Consignment allows businesses to sell goods via third-party sellers without requiring the sellers to pay for the goods upfront. Because consignees are only tasked with selling consigned inventory, ownership remains with the consignor until it is sold to final customers. In exchange, the consignee will get a commission from the sales. In this article, we’ll teach you consignment inventory accounting and go over the accounting process for consignors and consignee.

How the Consignment Cycle Works

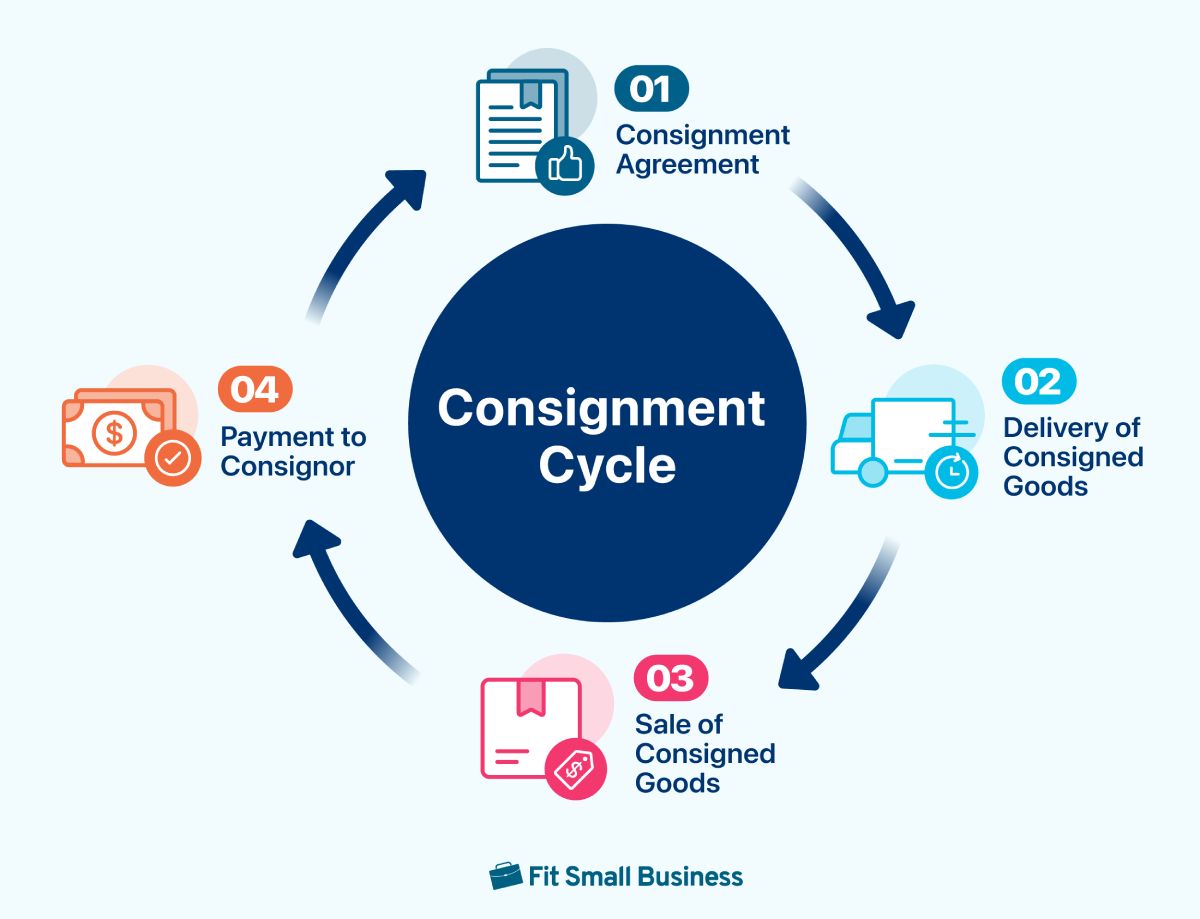

Understanding how to account for inventory consignment requires understanding what to do at each stage of the consignment process. A consignment arrangement revolves around four steps:

Step 1: Signing of Consignment Agreement

The consignment agreement is a crucial step in the consignment cycle. We recommend that consignors put this in writing to avoid confusion and misunderstandings.

This agreement will serve as a contract between the consignor and consignee, binding each party to perform their roles and responsibilities in the transaction.

The agreement should contain at least the following information:

- Details of the contracting parties, such as name or business name, address, and contact information.

- Consignment period that mentions the commencement and termination of the contract.

- Ownership provision stipulating that the ownership of the consigned goods remains with the consignor until it is sold to final customers.

- Sales provision stipulating how and at what price should the consigned goods be sold.

- Remittance provision stipulating how and when should the consignee remit the proceeds, such as remittances that must be made on the 25th of each month through PayPal or bank transfer.

- Sales tax collection stipulating that the consignee should collect and pay sales taxes directly to the state department.

- Loss provision stipulating who shoulders the loss of consigned goods because of spoilage, breakage, theft, and fortuitous events.

- Commissions and fees provision stipulating the amount of commission the consignee can deduct from the total proceeds of consignment sales.

Step 2: Delivery of Consigned Goods

For consignors

- Ship the goods to the consignee on a timely basis to avoid stockouts

- Pay for the shipping and insurance fees related to the shipment

- Provide the necessary equipment needed to preserve perishable products, such as freezers for ice cream products

For consignees

- Inform the consignor if the goods have already arrived

- Ensure proper safekeeping of the consigned goods and have the right equipment for this purpose. In some cases, consignors provide equipment for free

- Keep proper accounting of consigned goods to prevent them from being mixed up with other goods in your inventory

- (If you paid for the shipment costs) Inform the consignor that you will deduct this from the sales proceeds

Step 3: Sale of Consigned Goods

For consignors

- Ask for a daily sales report from the consignee to update your records

- If the stock is running out, send another batch to avoid stockouts

For consignees

- Sell the consignor’s goods based on the stipulations in the consignment agreement

- Set your own price if it’s allowed in the consignment agreement. Otherwise, stick to the consignor’s suggested retail prices (SRP)

- Prepare a daily sales report for the consignor

- Inform the consignor of spoilages or breakages if there are any

- Ship the goods to final customers. If there are delivery costs, the final customers should pay for it

Step 4: Payment to Consignor

For consignors

- Compute the remittance amount that you expect to receive

- Remind the consignee to remit payments

- If there’s a mismatch between you and the consignee’s computation, find a way to resolve this issue by going over the records

For consignees

- Compute the remittance amount and deduct commission fees

- Send the payment to the consignor via the agreed payment channel

- If there are payment fees, ask the consignor if they can pay for it

Example of Consignment Inventory Accounting

As part of consignment inventory management, both parties should practice proper accounting of consigned goods. For consignors, proper accounting helps them keep track of profits. Whereas for consignees, it helps them segregate consigned goods from other inventory items.

In this section, we’ll show you the different journal entries that consignors and consignees should do to account for consignment transactions.

For illustration, let’s assume that Bakery Inc., the consignor, entered into a consignment arrangement with Walmart, the consignee, to sell its pastry products.

- On January 2, Bakery Inc. shipped $40,000 worth of pastry products and paid $2,500 in shipping.

- To stimulate sales, Walmart spent $700 in advertising costs.

- Walmart sold 75% of the consigned goods for a total sales amount of $45,000 and reported this amount to Bakery Inc.

- On January 31, Bakery Inc. collected cash due from Bakery Inc. less 10% commission and advertising costs. They also pulled out spoiled goods worth $200.

Click each tab to view the journal entries per transaction.

Related Resources:

- What Is Bookkeeping and What Does a Bookkeeper Do?

- Cost of Goods Sold: What It Is & How To Calculate It

Frequently Asked Questions (FAQs)’

Yes, because both parties must keep track of consignment transactions. For the consignee, proper accounting ensures that consigned goods aren’t mixed with other goods. For the consignor, it helps them account for the cost of goods sold and revenue.

The consignor records the inventory on consignment because they still own the consigned goods until sold to final customers. The consignee does not show consigned inventory on their balance sheet.

The consignee may continue to sell these goods even if new stocks have arrived. However, for perishable goods, the consignor may pull out old stock and replace it with new stock.

Bottom Line

Consignment is a good business model if you want to expand your retail business by being a consignee. For consignors, consignment is an opportunity to introduce your products to a different market. We hope this guide taught you how consignment inventory works and the different journal entries involved in the consignment process.