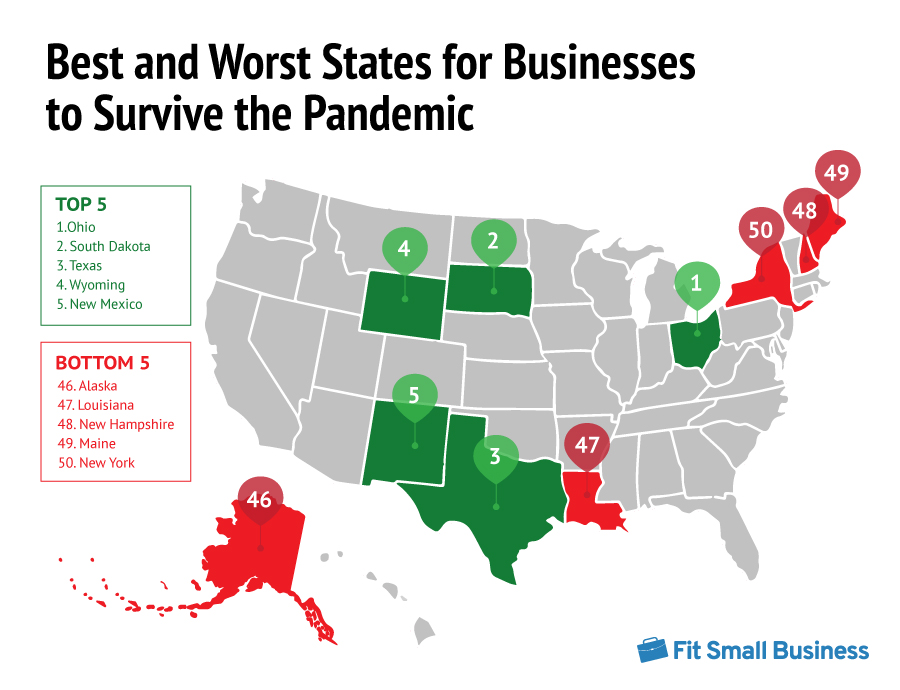

Our 50-state analysis shows that business owners in Ohio (which ranked #1) were best situated to weather the economic turmoil of the COVID-19 pandemic. Those in New York (#50) fared the worst.

Fit Small Business surveyed every state using metrics including overall financial health, infection rates, emergency reserve totals, and consumer confidence to determine in which states businesses were most likely to survive the coronavirus-driven recession. We then weighed these (see methodology below) to come up with the final rankings:

- Economic And Financial Health (20%)

- Least Economic Stressors (25%)

- Emergency Reserves & Relief (25%)

- COVID-19 Rates & Healthcare Infrastructure (20%)

- Consumer Confidence (10%)

Like New York, other states that are dependent on international commerce and tourism such as California (#35), Nevada (#43) and Florida (#44) made poor showings on our list. In contrast, the Midwest performed well in the rankings, with South Dakota (#2), Iowa (#7) and Nebraska (#10) following Ohio in the top spot. These Midwestern states not only are significantly less traveled to than their more high-profile counterparts, they also generally have less population density.

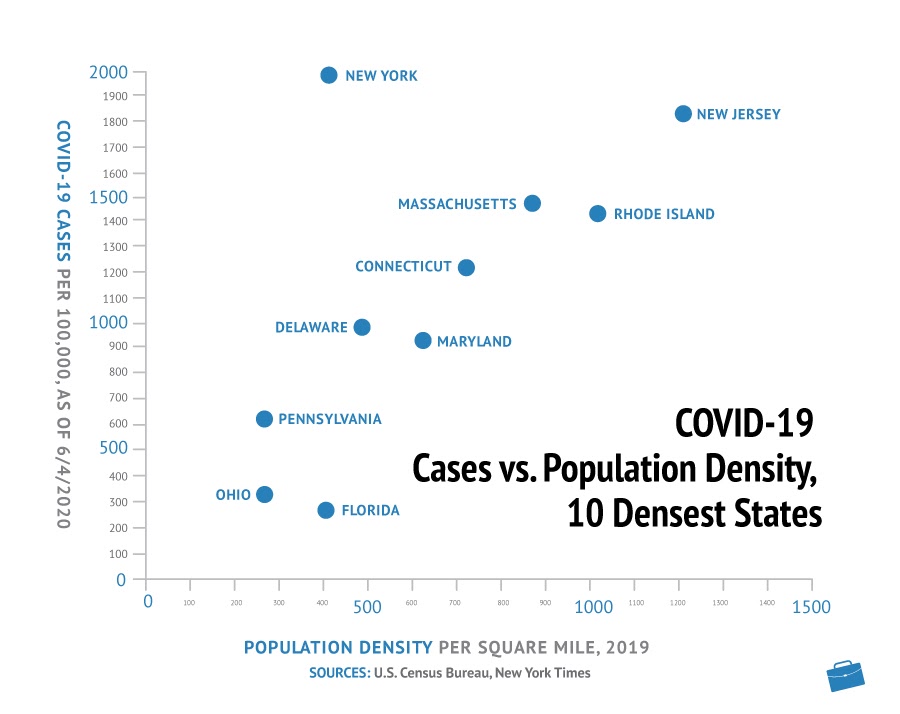

Eight out of the top ten most population-dense states—including New York, New Jersey, Rhode Island, Massachusetts, and Maryland—also have the highest coronavirus rates. This tracks with a recent study by Moody’s Analytics identifying low population density as a key factor in the economic recovery of American cities.

The chart above shows a clear correlation between population density and infection rate—with one notable exception. New York itself is the outlier in this infographic. Though the state is moderately large, two-thirds of its population lives in New York City. Though the state overall is not particularly dense, the high density in New York City has been one factor (out of many) which has contributed to the high infection rate in the city, inflating the state’s totals. Over half of the current COVID-19 cases in New York are in the New York City metropolitan area.

New York City is also the most visited city in the U.S., making it even more vulnerable to COVID-19 infections from overseas and other parts of the nation. Eight out of the ten most travelled-to cities in the U.S. are located within states reporting some of the highest number of cases of the virus.

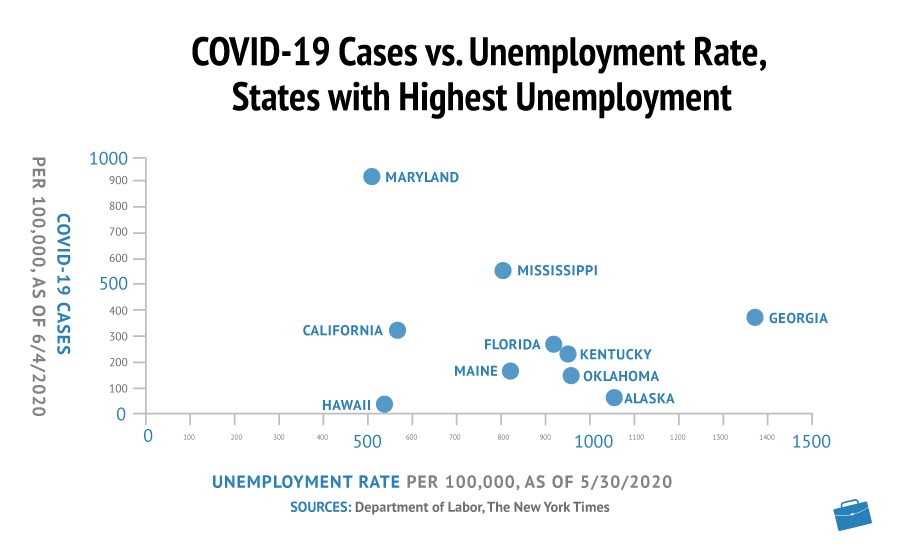

But as this chart illustrates, states may also suffer economically at the hands of the pandemic even if they have both low COVID-19 rates and are far away from their more afflicted neighbors. Hawaii, whose economy largely relies on tourism, has some of the lowest coronavirus rates—but the highest unemployment numbers. Alaska, dependent on air travel, is in a similar predicament. Travel restrictions during the pandemic have hurt both these states.

Kentucky’s outsized reliance on manufacturing jobs may explain its place on this chart; those jobs have suffered. And in Georgia’s case, several explanations have been offered for the high unemployment numbers, including a higher than usual claim processing rate, more jobs in impacted industries, smaller firms, and even an anti-union climate.

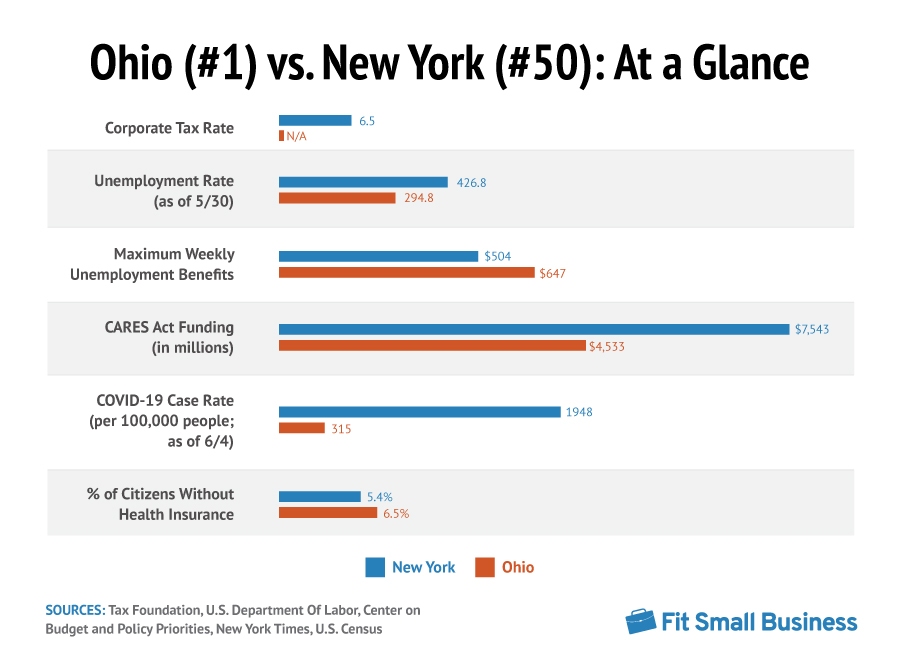

One of the most startling finds in our rankings are the showings of both Ohio and New York. The 9th most population-dense state and home of several bustling cities and modest business hubs, Ohio would at first glance seem to share at least some of the hardships as New York. And while it is true that Ohio is experiencing its share of economic and job losses due to the pandemic-driven recession, it nonetheless made the top of our list.

Ohio combines the best factors of New York or California with all the advantages of being a smaller state in the Midwest. Declared by Forbes in 2017 to be the best state to launch a start-up, it has a lower cost-of-living and cheaper real-estate than more high-profile locations. Tucked into the middle of the country and #31 of most traveled-to states, Ohio enjoys both relative isolation and access to Fortune 500 companies and over 200 institutions of higher learning.

Moreover, with a Budget Stabilization Fund of $2.7 billion, Ohio was set up better than New York for a crisis before any of this started. New York City does not have a similarly robust reserve fund, and the state as a whole ranked 44 on our list for overall “rainy day” savings. Budget experts, including City Comptroller Scott Stringer, have warned for years that a sustained crisis would quickly wipe out NYC’s financial reserves.

Indeed, per a Boston Consulting Group report requested by New York governor Andrew Cuomo, New York may need three years to recover from the economic impact of the coronavirus. BCG also projected that the state could lose as much as 14% of its GDP, with a revenue shortfall of $13.3 billion, and that federal funding would be necessary for the state to work its way back to solvency.

Having one of the tightest and comprehensive COVID-19 lockdowns in the nation, though unquestionably effective in fighting the spread of the virus, may have also impacted New York’s ability to bounce back financially. Fortune estimates that the state’s economic fallout from the lockdowns will total $63 billion, or $173 million per day they are in effect. In contrast, while Ohio also has lockdown and business restrictions in place, they have not been as comprehensive or as long-lasting as New York’s.

The Top Ten States

1. Ohio

With a diversified economy boasting everything including manufacturing, financial services, information technology, healthcare, and agribusiness, Ohio is very well positioned to weather the current recession. Its robust financial crisis funds, as noted by its rank at #9 in our Emergency Reserves & Relief category, provide it with a “cushion” states like New York do not have. Our data also indicates that the state had a strong baseline economic health prior to the COVID-19 outbreak. And its geographic location and relative independence from the hardest-hit industries give Ohio an extra survival edge.

Another factor in the state’s favor is the plethora of Fortune 500 companies at its financial core, including Proctor & Gamble, Goodyear, Kroger, Progressive Insurance, and many more. Though the state’s economy has undoubtedly been impacted by the COVID-19 pandemic, the “next Silicon Valley” in the Midwest combines the best qualities of a major economic hub with a lower cost-of-living, so it’s no surprise that Ohio tops our list for surviving the new recession.

2. South Dakota

South Dakota has entered the age of COVID-19 with relatively little financial baggage, ranking at #1 in our Least Economic Stressors category. It also had the second-lowest unemployment rate, possibly explained by the fact that it had very few official quarantine restrictions in place as well as possessing a small population. Moreover, the state touts their limited taxes and low cost-of-living as boons to the business owner, and those factors have led to fewer jobs being lost.

In a time where international supply chains can be brought to a screeching halt by a global pandemic, South Dakota is at the heart of American agriculture. Boasting large swathes of land for crops and livestock, it’s no wonder that agriculture is its #1 industry. If it can prevent future COVID-19 outbreaks in food manufacturing facilities like the one in the Smithfield Foods plant in April, South Dakota has a great shot at recovering from the pandemic.

3. Texas

Texas is another state on our list approaching the new recession with a solid economic foundation. It ranked #1 in our Emergency Reserves & Relief category, having the second-highest CARES Act endowment at over $10 billion. The state also possesses adequate economic reserves and offers decent compensation for the unemployed. When these factors are combined with a relatively low cost of living and what is considered to be a pro-business environment, Texas just might be “the case study for economic recovery from the COVID-19 recession.”

Like Ohio, Texas may also be a case of those states with the biggest balance between city and rural environments faring the best post-coronavirus. Despite having the second largest economy by GDP in the U.S. and being the second most populous state in the nation, it only ranks 24th in population density. Texas also has an economy based on a wide variety of industries, including agriculture, aeronautics, and computer technology. So while the state has indeed taken its share of bumps from the current recession, it seems that it has enough resources to weather the storm.

4. Wyoming

#1 in our 50-state sub-rankings based on Economic and Financial Health, Wyoming has a very low cost of living and no corporate income tax. It also has no sales tax on energy or equipment used in manufacturing, and some of the lowest property taxes in the USA. Our research also revealed that the state also ranked #1 for “rainy day” reserves in the bank. So in a nation turned upside-down by the economic ravages of the coronavirus, Wyoming might seem attractive to the business owner looking for a brand new start way out West.

Wyoming also has the second lowest population density in the United States as well as some of the lowest COVID-19 infection rates as of this writing. Perhaps the state does not seem like much of a bustling metropolitan paradise, but in a post-pandemic world such a location could be more attractive to both business owners and citizens. It also has vast natural resources, which are a boon in a world suffering from supply chain breakdown.

5. New Mexico

New Mexico earned high marks in a number of metrics that indicate the ability to survive the pandemic and recession. The state ranked #4 for Least Economic Stressors, with low unemployment rates and manageable Medicaid spending increases. The state’s government is also very active in the development of its economy and infrastructure, offering numerous tax credits and exemptions. Furthermore, New Mexico does not collect inheritance, estate, or sales taxes, and is considered one of the largest tax havens in the U.S. As in the cases of Wyoming and South Dakota, New Mexico offers the forward-thinking entrepreneur a “blank slate” to anticipate the needs of the nation in the future.

The state’s diverse economy has also contributed to its ability to survive the recession. While the nation’s oil industries as a whole indeed suffered great losses so far this year, New Mexico’s substantial slice of it provided the state last year with a record $3.1 billion in revenue to help ride the pandemic out. And in possibly one of the strangest potential post-coronavirus success stories, New Mexico might become a new mecca of filmmaking. Gaining a reputation for a well-managed response to COVID-19, its State Film Office says it is receiving numerous inquiries from studios to relocate their projects because “it is safer.”

6. Arkansas

Arkansas excels in a range of categories for our rankings, including Economic & Financial Health, Least Economic Stressors, Emergency Reserves & Relief, and even Consumer Confidence. The state’s governor Asa Hutchinson credits its lack of an official stay-at-home order with keeping the state’s unemployment rate 4% lower than the national average. Combined with a low cost-of-living and population density, this is another state that might have a good shot at emerging from the current crisis.

Moreover, a state like Arkansas which is able to produce a substantial amount of its own exports in a time of international supply chain shock seems to have an advantage. In 2018, it exported $6.4 billion in goods to the world, including aircraft, produce, organic chemicals, and steel. The state is home to six Fortune 500 companies including the #1 corporation in the world, Walmart. When one considers that Walmart is one of the few retailers still booming during this economic downturn, it’s a nice position for Arkansas to be in.

7. Iowa

Iowa ranked #3 in our Least Economic Stressors category, with little projected fiscal shock as the result of COVID-19. Our data also reveals a low overall unemployment rate, and indeed the state had a surprising drop in unemployment claims at the beginning of June. Another factor towards Iowa’s stability in the face of the coronavirus is that it possessed $800 million in reserves with a projected budget surplus of $200 million before the pandemic even began.

The state also does not primarily rely on industries hurt by COVID-19. The biggest sector of Iowa’s economy is food manufacturing, and companies with processing plants in the state include General Mills, Quaker Oats, ConAgra Foods, Tyson Foods, and Heinz. And with thousands of financial firms, Iowa has also been called “the insurance capital of the world” by the U.S. Chamber of Commerce. All this, plus a low population density, makes the state another ideal location for businesses post-coronavirus.

8. Utah

Utah ranked at #2 in our Least Economic Stressors category, and had the #1 lowest unemployment rate. At the end of May the state drew headlines for how much their unemployment had dropped, with a cautious reopening of the economy a possible factor for their success. Also helping Utah is the fact that for the past two years the state has had the highest export growth rate in the nation, and some experts believe that it could become a significant force in the global economy post-coronavirus.

Like its neighbor Wyoming, Utah is another doubly-landlocked state with low population density and a high reserve of natural resources. The state has emerged from more than a century of a focus on mining and agriculture to diversify its industries for the future. This includes an explosion of tech startups, making Salt Lake City a version of Silicon Valley with a much lower cost of living.

9. West Virginia

West Virginia ranked #1 in our COVID-19 & Healthcare category, and their focus on hospitals and medical services is a major reason. The state has well over 60 hospitals and health systems, contributing over $9.8 billion to the state’s economy and employing over 44,000 people. It also, at the time of this writing, has the 2nd least cases of COVID-19 within the nation.

To be fair, the Mountain State is facing its share of economic challenges as the result of the pandemic, and an “economic stress test” conducted by Moody’s Analytics projected that it could face a $1.98 billion budget shortfall & 41.7% decline in the economy. That said, given West Virginia’s paucity of coronavirus cases, there will probably be some leftovers from the $1.6 billion in federal funds it received for COVID-19 treatment and testing.

10. Nebraska

Nebraska’s ability to keep its unemployment numbers down is a big reason it has made our top ten of the states best able to survive the pandemic. The state had the 9th lowest unemployment rate, and ranked at #8 in our overall Least Economic Stressors category. A possible reason for Nebraska’s relative lack of job losses during the pandemic is its very diversified economy focused on “necessity” industries such as food production, finance, and insurance.

The state also maintained a low unemployment rate during the years leading up to the pandemic, and enjoyed a relatively healthy and growing economy before the economic downturn. Twenty-six Nebraska businesses made Inc’s 2019 list of the fastest-growing 5000 companies in the nation, with a heavy concentration on medical staffing, software, and IT management. The state appears to definitely have a fighting chance in the “new normal” of the nation’s economy.

Definitive Ranking of All 50 States

OVERALL STATE RANKING | STATE | OVERALL STATE SCORE |

|---|---|---|

1 | Ohio | 12.7 |

2 | South Dakota | 13.9 |

3 | Texas | 14.45 |

4 | Wyoming | 15.05 |

5 | New Mexico | 15.85 |

6 | Arkansas | 16.1 |

7 | Iowa | 16.35 |

8 | Utah | 17.7 |

9 | West Virginia | 17.8 |

10 | Nebraska | 18.8 |

11 | Idaho | 19.3 |

12 | Tennessee | 20.4 |

13 | Minnesota | 20.65 |

14 | Oklahoma | 20.9 |

15 | North Dakota | 20.9 |

16 | Vermont | 20.9 |

17 | Alabama | 21.65 |

18 | North Carolina | 22.3 |

19 | Pennsylvania | 22.55 |

20 | Oregon | 23.3 |

21 | Georgia | 23.7 |

22 | Colorado | 24.85 |

23 | Massachusetts | 24.85 |

24 | Montana | 24.9 |

25 | Missouri | 25.9 |

26 | Mississippi | 26.3 |

27 | Kentucky | 26.45 |

28 | Michigan | 26.55 |

29 | Washington | 26.6 |

30 | Indiana | 26.65 |

31 | Kansas | 28.85 |

32 | Arizona | 28.9 |

33 | Connecticut | 29.45 |

34 | Hawaii | 29.6 |

35 | California | 29.9 |

36 | Rhode Island | 30.2 |

37 | Illinois | 30.65 |

38 | Virginia | 31.3 |

39 | South Carolina | 31.5 |

40 | Delaware | 31.6 |

41 | Wisconsin | 32 |

42 | Maryland | 32.4 |

43 | Nevada | 33.35 |

44 | Florida | 33.6 |

45 | New Jersey | 33.65 |

46 | Alaska | 34.35 |

47 | Louisiana | 35.6 |

48 | New Hampshire | 36.3 |

49 | Maine | 36.55 |

50 | New York | 37.45 |

Click here to see all data considered in our study.

Full Methodology

Our ranking of the best states to survive the current pandemic was based on five categories, each one containing a number of relevant metrics derived from authoritative sources such as the U.S. Department of Labor, Moody’s Analytics, the U.S. Census, the Tax Foundation, the New York Times, and the Center on Budget and Policy Priorities. We analyzed the data for these metrics and assigned weights to each based on their relative importance to recession survival:

1. Economic And Financial Health (20%):

For this metric we analyzed core indicators of a state’s health, Cost-Of-Living and State Corporate Income Tax Rate. It was important to establish the fiscal health of these states before the pandemic hit, and determine which ones were more ideal for business owners. We weighed this category slightly lower than some of the others because we are focusing mostly on the current economic impact of COVID-19.

2. Least Economic Stressors (25%):

Metrics considered for this category include the most current unemployment claim numbers available at the time of this writing, which were converted into rates using population data. We also factored in the “Baseline Fiscal Shock” projections from Moody’s Analytics, which were determined by a state’s Tax Revenue Shortfall and Medicaid Spending Increase due to COVID-19.

3. Emergency Reserves & Relief (25%)

This section analyzes the overall reserve of funds each state has to help provide financial relief to those impacted by the pandemic, as well as fill budget gaps cratered by the economic downturn. These metrics include Unemployment Compensation, Funds Received From The CARES Act, and State “Rainy Day” Funds. This data provides an excellent baseline from which to predict a state’s ability to absorb the economic fallout of the coronavirus.

4. COVID-19 Rates & Healthcare Infrastructure (20%):

Of course, it was essential for a study like this to include the most current COVID-19 case data, and we included Infection and Mortality Rates. Also factored into this category are # Of Citizens With Health Insurance and # of Hospitals.

5. Consumer Confidence (10%):

Finally, we considered a recent state-by-state snapshot of Consumer Confidence, provided by Morning Consult. This is more of a subjective metric reflecting the general mood within each state regarding economic recovery from the pandemic, and consequently we weighed this category much less than the others in this study.

Bottom Line

The rankings of states on our list reveal several characteristics of an ideal state to survive the current pandemic. These include pre-coronavirus economic factors such as having a low cost of living, levying low tax burdens on businesses, and having a robust “rainy day” reserve fund for emergencies. Another key aspect of a state’s ability to recover is the diversification of its core industries, especially those sectors less directly impacted by COVID-19. And finally, elements such as population density and volume of travelers can play an important role in both increasing infections and consequently damaging the economy of the state.

Our study also underlines the inescapable fact that all 50 states are in this situation together, highly interdependent not only upon each other but the larger global community as well. As we consider the myriad factors that have led the United States to this current recession, it is important to also map out the future.