Kabbage and OnDeck both provide small business owners with short-term financing that can be used for working capital and midsized projects. Both are excellent lending products with slight differences between them.

Kabbage gets the slight edge as best overall due to a lower annual percentage rate (APR), monthly payment option, and lower required annual business revenue. OnDeck is best used for projects requiring a larger loan amount, businesses needing a term loan instead of a line of credit, and borrowers with a lower personal credit score.

Kabbage vs OnDeck: At a Glance

|  | |

Best For | Recurring working capital | Financing large projects |

Maximum Loan Amount | $150,000 | $250,000 |

Repayment Terms | Six, 12, or 18 months | 12 to 24 months |

Repayment Schedule | Monthly | Daily or weekly |

Estimated APR Range | 3% to 42%* | 35% to 100% |

Funding Time | Up to three business days | One business day |

Minimum Credit Score | 640 | 600 |

Loan Originations | More than $7 billion | More than $13 billion |

*Kabbage charges a monthly fee ranging from 0.25% to 3.5%, we have used these values to provide an estimated APR range.

When To Use Kabbage

Kabbage offers a line of credit product that allows you to take out multiple draws at one time as long as you have available credit. Kabbage’s line of credit is great for recurring working capital for your business. Kabbage’s lending products have lower APR than OnDeck, although the initial funding time can take up to three days compared to one day with OnDeck. With its easy application process and lower revenue requirements, it’s one of our top choices for the best easy business loans.

You should choose Kabbage over OnDeck when:

- You’re looking for a line of credit instead of a term loan

- Your business has at least $50,000 in annual revenue

- You have at least a 640 personal credit score

- You’re looking for monthly repayment as opposed to daily or weekly

When To Use OnDeck

OnDeck offers both line of credit and term loan products. If you’re looking for a larger loan amount for bigger projects, OnDeck is an excellent choice. OnDeck offers term loans of up to $250,000 and lines of credit of up to $100,000. You can receive same-day funding on term loans of up to $100,000 while larger loans may take longer. OnDeck has a strict rejection policy for borrowers who don’t meet the minimum credit score, time-in-business requirement, and annual revenue requirement.

You should choose OnDeck over Kabbage when

- You’re looking for a term loan instead of a line of credit

- You need a loan of greater than $150,000

- You want same-day funding

- You prefer to repay on a daily or weekly basis instead of monthly

When To Use a Competitor

If you need a working capital loan, you may want to consider Bluevine, our best overall provider of business lines of credit. Bluevine offers an APR of as low as 6.2%. You can get a line of credit of up to $250,000 for up to 12 months as long as you have been in business for at least 24 months and have at least $40,000 in monthly revenue. Visit Bluevine’s website for more information or to apply.

Kabbage vs OnDeck: Terms, Costs & Qualifications

Kabbage gets the slight edge thanks to a lower estimated APR, monthly repayment option, and lower minimum annual revenue requirement. In addition, Kabbage borrowers can take out multiple draws against a line of credit as long as there’s available credit. OnDeck borrowers must pay down a term loan halfway before borrowing again but can take multiple draws out against its line of credit product.

OnDeck requires borrowers to have a minimum credit score of 600, slightly lower than Kabbage’s minimum of 640. OnDeck requires your business must be in operation for at least one year with at least $100,000 in annual revenue. OnDeck is strict with these qualifications, and companies not meeting all of them will likely be denied.

One perk with OnDeck term loans is prepayment benefits. If you qualify, you can have all remaining interest waived if you pay the loan off early.

With OnDeck’s line of credit, each draw gets lumped into one weekly payment so that you won’t have separate payments for each draw against the line of credit. This makes managing payments on your line of credit easier.

To learn more before applying for any loan, check out our guide for getting a small business loan.

Kabbage vs OnDeck: Mobile Apps

You can apply for a Kabbage line of credit directly through the company’s mobile app. You can also manage your existing accounts through the app. The app is available through the Google Play store and the Apple App Store. Reviews are mainly positive on both apps, with a 3.7 out of 5-star rating on Google Play with 499 ratings and 4.9 out of 5 stars on the Apple App Store with more than 8,400 ratings.

While OnDeck used to have a mobile app, it no longer has an app. If having access to your accounts through an app is important to you, choose Kabbage.

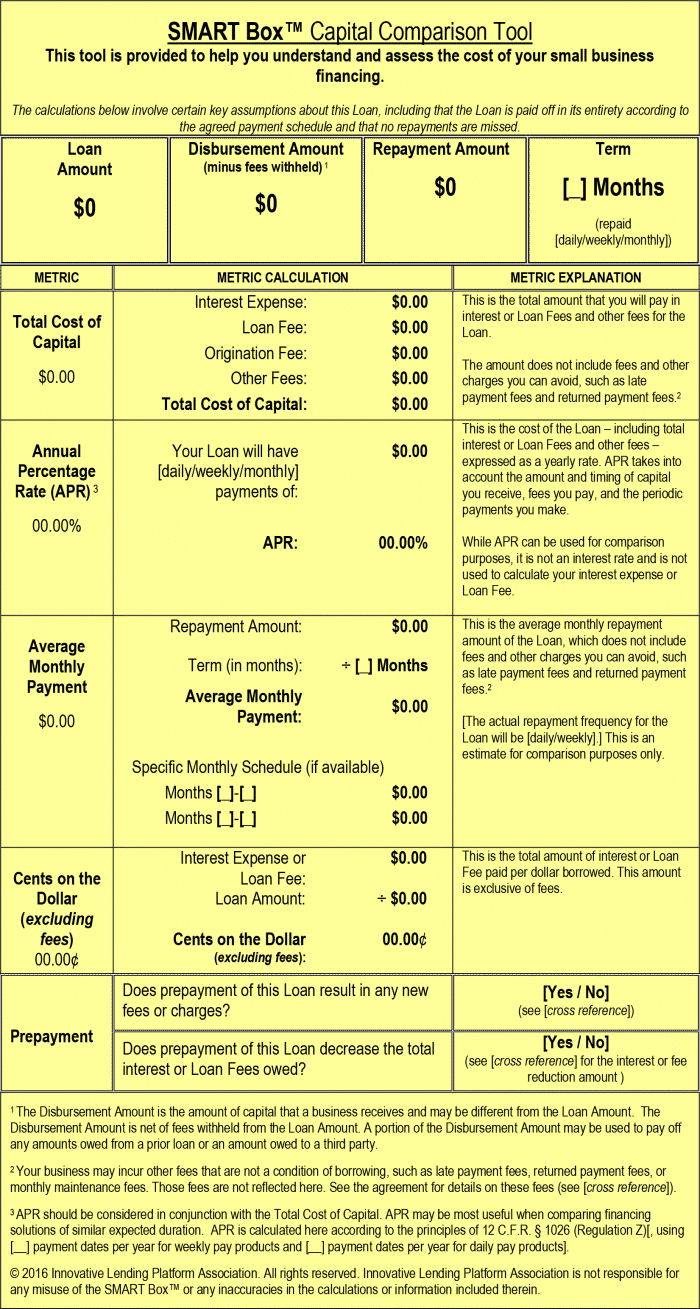

SMART Box Capital Comparison Tool

OnDeck and Kabbage continue to provide a tool through the Innovative Lending Platform Association (ILPA) to help businesses understand the costs associated with their loans and lines of credit. The disclosure is called SMART Box, and an example is shown below:

How We Evaluated Kabbage vs OnDeck

Kabbage has the edge in several areas, including lower maximum APR and less-frequent payments. OnDeck offers a higher maximum loan amount, a longer maximum repayment period, and a quicker funding time. We evaluated the two companies in the following categories:

- Minimum credit score

- Minimum annual revenue requirement

- Rates and fees

- Loan amounts

- Repayment terms and schedule

- Application, approval, and funding speed

- Website and mobile app reviews

Categories | ||

Minimum Credit Score | ✔ | |

Minimum Annual Revenue | ✔ | |

Estimated APR | ✔ | |

Fees | ✔ | |

Maximum Loan Amount | ✔ | |

Repayment Schedule | Monthly | Daily or weekly |

Funding Speed | ✔ | |

Mobile App | ✔ | |

Overall Advantage | ✔ |

Bottom Line

With Kabbage lines of credit open to all borrowers again, it gets the slight edge over OnDeck due to lower estimated APR and minimum annual revenue requirements. OnDeck has a higher maximum loan size which works best for larger projects. OnDeck also offers faster funding and longer repayment terms. For recurring working capital needs, both provide a great line of credit product. But Kabbage’s better rates, monthly repayment option, and lower annual revenue requirement make it the better line of credit for your working capital needs.