructions ChexSystems requires you to follow to request a score:

- You must be 18 years of age or older to communicate with ChexSystems.

- Correspondence must include the consumer’s full name, current address, date of birth, and Social Security number.

- Once your request has been received, ChexSystems will mail a response to you.

- You agree to provide accurate identifying information.

- ChexSystems may access, store, and use your identifying information to the extent permitted by law.

What To Do If You’re Denied a Business Bank Account

If you are denied a business bank account because of a poor ChexSystems score, you can choose banks that don’t use ChexSystems. Some providers will instead perform a soft pull of your credit to ensure there isn’t a risk in opening an account. However, you should attempt to resolve any items on your report so that it doesn’t become an issue for your business or you personally later.

The following section will show you how to read your report and the steps to take to clear any negative items off your report, limiting your business ChexSystems impacts.

How To Read Your ChexSystems Report & Resolve Issues

1. Request a copy of your report.

As mentioned above, you can request a copy of your report once a year through the ChexSystems website. The report’s first page will show your information and any negative items filed against you or your business.

The beginning of your report will show reported information and any inquiries.

2. Dispute any errors.

You can file disputes on the ChexSystems website regarding any incorrect items on your report. Once submitted, it has 30 days to research and correct any errors.

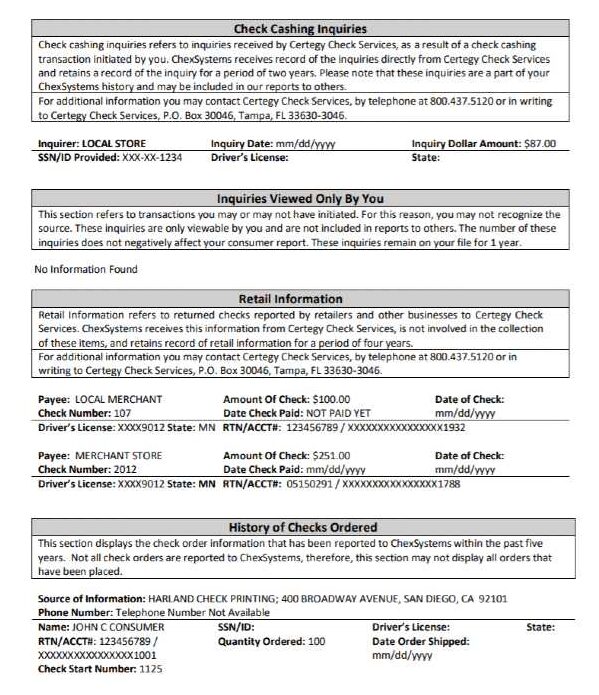

The report will show check cashing inquiries, your inquiries, retail information, and the history of checks ordered.

Further down on your report, you’ll find information regarding your checks.

3. Pay off any remaining debts.

If there are debts on the report from nonsufficient funds left over at other banks, pay those off before they go to collections. You can also negotiate a payment plan with any creditors on the report. Request those creditors to update your report as you get those debts paid off.

4. Check your report annually to verify progress.

Once ChexSystems has corrected errors and you have paid debts, check your report each year to make sure they drop off the report. Some may drop off right away, while others may take years. Items drop off on their own after five years.

Account Options If You’re Denied a Business Bank Account

If you cannot open a business bank account due to a poor ChexSystems score, there are limited options on where you can bank in the meantime while you repair your score. However, there are a couple of options to consider:

- Prepaid debit and credit cards: Using a business prepaid card is one short-term solution to pay bills online while you improve your ChexSystems score. Prepaid debit cards are more of an option for personal customers as opposed to businesses but can be used on a short-term basis for small business expenses. Drawbacks include high activation fees for debit cards and high interest rates for credit cards. For our recommendations, see our lists of the leading business prepaid cards and best small business credit cards.

- Second-chance banks: Some banks specialize in opening accounts for customers who have had financial difficulties in the past. These accounts tend to charge high service fees, so this would be a short-term solution while you improve your ChexSystems score. One example of a second-chance bank is Woodforest National Bank. Check out our review of Woodforest’s business checking for more information.

Tips To Improve Your ChexSystems Report

To try to limit your business ChexSystems impacts, follow the tips below to improve your score:

- Check your reports regularly: Even if you haven’t had any issues with a checking account, you should request your report annually. This allows you to stay on top of any errors and get them fixed quickly.

- Dispute errors: ChexSystems reports could contain inaccurate information. Erroneous negative information can lower your ChexSystems score. Make sure to dispute errors with ChexSystems and the bank that reported the error immediately.

- Pay off outstanding debts: Pay off any unpaid balances on your previous accounts or make payment arrangements with the bank. Request that your bank updates the payment status in ChexSystems when the debt is settled to help improve your score.

- Manage your bank accounts responsibly: Avoid making negative banking activities and manage your bank accounts responsibly. Monitor your account regularly to ensure it has sufficient funds to cover your checks and avoid overdrawn balances and unpaid fees.

- Ask your bank for overdraft protection: Some banks offer an overdraft protection service to help prevent checks, ATM transactions, and wire or electronic transfers from causing the account’s balance to fall below zero. This prevents overdrawn balances and insufficient funds.

- Set up banking alerts: You may opt to receive alerts every time a transaction is made with your account so that you can monitor potential fraudulent transactions easily.

Other Bank Account Reporting Agencies

While this article covers how ChexSystems impacts your business, it isn’t the only tool used by banks to investigate potential banking customers. Even if your business bank doesn’t use ChexSystems, it may be using a similar system to detect fraud and report negative transactions. Two other commonly-used systems are Early Warning Services (EWS) and TeleCheck.

Early Warning Services (EWS)

The EWS assists banks, retail stores, and payment processors with detecting fraud associated with bank accounts and payment transactions. It is co-owned by Bank of America, Truist, Capital One, JPMorgan Chase, PNC Bank, U.S. Bank, and Wells Fargo.

TeleCheck

An entity owned by Fiserv Inc, TeleCheck assists retailers, banks, and other businesses with fraud reduction and other risks involved with payment acceptance and account opening.

Frequently Asked Questions (FAQs)

Yes, you can still open a business account if you are in ChexSystems, but it may be difficult. Some banks may deny you any account until the items on your report are resolved, whereas others allow you to open a business account without going through ChexSystems, such as Bluevine.

While having issues with ChexSystems could cause a bank to deny a business account, there could be other reasons. Poor personal or business credit scores could also cause a bank to decline a business. In addition, businesses without all the proper paperwork for their organization type could be denied an account.

Yes, you can open a business bank account if you owe another bank money, but if the new bank uses ChexSystems, EWS, or TeleCheck, there is a good chance you will be denied. The best plan is to pay any outstanding debts before opening a new account or choose a bank that doesn’t use ChexSystems.

Bottom Line

While ChexSystems is primarily a consumer tool, having a negative ChexSystems report can affect your personal finances and your business. You may be denied opening a small business checking account, which will significantly hamper the ability of your business to grow and expand. It will also make it nearly impossible to get business credit. Keep a close eye on your ChexSystems report and resolve any issues quickly to avoid any potential problems.