A house-flipping calculator is a powerful tool that calculates crucial financial data related to your property transformation projects. Whether you’re a seasoned real estate investor or an aspiring flipper, understanding the intricacies of potential profits and costs is essential. This calculator assists you in determining key metrics, such as the potential return on investment (ROI), estimated profits, and projected total spend. This knowledge will help you make informed decisions in the dynamic world of real estate investment.

Use our fix-and-flip calculator above for a better understanding of the profitability of your property. We’ll provide a comprehensive breakdown of each component within the calculator, and explain how they collectively influence the success of your fix-and-flip projects.

How the House-flipping Calculator Works

Our house-flipping calculator simplifies the complex and time-consuming calculations that can be daunting for real estate investors. The calculator performs the necessary computations by inputting key property details, such as purchase price and flipping costs. It will calculate metrics, including ROI, profits, and total expenditure, to help provide a clear financial overview of your house-flipping project.

The results provided by the fix-and-flip calculator are estimations and should be used with thorough research and market analysis. The calculator does not account for market fluctuations or unforeseen external factors that can affect the profitability of a house-flipping project. The flipping calculator is a valuable tool for supporting business growth and forecasting potential earnings based on projected ROI.

Who Should & Should Not Use a House-flipping Calculator

A house-flipping calculator is a tool for individuals involved in real estate investment, particularly those considering fix-and-flip projects. Seasoned investors can use it to fine-tune their strategies, while newcomers can gain valuable insights into the financial aspects of house flipping. The table below outlines who the house-flipping calculator is best suited for:

Who Should Use a House-flipping Calculator | Who Should NOT Use a House-flipping Calculator |

|---|---|

Experienced real estate investors | Individuals seeking purely passive real estate income |

Aspiring flippers looking to assess project viability | Those with minimal interest in property transformation |

Investors aiming to optimize their project planning | Individuals without access to reliable property data |

Those who want to estimate ROI and potential profits | Those unwilling to conduct thorough market research |

Investors interested in active property transformation | Those expecting the calculator to replace due diligence |

Inputs for the House-flipping Calculator

Each component of the house-flipping calculator plays a crucial role in assessing the viability and profitability of your property transformation project. We’ll take a look at the data required to input into the fix-and-flip calculator to get the best estimated outcomes.

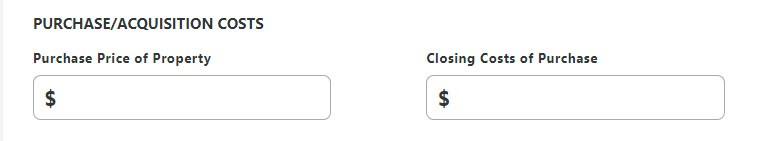

Purchase/Acquisition Costs

These costs encompass the financial requirement to acquire the property. They typically include the purchase price and all associated costs, like the real estate agent fees for finding the property and additional expenses like inspection fees or appraisal costs. The acquisition costs can vary depending on the location, type of property, and individual circumstances of the transaction.

An outline of closing costs is typically provided by the closing agent or settlement agent involved in the real estate transaction. Still, it usually amounts to 2% to 6% of the loan amount. These closing costs may include lender fees, title insurance, taxes, and various administrative charges. Accurate input of these costs is important because they form the basis for your total investment and significantly impact your overall profitability.

Note that if you are paying for a home in all cash, your closing costs will not include anything loan-related, like loan origination fees, credit score reporting, and appraisal fees.

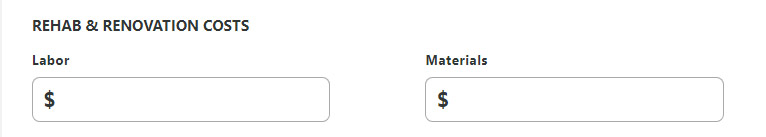

Rehab & Renovation Costs

This category covers the expenses associated with repairing and renovating the property to increase its value. It includes materials, labor, permits, and any unexpected contingencies that might arise during the renovation process. Typically, flippers estimate these costs at around 10% of the purchase price.

The choice of property plays a large role in the extent of renovations and rehab expenses. Opting for a well-maintained property may necessitate only minor enhancements like repainting, landscaping, and appliance upgrades to maximize profit potential. However, distressed properties like foreclosure listings may demand more extensive renovations. Selecting the right property and accurately estimating rehab costs with the house-flipping profit calculator are important to achieving accurate calculations.

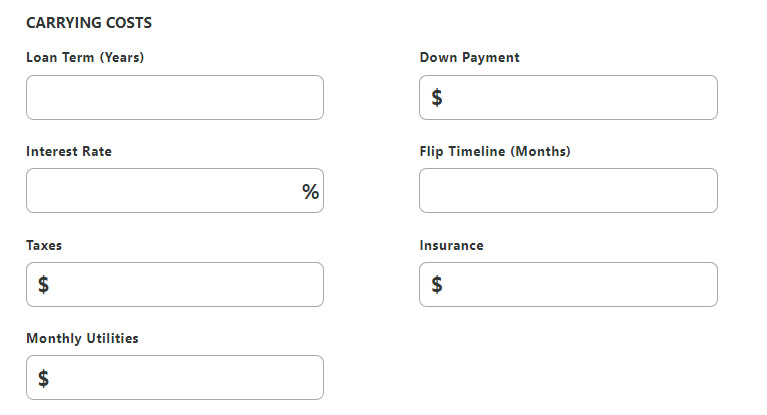

Carrying Costs

Carrying costs are the expenses incurred while you own the property but before it’s sold. This includes property taxes, insurance, utilities, and mortgage payments, if applicable. These costs directly impact your profitability and can accumulate significantly over the duration of your project.

Some carrying costs to be imputed in the flip calculator:

- Loan term: The loan term represents the number of years you’ve borrowed money to finance your property. It dictates the number of years over which you’ll make mortgage payments.

- Down payment: The down payment is the initial lump sum payment you make toward the property’s purchase price. It’s typically a percentage of the property’s total cost, and the remaining balance is covered by alternative financing.

- Interest rate: The interest rate is the annual percentage rate charged by the lender for borrowing money through a mortgage. It directly affects the cost of borrowing and influences your monthly mortgage payments.

- Flip timeline: The flip timeline refers to the number of months you plan to own the property before selling it. This timeline impacts the duration of other carrying costs.

- Taxes: These taxes can vary significantly based on the property’s location and assessed value. They are a recurring cost that contributes to carrying expenses.

- Insurance: Property insurance provides coverage for potential damage to the property in events like fire or natural disasters. It’s essential to protect your investment before you sell it, and is typically paid on a monthly or annual basis.

- Monthly utilities: Monthly utilities are expenses for services like electricity, water, gas, and sewage. These costs are ongoing as long as you own the property and are considered part of the carrying expenses during your ownership period.

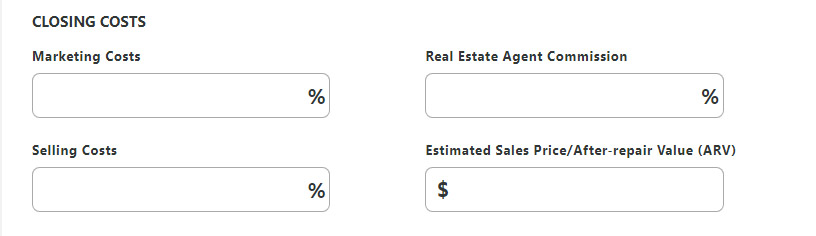

Closing Costs

The last set of inputs in the real estate flip calculator pertains to closing costs associated with selling the property. These costs should be differentiated from the closing costs incurred during the property’s purchase. Selling-related closing costs encompass a variety of expenses, such as real estate agent commissions, marketing expenditures, selling costs, and the estimated sales price, or after-repair value (ARV).

- Marketing costs: Marketing costs refer to the expenses incurred to promote and advertise the property to potential buyers. This includes expenses for staging, professional photography, online listings, print materials, and any other marketing efforts aimed at attracting buyers to the property.

- Real estate agent commission: The real estate agent commission is a fee paid to the real estate agents involved in the sale of the property. Typically, this fee is calculated as a percentage (around 4% to 6%) of the final sales price and is divided between the listing agent and the buyer’s agent.

- Selling costs: Selling costs can be various expenses related to the sale of the property that is not directly associated with marketing or real estate agent commissions. These can include legal fees, title insurance, escrow fees, and other administrative costs incurred during the closing process.

- Estimated sales price/After-repair value (ARV): The estimated sales price, or ARV, represents the projected market value of the property after all necessary repairs and renovations have been completed. It’s critical for calculating potential profits and understanding the property’s value in the current market. The equation for ARV is:

ARV = Property’s Current Value + Value of Renovations

For example, you purchased a property with a current value of $150,000, and you plan to invest $30,000 in renovations and improvements. Using the above formula to calculate ARV as follows:

ARV = Property’s Current Value + Value of Renovations

$180,000 ARV = $150,000 + $30,000

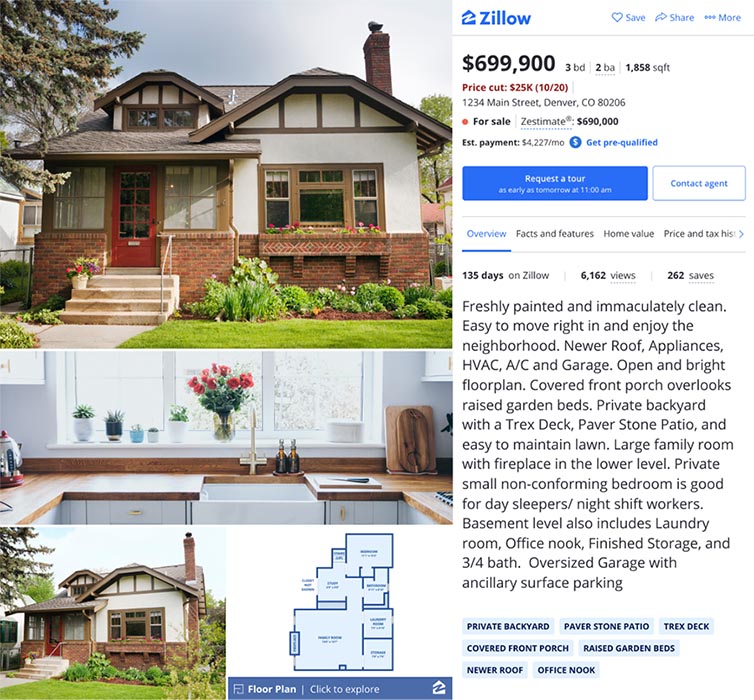

Sales listing on Zillow (Source: Zillow)

Listing your house-flipping projects on Zillow is a strategic move to attract potential buyers and maximize exposure. To do so, create a Zillow account as a seller, providing comprehensive details about the property, including high-quality photos, a compelling property description, and accurate pricing. Leveraging Zillow’s platform can help you tap into a broad audience of real estate enthusiasts and prospective buyers that can increase the chances of selling your flipped property at a favorable price.

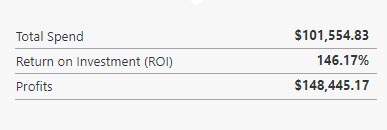

Outputs of the House-flipping Calculator

Once you’ve inputted all the costs for your house-flipping project, it’s time to calculate and decipher the outcomes. Utilizing your provided data, the fix-and-flip calculator will crunch the numbers, generating key metrics such as total spend, return on investment (ROI), and potential profit. These results offer a comprehensive financial snapshot of your project, aiding in decision-making and strategy refinement.

Total Spend

Total spend represents the complete financial commitment involved in your fix-and-flip project. It encompasses both the initial purchase price of the property and the expenses associated with renovations and repairs. Understanding this figure is essential as it is the foundation for assessing your project’s feasibility. A lower total spend relative to the property’s ARV generally indicates a more favorable investment, but it should be balanced with quality renovations.

Total Spend = Purchase/Acquisition Costs + Rehab/Renovation Costs + Carrying Costs + Closing Costs

The total spend will be used to compute the return on investment (ROI) and profits of your project. Compare the total spend to your estimated budget to see if you finished your flip below or above budget. If you went above your budget, look at where you allocated your money and modify that for the next flip to ensure you meet your goals.

Return on Investment (ROI)

ROI is the primary indicator of your project’s profitability. It measures the return you can expect on your real estate investment, expressed as a percentage. The ROI equation considers your net profit, which is the difference between your selling price and total spend, in relation to the initial capital invested. A higher ROI indicates a more lucrative venture, but it’s essential to factor in the time required to achieve that ROI and assess associated risks.

ROI = (Estimated Sales Price (ARV) – Total Spend) / Total Spend x 100%

Profit

Profit is the ultimate goal in house flipping, and the calculator helps determine your potential earnings. It’s the difference between the selling price of the renovated property and your total spend. A positive profit indicates a potentially successful flip. However, profit, ROI, and total spend provide a comprehensive picture of your project’s financial health. These numbers will help you gauge the flip’s overall success and guide future investment decisions.

Profit = Estimated Sales Price (ARV) – Total Spend

Common Pitfalls to Avoid When Using a House-flipping Calculator

Entering the world of house flipping and utilizing a calculator to assess your projects can be financially rewarding, but it also comes with potential pitfalls. Here’s an insightful look at some common missteps to avoid in the process of house flipping and while using the calculator:

- Overestimating renovation profits: One common mistake is being overly optimistic about the potential profit margins from renovations.

- Underestimating expenses: Failing to account for all expenses can lead to budget shortfalls. Ensure you include all carrying costs, closing costs, and unexpected contingencies in your calculations.

- Ignoring market trends: Neglecting to stay updated on local real estate market trends and statistics can result in misjudging property values, demand, and potential selling prices.

- Misjudging the timeline: House flipping often takes longer than anticipated. An extended timeline can increase carrying costs and affect your overall ROI.

- Overleveraging: Taking on too much debt or leveraging multiple projects simultaneously can strain your finances and increase risk.

- Underestimating interest costs: Low-balling the impact of interest on loans can lead to financial strain. Always consider the interest rate and loan term when assessing carrying costs.

- Relying solely on the calculator: While the calculator is a valuable tool, it should not replace comprehensive market research and due diligence. Real estate markets can be unpredictable, and relying solely on calculated estimates can lead to unexpected challenges.

- Neglecting property inspection: Skipping a thorough property inspection can result in unforeseen issues, such as structural damage or hidden defects, that can significantly impact your budget and timeline.

- Overimproving the property: It’s easy to get carried away with renovations. Avoid overimproving the property beyond what the market demands, as it may not yield a higher selling price.

- Underestimating holding costs: Failing to consider ongoing holding costs, including taxes, insurance, and utilities, can erode profits over time.

- Overlooking legal and regulatory compliance: Ignoring local zoning laws, building codes, or permit requirements can lead to costly legal issues that delay your project and increase expenses.

Frequently Asked Questions (FAQs)

The accuracy of the calculator’s estimates depends on the accuracy of the input data. The more precise your information about the purchase price, renovation costs, and the after-repair value (ARV), the more reliable the results will be. It’s essential to verify and update your data regularly to maintain accuracy throughout your project.

While the calculator provides valuable insights, it’s essential to consider additional factors such as market trends, location-specific dynamics, and unexpected contingencies. Investors should always conduct due diligence and consult with real estate professionals to make well-informed decisions. Location-specific dynamics, such as zoning laws and permit requirements, can also impact your project. Additionally, be prepared for unexpected contingencies, like unforeseen repairs or delays, which can affect your timeline and budget.

The calculator is a valuable tool for assessing the potential profitability of a property. It can help you identify properties with favorable ROI and profit margins. However, it’s just one part of the decision-making process.

Ultimately investors should remember that while the calculator offers quantitative data, real estate investments should also align with your broader financial objectives and risk tolerance. A successful real estate investment takes a holistic approach, combining financial analysis with a keen understanding of the local market, property condition, and your own investment strategy.

Bottom Line

The house-flipping calculator serves as an invaluable tool for both seasoned investors and newcomers. By effectively utilizing this calculator and understanding its outputs, individuals can make informed decisions about their fix-and-flip projects. It’s crucial to remember that while the calculator provides valuable estimates, it should always be complemented by thorough research and market analysis.