IRS Form 1125-E is used to report compensation for corporate officers, and state law determines who is considered an officer for the purposes of Form 1125-E reporting. The form is required for S corporations (S-corps) or C corporations (C-corps) with gross receipts of $500,000 or more for the year.

Key takeaways

- For each officer, Form 1125-E discloses their name, Social Security number, ownership percentage, time devoted to the business, and compensation received.

- Gross receipts may include line items from various schedules throughout the tax return.

- Form 1125-E is included with the main Form 1120 or 1120-S tax return.

- Form 1125-E’s due date is the same as that of the main form.

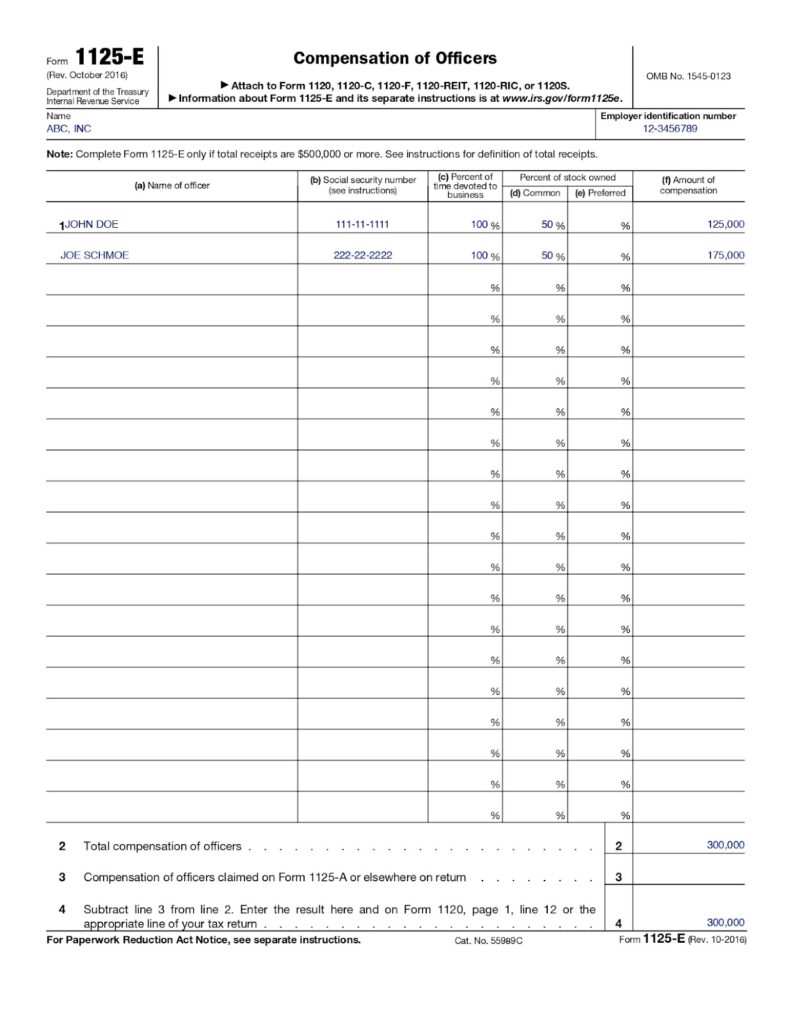

Example – Completing Form 1125-E

Joe Schmoe and his best friend John Doe operate ABC, Inc. Joe is the CEO, and John is the chief financial officer (CFO):

- Gross receipts – ABC, Inc.: $600,000

- Wages – Joe Schmoe, CEO: $175,000

- Wages – John Doe, CFO: $125,000

Given that ABC, Inc. meets the gross receipts threshold, Form 1125-E must be included in its corporate tax filing.

Form 1125-E with sample data

- Line 1: Form 1125-E must include each officer’s name, Social Security number, percentage of time devoted to the business Percentage of time must be a numerical value. Text entries—such as as needed or part-time—are unacceptable percentage of ownership, and amount of compensation. If no preferred stock has been issued, you can leave the column blank.

- Line 2: Sum the compensation for all the officers listed.

- Line 3: Form 1125-A relates to cost of goods sold (COGS). If officer compensation was allocated to COGS on Form 1125-A, then include the officer compensation allocated to the cost of labor on this line.

- Line 4: Subtract line 3 from line 2, then enter the result on line 4.

How Does Form 1125-E Flow to Form 1120/1120-S?

- For Form 1120-S, the officer compensation expense carries to line 7 from Form 1125-E.

- For C-corps, this expense flows from Form 1125-E, line 4, to Form 1120, line 12.

Officer compensation is a deductible corporate expense. Some officer compensation may be included in COGS, as shown on line 3 of the form.

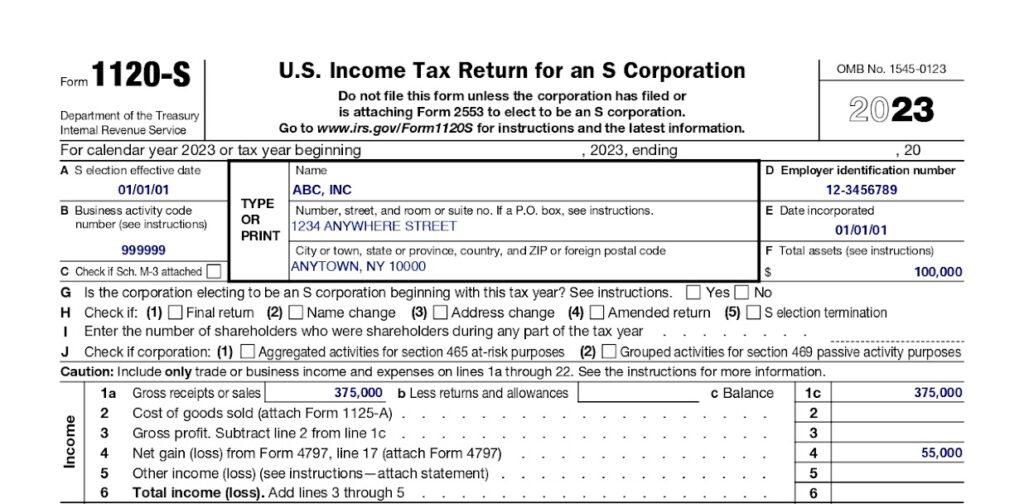

For S-corps, gross receipts are calculated from Form 1120-S by adding the following lines from page 1:

- 1a: Gross receipts or sales

- 4: Net gain (loss) from Form 4797, line 17

- 5: Other income (loss)

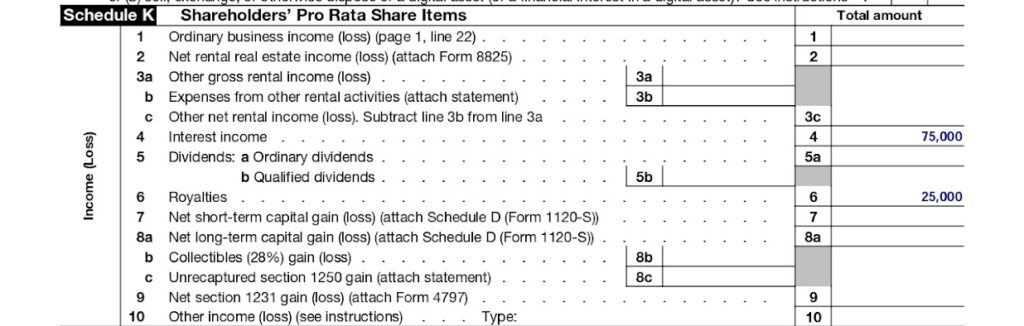

Also, it takes the following lines from Schedule K:

- 3a: Other gross rental income (loss)

- 4: Interest income

- 5a: Ordinary dividends

- 6: Royalties

- 7: Net short-term capital gain (loss)

- 8a: Net long-term capital gain (loss)

- 9: Net section 1231 gain (loss)

- 10: Other income (loss)

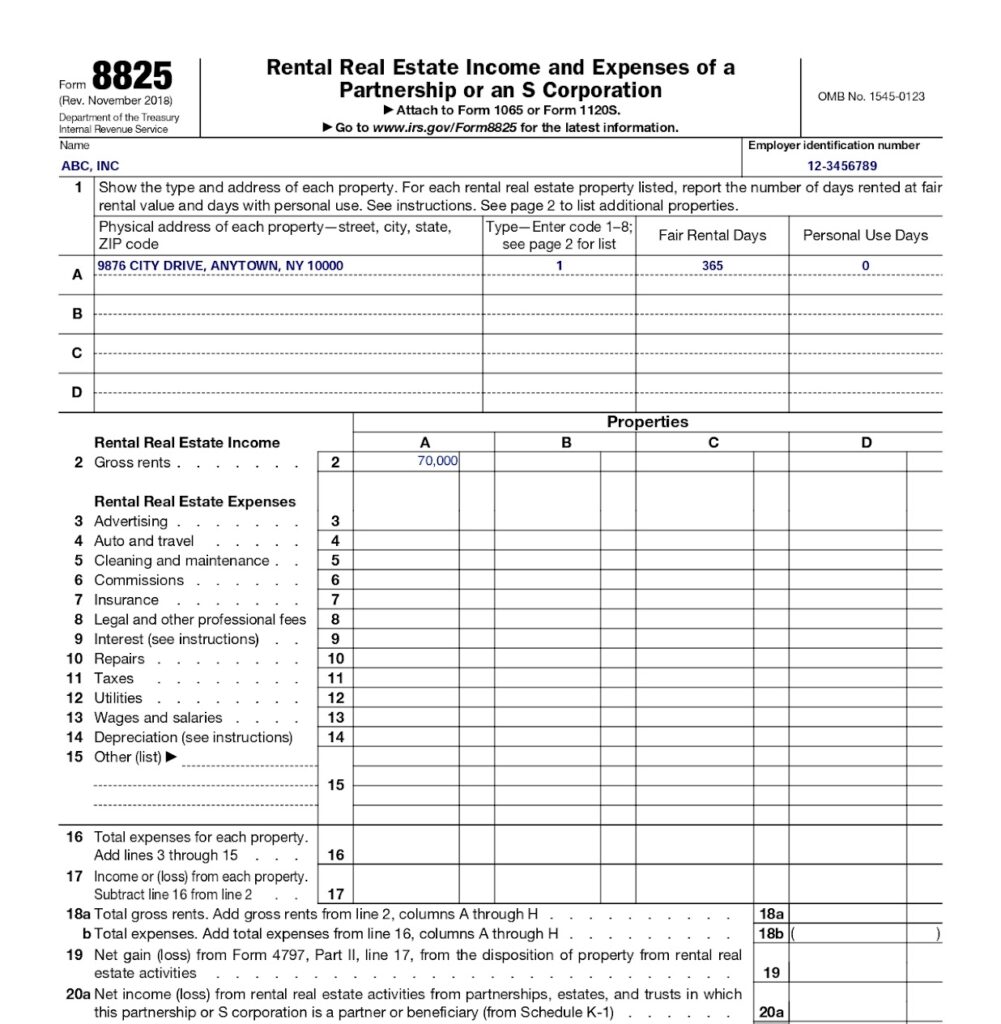

Then, income or net gain from lines on Form 8825 are added:

- 2: Gross rents

- 19: Net gain (loss) from Form 4797

- 20a: Net income (loss) from rental real estate activities from partnerships, estates, and trusts in which this partnership or S-corp is a partner or beneficiary (from Schedule K-1)

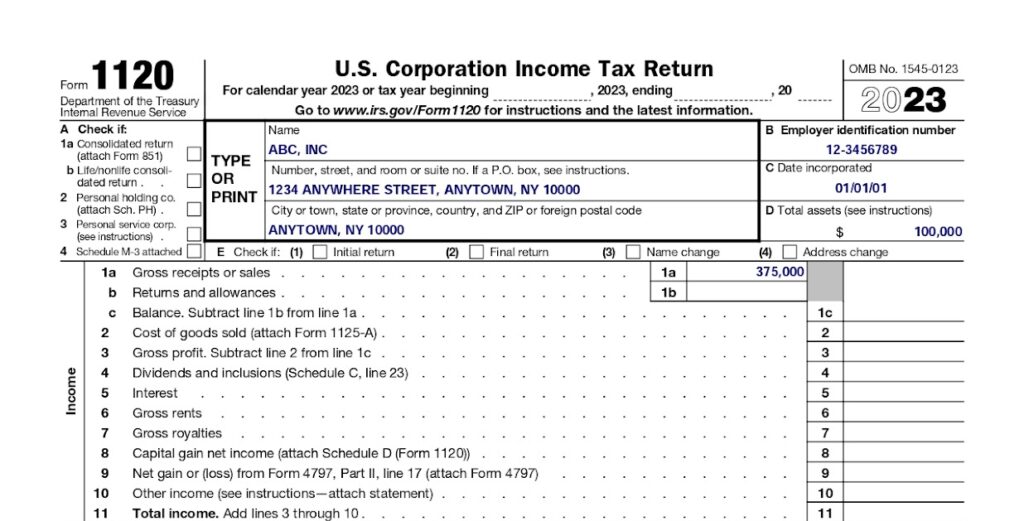

The line items referenced above are shown below.

Total gross receipts for the purposes of Form 1125-E is $600,000. It is calculated as follows:

Line 1a - Gross Receipts | 375,000 |

Line 4 - Net Gain/Loss | 55,000 |

Line 4 (Schedule K) - Interest Income | 75,000 |

Line 6 (Schedule K) - Royalties | 25,000 |

Line 2 (Form 8825) - Gross Rents | 70,000 |

Total Gross Receipts | 600,000 |

ABC, Inc. must file Form 1125-E since gross receipts of $600,000 exceed the $500,000 threshold.

For C-corps, gross receipts are calculated by adding the following lines from page 1:

- 1a: Gross receipts or sales

- 4: Dividends and inclusions

- 5: Interest

- 6: Gross rents

- 7: Gross royalties

- 8: Capital gain net income from Schedule D

- 9: Net gain (or loss) from Form 4797

- 10: Other income

The image below shows sample information for Form 1120, lines 1a–10. The information on these lines would be used to determine if Form 1125-E is required, and if so, the total to report.

Sample 1125-E input from Form 1120, Lines 1a–10

Total gross receipts for the purposes of Form 1125-E is $375,000, and it is calculated like so:

Line 1a - Gross Receipts | 375,000 |

Total Gross Receipts: | 375,000 |

Given gross receipts are less than $500,000, ABC, Inc. does not need to include Form 1125-E with its Form 1120 tax filing.

Frequently Asked Questions (FAQs)

Yes, officer compensation is reported on Form W-2.

While who classifies as an officer is governed by state law, generally, officers would include the CEO, CFO, and chief operating officer (COO). Depending on the jurisdiction, corporate administrative positions, such as a corporate secretary, may also be assigned the status of officer.

Form 1125-E is due with the main tax form it is filed with. A Form 1125-E filed with Form 1120-S is due on March 15 while a Form 1125-E filed with Form 1120 is due on April 15.

Bottom Line

Form 1125-E is used to provide the IRS with separately stated transparency regarding the compensation of officers in corporations with gross receipts of $500,000 or more. Reference the form instructions for IRS Form 1125-E for additional details on what should be included.