IRS Form 1125-A is used by corporations, partnerships, and multimember limited liability companies (LLCs)―filers of Forms 1120, 1120-C, 1120-F, 1120-S, or 1065―to calculate their cost of goods sold (COGS) for the year. It applies to businesses that sell products while businesses that sell services generally don’t need it—unless they also sell parts and supplies.

Key Takeaways

- Taxpayers with average gross receipts in the prior three years of less than $30 million are defined as small taxpayers.

- Small taxpayers can treat all inventory as supplies or report inventory for tax purposes using their book method of inventory accounting.

- The due date for form 1125-A is the same as that of the main form and both forms are remitted together.

- Form 1125-A is not required for sole proprietors and single-member LLCs as they use Part II of Schedule C to calculate COGS.

Example of Completing Form 1125-A

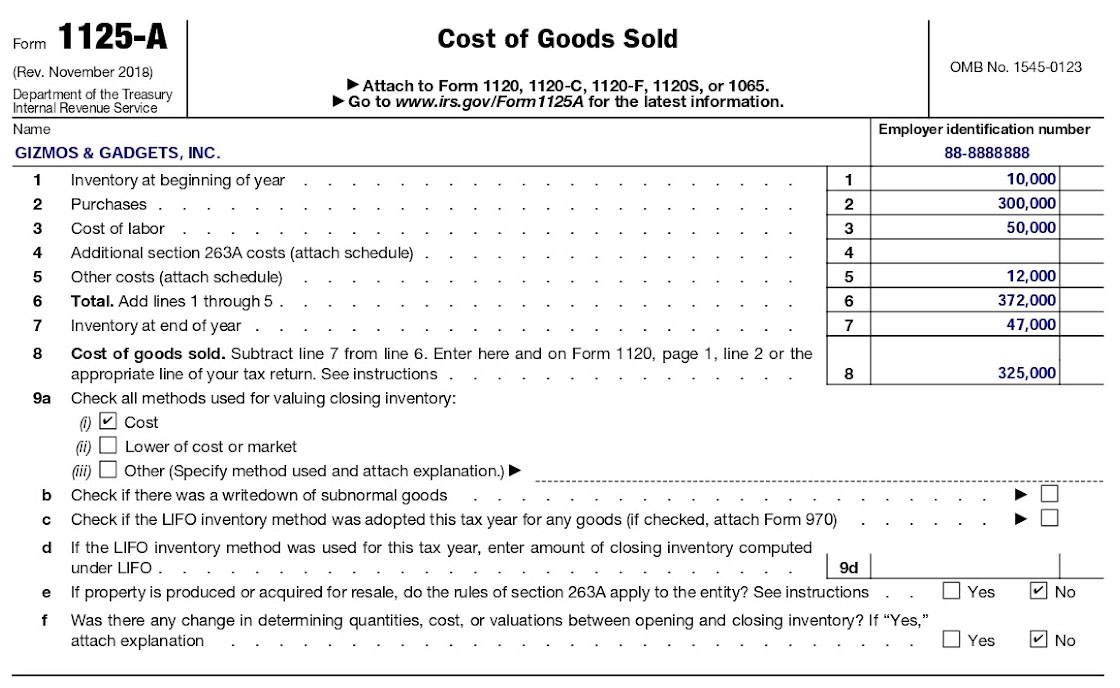

Gizmos & Gadgets (G&G) used the following activity to complete Form 1125-A for 2024:

- Gross receipts – 2023: $500,000

- Gross receipts – 2022: $450,000

- Gross receipts – 2021: $400,000

- Average gross receipts for 3 prior years: $450,000

- Beginning of year inventory: $10,000

- Purchases: $300,000

- Cost of labor: $50,000

- Freight: 4,000

- Supplies: 8,000

- End of year inventory: $47,000

With average gross receipts of $450,000, G&G qualifies as a small taxpayer and has some flexibility in how it calculates and reports inventory for taxes. G&G decides to continue its practice from prior years of valuing inventory for tax purposes the same as for its books, which is one of the methods allowed for small taxpayers.

Form 1125-A with sample data

- Line 1: The book value of the inventory that G&G held at the beginning of the year is reported here.

- Line 2: The business purchased $300,000 in inventory during the year and reported that total on line 2.

- Line 3: G&G used this line to report the salaries and wages paid for work involved in producing the company’s products for sale.

- Line 4: Section 263A requires that costs be capitalized For tax purposes, capitalization is when an expense is not deducted in full in one year. Instead, the expense is divided into segments—and each segment is deducted over multiple years. when those costs are incurred in the course of the production or acquisition of property for resale. Generally, these requirements do not apply to small taxpayers like G&G. Large taxpayers will need to attach a schedule of capitalized costs.

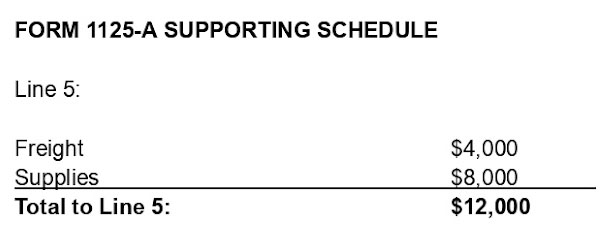

- Line 5: This line is for costs not listed elsewhere on the form. These might include supplies, freight, storage, and overhead. A schedule of these costs must be attached.

G&G’s attachment is shown here:

Form 1125-A , line 5 attachment with sample data

- Line 6: Sum lines 1 through 5.

- Line 7: The book value of the inventory that G&G held at the end of the year was reported here.

The book value of inventory is usually determined using the following methods: average cost (AVCO), first-in, first-out (FIFO), last-in, first-out (LIFO), or specific identification.

- Line 8: Subtract the year-end inventory on line 7 from the sum total of costs reported on line 6. This is the COGS that G&G will report on line 2 of its corporate return (Form 1120).

- Line 9a: This is where G&G reported cost as its method for valuing ending inventory. Other options for valuation are shown on lines 9a(ii) and 9a(iii). If 9a(iii) is selected, the method used should be provided. An explanation of that method should be attached to the form. All methods used by the taxpayer should be selected on line 9.

Line 9 Ending Inventory Valuation Options | ||

|---|---|---|

Line 9a(i) (Cost) | Line 9a(ii) (Lower of Cost or Market) | Line 9a(iii) (Other) |

Inventory valued at the cost paid to obtain the items calculated using AVCO, LIFO, FIFO, or specific identification. | Inventory valued at the lesser of cost of production or the amount the items could be sold for (market value). | Description of valuation method other than cost or market value (rare). |

- Line 9b: Companies that did not use the AVCO method would check this box if they recorded a reduction in inventory for damaged or unusable inventory. Otherwise, this box would be left blank.

- Line 9c: This box would only be checked if this is the first year that LIFO valuation was used. If it was, then Form 970 would also need to be filed.

- Line 9d: If LIFO was used to value inventory, the ending book value should be entered on this line.

- Line 9e: Generally, Section 263A rules apply to businesses that produce or acquire property for resale. Usually, small taxpayers like G&G are exempt from 263A requirements. When the requirements do not apply, “no” is checked.

- Line 9f: If the business valued ending inventory in a manner different from how beginning inventory was valued, the box on this line should be checked and an explanation should be attached.

How Does Form 1125-A Flow to the Main Tax Form?

The COGS calculated on Form 1125-A, line 8, should carry to the income tax return for the business. For each respective entity, it should be reported on the following lines:

- Partnerships/multimember LLCs: Form 1065, line 2

- S corporations (S-corps): Form 1120-S, line 2

- C corporations (C-corps): Form 1120, line 2

- Cooperative associations: Form 1120-C, line 2

- Foreign corporations: Form 1120-F, Part II, line 2

How to File Form 1125-A?

Form 1125-A is filed with the main income tax form (1120, 1120-C, 1120-F, 1120-S, or 1065) by the due date of the main form.

Frequently Asked Questions (FAQs)

Purchases are additions to inventory, acquired throughout the year. They can consist of purchases of finished goods for resale or raw materials for manufacturing.

COGS is calculated by adding beginning inventory to purchases and subtracting ending inventory. Form 1125-A combines basic COGS with form-specific adjustments.

Bottom Line

Form 1125-A is used to calculate the COGS that are then carried to the taxpayer’s main income tax form. Reference the IRS Form 1125-A instructions for additional details on what should be included.