The steps below are designed to help you make sense of the IRS Form 8846 instructions for claiming the FICA tip credit. Examples of the completed form have been provided for reference. To prepare the form, you’ll need to have the company’s legal name, EIN, and total tips paid to employees during the year. Form 8846 can be found in most tax preparation software and on the IRS website.

Key Takeaways:

- Federal minimum wage of $5.15 an hour must be used in the calculation, regardless of the existing state or federal minimum wage amount.

- Food and beverage employers who pay:

- less than $5.15 per hour will calculate the shortfall between wages paid and the minimum wage by allocating tips (shown in Step 2).

- $5.15 or more an hour do not need to adjust tips; FICA tip credit is 7.65% of the tip amount.

Our step-by-step Form 8846 instructions are illustrated through two examples. In the first, the employer is paying less than the $5.15 hourly minimum wage for FICA tip credit purposes, whereas in the last, the employer is paying wages of $5.15 or more per hour. The calculation for the latter is much simpler, as no true up adjustment is necessary to allocate tips to wages for purposes of meeting the minimum wage requirement.

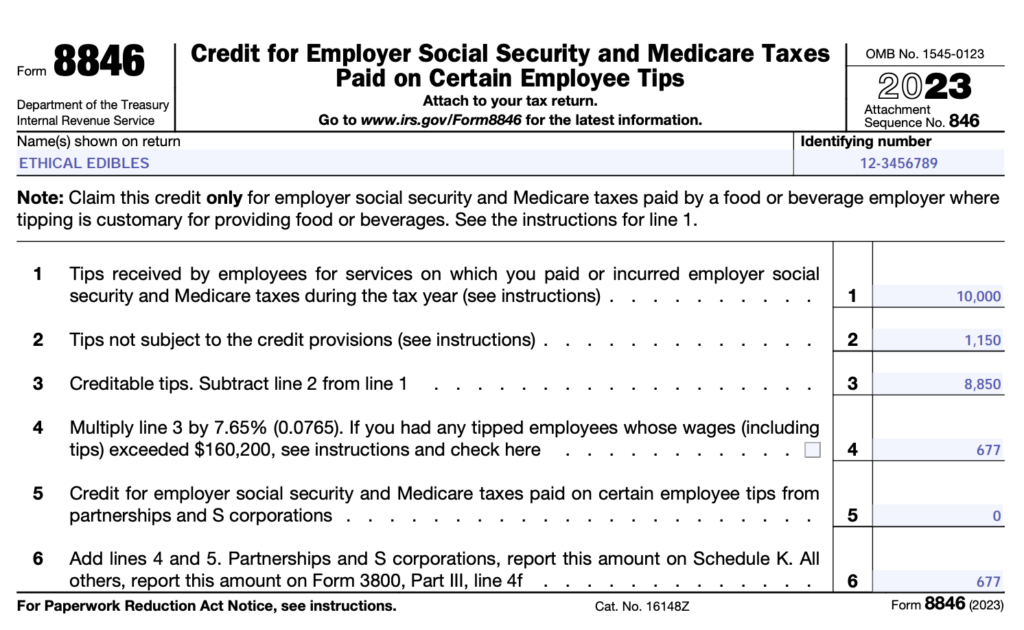

Example 1: Employer Paying Less Than $5.15 per Hour

Ethical Edibles reported employee tips of $10,000 to the IRS in 2023. For purposes of this example, they paid wages of $4 per hour for a total of $4,000 in wages.

Form 8846 for employer paying less than $5.15 an hour

Step 1: Provide Basic Business Info and Total Tip Amount

Enter the business name and EIN at the top of the IRS Form 8846. Enter the tips subject to FICA taxes on line 1. These tips should include gratuities received for the provision or delivery of food or beverages in situations where it’s typical for tips to be furnished.

For example, tips would not be typical in a fast food restaurant, so those tips would not be reported here. Ethical Edibles meets the criteria to report the totality of its tips on line 1.

Step 2: Calculate Shortfall Between Minimum Wage and Wages Paid

When an employer pays less than the $5.15 federal minimum wage The federal minimum wage amount of $5.15 must be used in the calculation, regardless of the existing state or federal minimum wage amount. amount used to calculate the credit, the hypothetical amount of compensation that would have been paid if they had paid the hourly wage is presented on this line. When an employer pays a federal minimum wage of $5.15 or more, zero is input on line 2.

Given that employees worked a total of 1,000 hours, the total compensation Ethical Edibles would have paid given a rate of $5.15 would be $5,150, as shown below.

Hours Worked | 1,000 | |

Hourly Wage | $4.00 | |

2023 Tip Income | $10,000 | |

CALCULATIONS | TOTALS | |

Actual Wages | $4 × 1,000 hours | $4,000 |

Minimum Required Wages | $5.15 × 1,000 | $5,150 |

Wage Shortfall (Tip Allocation) | $5,150 - 4,000 | $1,150 |

Step 3: Calculate Creditable Tips

Creditable tips are the amount of tips for which you can claim the 7.65% tip credit after a portion is allocated to wages under $5.15 per hour. Subtract line 2 from line 1 to arrive at the creditable tips shown on line 3.

Ethical Edibles’ tip adjustment = $10,000 – $1,150 = $8,850

Step 4: Calculate the FICA Tip Credit

To arrive at the FICA tip credit, take the line 4 amount and multiply it by 7.65%. This percentage represents the combined tax rate for Social Security and Medicare tax. A special calculation applies when an employee’s wages and tips exceed the Social Security wage base The Social Security wage base is $168,600 for 2024 and $160,200 for 2023. , and the form instructions should be consulted in this situation.

Ethical Edibles’ FICA tip credit amount = $8,850 × 0.0765 = $677.03

Step 5: Include FICA Credit From Partnership or S-corp Investments

On line 5, enter any credit for employer Social Security and Medicare taxes paid on specific employee tips flowing through from partnerships and S corporations (S-corps). These amounts would come from the partnership or S-corp Schedule K-1 issued from that business return. Ethical Edibles is not an owner in any partnerships’ or S-corps’ investments, so zero is entered on this line.

Step 6: Sum the FICA Credit From Lines 4 & 5

Add the amounts from lines 4 and 5 to arrive at the total credit to input on line 6. Ethical Edibles is organized as a partnership, so the amount on line 6 carries to Schedule K for the entity’s business return.

Per the form instructions, partnerships and S-corps should report the line 6 amount on Schedule K. All other entity types should report this amount on Form 3800, Part III, line 4f. Each partner of Ethical Edibles must also file Form 8846 and report their share of the credit on line 5.

Step 7: File the Completed Form

The completed Form 8846 should be filed with the entity’s business income tax return. It is due on the same due date as the income tax filing.

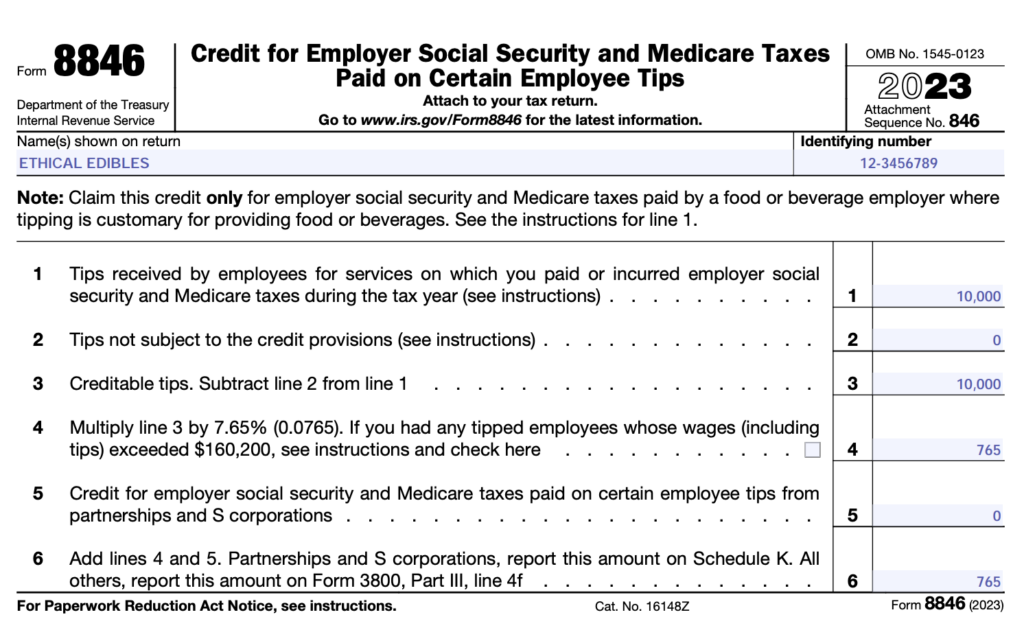

Example 2: Employer Paying $5.15 or More per Hour

For this sample, let’s assume that Ethical Edibles again reported employee tips of $10,000 to the IRS in 2023. It paid wages of $11 an hour for 1,000 hours, for a total of $11,000 in wages.

Form 8846 for employer paying $5.15 or more per hour

Step 1: Provide Basic Business Info and Total Tip Amount

As in the previous example, Ethical Edibles would need to enter the business name and EIN at the top of Form 8846 and report the total tips of $10,000 on line 1.

Step 2: Calculate Shortfall Between Minimum Wage and Wages Paid

Since Ethical Edibles pays its employees $11 per hour, its hourly wage exceeds the federal minimum wage of $5.15. As such, zero is input on line 2.

Step 3: Calculate Creditable Tips

Since Ethical Edibles already pays more than $5.15 hourly, the credit is calculated on the full $10,000 of reported tips.

Step 4: Calculate the FICA Tip Credit

The $10,000 on line 4 is then multiplied by 7.65% (0.0765). For Ethical Edibles, this amount is $765. As noted previously, a special calculation applies when an employee’s wages and tips exceed the social security wage base.

Step 5: Include FICA Credit From Partnership or S-corp Investments

Ethical Edibles does not have any partnership or S-corp investments and, as such, zero is entered on this line.

Step 6: Sum the FICA Credit From Lines 4 & 5

Add the amounts from lines 4 and 5 to arrive at the total credit to input on line 6. Ethical Edibles is organized as a partnership, so the amount on line 6 carries to Schedule K for the entity’s business return.

Step 7: File the Completed Form

The completed form is filed with the entity’s business income tax return and is due on the same due date as that tax filing.

Frequently Asked Questions (FAQs)

Businesses that operate in the food service industry and employ tipped employees qualify to use Form 8846 to claim the FICA tip credit.

The FICA tip credit is calculated on Form 8846 and is then carried to line 6 on Schedule K for partnerships and S-corps. All other entity types should report this amount on Form 3800, Part III, line 4f.

Bottom Line

We hope our Form 8846 instructions have provided sufficient guidance in calculating FICA tip credits. Employers who pay less than the hourly federal minimum wage of $5.15 will need to allocate enough employee tips to ensure each employee meets the $5.15 minimum. Meanwhile, employers who pay the federal minimum wage amount or more do not need to adjust tips for this calculation and simply calculate the FICA tip credit as 7.65% of the tip amount.