Reading an IRS transcript

An IRS transcript is a register of tax activity that the IRS has recorded. It is also a line of defense against identity theft. You can use its information to

• Resolve tax issues without having to call the IRS

• Verify income to a third party when you don’t have a copy of your original return

• Get documents to help you respond to an IRS notice or examination

can be very manageable if you know what to look for. You’ll first need to choose the right kind of transcript, review it for accuracy, and analyze the codes provided. You may have additional action items based on the information provided, but most likely, you’ll need to just sit tight and wait for the IRS to follow up. Even though you may still be in a holding pattern after reviewing your transcript, you’ll at least know what has been processed by the IRS.

Key Takeaways

- The IRS provides five transcript options: Tax Return, Tax Account, Record of Account, Wage and Income, and Verification of Non-filing Letter. Taxpayers should choose a transcript type based on what the transcript is needed for.

- Transcripts are obtained online, by phone, or by mail.

- Transcripts may offer quicker resolutions to outstanding issues than a phone call to the IRS.

Step 1: Determine the Appropriate Type of Transcript

The IRS offers five types of transcripts with varying uses.

Information Provided | Typical Use | Availability Time Frame | |

1. Tax Return | Most line items and schedules from the originally filed tax return | Loans, grants, scholarships, return amendments, IRS notice response, mortgage financing, general taxpayer records | 4 years (including current tax year) |

2. Tax Account | Basic taxpayer data (marital status, AGI, taxable income, and payments); also includes changes from after the return was filed | Extension confirmation, payment history, account and refund history (e.g., records of penalty and interest assessed), notice response | 4 years (including current tax year) |

3. Record of Account | Tax return and tax account transcripts combined | Any of the purposes for which a tax return or tax account transcript would be used | Any year for which there was recent IRS action, as well as the current year and previous 5 years |

4. Wage and Income | List of taxpayer income reported to the IRS on forms W-2, 1099, 5498, etc. | Notice response, income records, employment verification | Current year and previous 9 years; generally available mid-May for the prior year |

Confirmation that there is no record of a tax return filed with the IRS for that year | Student financial aid applications | 4 years (including current tax year) |

There are three ways you can obtain an IRS transcript:

1. Online

You may obtain a transcript from the IRS website by using the IRS’s Get Transcript tool. To use the online tool, you must create an account and have your identity verified by a third-party vendor. To verify your identity, you will need to either present a government-issued ID with a photo and take a selfie or schedule a live call with an agent from the third-party vendor (currently ID.ME).

You must be at least 18 years old to access the verification system. If you are unable to verify your identity through the third-party vendor, you may use one of the alternative methods below to request a transcript, which may involve a longer wait time than the online tool.

2. By Phone

Call the IRS’s automated line at 1-800-908-9946. The transcript should arrive at the address on file anywhere from 5–10 calendar days if ordered to be received by postal mail.

3. By Mail

You will need to have the mailing address from your most recently filed tax return. Then, you’ll need to complete IRS Form 4506-T. For copies of a tax return, you’ll need IRS Form 4506 or IRS Form 4506-T-EZ.

Step 2: Review Transcript Information for Accuracy

You’ll want to review your transcript to ensure that the information presented makes sense. Identifying information such as your Social Security number (SSN) and address may be partially redacted, but the visible information should be confirmed.

You’ll also want to do a sanity check for the information provided. For example, if you didn’t file a return for 2022 but have a tax return transcript showing tax filing information for that year, you should contact the IRS so that its records can be updated.

Key Information Reported on IRS Transcripts

The following items should be reviewed for accuracy and reasonableness:

- Name and Employee Identification Number (EIN)/SSN; this should match the tax return you filed

- Return type (e.g., 1040, 1120, or 1120-S)

- Taxable income

- Credits

- Deductions

- Refund or tax to be paid

To protect taxpayer data, the IRS partially masks SSNs and EINs on transcripts, leaving only the last four digits visible. Taxpayer names and addresses are also partially obscured. Financial data is not redacted.

Customer File Number

Customer file numbers were instituted by the IRS so that third parties could have an identifying number for the taxpayer without having to use sensitive data. They are unnecessary to obtain a transcript, are assigned by a third party, and are input when the taxpayer requests an online transcript.

That customer file number prints on the transcript for ease of user reference. The taxpayer can then download the transcript and provide it directly to the third-party requester.

Step 3: Analyze Code Info

Your tax transcript will likely have a series of codes indicating the type of activity that transpired. Here is a list of commonly used transcript codes:

TC | Description |

013 | Name Change |

014 | Address Change |

076 | Acceptance of Form 8832, Entity Classification Election |

078 | Rejection of Form 8832, Entity Classification Election |

079 | Revocation of Form 8832, Entity Classification Election |

150 | Return Filed/Tax Liability Assessed; learn more about code 150 |

166 | Delinquency Penalty |

170 | Estimated Tax Penalty |

196 | Interest Assessed |

276 | Failure to Pay Tax Penalty |

290 | Additional Tax Assessment |

291 | Abatement Prior Tax Assessment |

300 | Additional Tax or Deficiency Assessment |

420 | Return is under examination; full audit is possible but not automatic |

428 | Examination or Appeals Case Transfer |

460 | Extension of Time for Filing |

480 | Offer in Compromise Pending |

494 | Notice of Deficiency |

570 | Tax Refund Frozen; learn more |

660 | Estimated Tax |

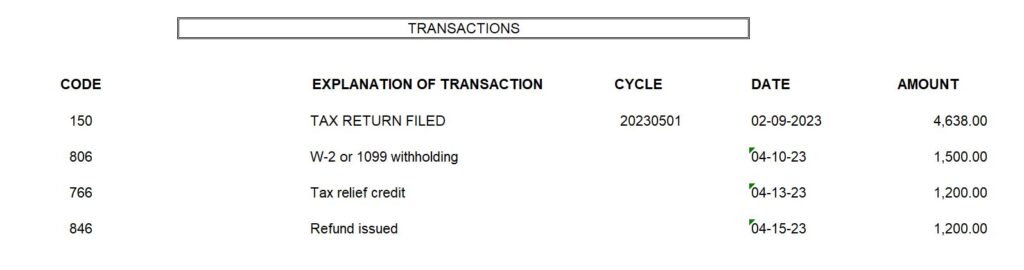

766 | Application of Refundable Credit; learn more |

768 | Earned Income Credit |

800 | Credit for Withheld Taxes |

806 | Withholding from informational statements (e.g., 1099 or W-2); learn more |

846 | Refund issued |

971 | IRS Notice Issued; learn more |

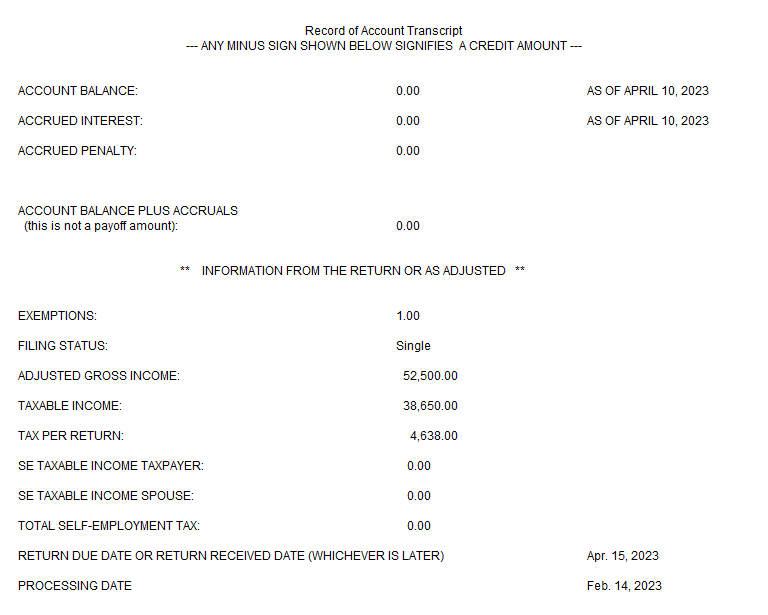

Sample Record of Account Transcript

The Record of Account transcript below has sample data for a fictional taxpayer who submitted a timely-filed tax return. Basic taxpayer data is provided here, along with adjusted gross income (AGI) and taxable income. The IRS assessed a tax of $4,638 on taxable income of $38,650.

Tax account information from a sample Record of Account transcript

Transactional data from a sample Record of Account transcript

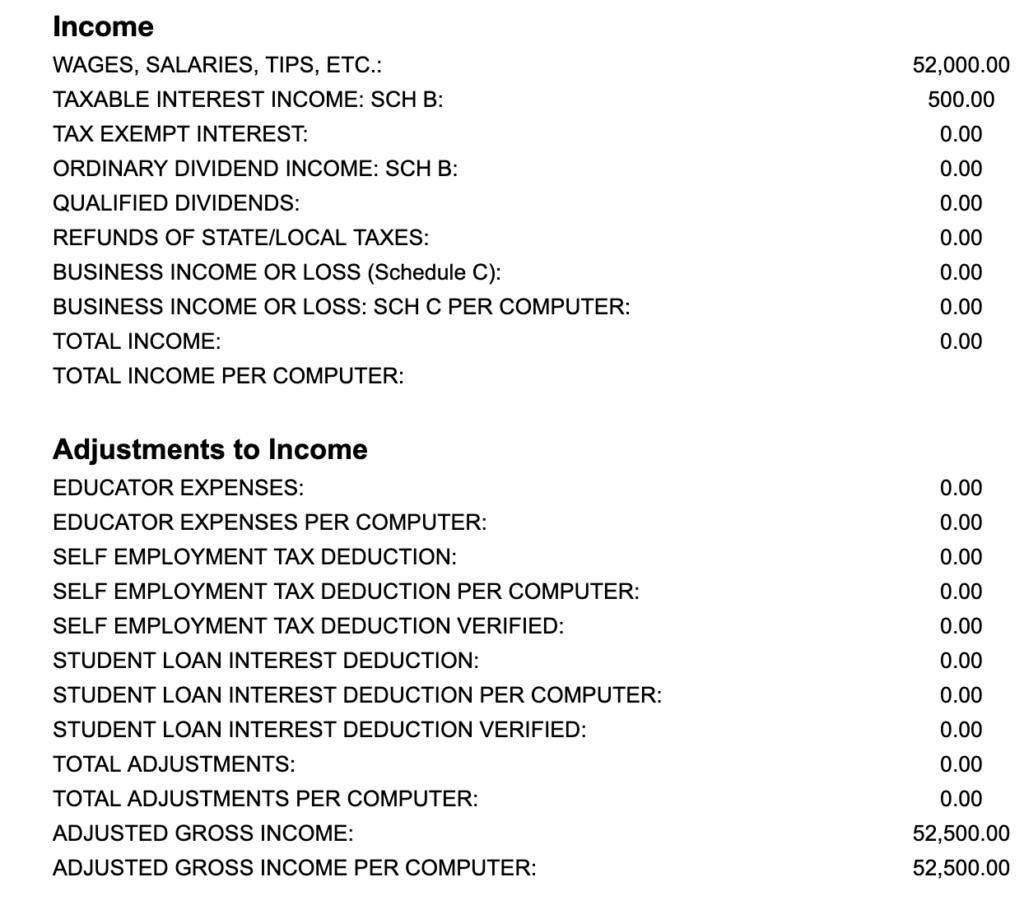

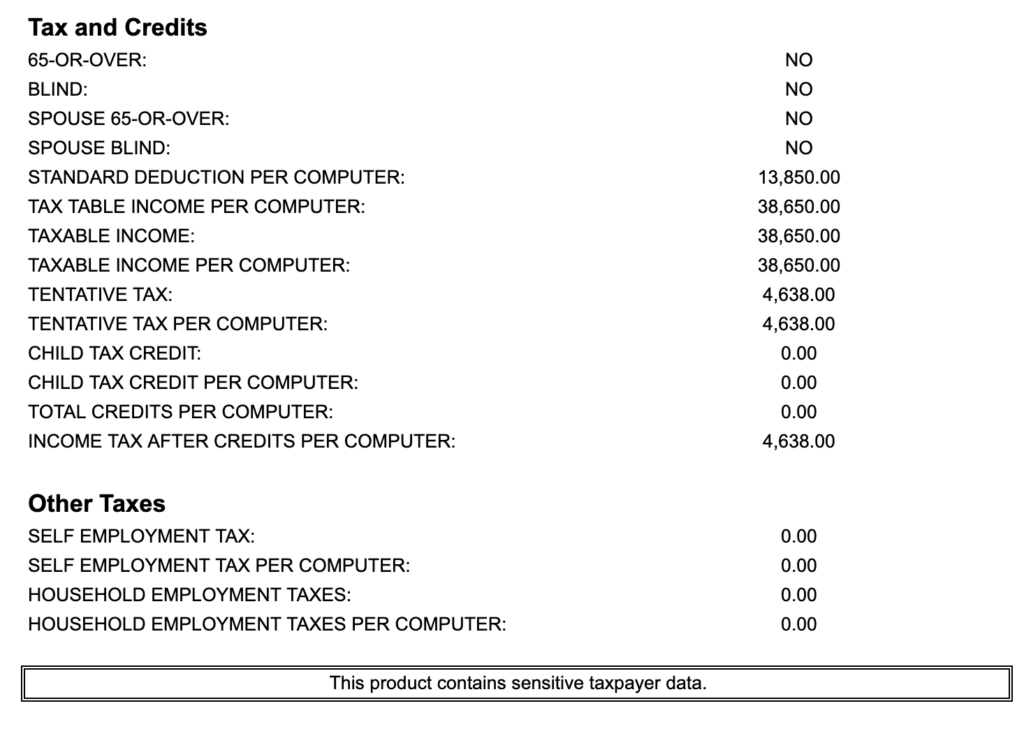

In addition to the summary information initially provided, the Record of Account transcript contains line items from the tax return submitted by the taxpayer. The sample data below represents a truncated version of the tax return line items, illustrated with fictional numbers.

- The wages represent income reported on a Form W-2 from the taxpayer’s employer.

- The taxable interest came from the taxpayer’s high-yield savings account.

- The standard deduction of $13,850 is a standard amount set by the IRS and generally revised annually.

Sample of taxable income and AGI section on a Record of Account transcript

Sample of a tax return section on a Record of Account transcript

Step 4: Identify Next Steps

Be sure to save a copy of your transcript for future reference. Most transcript codes are informational and require you to wait for the IRS to provide additional information. However, if you identify an error or a misposting, you’ll want to contact the IRS as soon as possible to rectify the situation. For personal tax return issues, you should call the IRS at 1-800-829-1040.

Frequently Asked Questions (FAQs)

If you find an error on a tax return transcript, contact the IRS at 1-800-829-1040. Another option is to provide power of attorney to a tax professional to deal with the IRS on your behalf.

A business transcript can be ordered by phone, mail, or logging into the IRS’s business tax account (note that sole proprietors and single-member LLCs are ineligible to access a business tax account). Individual partners or shareholders must have an SSN or an individual tax ID number and at least one Schedule K-1 that has been filed to access a business account transcript. All other taxpayers can order transcripts via phone or mail.

Tax return information will only be on a transcript once the IRS has acknowledged a return as received and begun its processing procedures. If tax return information is not visible for the year that was filed, you should confirm that the IRS received it by calling 1-800-829-1040.

Transaction codes represent IRS actions on your account. While some IRS actions denote receipt or processing of the information you submitted, other actions are shown as memo items and don’t have a numerical impact on the return.

Bottom Line

The quickest way to access your IRS tax records is to use the IRS’s Get Transcript tool. Access is free, and the online transcript allows taxpayers to troubleshoot issues quickly and efficiently. Now that you know how to read an IRS account transcript, keep in mind that transcripts are used most effectively when the taxpayer has a good understanding of the type of transcript to request and the codes presented.