The best real estate investing apps make investing easier and more accessible, even for first-time investors. They equip investors with the tools and information necessary to make informed decisions and confidently navigate the market. These apps offer a range of investment options, including real estate investment trusts (REITs), residential and commercial properties, rentals, and real estate crowdfunding.

To help you find the best real estate investment apps, we’ve compiled a list based on factors like investment choices, property analysis tools, user-friendly interfaces, and achievable minimum investing requirements. Whether you’re a seasoned investor or just starting out, here are the best apps to invest in real estate:

- Best for advanced software and eREITs: Fundrise

- Best for alternative investing: Yieldstreet

- Best for non-accredited investors seeking REITs: RealtyMogul

- Best for commercial real estate properties: CrowdStreet

- Best for single-family rental properties and accredited investors: Roofstock

- Best for beginner investors: HappyNest

Best Real Estate Investing Apps at a Glance

App | Starting Price | Geographic Diversification | Offers Multiple Property Types | Customer Support |

|---|---|---|---|---|

$10 per month | ✓ | ✓ | ||

$10,000 | ✓ | ✓ |

| |

| $5,000 | ✓ | ✓ |

|

$25,000 | ✓ | ✓ | ||

$5,000 | ✓ | ✓ |

| |

$10 | ✓ | ✕ | ||

Fundrise: Best for Advanced Software & Affordable eREITs

Pros

- Fully integrated platform

- Low fees

- Offers quarterly liquidity

Cons

- Not available to non-accredited investors

- Does not offer property analysis tools

- Very limited customer support

Fundrise Pricing

- Fundrise pro membership costs $10 per month or $99 per year

- $8.50 per year for every $1,000 invested

Our Expert Opinion on Fundrise

Fundrise is a real estate investing app that enables you to invest in different property types, including multi-family apartments, industrial properties, and single-family rentals, with low fees. It’s open to accredited investors only and offers services like eFunds, where you can buy land, construct housing estates, and sell them. It also offers a variety of investing options for multiple property and investment types.

This app is best for online investment in commercial real estate through eREITs, allowing investors to participate in deals for as low as $10. Fundrise offers diversification across multiple properties with ease and affordability. To further improve their services, adding property analysis tools could enhance the app’s value to investors.

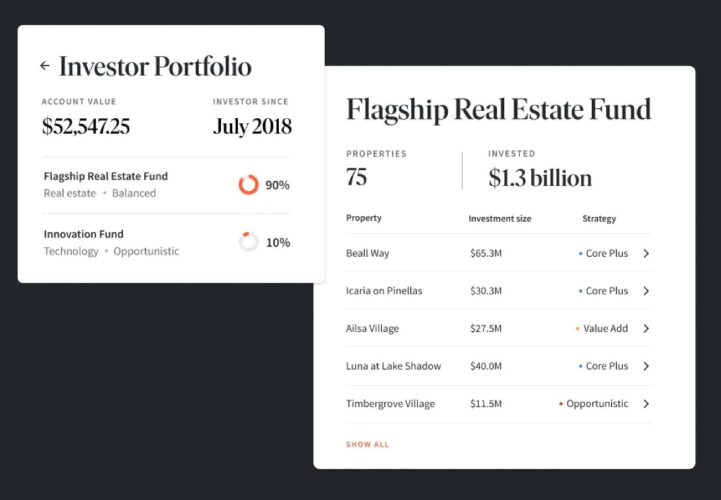

View Fundrise’s internal investor servicing and fund management software (Source: Fundrise)

- No performance fees: Performance-based fees, like “promote” or “carried interest” fees, are eliminated in funds for everyday investors to avoid short-term decision-making and excessive risk-taking.

- Fundrise Pro: Enables active investors to personalize their allocations, directly invest in specific funds, and access expert-level data for greater control and customization.

- Investor-owned: Investors can own a stake in Fundrise through iPO (internet public offering).

Fundrise has a rating of 2 out of 5. Customers appreciate its accessibility, user-friendly platform, and quarterly dividend payments. Some customers also commended the ease of tracking investment performance. This allowed them a “hands-off” investment experience and quarterly dividend payments.

However, some reviewers raised concerns about the absence of advisory services, difficulties in retrieving owed funds, and limited low-risk investment options. One customer reported the non-payment of funds owed to him. If you prefer lower-risk investment options, Happy Nest could be an alternative—providing more beginner-friendly investment options.

Yieldstreet: Best for Alternative Investing

Pros

- Curated by seasoned professionals

- Access to private market professionals for investor support

- Access to a customizable set of investments

Cons

- High minimum investment

- Most investments are only open to accredited investors

- Does not offer redemption programs for most investments

Yieldstreet Pricing

- Minimum investment depends on investment offerings, which may range from $10,000 to $15,000

Our Expert Opinion on Yieldstreet

Yieldstreet is a leading real estate investing app, particularly for the private market. While it is more accessible to accredited investors, it also provides access to non-accredited investors. Furthermore, it offers a wide variety of investment types and asset classes, which include real estate, art, legal finance, and transportation.

With its broad selection of alternative asset classes, Yieldstreet is best for alternative investing, allowing investors to diversify their portfolios. One way Yieldstreet could improve is by providing more affordable pricing, making the platform accessible to wider audiences.

Take a quiz on Yieldstreet’s website to help you decide how and where to begin investing (Source: Yieldstreet)

- Additional resources: The website provides a blog featuring a diverse range of articles that offer market data, insights, and educational content about the private market.

- Yieldstreet Prism Fund: A fixed-income portfolio across five asset classes for non-accredited investors.

- Yieldstreet IRA: Allows you to add alternatives to your retirement portfolio for further diversification.

Yieldstreet has a rating of 1.9 out of 5 from users. It is commended for providing access to multiple types of investments, which include real estate, marine, and art investments. Users liked that it allowed individuals to invest in private structured credit deals. Lastly, because they allow investments backed by assets, customers are provided with more protection.

However, some customers reported inaccuracy in their performance reports. A few reviewers mentioned that customer support was difficult to contact. For those who require a better and more transparent performance report, Fundrise may be an alternative to consider.

RealtyMogul: Best for Non-accredited Investors Seeking REITs

Pros

- Provides early redemption programs for REITs

- Allows self-directed IRA (SDIRA) to invest in commercial real estate

- Offers multiple property and investment types

Cons

- Does not offer debt investment type

- Contains a short track record

- High minimum investment requirement

RealtyMogul Pricing

- Minimum investment of $5,000

- 1% to 1.25% of asset management fee per year

Our Expert Opinion on RealtyMogul

RealtyMogul is a real estate investment app that grants both non-accredited and accredited investors access to various commercial real estate opportunities, such as multi-family properties, offices, retail and medical buildings, and industrial sites. With a wide range of investing options, market data, and insights, the app offers seamless funding and continuous investment monitoring for its users.

This app is particularly best for non-accredited investors looking to invest in REITs. It provides access to two public, non-traded REITs that are not as readily available for them on other platforms. However, it can improve by providing more investment options for non-accredited investors.

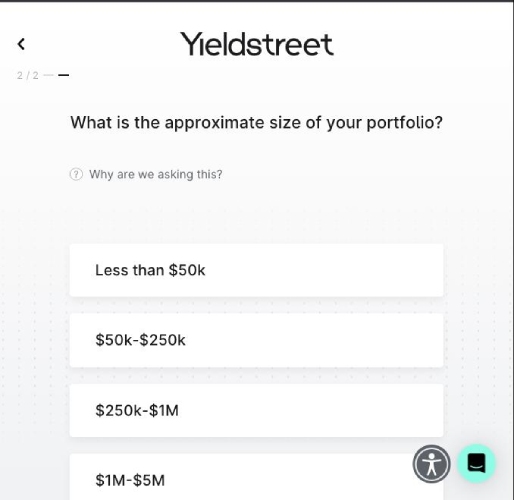

A sample RealtyMogul dashboard (Source: RealtyMogul)

- Redemption program: Offers a redemption program for RealtyMogul Income REIT and RealtyMogul Apartment Growth REIT, with no penalty after a three-year holding period, subject to availability. There is no redemption program for private placements.

- Share repurchase program: Allows shareholders to sell their RealtyMogul Income REIT and RealtyMogul Apartment Growth REIT investments back to the company on a quarterly basis, starting from the first year, at a reduced price.

- Auto-invest: Once actively enrolled, investors in The Income REIT and The Apartment Growth REIT can enjoy the convenience of watching their investments grow automatically month after month.

RealtyMogul has a rating of 3 out of 5 based on reviews. While there is not a lot of positive feedback on third-party reviews, the few reviews reveal a customer expressing disappointment with the outcome and deviation from the expected one- to three-year holding period. Transparency concern was also raised, with a reviewer expressing frustration over a perceived lack of clear communication from the company. If you prefer better transparency, consider Fundrise, as they actively provide reporting transparency through its software.

CrowdStreet: Best for Commercial Real Estate Properties

Pros

- One of the largest online commercial real estate marketplaces

- Provides a wide selection of property and investment types

- Offers free registration

Cons

- Available only for accredited investors

- No mobile app

- Does not provide a redemption program

CrowdStreet Pricing

- $25,000 minimum investment required

- 1% to 2% management fee per year

Our Expert Opinion on CrowdStreet

CrowdStreet, a leading real estate investing app, empowers individual investors to diversify their portfolios seamlessly. It offers a wide range of investment options, comprehensive market data, and research, allowing investors to choose individual properties or invest in CrowdStreet-backed funds comprising a diverse lineup of real estate projects. This simplified approach streamlines the investment process.

This is best for accredited investors looking to invest in commercial real estate properties. It establishes seamless partnerships between individual investors and project developers, fostering opportunities in the commercial real estate sector. To enhance convenience and accessibility, CrowdStreet can further improve by making the app available on mobile devices.

Read the Mid-Year 2023 Market Outlook from CrowdStreet (Source: CrowdStreet)

- In-depth research: Informative video webinars accompany individual investment offerings, enabling investors to assess the project’s specifics and determine its suitability for their portfolio.

- Additional resources: A learning center provides “how-to” videos and articles about general investing topics.

- Marketplace: Offers a range of five to 15 private equity investment opportunities, encompassing both single-asset projects and funds.

CrowdStreet holds a rating of 4 out of 5. Positive feedback emphasizes the platform’s diverse investment options and comprehensive research resources. Customers also praise its well-designed technology, high returns, and abundant investor resources available.

However, negative feedback points out certain drawbacks, such as high minimum investment requirements, unavailability to non-accredited investors, long liquidity and hold periods, and high fees. Some customers express dissatisfaction with the lack of effective management and direction. Additionally, there have been reports of issues with customer service. For a more affordable option, consider HappyNest, which allows you to invest for as low as $10.

Roofstock: Best for Single-family Rental Properties

Pros

- Offers an integrated financing solution for easier financing

- Sign-up does not require any fees or bank details

- Features a user-friendly interface

Cons

- Real estate properties are highly illiquid investments

- Roofstock One is not accessible to non-accredited investors

- No mobile app available

Roofstock Pricing

- Minimum investment requirement of $5,000 for Roofstock One

- 0.50% or $500 account fee

Our Expert Opinion on Roofstock

Roofstock is one of the best apps for real estate investors, providing an online marketplace where investors can acquire tenant-occupied houses and REIT investments through the Roofstock One platform. It offers a wide selection of pre-vetted properties, low costs, and facilitates immediate rent collection.

This app is best for single-family rental properties with its extensive marketplace featuring hundreds of single-family homes. Additionally, it provides lower transactional fees compared to traditional real estate agents. However, Roofstock can improve accessibility by making the app available on mobile devices, broadening its reach, and enhancing convenience for users.

Discover neighborhood insights on Roofstock’s website (Source: Roofstock)

- Lease Up Guarantee: Roofstock guarantees up to one year of rent coverage if a lease isn’t signed within 45 days of purchasing a vacant “rent-ready” home, providing security for buyers.

- Roofstock One: Allows accredited investors to invest in portfolios of single-family properties, with a minimum investment requirement of $5,000.

- Roofstock Academy: Access an online course on mastering turnkey rental properties, featuring one-on-one coaching sessions and a private network of real estate investors.

Roofstock has a rating of 2.9 out of 5. Positive feedback highlights the database with prescreened properties with good return on investment (ROI). It also offers easy financing solutions that address the common challenge of purchasing single-family rental properties. Customers appreciate the thorough inspections conducted by Roofstock, ensuring the quality of the houses and estimating repair costs.

However, negative feedback mentions the lack of availability and poor customer service. Some customers find Roofstock to be relatively expensive compared to alternatives that provide better customer support and faster response times to inquiries. For a more affordable option, consider HappyNest or Fundrise, which have a $10 starting price.

Read how our experts feel about this app in our Roofstock Review.

HappyNest: Best for Beginner Investors

Pros

- Available for non-accredited investors

- Accessible through mobile app

- No monthly fees and no broker fees

Cons

- Offers limited property and investment types to choose from

- Does not provide market data or insights

- Does not provide access to direct deals

HappyNest Pricing

- Starting at $10

- 0.0417% monthly management fee

Our Expert Opinion on HappyNest

HappyNest is a simple and straightforward real estate investing app that caters to both accredited and non-accredited investors, offering various investment options, commercial real estate investing, and diversified funds. Notably, the app prioritizes the security of personal data and refrains from sharing it with third-party vendors.

This app is one of the best real estate investment apps for beginners as it allows investing with as little as $10 and without any monthly fees. The user-friendly interface and mobile app make investing more accessible to a broader audience. However, HappyNest could enhance its services by adding more to its portfolio with various property types and direct deals. Currently, it offers only one portfolio comprising three properties. Diversifying the investment choices would provide users with greater flexibility and opportunities for growth.

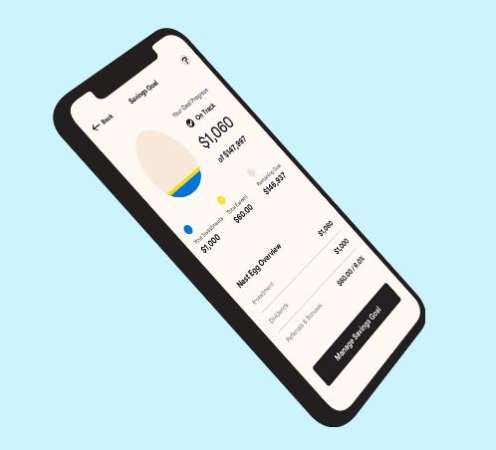

View HappyNest’s mobile app interface (Source: HappyNest)

- HappyNest blog: A compilation of articles that teach people how to invest in commercial real estate.

- Downloadable real estate investing guide: An e-book about learning how to invest in real estate written by a team of financial experts is available for download through the website.

- Partnering with application programming interface (APIs): HappyNest keeps your banking connections secure by using trusted partners who directly connect with your financial institution and employ industry-leading verification techniques.

HappyNest has a rating of 4.1 out of 5. Positive feedback emphasizes the simple and straightforward app that makes investing accessible to anyone. It is also commended for having an achievable minimum investing requirement and low fees. Reviewers also appreciated HappyNest as a great place to start investing, finding it accommodating and trustworthy.

However, some reviewers mentioned feeling uncomfortable due to their investments being inaccessible or non-withdrawable for extended periods. Some negative feedback also include delays in receiving refunds, and lack of transparency in the investment process. For those who require better transparency, consider Fundrise, which actively provides reporting transparency through its software.

How We Evaluated the Top Real Estate Investing Apps

We evaluated the top real estate investing apps to assist you in succeeding on your real estate investing journey, whether you’re a seasoned investor or a beginner. We examined each app’s investment details, general features, ease of use, help and support, customer rating, and expert score to ensure they provide quality investing services.

As a result, we found Fundrise to be the best real estate investment app due to its easily achievable minimum investment requirement and user-friendly yet advanced interface. The app offers accessibility to a variety of investment options and property types, granting you more control and diversification over your investments.

The following are the criteria we used to find the best real estate investing apps:

40% of Overall Score

We assessed the different app features, such as property analysis tools, investment calculators, market data, neighborhood information, direct investment opportunities, and crowdfunding capabilities.

25% of Overall Score

We looked into the minimum investment required as well as availability of various investment options, property and investment types, and geographic diversification.

10% of Overall Score

We evaluated the apps considering the technical skills needed for setup and operation, the user-friendly interface, and mobile app availability.

10% of Overall Score

We analyzed customer feedback for each program, with a specific focus on product reviews and provider popularity, to ensure the apps meet user satisfaction.

10% of Overall Score

Expertise in the field and direct experience with the providers allow us to assess each app’s distinctive features, cost-effectiveness, and ease of use.

5% of Overall Score

We examined the accessibility and availability of customer service for technical support and instructor assistance.

Frequently Asked Questions (FAQs)

Real estate investments can provide you with significant returns over time, but the highest returns can vary based on several factors, such as location, market conditions, property type, and economic trends. Some real estate investments associated with higher returns include prime urban properties, developing markets, commercial properties, short-term rentals, fixer-uppers and flipping, REITs, and undervalued or up-and-coming neighborhoods.

Yes, you can invest $100 in real estate. However, available options for this budget may be limited. You can explore investing in real estate crowdfunding platforms, REITs, and mutual funds with this budget.

The most cost-effective way to invest in real estate can vary depending on individual circumstances and financial goals. However, some generally cost-effective methods to invest in real estate include REITs, crowdfunding platforms, mutual funds, real estate micro-investing apps, and buy-and-hold rental properties.