Form W-8BEN-E is an Internal Revenue Service (IRS) form used by foreign companies that get paid by US companies. For example, if you hire a contractor not based in the US and contracting through a foreign entity, the contracting company is required to submit the document to your business. The form, called the Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities) is a long, complex tax form that must be completed before any foreign company receives payment from a US source.

Paying foreign entities and contractors can be confusing, and mistakes can cause fines and penalties. Stay compliant by using global payroll software like Remote to help your small business manage the IRS forms you need when using foreign workers. At the end of each tax year, Remote will generate the appropriate tax forms and share them directly with the contractor or contracting company you’re working with. Try it today.

When Form W-8BEN-E Is Necessary

Any non-US company that receives payments from a business based in the US must complete the W-8BEN-E form, even if that foreign company is an individual operating their own business, like many domestic freelancers. If your company enters into a contract with a foreign recruiting firm, it will need to provide you with a completed W-8BEN-E form before you can pay it for the provided contractor. Foreign entities do not have to submit or file the form with the IRS; they just need to provide you with a copy for your records.

Nearly every person and company paid in the US is subject to some level of taxation—that applies to foreign businesses as well. Most payments made to foreign entities are subject to a 30% withholding tax. Companies in some countries can get a reduction or credit if their home country has a tax treaty with the US. All of this information will be available to you by reviewing the W-8BEN-E form provided by the foreign entity. It’s then up to you to properly withhold those taxes at the correct rates before making payments to the international company.

If your small business makes any of the following types of payments to a foreign entity, those payments are subject to the withholding tax:

- Compensation for services performed

- Interest

- Dividends

- Rent

- Annuities

- Royalties

- Any other fixed or determinable payments, regardless of payment frequency

The purpose of the W-8BEN-E form is similar to a W-9 form completed by a US contractor who provides your small business with services. Your company must collect each form before making the first payment, which is necessary so you know the amount of withholding tax to collect and if the foreign entity is allowed any exemptions or credits.

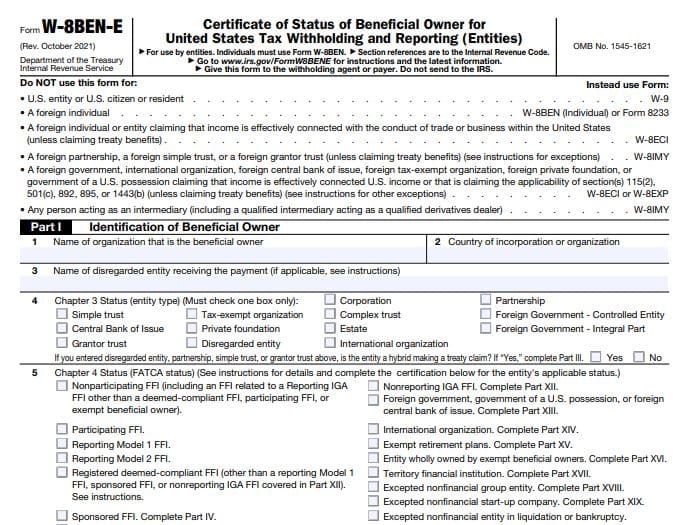

Completing Form W-8BEN-E

Your small business must collect a copy of Form W-8BEN-E but is not required to actually complete the form—that’s the job of the foreign company. However, you should still know how to complete the form so you can review it for accuracy before making the first payment to the foreign entity.

Required Information

Form W-8BEN-E is a long form—it has 30 parts. We don’t need to go through all of those parts, but will instead review the most important information you need to look out for and review when a foreign entity sends you this form.

- Name of organization: The full legal name of the business must be provided to make sure you’re paying the right company

- Country of incorporation: Necessary so you know if the US has a tax treaty with the country, entitling the foreign entity to a possible reduction or elimination of US tax withholding

- Name of disregarded entity (if applicable): A single business owner (like a single-member LLC) who is not separate from their company for tax purposes would be treated differently than a corporation where the individual worker is an employee of their company

- Type of organization: Corporation, partnership, trust, tax-exempt organization, estate, disregarded entity, or foreign government must be selected so you know the type of organizational structure

- Foreign Account Tax Compliance Act (FATCA) status: Only one box should be selected from this extensive list

- Permanent address: To verify the foreign entity’s national location

- Tax Identification Number (TIN) or Employer Identification Number (EIN) (if applicable): Not all foreign entities are required to have a TIN or EIN, but it must be listed here if they are

- Global Intermediary Identifying Number (GIIN): This is a foreign tax identification number

Other parts of the form will only be completed if required, based on certain selections made in the above requirements. This is why it’s important to understand the form, so you know what other sections should or should not be completed by the foreign entity.

Form Expiration

Form W-8BEN-E is valid for three calendar years after the end of the year the form was signed. For example, if a foreign entity gave you a form signed July 1, 2022, that foreign entity’s W-8BEN-E would be valid until Dec. 31, 2025. Make sure you send the foreign company a new form in advance of this date so they can complete and return it to you without missing any payments.

However, if any information about the foreign entity changes during that time, the form becomes invalid. If, for example, the foreign entity changes its name, it will need to complete a new form and submit it to you before it can receive any further payments. Submitting a new form also resets the clock on the expiration date.

Your Responsibilities

Review the form for accuracy and completeness to make sure your small business is compliant with US tax law. Make sure the payment processor you use has the capability to process international payments and knows the amount of tax to withhold. Here are two key tips to help you stay compliant.

W-8BEN-E Best Practices & Potential Pitfalls

As work becomes more distributed, even across international borders, this places additional burdens on your finance and payroll teams. They must ensure proper documentation to ensure accurate international payments.

Unlike paying domestic independent contractors where you do not make any withholdings, you may need to make tax withholdings when you make payments to foreign entities. Here are a few tips to streamline the collection and retention of the documentation:

- Collect Form W-8BEN-E electronically (as noted above)

- Collect ID electronically

- Have at least two internal employees review forms for accuracy

- When calculating withholding tax, have at least two employees review the calculation, especially if the foreign entity is claiming a tax reduction or exemption

- Use data automation tools when able

- Use software that tracks changes to international tax law

- Retain documents in secure electronic storage

- Set a calendar reminder or use an automated tool to remind you at least 90 days before the Form W-8BEN-E expiration date to send the foreign entity a new form

Due diligence is crucial to compliance. Failure by the foreign entity to submit Form W-8BEN-E to you results in the foreign entity paying the full 30% tax rate, regardless of whether they qualified for tax reductions or exemptions.

Form W-8BEN-E vs Form W-8BEN

- The key difference between Form W-8BEN-E and Form W-8BEN comes down to if you are working with an entity or an individual. If you’re contracting with a foreign company, use Form W-8BEN-E. If you’re partnering with a foreign individual (an independent contractor or freelancer), use Form W-8BEN. In both cases, your international partner (be it a company or individual) is responsible for filling out the form.

- There are five W-8 forms in total, each used for a different purpose when making foreign payments from a US company. The W-8BEN-E and W-8BEN are the most commonly used.

W-8BEN-E | W-8BEN |

|---|---|

Used for contracting with a foreign entity | Used for contracting with a foreign individual |

Subject to 30% tax withholding | US businesses may not need to withhold tax (foreign individuals may still be subject to US tax up to 30%) |

Long and complex form | Short form closely resembling a W-9 |

Low compliance risk for employee misclassification | High compliance risk for employee misclassification |

Bottom Line

The global nature of today’s workforce increases your available talent pool but also creates complexities about the type of employees to hire and how you hire them. If you partner with international companies, which is becoming easier and more common, there are compliance hurdles that you need to overcome, including knowing which tax forms you should receive from your international partner. If you understand when and how to use IRS Form W-8BEN-E, you can avoid compliance headaches and focus on growing your business.