Having to reduce your workforce, whether temporarily or permanently, is never easy. But for small businesses, it’s important to understand all options, such as when to do a layoff vs furlough.

Furlough vs Layoff: Key Differences to Know

Key Takeaways:

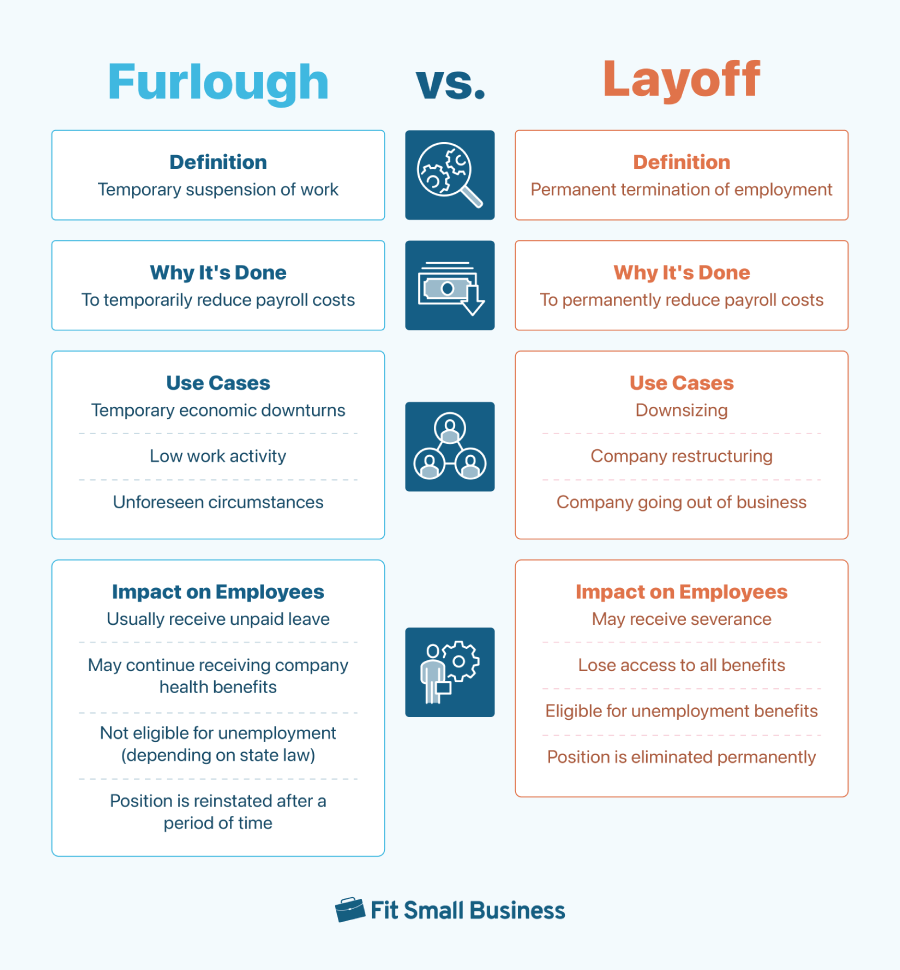

- A furlough is a temporary leave of absence, while a layoff is a permanent termination of employment.

- Companies that are facing financial difficulties, looking to downsize, or closing part of their business can reduce costs with a furlough or layoff.

- Avoid discrimination of protected classes when deciding to furlough or lay off a portion of your employees.

Overview of Differences Between Furloughs vs Layoffs

- Compensation: Some employees who are laid off may be eligible to receive severance pay. This is at the discretion of the company and usually depends on the tenure of the employees. However, with furloughed employees, since they will eventually return to their jobs, there is no compensation package during their time away.

- Healthcare benefits: For laid-off employees, healthcare benefits typically end the day they are terminated. In some cases, employers can agree to pay their portion of COBRA premiums, but this is not a requirement. For furloughed employees, since they are still employees, you must keep their healthcare benefits active. However, you can require the employee to pay their portion of premiums during their time away from work.

- Job assurance: Furloughed employees have the reassurance that once the problems at work are resolved, they can return to their jobs. However, with laid-off employees, their release from their job duties is permanent. It is important that you clarify this distinction in the layoff and furlough paperwork that you provide to affected employees.

- Legality: Both situations require you to use caution where the law is concerned. Be sure not to discriminate based on any protected classes when selecting which employees will be furloughed or laid off.

- Paid time off: Any laid-off employee who has accrued but unused paid time off may be eligible to receive compensation (depending on state laws and your PTO policies). Furloughed employees will not be paid for their time off and will also not be allowed to use any of their paid time off as compensation during their furlough.

- Unemployment: Furloughed employees will not be eligible for unemployment benefits because they are still technically employed (although not being paid). Laid-off employees, on the other hand, will be eligible to apply for unemployment.

What Is a Furlough?

A furlough is a temporary, unpaid leave of absence during times of financial crisis or reduction in available work. It can be for full-time or part-time employees, and these temporary leaves of absence can last anywhere from a few days to several months.

Businesses typically use furloughs during times of financial hardship or economic downturn, as they are a way to reduce payroll costs without resorting to layoffs, which is a more permanent solution.

How Furloughs Work

The first step in implementing a furlough is to determine how long the leave will last and how many employees will be affected. Once you’ve made the decision, develop a plan for how work will be completed during the furlough period. This may involve assigning tasks to other employees, hiring temporary workers, or using automation and technology to keep things running smoothly.

You’ll also need to have a plan for continuing health benefits, if applicable. Depending on your plan documents, you may be required to continue paying health premiums for any furloughed employee since they’re still technically employed by your company, even though they’re not working any hours.

Once the plan is in place, communicate the furlough to your employees. This includes letting employees know how long it will last, what their job responsibilities will be during the mandatory leave, and when they can expect to return to work. Employees may also be given the option to take unpaid vacation time or use other leave options during the furlough period.

Furloughing Exempt vs Nonexempt Employees

There’s a small but important point to make with furloughing different types of employees. Exempt employees, those ineligible for overtime pay under the Fair Labor Standards Act (FLSA), should be told that they are not allowed to do any work during their furlough. If an exempt employee works for a single moment, they’re entitled to their full salary for the entire week.

You may also want to restrict nonexempt employees from doing any work during a furlough, but the consequences are less severe. For nonexempt employees, you only need to pay them for the time they work, effectively reducing their hours dramatically but still getting some level of productivity. This is an alternative option discussed in more detail below.

What Is a Layoff?

A layoff is a permanent termination due to business closures, downsizing, lack of work, or restructuring. They differ from traditional terminations, which generally result from poor performance or misconduct. Layoffs are usually done to cut costs or save money.

Although the meaning is the same, layoffs generally fall into one of the following categories.

- Voluntary layoff: Occurs when employers offer an employee a reason to accept the layoff, such as a severance.

- Involuntary layoff: Occurs when employees are forced to leave the company, with or without a severance.

A voluntary or involuntary layoff then falls under one of the following subcategories:

- Traditional layoff: An involuntary separation from employment due to budget concerns or operational changes.

- Reduction in force (RIF): A permanent reduction in employees due to a major change in the company, such as downsizing or plant closures.

- Mass layoff: A large pool of employees are laid off, generally due to a shift in strategies or severe budget issues.

Sometimes, layoffs are done in response to a decrease in business or a change in the economy. However, if you’re just experiencing a temporary downturn in business, a furlough may be a better option.

How Layoffs Work

There are two main types of layoffs: voluntary and involuntary. Voluntary layoffs happen when employees voluntarily leave their positions, usually because the company has offered a reason, like severance pay. Involuntary layoffs happen when employees are forced to leave their positions, often with no severance pay.

Regardless of whether a layoff is voluntary or involuntary, you’ll need to identify the positions you want to eliminate. If you’re facing a reduction in work, start by eliminating the positions most affected. If you’re looking to reduce payroll costs while minimizing the impact on your business, you’ll need to analyze highly compensated positions and the revenue they generate. The larger that gap, the more likely you are to eliminate that position.

Once the decision has been made, you’ll need to deliver the news to the affected employees. I recommend giving them as much notice as possible, at least two weeks. You will also work with those employees to determine their severance package and help them transition out of the company, including giving them information on benefits continuation as part of the Consolidated Omnibus Budget Reconciliation Act (COBRA).

Pros and Cons

When to Do a Furlough vs Layoff

Deciding between furloughing or laying off employees can be difficult. It is a matter of whether you want the affected employees to return to your business once the issue has settled.

The choice you make will largely depend on your specific circumstances. If you’re confident that things will eventually pick back up and you’ll be able to bring your employees back on board, then a furlough might be the way to go. However, if you’re facing long-term financial challenges or don’t see things improving soon, layoffs might be necessary.

Legal Considerations

Employment laws affect every business, especially when you’re dealing with employee separations, whether permanent or temporary. Below is a list of laws to consider when furloughing or laying off employees.

- Worker Adjustment and Retraining Notification (WARN) Act: Federal law that requires employers to give workers 60 days’ notice before a mass layoff or plant closure. The law applies to businesses with 100 or more full-time employees, as well as businesses with 50 or more full-time employees if they make up at least one-third of the workforce.

- Civil Rights Act: When making furloughs or layoffs, employers must be careful not to discriminate against protected groups of workers. Both federal and state laws prohibit employers from making decisions based on race, color, religion, sex, national origin, disability, or age.

- Age Discrimination in Employment Act (ADEA): Protects workers who are 40 years or older from age discrimination. So, if an employee in this age range believes they were let go because of their age, they may have grounds for a lawsuit. You can defend against an ADEA case by having robust documentation.

- Fair Labor Standards Act (FLSA): Mandates that employers cannot ask furloughed employees to perform any work without proper compensation. This means that if an employee does any work, even answering emails, they must be fully compensated.

Furlough vs Layoff Frequently Asked Questions (FAQs)

No. Employees who are furloughed are temporarily removed from their positions with a company and are not paid during their absence. Upon return, their pay is reinstated. However, employers may choose to continue certain benefits during the furlough, such as healthcare coverage.

A furlough does not last a certain period of time. It can be as short as a few days, or as long as a few months. The timeframe of the furlough is dependent on the need, such as the severity of the financial crisis or when available work may return.

The main types of layoffs include traditional layoffs, reduction in force, and mass layoffs. Each type permanently removes a portion of your workforce from employment due to budget cuts or operational changes.