Simply Business is an online insurance brokerage connecting small businesses with over 15 top business insurance providers. Its focus is on businesses with five or fewer employees, including startups.

It is licensed to offer insurance in 50 states, and after you purchase a policy, it gives you access to your policy documents. It is one of the only online brokerages that allows you to get a quote, customize the coverages for the quotes, and then purchase the policy entirely online without the need to speak with anyone.

Pros

- Works with multiple top-rated carriers

- Compare quotes online

- Online accounts and same-day certificates of insurance (COI)

- Broad range of industries covered

Cons

- No 24/7 call center

- No mobile app for business customers

- Not all coverages available online

- No process for filing a claim directly with Simply Business

Average Annual Starting Price for General Liability

- $456 for handyperson insurance

- $270 for ecommerce insurance

Standout Features

- Online quoting and policy purchasing system

- Ability to tailor coverage to fit your industry; with real-time quotes

Visit Simply Business To Compare Quotes

When To Use

Simply Business Alternatives

Best for: Businesses that need frequent or unlimited COIs | Best for: Small business owners having trouble finding coverage | Best for: Those needing a one-stop shop for handling policy and claims |

AM Best financial rating: A- (Excellent) | AM Best financial rating: A- (Excellent) to A+ (Superior) | AM Best financial rating: A+ (Superior) |

Simply Business Insurance Options

Simply Business offers most of the core policies a business needs. Online, you can consistently get a quote for:

- General liability

- Professional liability

- Cyber insurance

- Workers’ compensation, includes self-employed and ghost policies

- Inland marine

Beyond those coverages, the online options become more limited. However, you can call and speak with one of Simply Business’ agents about more coverage options.

Simply Business Partner Providers

Simply Business works with 16 top providers. Their financial ratings from AM Best range from A- (Excellent) to A++ (Superior), so all of the providers are in a strong financial position:

- Accredited America

- American Builders Insurance Company

- Arch Insurance

- Axis Insurance

- biBERK Insurance

- Clear Blue Insurance Company

- CNA Insurance

- Frank Winston Crum Insurance

- Harborway Insurance

- Hiscox Insurance

- Markel Insurance

- Preferra Insurance Company Risk Retention Group

- RLI Insurance

- Solepro Insurance

- Travelers Insurance

- USG Insurance Services

Some of the companies above work with higher-risk industries, and some are specialty insurers. This makes it so that a wide range of industries can get quotes and find insurance through Simply Business.

Simply Business Quoting Process

The process for getting a quote, comparing prices, and purchasing a policy is where Simply Business stands out from other brokers. To get a quote, be prepared to answer some basic questions about your business: industry type, location, when it started, projected revenue, and number of employees. After doing so, Simply Business will present you with quotes from some of its partners.

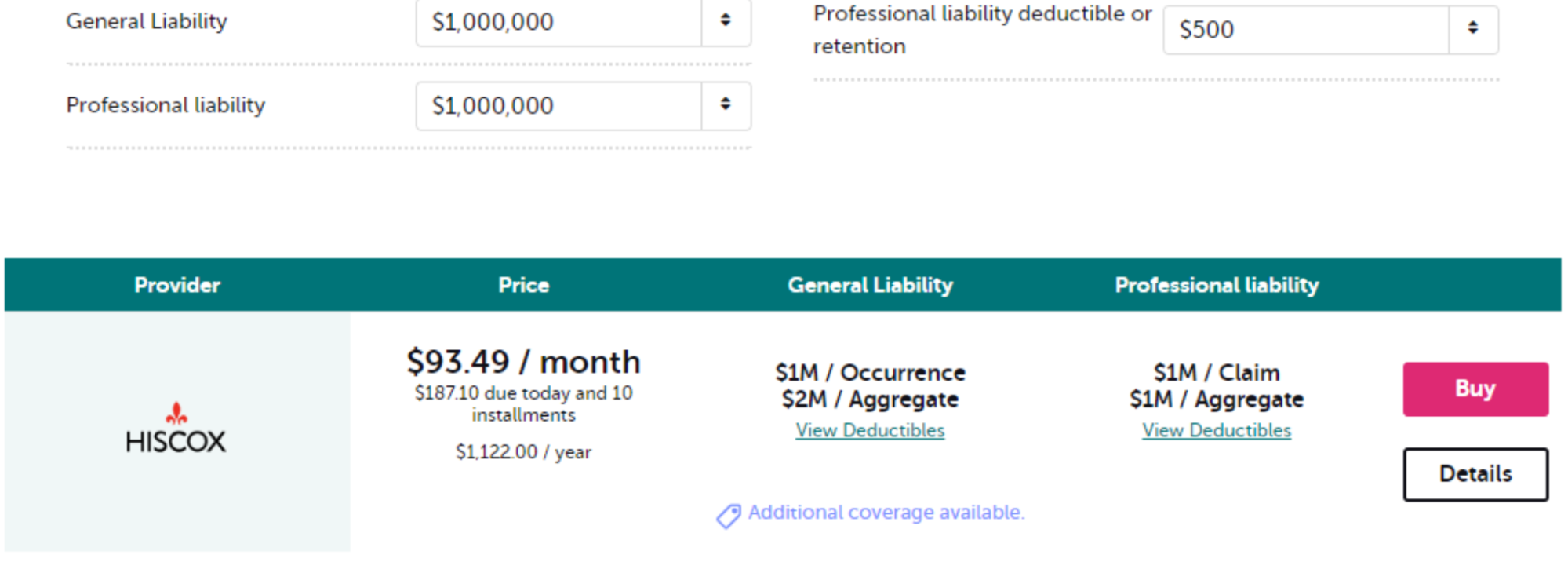

Often, after it generates the quotes, you can adjust the coverage limits and deductibles. Then, it will refresh the prices.

Options to make adjustments are positioned directly above the quote

For each of the providers who return a quote, Simply Business offers key information on it, including the financial rating for the providers from AM Best. After deciding which coverage and price works best for you, you can purchase the policy online or call to do so over the phone with one of its dedicated agents.

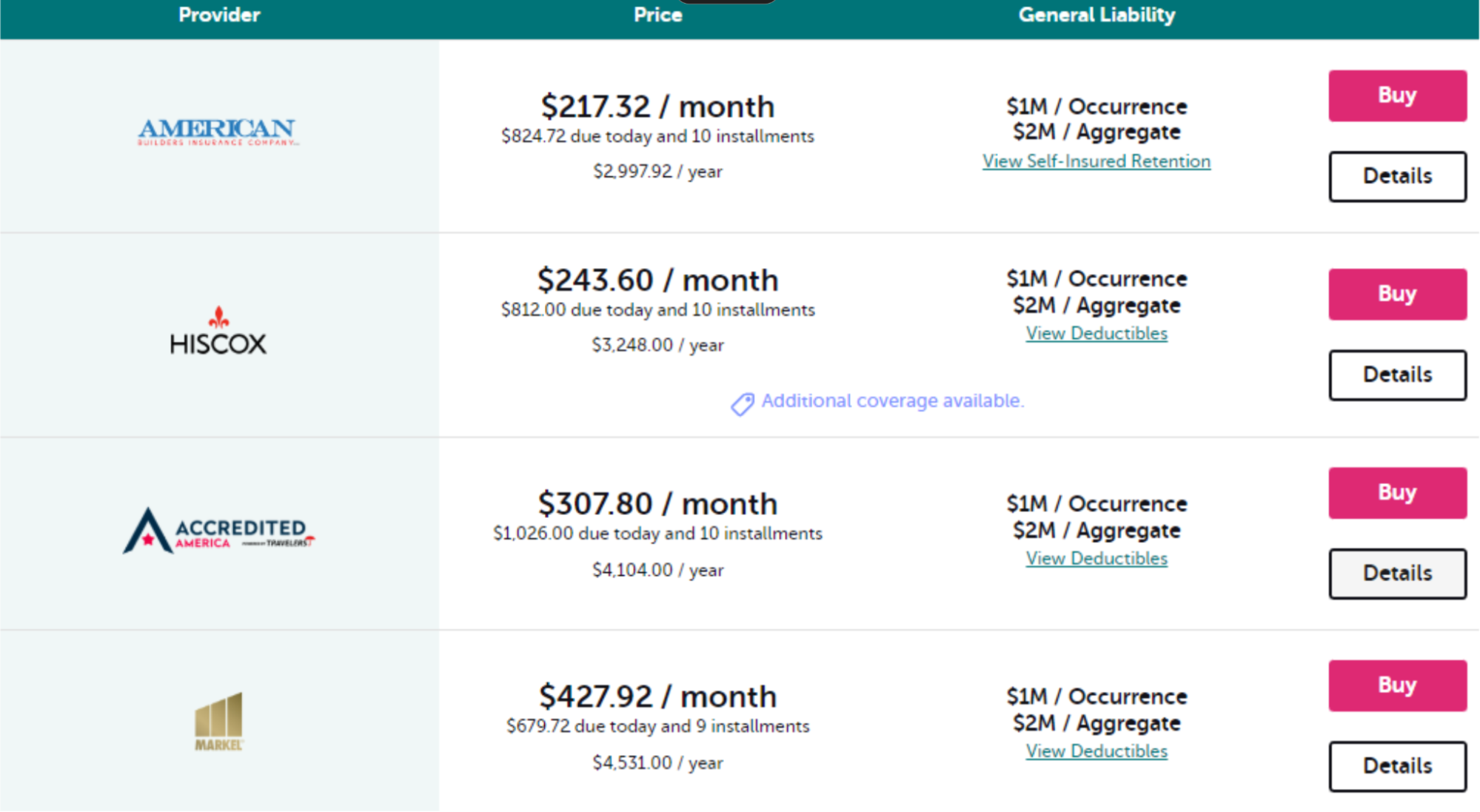

Our five quotes for a fictional handyperson business

Simply Business Insurance Costs

Simply Business does not publish many figures on the average cost for different policies and industries on its website. Note that costs for insurance premiums usually have a wide range depending on the size of the business, risk of the industry, number of employees, revenue, and claims history—just to name several key indicators.

For this Simply Business insurance review, we received five quotes for a handyperson business. All were for general liability with a limit of $1 million per occurrence and $2 million aggregate. Some of the providers, like Hiscox, had additional coverage for tools and equipment available.

Provider | Monthly Cost After First Two Months Down Payment |

|---|---|

American Builders Insurance | $217.32 |

Hiscox | $243.60 |

Accredited America | $307.80 |

Markel | $427.92 |

Harborway Insurance | $346.12 |

You can see the benefit of using a broker because all of the providers offer the same level of coverage. However, if you choose to go with American Builders Insurance, you would pay $2,607.84 annually vs $5,135.04 annually with Markel—for a difference of $2,527.20.

Simply Business Insurance Reviews

Those who left a Simply Business insurance review seemed very happy with the provider and its services, as many customers have left overwhelmingly positive comments. One reviewer said that they were having difficulty getting insurance, but Simply Business did its job and found them coverage.

Another recent review highlighted the key benefits of the provider: fast and easy. The user stated that they received three quotes, complete with details, and had no calls with agents to deal with. They were happy that they got insured quickly as they could focus on growing their business. Other customers left comments like, “Excellent” or “Simple to use, quick response, and competitively priced.”

Here are the Simply Business insurance review scores on several third-party sites:

- ConsumerAffairs1: 4.7 out of 5 from more than 130 reviews

- Trustpilot2: 4.7 out of 5 from more than 650 reviews

- Feefo3: 4.7 out of 5 stars from nearly 250 user reviews

Simply Business Customer Service

Once you purchase your policy, you will gain access to an account where you can manage it. The options you have include adding an additional insured, obtaining your policy documents, payment options, and requesting a COI. If you need to make specific changes to your policy coverage, such as limits, you will need to call Simply Business. Its hours are Monday through Friday, 8 a.m. to 8 p.m. Eastern time.

Helpfully, it has policies designed for Amazon sellers and a separate creation process for Amazon-specific COIs. All the above information is available online at its help center.

The claim process is the weakest area for customer service. If you need to file a claim, you are directed to your policy documents and then to contact the provider directly. However, if you cannot find that information, you can reach out to Simply Business for assistance—it does publish all the claims department contact information for the carriers that it partners with.

Frequently Asked Questions (FAQs)

Yes, Simply Business is a legitimate company with more than 800,000 customers. It is an online broker offering insurance—especially general liability and workers’ compensation—to small businesses. It is licensed to sell insurance nationwide and has more than 15 years’ experience.

In 2017, Travelers Insurance acquired Simply Business, although Simply Business was founded in 2005.

It is open from Monday to Friday from 8 a.m. to 8 p.m. ET, if you need to speak to someone via its phone number, (855) 869-5183.

You will need to file a claim directly with the provider offering insurance, not with Simply Business. If you are unsure, you can reach out to Simply Business via email or phone, and it will help you locate the contact information. Helpfully, under the “claims” tab on its website, it lists the contact information for all the carriers with whom it partners.

There are three ways you can get a COI from Simply Business: Online through your account, online through a request form, or over the phone. If the COI requires a change to the policy, you will need to call Simply Business. If it is an urgent request, it can be created same day—but if it isn’t urgent, it can take up to 24 hours for it to process the request, and that excludes weekends.

Yes, you can. For most of the lines of business that it offers online quotes for, you can purchase a policy online without needing to speak with anyone.

Bottom Line

Simply Business is an online insurance brokerage for small businesses. It specializes in smaller businesses with five or fewer employees. It stands out from other online brokerages by letting you compare quotes and purchase a policy online without needing to speak with anyone. Get a quote and buy insurance in 10 minutes or less today.

Visit Simply Business to Compare Quotes

User Review References: