A cash-basis taxpayer is an individual or tax-paying entity that accounts for their business activity using the cash-basis method of accounting.

What a Cash-basis Taxpayer Is & How Cash-basis Accounting Works

Under cash-basis accounting, the taxpayer records income once payment is received and records expenses when payments are made. When noncash payments are received as income, the amount recorded is the fair market value (FMV) of the property received. Payments made with a bank credit card are deductible as cash payments, whereas payments made with a store credit card are treated as an account payable and not deductible until the cash is paid to the store.

Key Takeaways:

- Under the cash-basis method, income is considered received once the business owner has the right to the funds—even if they choose not to withdraw them.

- The method of accounting is elected by checking the appropriate box on the first tax return filed for the business.

- Prepaid expenses may need to be deducted over time if the benefit from prepayment exceeds 12 months

How Does Cash-basis Accounting Work?

Under the cash-basis method, income is recognized when payment is received and expenses are recognized when they are paid. This is contrasted with the accrual method The cash-basis and accrual methods are two of the most commonly used accounting methods for US taxpayers , where income is recorded when it is earned and expenses are recorded when they are incurred.

When Should Income Be Considered Received?

Cash-basis income is considered received once it is available in a location over which you have ownership. This means that if a customer pays their invoice electronically and you can move or control the funds, then the income is considered received.

This idea is referred to as constructive receipt, a fundamental principle of cash-basis accounting. Funds constructively received should be included in income in the year the funds were accessible, along with actual receipts of income.

1. Constructive Receipt

- Joe is a plumber who replaced two bathroom sinks on December 18 for Kate.

- Kate mails a check to Joe on December 24, 2023.

- Joe receives the check on December 27 but doesn’t deposit the check until January 12, 2024.

Since Joe had unrestricted access to the funds in 2023 but made the choice not to deposit the check until 2024, he constructively received the payment. He should include it in his 2023 income.

2. Not Constructive Receipt

- Kate mails a check to Joe for his services on December 24, 2023.

- Due to the uptick in holiday mail, the check takes a detour around the US and doesn’t reach Joe until January 12, 2024.

- Joe did not have access to the funds until the check reached him on January 12.

As a result, there was no constructive receipt until Joe received the funds in 2024. He should include Kate’s payment in his 2024 income.

Constructive Receipt Deferral Through Contract: The tax court has allowed taxpayers to circumvent constructive receipt by contractually agreeing with a customer to defer payment. With payment deferred through the contract, income referenced in the contract does not need to be reported until it is received.

The tax court has permitted income deferral for contracts put in place before the payment is due. However, in the shadow of tax court losses, the IRS has noted that it won’t rule on constructive receipt deferral—unless the payment deferral contract is put in place before the income is earned.

Who Can Use the Cash-basis Method of Accounting?

As a general rule, most taxpayers can use the cash-basis method of accounting, except for:

- C Corporations (C-corps) with over $30 million in gross receipts over the prior three years beginning in 2024 The average gross receipts allowed as a small business taxpayer is indexed annually for inflation.

- Partnerships with at least one C-corps as a partner

- Taxpayers accounting for inventory (accrual method required as a general rule)

Partnerships with a C-corps as a partner may still be eligible to use the cash-basis method if the corporate partner is considered a small business taxpayer. A small business taxpayer has an average of $30 million or less in gross receipts over the previous three years beginning in 2024. The $30 million threshold is adjusted every year by the IRS to account for economic changes.

Note that businesses exempted from the cash basis method for inventory accounting may use the cash basis method of accounting to record other income and expense items. Also, entities that are required to use the accrual method of accounting for inventory may still be permitted to use the cash-basis method of accounting for all income and expense items if they meet the criteria for a small business taxpayer.

Income and Expenses Treatment Under the Cash-basis Method

See how sample income and expense items would be treated under the cash-basis method of accounting.

Treatment of Prepaid Expenses Using the Cash-basis Method

In general, under the cash-basis method, expenses are deductible when they are paid. However, there are certain expenses like rent and insurance, that—when prepaid—provide considerable value beyond the end of the year. For a prepaid expense, both cash and accrual taxpayers must record it as an asset and deduct an equal portion over the term that the prepayment covers.

However, if either of the situations below apply, the prepaid expense can be deducted in full and does not have to be recorded as an asset.

- The value of the benefit is used up within 12 months from the first day the benefit started.

- The benefit is used up before the end of the same tax year the payment was made.

Electing the Cash Method and Changing Accounting Methods

The IRS allows taxpayers to select an accounting method of their choice, as long as it accurately depicts the taxpayer’s income and expenses. It’s important to choose one that meets this objective, as the IRS retains the right to disallow methods that are deemed inadequate.

You elect your chosen method of accounting by checking a box in the following sections of your initial business return:

- Sole proprietorship/Single-member LLC: Schedule C, Page 1, line F

- S-corp: Schedule B, line 1

- C-corp: Schedule K, line1

- Multi-member LLC: Page 1, line H

- Partnership: Form 1065, line H

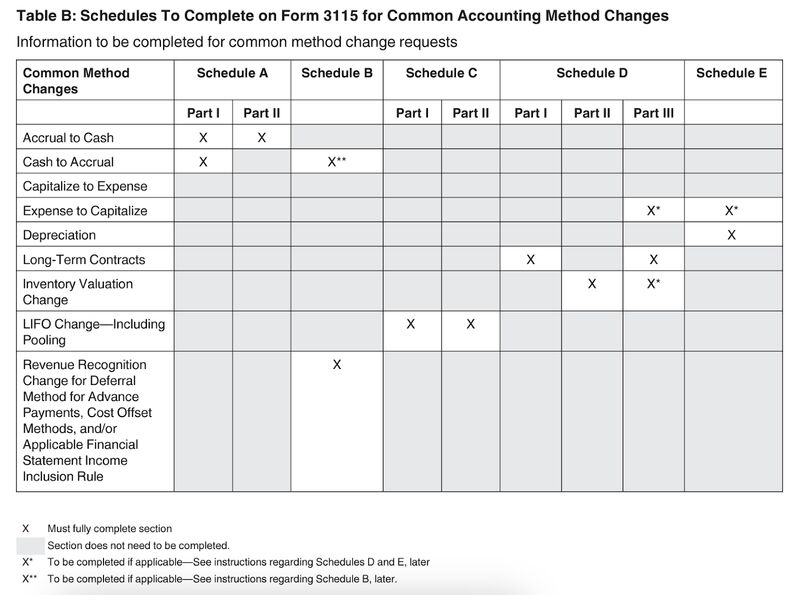

The cash-basis method of accounting is selected in the first year a business return is filed and is subsequently reported on all future returns. Changing to or from the cash method requires IRS consent, which is requested by completing IRS Form 3115 and populating the following sections:

Table B on IRS Form 3115 (Source: IRS Form 3115 instructions)

The IRS has two types of changes: automatic and non-automatic.

- Changing between the cash and accrual methods of accounting is an automatic change—and with an automatic change, Form 3115 is completed and filed with the tax return for the year of the change. The change is considered automatic because advance IRS consent is not required.

- Non-automatic changes require that Form 3115 be filed as early as possible in the year of change, prior to the filing of the tax return.

Frequently Asked Questions (FAQs)

Companies that can’t use the cash-basis method of accounting include large C-corps, partnerships with C-corps, and businesses that keep inventory and do not meet the small business taxpayer exception.

You do not have to use the same accounting method for your independent businesses—as long as accounting records for each company are kept separate.

The cash-basis method of accounting is one of the simplest methods of accounting, but it is generally considered to be a less precise method of determining income and expenses than the accrual method. Many taxpayers like the cash method because it matches the recognition of taxable income with the receipt of cash that is then available to pay the tax.

Bottom Line

A cash-method taxpayer reports income when it is constructively received and reports expenses when they are paid. In general, most taxpayers who can use the cash-basis method of accounting do so due to its simplicity. Certain taxpayers are prohibited from using the cash-basis method of accounting—unless they meet the exception for small business taxpayers. The small business taxpayer exemption allows for a generous amount of gross receipts to qualify, so many businesses that might otherwise have to use the accrual method may still be able to meet the criteria set for a cash-method taxpayer.