IRS code 971 on your transcript means that the IRS has sent you a notice, generally indicating that more time or information is needed to resolve an issue. Notices can cover a wide range of topics, including tax return adjustments, document requests, and account changes. To respond to a transcript code (TC) 971 notice, you should review the notice details, determine if you agree with the notice, draft your response, and then remit your communication to the IRS.

Key Takeaways:

- TC 971 will likely be presented on a transcript with one or more other codes to provide further clarity on the outstanding issue.

- It is common for TC 971 to be accompanied by TC 570, which indicates that the IRS put a hold on processing your refund.

- If you see TC 971 on your transcript but did not receive a notice, you can create an online IRS account and view your notice there.

What to Do When TC 971 Is on Your Transcript

If you see TC 971 on your tax transcript and have not received a notice in the mail, you can log into the online account where you pulled your transcript and view your tax notices. You visit the IRS website to create an online account if you don’t have one.

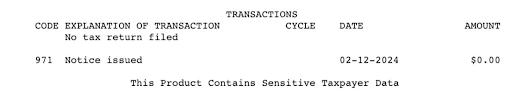

Example of TC 971 on IRS Transcript

How to Respond to an IRS Code 971 Notice

When you receive the notice issued for TC 971, follow the process below.

Step 1: Review the Details of the Notice Issued for IRS Code 971

If you use an outside tax preparer who will be assisting with your response, ensure you send all pages of the notice to them. The notice should have the following parts, which will be relevant to your response:

- IRS notice number and issue date: You may need this information for subsequent correspondence with the IRS.

- IRS contact information: The IRS should provide a phone number or address to use for inquiries or more information.

- Explanation of issue: The IRS notice should explain why the notice is being sent, changes (if any) that have been made to your tax return, and instructions for next steps.

Here are some common reasons for a TC 971 notice:

- Computational errors (math mistakes): In these cases, the IRS may have adjusted the calculations made on your return.

- Missing information: The IRS may require additional documents to support the information presented on your return.

- Refund adjustments: If your refund has been modified, the notice should explain the adjustment.

- Assessment of additional tax: If additional tax has been assessed by the IRS, the notice will detail the balance due and separately identify any components allocable to penalties or interest.

- Amended tax return: A TC 971 notice frequently has a description that says “amended tax return or claim forwarded for processing.” This may mean that the return needs manual review by an IRS agent and is queuing for review.

- Notice of Intent to Levy: This notice indicates that the IRS plans to seize personal assets to satisfy a balance due unless the requested amount is paid in full by the date indicated on the letter.

Step 2: Determine if You Agree With the Notice

The tax notice issued pursuant to TC 971 will likely give you the option to agree or disagree.

- If you agree with the information provided, follow the IRS notice instructions for making payment or providing additional information.

- If you believe the IRS position is incorrect, you may dispute the assessment by following the instructions presented on the notice. These instructions generally provide a time frame and method for responding (e.g. fax, postal mail, etc.). Prepare a letter identifying why you disagree, to be accompanied by supporting documentation, discussed in the next section.

Step 3: Draft Your Response

When drafting your notice response, use clear and concise language. Be sure to include your contact information (email, phone number, and postal address) so that if a specific agent is assigned, they can easily reach you.

If a form or template is provided by the IRS with the notice, be sure to complete and return that form with your response. Attach any documents specifically requested by the IRS, along with any documents that support your response. Examples of support documents include:

- Copies of prior year tax returns

- Forms W-2, 1099, and 1098, receipts, and bank statements

- Certified mailing receipts for payment or correspondence sent via postal mail

- Copies of canceled checks or payment confirmationsStep 4: Remit Your Response to the IRS

Step 4: Remit Your Response to the IRS

The notice you receive relating to code 971 should state the preferred method of response. In some cases, an agent has already been assigned, and their individual information is provided. Remit your response package to the postal address, fax number, or email address provided.

Ensure the packet includes the following:

- A copy of the original tax notice

- Your response letter

- Any supporting documentation requested

- Any additional documentation that supports the position taken in your response

If you are sending your response via postal mail, then send the response via a trackable mail service. Generally, it’s a safe bet to send postal mail responses to the IRS via certified mail. If you are faxing your response, save the fax confirmation number. You should still receive confirmation information when sending an eFax.

Be sure to send your response within the time frame allotted by the IRS. This time frame should be explicitly stated on the notice; failure to respond within the designated time frame may result in further assessment of penalties, interest, or a default judgment. Keep a copy of the notice response for your records.

IRS Code 971 With Code 570

TC 971 is frequently seen with TC 570, which indicates that the IRS has put a temporary hold on processing your refund while it looks into an outstanding issue. Since code 971 indicates that a notice is forthcoming, you can expect to receive a notice with details on the situation that is holding up your refund.

Example of Code 971 and Code 570 on IRS Transcript

Frequently Asked Questions (FAQs)

Your expected refund timing will depend on what is shown on the notice that the IRS issues. Once the issue on the notice is resolved, refund timing can vary from a few weeks to several months.

Publication 971 is an IRS communication about the responsibility of one spouse for the other spouse’s tax liability. Publication 971 is not related to TC 971.

Code 971 means that the IRS needs more information and will issue a tax notice with further instructions.

Bottom Line

Code 971 means that the IRS needs more information and an IRS notice is on the way. If you do not receive the IRS notice via postal mail, you’ll need to check your IRS online account to view what was sent. Once the notice has been reviewed, your response should be timely, cover all inquiries, and use a trackable delivery method.