Key takeaways:

- A Uniform Commercial Code (UCC) filing is an official legal notice that allows a creditor the right to take possession of assets in the event of loan default and to notify other creditors of existing liens.

- It’s used to create a UCC lien, and the terms can dictate that a lien be placed on a single asset or a group of assets.

- It’s most commonly used as a form of collateral imposed by a lender to secure a loan and to mitigate the risk of the transaction.

- It is a matter of public record and can be viewed by most individuals to let others know that a lender has a security interest in the collateral. Even if it isn’t a lender’s requirement, it may help a borrower qualify for lower rates.

UCC filing vs lien: What’s the difference?

Before we dive deeper, I’d like to kick off with the fact that a UCC filing and a UCC lien cannot be used interchangeably — that’s a common misconception. Instead, they are differing elements that are part of the process of placing a claim on an asset.

- A UCC filing is an official legal notice that files a claim that there’s a security interest involved with an asset or multiple assets. It can be used for various transactions and is filed by a creditor to ensure their placement in terms of a lien position.

- A UCC lien is effective once a UCC filing has been initiated. It has to do with the specific claim of a singular asset, acts as the security of the asset it’s associated with, and can be seized by the lien holder in the event of default.

Types of UCC filings

A UCC filing can be used to place a lien on a single asset or a blanket lien on multiple assets.

1. UCC lien against a single asset

When a lender files a UCC lien against specific collateral (oftentimes the asset being acquired), the lender secures interest in one or more assets — not against all company assets. This is most common when purchasing equipment and for inventory financing.

For example, a farmer who finances a piece of farm equipment would have a UCC lien filed by the lender on just that specific piece of equipment, not all equipment owned by the farmer.

2. Blanket UCC lien against multiple assets

In some cases, a lien against specific collateral may not provide the necessary security for the lender. In this case, the lender would file a blanket UCC lien over all of a company’s assets. This provides more security to the lender and allows the business owner to borrow larger amounts of money. However, blanket liens can make it challenging for the business to get additional funding until the lien is satisfied or the lender removes it.

How a UCC filing affects you

If you’re seeking financing and a UCC filing is required, you should be aware of a few circumstances that may impact your business.

A UCC lien gives a lender the right to repossess your assets if you do not adhere to the terms of the loan agreement. This most commonly occurs if you fail to make required payments in a timely manner. The terms of your specific loan agreement can dictate when a repossession may occur based on things like the frequency and severity of late payments.

While a UCC filing by itself may not negatively impact your credit score, creditors can — and often do — consider factors other than your score. Your business credit report will show UCC liens filed within the past five years, and creditors may view your business less favorably if you have had too many recent liens, applications for credit, or high dollar amounts of outstanding loans.

When you agree to have a UCC lien placed against your assets, it will be more difficult for you to use that same asset as collateral for subsequent loans.

While it is possible to have multiple liens against the same asset, UCC liens operate on a first-come, first-served basis. This means that in the event of a loan default, the lender that filed the first UCC lien will have priority in receiving sales proceeds to offset financial losses. As a result, lenders in a second or third lien position would be less likely to receive funds.

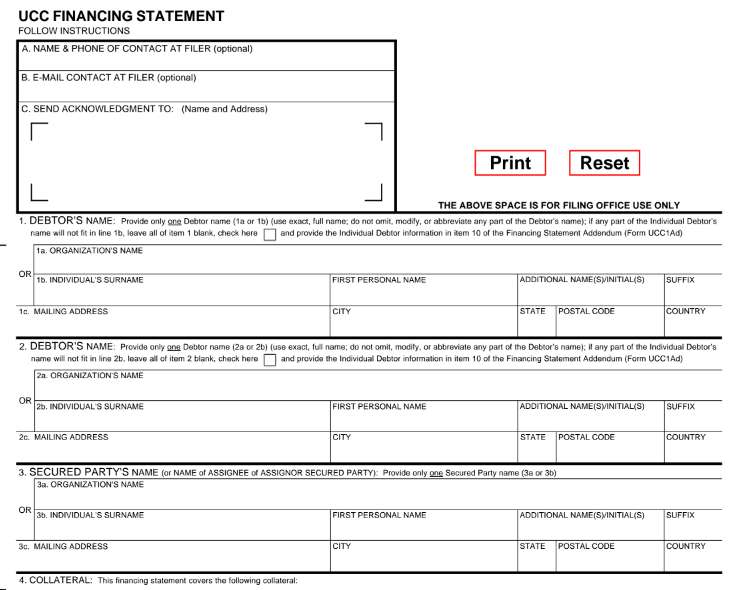

The UCC financing statement

The UCC financing statement is the document that is used to file a UCC lien on assets. Below is an example of what it looks like. It represents the necessary information fields that provide details about the company that holds the interest in the asset, a description of the asset, the borrower’s information, and details about what type of lien it is.

UCC-1 financing statement example

How a UCC lien works

A UCC lien is essentially what acts as security for a loan and is placed on an asset that can be liquidated in the event of loan default. From start to finish, here are the typical steps of how it works.

1. You apply for a loan

Depending on the lender you work with and the details of the loan you apply for, you may already have an idea of whether or not UCC lien requirements may be necessary. This may also be determined after the initial application once the lender has reviewed the various terms and conditions. UCC liens are commonly used for securing assets associated with equipment loans but may also apply to real estate, vehicles, or any other loan where the asset has substantial value.

2. The lender issues an approval with terms and conditions

Once you’ve been approved, you’ll be issued a term sheet outlining the various terms and conditions of the potential loan agreement. If not previously notified, this is typically when the lender will let you know if the loan will require a UCC lien. Depending on the loan details, the lien can be placed on a single asset or a group of assets.

3. The lender completes the UCC filing

If you agree to the terms of the loan, you’ll then need to sign the final set of loan documents that gives the lender permission to file the UCC lien on your assets. The lender will then submit a UCC financing statement with your local Secretary of State.

4. The UCC lien is removed when the loan is paid off

UCC liens have an initial period of 5 years, and the filing can be renewed for as long as the loan has a balance. That being said, the lien can be removed prematurely in the event you pay off the loan before the initial 5-year period. The removal process can sometimes take several months, but you can always request to have it expedited if you need it removed for the purposes of pledging the collateral for another type of business loan.

Why a UCC lien is used

UCC liens are utilized by lenders or other creditors as a way to mitigate risk in the event of default. Since the UCC filing allows the lien holder to take possession of the asset if the loan agreement is breached, it gives the lender the ability to then sell the asset to recoup any financial losses.

They also help ensure that ownership cannot be transferred without the loan first being satisfied. This is because buyers will typically conduct a search for active UCC liens before purchasing an asset and will not proceed with the transaction unless it is delivered free and clear of any such liens or other ownership claims.

When a UCC lien is used

A UCC lien can be used for nearly any type of loan, such as lines of credit, equipment loans, and working capital loans. Lenders can have it as a blanket requirement as a condition of issuing a particular type of loan. It can also be required on a case-by-case basis; if necessary, it typically depends on the strength of a business loan application and your creditworthiness as a borrower.

It can be filed on many different types of assets and with more than one lien holder. This can include titled assets, such as vehicles, and nontitled assets. Some other common examples include:

- Commercial instruments

- Factoring contracts

- Inventory

- Investment securities

- Large operating equipment

- Letters of credit

- Office equipment

- Real estate

- Receivables

- Vehicles

Lenders like Bluevine may require you to agree to a UCC lien in exchange for getting approved for a small business line of credit. These credit lines, however, can be used for any number of business purposes. Bluevine offers up to $250,000 in funding in as little as 24 hours.

How to remove a UCC lien

The first step to removing a UCC lien is to pay off the loan. Once the loan has been satisfied, lenders must release the collateral. To do so, the lender will file a UCC-3 financing statement amendment, which removes the UCC lien.

If the borrower is struggling to remove a UCC lien, then they can submit a letter to the lienholder. They can also swear an oath of full payment with the Secretary of State’s office, and the state will then remove the UCC lien.

Lying about UCC liens can result in specific penalties, including fines or jail time, so be sure the loan has been paid in full before going this route.

To check if a lien has been released, the NASS? has provided links to state UCC lien information. Review your initial UCC-1 financing statement for details on how the lien is listed with the state.

How to check for a UCC lien

There are two ways to check if an asset you own has a current UCC lien:

- Check your loan agreement to determine whether you authorized the company to file a lien. You may have also been provided a copy of a UCC-1 financing statement, which should contain a description of the asset it is secured by.

- Do a UCC filing search by using the NASS public UCC search tool.

Financing options without a UCC lien

If you’re looking for options other than having a lien placed on your assets, there are few ways to potentially get financing. To do so, you’ll need to determine if it’s a requirement for the specific loan you’re trying to get and whether other types of loans may not have a UCC filing requirement.

- If a UCC lien is required on a case-by-case basis but the lender is asking you for it and your business credit or finances aren’t strong enough to warrant loan approval without the security of a UCC lien, try asking the lender if you can forgo the lien requirement if you strengthen other areas of your loan application. Some examples may include placing a larger down payment or improving your credit score.

- If all loans require a UCC lien regardless of a company’s qualifications, you’ll need to find another type of loan, possibly with another lender, that does not carry this requirement. This can include some credit lines, working capital loans, or other unsecured business loans.

Frequently asked questions (FAQs)

UCC stands for Uniform Commercial Code and is a uniform law that governs commercial transactions within the United States. A UCC filing is used to place a lien on an asset and is commonly used by lenders to mitigate risk when securing a loan.

If you default on a business loan with a UCC lien attached to it, the bank could get a judgment against your business, allowing it to repossess the assets listed in the UCC filing. The bank could sell those assets to try to pay off the remaining loan balance. If the sale of assets doesn’t satisfy the loan, it could go after other business assets, including cash, to pay off the remaining balance.

Yes, UCC filings will show up on your business credit report for up to five years. If you use your personal credit to take out a loan, which includes a UCC filing, a UCC lien won’t show up on your personal credit report. However, if the loan becomes delinquent and is turned over to a collection agency, this may show up on both your business and personal credit reports, depending on whether you used your company’s credit or your personal credit for the loan.

In the event of default, the lien holder can seize and sell the asset to recoup their losses. Depending on the asset and terms of the lien agreement, there may be legal considerations before the creditor can take action. In some cases, they may be able to proceed without the need for a court order.

The purpose of a UCC filing is to create a binding legal document that references that a creditor has placed a lien on an asset and has a claim to seize the asset in the event of default. It also acts as a public record that other creditors can reference to determine priority if other creditors have a lien placed against the asset.

A UCC filing is good for five years from its initial filing date. It can be renewed for an additional five years via a UCC-3 continuation statement and can continue until loan payoff when the asset can be released.