Roofstock is one of the best turnkey real estate companies, ideal for investors seeking to diversify their portfolio with turnkey single-family rentals (SFRs). Our evaluation looked at valuable features like investment opportunities, property management, ease of use, pricing, support, customer reviews, and our expert opinion to review its credibility as a source for real estate investors. Read through our Roofstock review to help you decide if Roofstock is right for your real estate business.

Pros

- Roofstock is available in 27 states, which is a larger footprint compared to other turnkey real estate investment companies

- Integrated financing solution

- Data analytics and rental property optimizing tools

Cons

- No mobile app

- Roofstock One not available for non-accredited investors

- Money-back guarantee and Vacancy Protection do not cover all Roofstock properties

Recommended For

- Property investors looking for remote real estate investing opportunities and hands-off property management

- High-volume and institutional investors looking to buy, manage, or sell single-family rentals

- Turnkey providers or fix-and-flippers who want to sell their properties to other investors

Not Recommended For

- Non-accredited investors who want automated and passive investment options

- Investors looking to expand their portfolio in commercial real estate

- International investors who want to invest in Roofstock One

- List on the Marketplace: Free

- Sell a property: 3.0% of the sale price or $2,500, whichever is higher

- Buy a property: $0.5% of the contract price or $500, whichever is higher

- Roofstock One: Minimum investment of $5,000

Roofstock Reviews: What Users Think of Roofstock

We came across a relatively small pool of third-party customer reviews for Roofstock. However, one satisfied buyer praised Roofstock for its diverse investment opportunities and professional team that assisted him throughout the rental acquisition process. Roofstock also gave him a “roadmap” for secure long-distance investments beyond his home state. A seller also expressed satisfaction with Roofstock, citing its ability to market residential assets to other property investors effectively.

- Trustpilot: 2.9 out of 5 stars based on four Roofstock.com reviews

However, we also found a few negative Roofstock reviews. One user said that although the platform is OK, Roofstock’s services are pretty expensive. Another customer complained about poor customer service, saying that the agent was unresponsive. While Roofstock has one of the largest footprints in terms of turnkey rental investments, you can check other alternatives like Norada Real Estate Investments for extensive customer service and fast responses to inquiries.

Would Our Expert Use Roofstock?

We highly recommend Roofstock to those looking to invest in SFRs and other residential investments, especially newbies who want to get their feet wet with low- to moderate-risk investments. You can find different real estate investment options regardless of your risk capacity. Furthermore, Roofstock’s robust features and experienced team can help you maximize your potential returns and protect your investments.

However, just like most real estate investments, investing in Roofstock may require lucrative capital. If you want to earn rental income, you must buy a property priced at a minimum of $25,000. Therefore, Roofstock may not be the best option for non-accredited and retail investors with low investment capital. Roofstock mainly focuses on SFRs and residential properties. If you’re looking for more diversity, we recommend checking Howard Hanna Real Estate Services.

Roofstock Alternatives

If you want to explore investment options other than Roofstock, check out alternative turnkey real estate investment companies and compare their features and pricing. Here are a few of the best alternate options:

Software |  |  |  | |

|---|---|---|---|---|

Best For | Investors who prefer a market-agnostic investing approach | Investors who want to buy and sell high-end properties | Analytics-driven investors who want access to the neighborhood investment rating (NIR) system | Individual investors who want end-to-end turnkey solutions |

Key Features |

|

|

|

|

Property Starting Price | $92,000 | $20,000 | $70,000 | $190,000 (average price) |

Learn More |

Roofstock Plans & Pricing

As a turnkey real estate investment company, Roofstock doesn’t offer subscription plans. Instead, you will be charged specific fees depending on what you want to do on the platform. Refer to the table below to determine how much you will pay to sell, buy, or invest in Roofstock:

Plans | List a Property on the Marketplace | Sell a Property | Buy a Property | Hands-off Management | Roofstock One |

|---|---|---|---|---|---|

Who Service Is Best For | Sellers who want to market their homes to property investors | Property investors who want to diversify into SFR investing | Turnkey providers and flip-and-flippers looking to sell their properties | Property owners who want to earn rental income without directly managing the property | Investors looking for passive and low-risk stock investments |

Related Fees | Free | 3.0% of the sale price or $2,500, whichever is higher | 0.5% of the contract price or $500, whichever is higher | Varies depending on the property manager; contact Roofstock for more info | $5,000 minimum investment and at least $100 at a time thereafter |

Add-ons

Roofstock property managers charge property owners several fees for managing and maintaining SRFs. Pricing varies depending on the service provider but often includes the following:

- Setup fee

- Management fee

- Leasing fee

- Leasing renewal fee

- Maintenance fees

- Eviction fees

General Roofstock Features

- Single-family rentals

- Multiple real estate investment options

- Roofstock Marketplace and Roofstock One

- Calculators, data analytics, and property optimizers

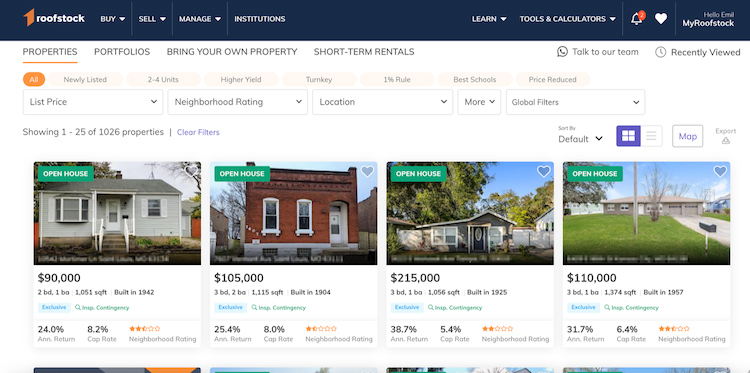

Roofstock allows you to invest in turnkey properties, particularly in single-family rentals (SFRs). There are several ways to invest through Roofstock:

- Sell your rental property on the Roofstock Marketplace

- Buy a rental property and have it managed by Roofstock

- Invest in Tracking and Common Stocks through Roofstock One for passive income

Roofstock SFR investing

Roofstock ensures your rental investment portfolio is profitable and efficient. Thus, it provides investors with multiple tools, including data analytics like Neighborhood Rating, Roofsavvy, and calculators. Roofstock also offers a money-back guarantee and Vacancy Protection for eligible properties, providing enough time for properties to start generating rental income.

Advanced Roofstock Features

Roofstock features assist in real estate investing, specifically in turnkey properties. Read the details about each feature by clicking on the tabs below:

- Buy residential assets

- SRFs, portfolios, and short-term rentals available

- Shop with an agent

Roofstock Marketplace allows individual and large-scale investors to buy, sell, and remotely manage real estate investments. You can directly own SFRs, small multi-family buildings, short-term vacation rentals, and large portfolios of residential assets. To get professional assistance growing your investment portfolio, Roofstock can connect you with a member of their Certified Agent Network.

Buying properties on the Roofstock Marketplace is a traditional form of homeownership. What makes it efficient for investors is its streamlined process of buying a property, obtaining financing, and finding a property manager. Using its Cloudhouse Rental Calculator, you can easily determine the profitability of a listing and receive a complete forecast of the potential return and rental revenue on any SFR.

- Remote property management and rental income

- SFRs managed by professional property managers

- Optimize properties using Stessa and Great Jones

What makes the Roofstock Marketplace a considerable investment option is the hands-off property management it offers to rental owners. First, you have to buy a rental property directly from a seller on the Marketplace, with Roofstock as the transaction facilitator. All transactions are securely done online so that you can finalize deals from anywhere. Some rental properties are certified and come with a 30-day money-back guarantee to ensure you’re satisfied with your investment.

Hands-off property management (Source: Roofstock)

After closing, Roofstock’s property management team will handle the rental’s daily operations. From there, you can earn rental income and gain continuous support from Roofstock. Note that as the property owner, you still have responsibilities like insurance, taxes, reserve funds, compensation for services rendered, utilities, and homeowner association (HOA) fees whenever applicable. Make sure to read and understand your property management agreement with Roofstock. Roofstock utilizes Stessa for simplified money management and Great Jones for tech-forward property management to track and optimize your rental properties.

- Sell rental properties on the Marketplace

- Roofstock Offers

- Extensive network of buyers

If you’re a property owner looking to sell a rental, list it on the Roofstock Marketplace and promote it to an extensive network of buyers looking for SFRs. When you sell a property, Roofstock will act as your exclusive broker. Nevertheless, you still gain complete control over the entire sale process and can set the price, as well as accept, negotiate, or reject offers.

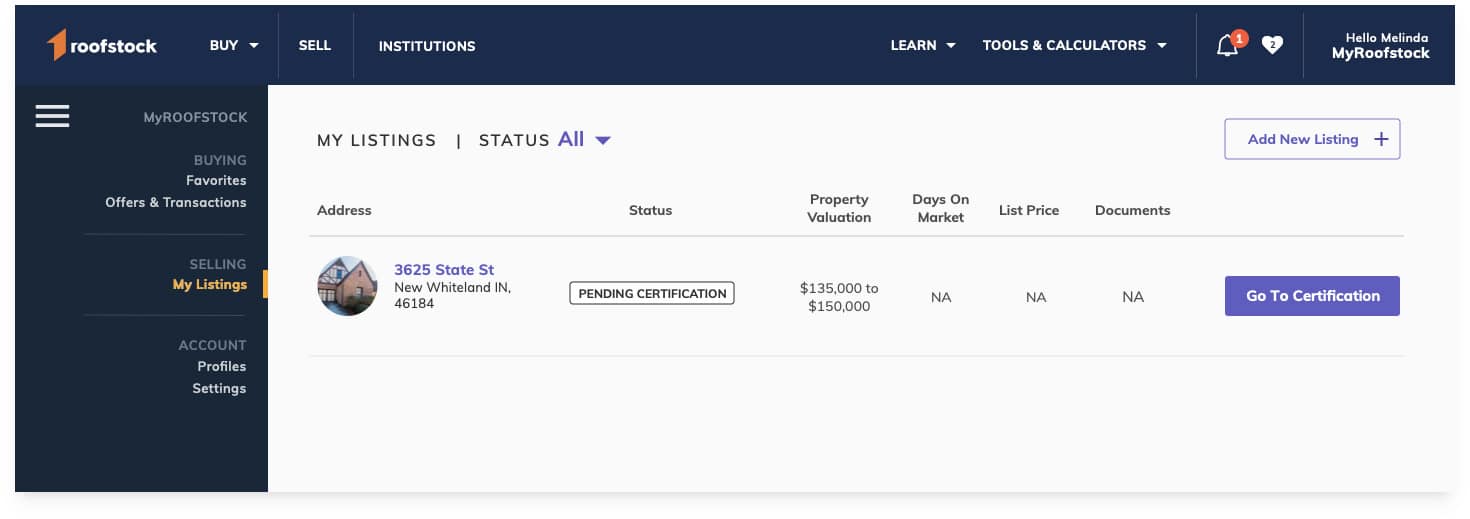

Seller services on the Roofstock Marketplace (Source: Roofstock)

With Roofstock Offers, you can sell your qualified rental properties for cash and close in as quickly as 10 days. This frees you from the complicated process of traditional homeselling—no more home staging or viewings.

- SFR rating index

- Provides neighborhood insights

- Powered by a proprietary algorithm

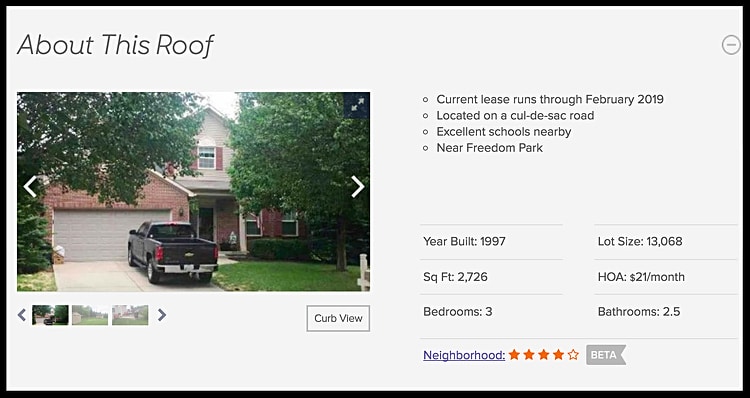

Roofstock’s Neighborhood Rating is an SFR rating index for neighborhoods located in the U.S. The index lets property buyers and sellers determine how well a neighborhood performs investment-wise. If you’re a buyer, you can check a property’s Neighborhood score and compare it with similar properties. For sellers, the Neighborhood Rating will help you assess the property’s saleability so you can make some improvements and curb its market value if necessary.

Sample neighborhood rating (Source: Roofstock)

Neighborhood Rating utilizes a proprietary algorithm computed at the census tract level to assess neighborhood-specific risks and benefits. Several factors are considered when running a Neighborhood score. These include school district quality, employment rates, home values, income levels, educational attainment, crime rates, and percentage of owner-occupied homes.

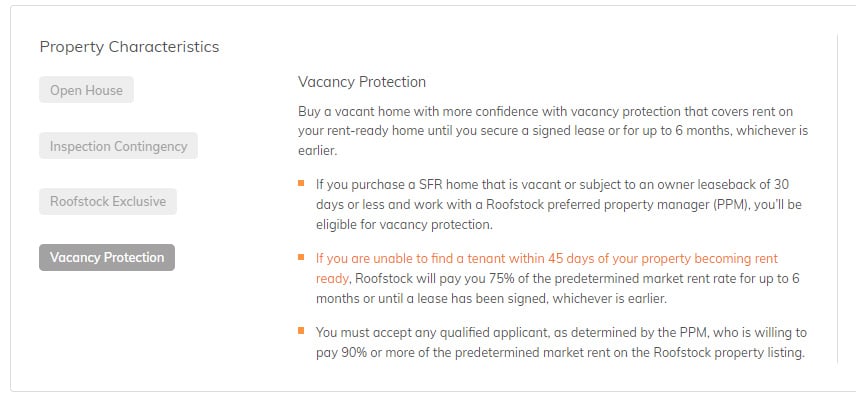

- Covers 75% of the rent for six months

- Only rent-ready SFRs purchased on the Marketplace are eligible

- Property should be managed by Roofstock preferred property managers

If you buy an SFR on the Marketplace that is vacant at closing, Roofstock offers Vacancy Protection for up to six months. To be eligible, you must work with a Roofstock preferred property manager, and your property must be rent-ready. The Vacancy Protection covers the rent on your home for a specific period. If you get no signed tenants within 45 days, Roofstock will pay you 75% of the predetermined market rent for six months or until a tenant signs a lease, whichever comes first.

Sample Roofstock SFR listing with Vacancy Protection

- Valid for 30 days from the closing date

- Certified SFRs purchased on the Roofstock Marketplace are eligible

- Refunds are based on the original price at closing

Roofstock provides a 30-day money-back guarantee for certified single-family homes that buyers are not satisfied with. If your property is eligible, you must send an email within 30 days from the closing date to start the process. Roofstock will then re-list your property for free on the Marketplace and other channels. When someone buys the property, Roofstock will give you a refund of the original price at closing. If the property doesn’t sell in 180 days, Roofstock will buy the property from you.

Note that Roofstock portfolios, short-term rentals, VIP programs, and multi-family properties are not eligible for the money-back guarantee.

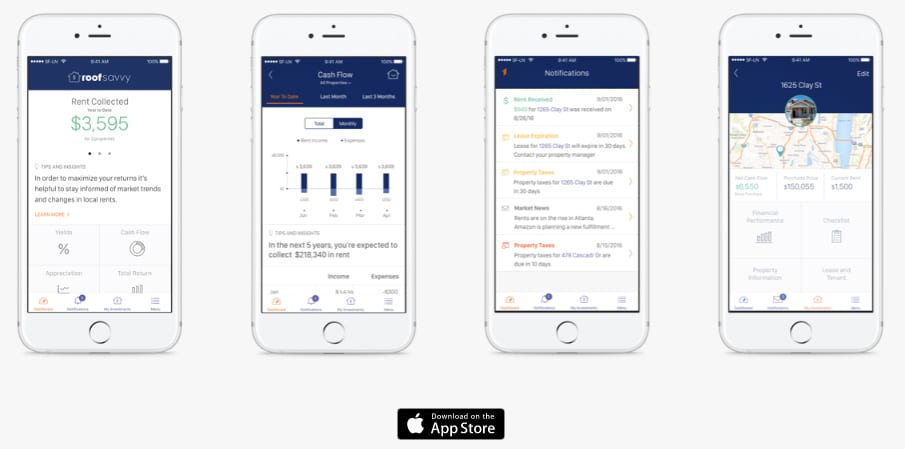

- Rental property optimizer

- Property performance and monthly income breakdown tracking

- Free mobile app available on iOS

To make sure your investment properties and portfolio are performing well in the market, Roofsavvy provides data analytics that helps investors monitor, analyze, and plan their investment strategies. It gathers current data on all your rental homes, which you can easily view on the dashboard. Review your rental income breakdown in proportion to your expenses, mortgage, and net cash.

Roofsavvy mobile app

Investors can access all property information and performance aspects, including past/current data, closing documentation, and contact details. Once a tenant pays rent, you will also get notified. Further, Roofsavvy sends you updates and reminders of upcoming events and related market trends, so you don’t miss anything. Download Roofsavvy on any iOS device, perfect for investors who are always on the go.

Note that Roofsavvy is only accessible to investors who purchase Roofstock properties and partner with a preferred property manager.

Roofstock preferred property managers

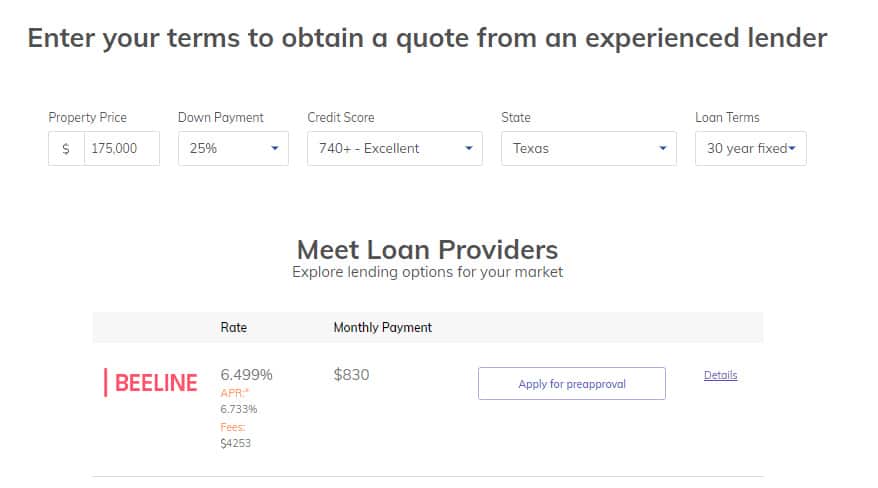

- Financing calculator

- Set your own financing terms

- Get pre-approved from lending partner

If you don’t have enough cash to pay the entire sale price, apply for pre-approval from Roofstock’s lending partners. All you need to do is select a third-party lender listed on Roofstock, apply for pre-approval, select a property in your budget, and submit your pre-approval letter.

Obtain a quote by using the Financing Calculator, which lets you determine possible mortgage rates and monthly payments based on your terms. Input the property price, down payment, credit score, state, and loan terms into the calculator to view available financing options. You can opt to connect with a lending partner and apply for a loan or simply contact your own lender if you prefer.

- Passive real estate investment option

- Targeted portfolio of Roofstock One Tracking Stocks

- Broad diversification through Roofstock One Common Stock

- Available to accredited investors only

Roofstock One provides an innovative rental investment platform for investors looking for a passive income stream. With a minimum investment of $5,000, you can start trading Roofstock’s property shares. This is a sound alternative to direct ownership, especially since Roofstock’s property managers will do the legwork to ensure all the properties in your portfolio are performing well.

Roofstock One features

Using Roofstock One’s software, customize your Roofstock portfolio based on the cities or states you want to invest in. More importantly, you can readily track the economic performance of rental properties in your portfolio. You will then receive distributions based on the rental yields. Tax filing is also simplified with the 1099-DIV form.

To participate in Roofstock One, you need to be an accredited investor as defined in Rule 501 of Regulation D under the Securities Act of 1933. Usually, these are financial companies and high-earning individuals qualified to invest in complex and sophisticated types of securities.

Here are the types of stocks and investment options available on Roofstock One:

- Tracking Stock: SFR real estate investment trust (REIT) providing exposure to multiple properties

- Common Stocks: A broad-based and diversified investment opportunity

- Self-directed individual retirement account (SDIRA) investing: Buy Common Stocks to diversify retirement investments

- 1031 Exchange: Defer all capital gains taxes by reinvesting the proceeds in a new property or portfolio

To get more real estate investment tips, you can visit Roofstock’s Blog page and Knowledge Center, which are growing repositories of information for buyers, sellers, owners, and investors.

- Self-study and 1:1 workshops

- Members-only Q&A sessions

- Access to an online investor community

To help you grow your investment portfolio, Roofstock Academy offers courses that discuss the different phases of real estate investing. Roofstock Academy offers several programs to suit every member’s unique learning style, schedule, and budget. If you prefer a self-study format, combine on-demand courses with exclusive events and members-only Q&A sessions. To speed up your learning, choose 1:1 coaching with an expert and get access to Roofstock Academy’s online investor community.

Roofstock Academy learning process

According to a Roofstock Academy review, the courses are helpful to beginner and intermediate investors who want to learn the fundamentals of real estate investing. Furthermore, Roofstock Academy does not discuss successful investments only, but also investment mistakes and how to avoid them.

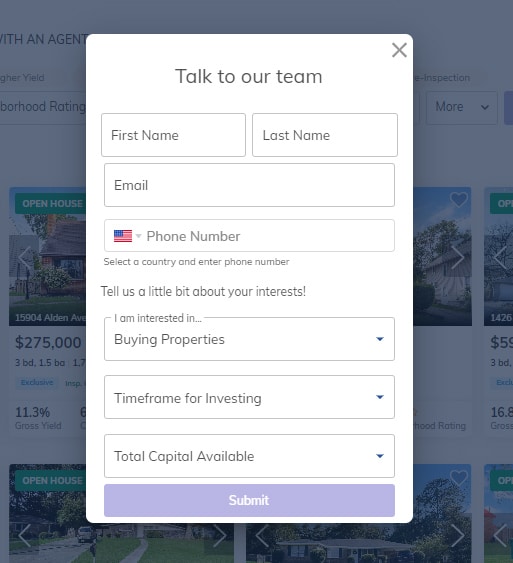

- Phone and email support for general inquiries

- Different teams for different types of inquiries

- Continuous support for Roofstock rental owners

If you have general questions, contact Roofstock’s customer support via phone and email. If you’re planning to buy a rental property, schedule a call, and a Roofstock representative will connect with you for more details. Roofstock also has Seller Support for serious owners who want to sell on the Roofstock Marketplace.

Roofstock customer support

If you’re a real estate agent who wants to work with Roofstock’s clients, reach out to Agent Support. For rental property owners on Roofstock, you will be connected to property managers who oversee your properties and assist you if you have questions or other concerns.

Roofstock’s Ease of Use

Roofstock is fairly straightforward. To sign up for a free account, add your email address and create a password. Fill in your personal information afterward and build your investor profile (you can skip the last step). Once your account is set up, start browsing properties, portfolios, and short-term rentals on the Roofstock Marketplace.

Buying a Roofstock property is done 100% online—just search for a property, analyze its investment potential, check out, and close. If you want to sell your property, you will have to sign a listing agreement, publish your listing on the Marketplace, negotiate, accept or reject offers, and close the transaction.

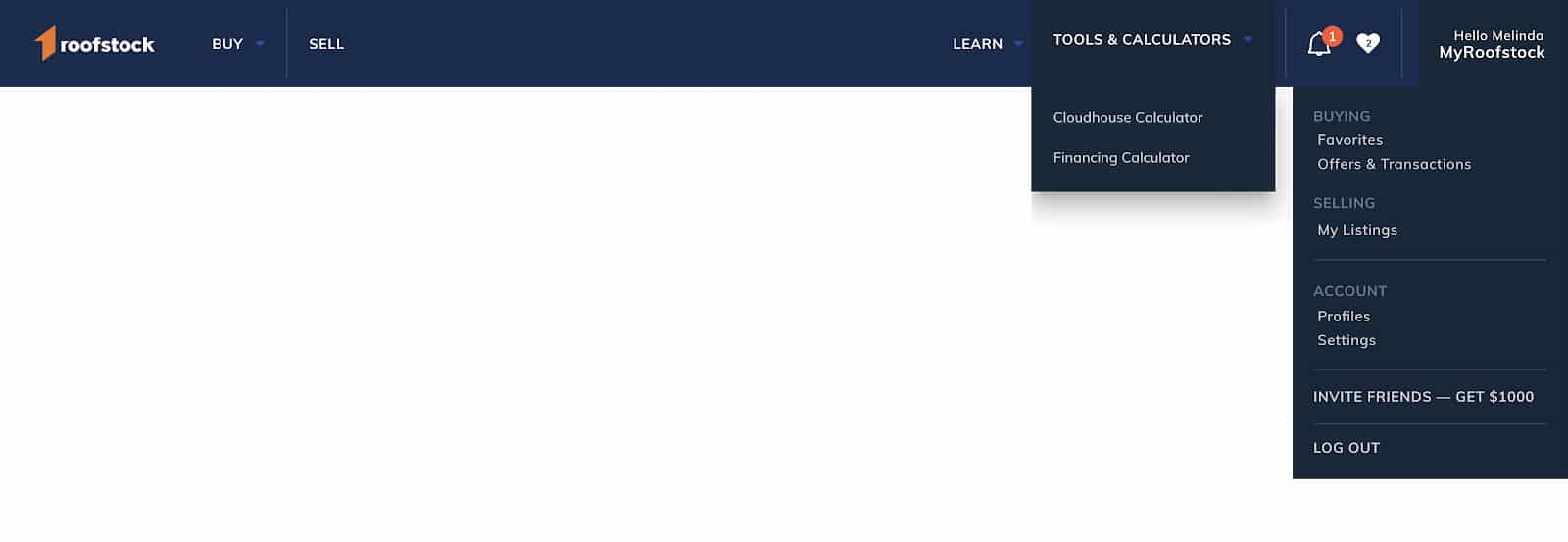

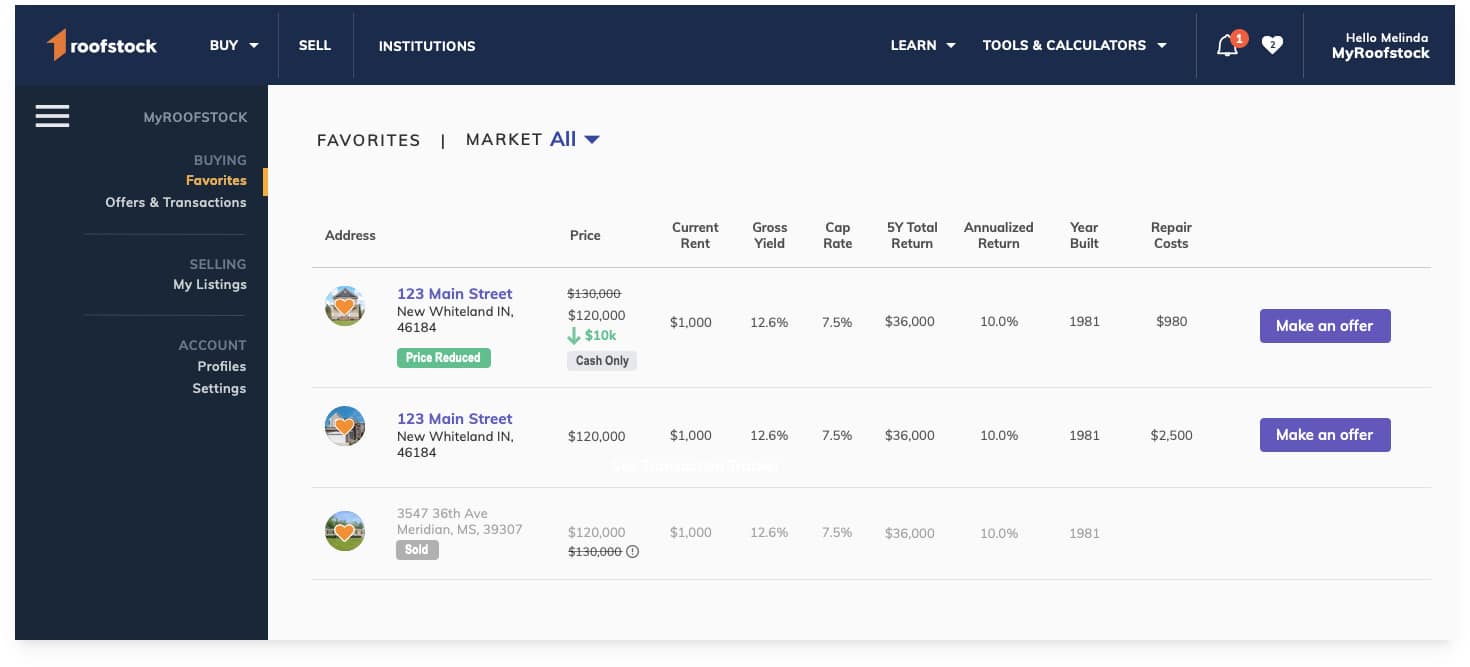

The MyRoofstock dashboard helps investors customize their buying and selling experience. With MyRoofstock, buyers can easily save their favorite properties, monitor property status and pricing changes, and view the certification status of a listing. Sellers can edit their listings, respond to offers, make counteroffers, and manage documents on their MyRoofstock dashboard. Users can also quickly access the Cloudhouse Rental and Financing Calculators on the dashboard.

MyRoofstock dashboard

If you’re new to Roofstock’s website, you might get overwhelmed by loads of information presented on the homepage. Since Roofstock offers multiple features and services, navigating the website might take time to find information about a feature. Nevertheless, you can easily jump to certain pages through the links on the top navigation bar and website footer.

How We Evaluated Roofstock

We conducted a comprehensive Roofstock review by analyzing various factors. Our assessment involved a thorough examination of numerous turnkey real estate companies, taking into account general and advanced features, user experience, customer reviews, pricing structure, and the intuitiveness of its user interface.

Our main objective was to determine the viability of Roofstock, especially if you’re planning to invest in real estate. Here is a detailed breakdown of the criteria:

- Turnkey process: This investment process includes property rehabilitation, tenant selection, fully operational, and rent-ready properties to investors.

- Average return on investment (ROI): The profitability and potential financial gains offered by the turnkey properties provided by each company.

- Location of inventory: The areas in which the company’s inventory is located were taken into account to determine the geographic diversification options.

- Average property prices: Allows investors to gauge affordability and align their investment goals with the price range that suits their budget and investment strategy.

- Suitability for investors: Identifying which types of investors each company is most suitable for helps potential investors determine if the company aligns with their investment objectives. They could be new to real estate investing, experienced investors, vacation property owners, and investors focused on retirement income.

- Fees: The fees charged by the company, like marketplace fees or property management fees, enable investors to consider the cost implications and factor them into their investment calculations.

Frequently Asked Questions (FAQs)

Yes. Based on Roofstock reviews that considered various factors, including its features, expert opinions, and customer feedback, Roofstock is a reliable company and is ideal for investors looking to invest in turnkey SFRs. It also provides a team of experienced property managers to guide you and help optimize your investments.

Yes, Roofstock is a good way to invest, especially for newbies who want to get their feet wet with low- to moderate-risk investments. It provides a range of investment options and features, and its experienced team can help you optimize your potential returns while also protecting your investments.

The 50% rule in real estate is one way to estimate the profitability of a rental property. This general rule of thumb suggests that about half of the gross income generated by your property will go toward operating expenses. These expenses can include property taxes, insurance, maintenance, repairs, vacancy costs, and property management fees. The other half of the income will be your profit. It’s important to note that this rule isn’t always accurate, but it can be a helpful tool for estimating profitability.

Bottom Line

Roofstock is an online real estate investment company that provides several options for investors looking to diversify their portfolio with SFRs. Based on this Roofstock review, customers liked how it simplifies real estate rental investing—from buying or selling a turnkey property to remotely managing a property and earning passive income by investing in property shares.

So, is Roofstock worth it? While Roofstock can be expensive for retail and non-accredited investors, it’s a sound alternative to hands-on property management and traditional homebuying/selling.