The auto lease inclusion is a reduction to allowable automobile lease payment deductions.

What Is Auto Lease Inclusion & How to Calculate

While the naming convention implies that something is included in income, the auto lease inclusion is a calculated amount by which lease payment deductions are reduced. The reduction is triggered if the lease duration is 30 days or more and the fair market value (FMV) The FMV is the cost established in the lease agreement. If the cost is not identified in the lease, you may use a commonly accepted reference, such as Kelley Blue Book (kbb.com), to identify the leased vehicle’s FMV. of the vehicle exceeds the threshold amount that the IRS sets for the year.

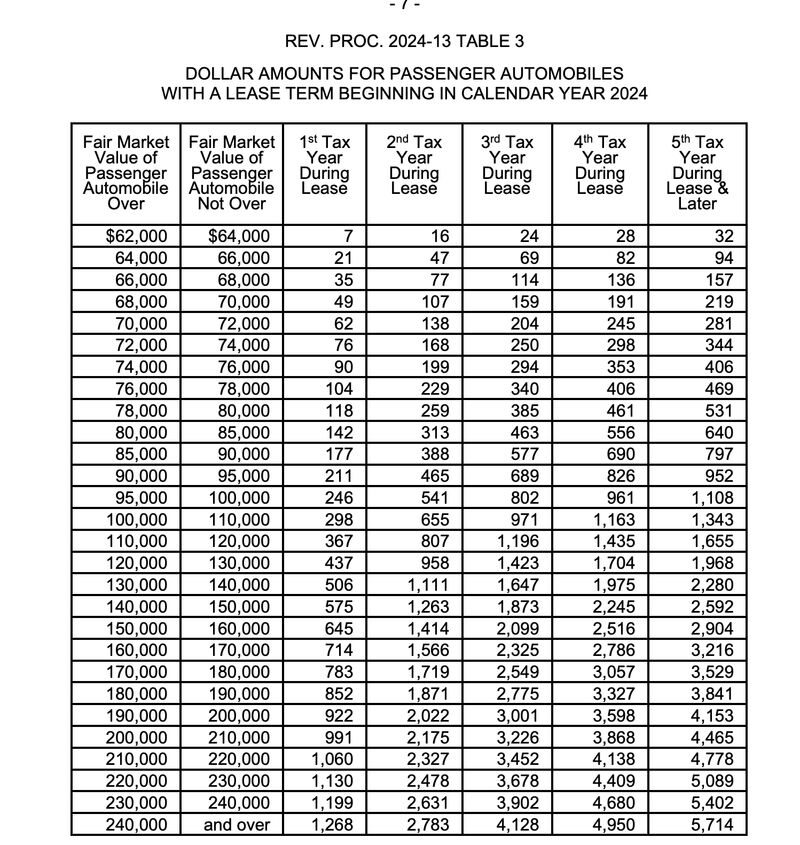

For 2024, the IRS threshold amount is $62,000. This means that if a vehicle with an FMV of $62,000 or more had a lease that began in 2024, the taxpayer would need to reduce their lease deduction for the year by the amount shown on the IRS tables referenced in our example section. You should use the table related to the year that the vehicle lease began.

Key Takeaways:

- The auto lease inclusion is based on annually indexed IRS tables.

- The auto lease inclusion is recorded by reducing the total lease payment by the inclusion amount.

- The reduced lease payment is reported on your income tax return as rent expense.

- Computation of the auto lease inclusion can be avoided by taking the standard mileage rate instead of using actual costs.

How Auto Lease Inclusion Works

When leased passenger vehicles are used for both business and personal purposes, the business percentage of the lease payment can be deducted from the taxpayer’s return. When vehicles aren’t leased and instead purchased outright, they may have limits on the allowable depreciation.

Those limits can’t be avoided by choosing to lease instead of buy. To equalize the leased auto benefit with the depreciation benefit for purchased cars, a portion of the lease payment is included in income.

Example of How to Calculate the Auto Lease Inclusion Amount

On February 1, 2023, Robert, a sole proprietor, entered into a two-year lease for a passenger vehicle that has an FMV of $81,000 and is to be used 80% for business.

- Lease Period 1: February 1, 2024 to February 1, 2025

- Lease Period 2: February 1, 2025 to February 1, 2026

Step 1: Determine the FMV at the Beginning of the Lease Term

Robert’s lease stated the FMV of the vehicle as $81,000, so we’ll use that amount. If the lease didn’t state a value, we’d use the Kelly Blue Book to determine the value.

Step 2: Look Up the Annual Inclusion Amounts for Each Year in the 2024 Table

Since the automobile was first leased in 2024, we’ll use the 2024 table to determine the inclusion amounts for each of the years in the lease. According to Rev. Proc. 2024, the annual lease inclusion amounts are:

- FMV of Auto: $81,000

- 2024: $142

- 2025: $313

- 2026: $463

IRS Rev. Proc. 2024-13

Step 3: Calculate the Inclusion Amount for Each Year

The income inclusion amount is the amount that is included in income by reducing the lease deduction. To calculate it, use this formula:

Inclusion amount each year = Amount from the table × Number of days during the tax year × Business-use percentage

2024 | 2025 | 2026 | |

|---|---|---|---|

Auto Inclusion Amount from Table | $142 | $313 | |

Number of Days Lease in Effect | 334 ÷ 365 | 365 ÷ 365 | 31 ÷ 365 |

Business Use % | 80% | 80% | 80% |

Income Inclusion | $104 | $250 | $21 |

Step 4: Deduct the Lease Inclusion Amount From the Lease Expense

After calculating the auto lease inclusion amount, Robert will reduce his lease payment deductions by that inclusion amount. As a sole proprietor, Robert will report the reduced lease payment on Schedule C.

2024 | 2025 | 2026 | |

|---|---|---|---|

Total Lease Payments | $4,400 | $4,800 | $400 |

Income Inclusion Amount | $104 | $250 | $21 |

Deduction to Schedule C, line 20a | $4,296 | $4,550 | $379 |

For other entities, the reduced lease payment will be reported on the following lines:

- Partnerships/Multimember LLCs: Form 1065, line 20

- S Corporations: Form 1120-S, line 11

- C Corporations: Form 1120, line 16

Deductions for Leased Vehicles Used Partially for Business

Taxpayers who use a personal vehicle for business may choose one of the following options to take the deduction for the vehicle’s business use:

Option 1: Deduction for Actual Costs

You may choose to deduct the actual cost of operating the leased vehicle. You may need to include the auto inclusion amount as part of the actual cost deduction.

- Step 1: Calculate the business use percentage by dividing the number of total miles driven by the number of business miles driven.

- Step 2: Use the business use percentage calculated previously and multiply it by each actual expense incurred for the operation of the vehicle.For example, if the calculated business percentage was 58%, your actual deduction would be as shown in the chart below.

Expense | Expense Amount | Business Percentage | Deduction |

|---|---|---|---|

Gas | $2,000 | 58% | $1,160 |

Repairs | $5,000 | 58% | $2,900 |

Insurance | $3,500 | 58% | $2,030 |

Lease Payments | $4,500 | 58% |

- Step 3: Determine if an auto inclusion adjustment applies. If your lease is for at least 30 days and the vehicle has an FMV that is more than the threshold amount ($62,000 for 2024), the inclusion adjustment must be computed.

- Step 4: Reduce the total of the lease payments for the year by the amount of the auto inclusion adjustment.

For option 1, the leased vehicle deductions will include the business portion of the actual expenses, including the lease payments that may need to be adjusted by the auto inclusion amount.

Option 2: Deduction for Standard Mileage

Owners of leased vehicles used for business and personal purposes may choose to take a deduction for standard mileage instead of deducting actual costs. The standard mileage rate is provided by the IRS every year and indexed for inflation.

When taking the standard mileage deduction, you may deduct the cost of parking and tolls. The lease inclusion amount does not apply if you deduct expenses using the standard mileage rate.

- Using the standard mileage method may require fewer computations, whereas using actual expenses may result in a larger deduction to taxable income.

- Self-employed business owners will need to complete Form 4562 (Depreciation and Amortization) irrespective of whether they use the actual cost or the standard mileage method.

For more detailed information on the standard mileage rate, check out our article on standard mileage vs actual expense method of deducting vehicle expenses.

Frequently Asked Questions (FAQs)

The exact inclusion amount depends on the value of the automobile, the business ownership percentage, and the specific period of the lease term. The lease inclusion applies to leases of more than 30 days for passenger vehicles in 2024 that have an FMV of more than $62,000.

The auto lease inclusion is recorded by reducing the total lease payment amount for the year by the inclusion amount and then reporting the reduced total on the section of your income tax return for rent expense.

No. You do not need to compute the auto lease inclusion if you are using the standard mileage deduction for your vehicle expenses for the year.

Bottom Line

The auto lease inclusion is not computed when the standard mileage method is being used. The auto lease inclusion amounts are provided on IRS tables that are indexed annually for inflation, and they reduce the total lease payment deduction. The reduced lease payments are then reported as rent expense on the taxpayer’s income tax return.