A qualified joint venture (QJV) is a business owned by a married couple. It allows them to report their business activity directly on their joint income tax return instead of filing a partnership return (Form 1065).

What Is a Qualified Joint Venture for Married Couples?

Without QJV rules, a business that is not formally organized with a state but is solely owned and operated by a married couple would default to being treated like a partnership for tax purposes—even when there is no official partnership agreement. Being treated as a partnership for tax purposes would subject the taxpayers to more complex reporting and administration.

Key Takeaways:

- Spouses must split the QJV income and expenses and each report their share separately but on the same joint individual tax return.

- Self-employment tax is calculated separately for each spouse, which can generate tax planning opportunities.

- In non-community property states, the spouses must allocate income and deductions based on their ownership percentages.

- In community property states, income and deductions can be allocated between spouses however they choose.

Qualified Joint Venture Benefits

Here are the two main benefits of reporting a business as a QJV:

- Less complicated tax filing: One of the main qualified joint venture benefits for married couples is not having to file a separate business return to report business activity. Instead, the business activity is reported on their personal income tax return on Schedule C, E, or F, depending on the type of business activity the couple is engaged in.

- Spouses have the opportunity to earn credit toward Social Security benefits: With a QJV, each spouse must complete a separate Schedule SE for Social Security and Medicare tax to be assessed.

Qualified Joint Venture Eligibility

To be eligible for a QJV, the following criteria must be met:

- The business cannot be organized under state law—such as a partnership, LLC, corporation, or similar state law entity.

- The taxpayers must be conducting a trade or business in which both spouses materially participate.

- The couple must be legally married and file a joint tax return.

- Both spouses must be the only owners of the business.

- Both spouses must agree to report their income on their joint return and not file a partnership tax return.

Election & Reporting for Qualified Joint Ventures

QJV status is elected through the process of each spouse separately reporting their share of the business or rental income on the jointly filed tax return. No special election statement is required for QJV status.

You’ll need to allocate the income, gain, loss, deductions, and credits for the tax year between each spouse. The allocation should be in line with each spouse’s interest in the business.

Each spouse will need to file their own Schedule C, E, or F and use their own Social Security number when reporting their portion of business activity.

- Schedule C for reporting income and expenses for most jointly-owned, non-farm or real estate businesses

- Schedule F for reporting income and expenses for farming activity

- Schedule E for reporting income and expenses from rental activity

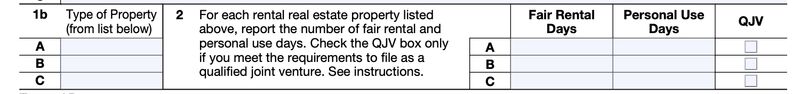

Each spouse’s investment in the property is reported as individually owned property, but only one Schedule E form is required. The QJV box should be checked on Schedule E to identify the QJV election.

Qualified Joint Venture Checkbox on Schedule E

For business activities that do not involve farming or rental activity, each spouse will need to complete their own Schedule C and Schedule SE. An example of how that would be reported is shown below, along with the tax impact.

Bob and Brenda have a breadmaking business that they are operating as a QJV. The fact pattern is as follows:

- 2024 Net income for business: $250,000

- 2024 Income reported on Bob’s Schedule C: $125,000

2024 Self-employment tax reported on Bob’s Schedule SE: $17,662

(125,000 × 0.9235 × 0.153)

- 2024 Income reported on Brenda’s Schedule C: $125,000

2024 Self-employment tax reported on Brenda’s Schedule SE: $17,662

(125,000 × 0.9235 × 0.153)

Bob and Brenda would pay a combined self-employment tax of $35,324.

Farming activities are reported using Schedule F and accompanied by Schedule SE. If Bob and Brenda conducted farming activities instead of their nonfarm breadmaking operations, they would each file separate Schedules F and separate Schedules SE instead of the Schedules C and SE used in the previous example. The calculation of self-employment tax would be the same.

For rental activities, both spouses can report a joint number on Schedule E. Income from rental activities is not subject to self-employment tax so no Schedule SE is required.

Qualified Joint Ventures: Common Law vs Community Property States In 2024, the nine community property states are Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin.

Regardless of where a couple lives in the US, they can choose to treat their unregistered partnership as either a general partnership and file a partnership tax return or a QJV. These options assume they meet the QJV qualifications discussed above.

However, if a couple elects to treat the unregistered partnership as a QJV, the method used to allocate the income and deductions between spouses will vary based on whether they live in a common law or community property state.

Allocating QJV Income in a Common Law State

Spouses that live in common law states must allocate all income and deductions from the QJV according to the amount that each spouse has contributed to the business. If all contributions to the business came from jointly-held funds, then the business income must be split 50/50 between the spouses.

Allocating QJV Income in a Community Property State

Spouses in community property states have complete freedom to allocate income and deductions from the QJV in any way they wish. For example, they can allocate 100% of income and deductions to only one of the spouses and report it on a single Schedule C, E, or F.

This provides potential tax and retirement planning opportunities for residents of community property states. As shown in the example above, if net income is above $168,600, self-employment tax can be minimized by allocating all the net income to just one spouse.

Self-employment Tax Savings with QJVs in Community Property States In 2024, the nine community property states are Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin.

Self-employment tax applies when earnings from a jointly owned business are $400 or more. If income from married taxpayers is solely attributed to one spouse’s Schedule C—as is allowed in community property states—a couple of important tax implications arise.

- Only one spouse gets credit toward future Social Security benefits, even though both spouses should get equal credit if the effort invested in the business is equal.

- If the earnings exceed the Social Security wage base ($168,600 for 2024), then reporting the income on one spouse’s Schedule C would result in less total self-employment tax being paid than if two Schedule Cs were being filed.

Let’s take a look at this concept with an example.

Alice and Aaron work full-time at a specialty food shop that they own and operate; there are no external investors in the business. They recently started selling exotic caviar and truffles, and in 2024, they produced a net profit of $500,000.

This table summarizes the calculation of the total SE tax based on the $500,000 being split evenly versus the $500,000 being allocated entirely to Alice.

Income Allocated Evenly | All Income Reported by Alice | ||

|---|---|---|---|

Alice | Aaron | Alice | |

Net Income | $250,000 | $250,000 | $500,000 |

× 0.9235 | × 0.9235 | × 0.9235 | |

Net SE Income | $230,875 | $230,875 | $461,750 |

Social Security Tax ($168,600 × 12.4%) | $20,906 | $20,906 | $20,906 |

Medicare Tax (Net SE Income × 2.9%) | $6,695 | $6,695 | $13,390 |

Total SE Tax Per Spouse | $27,601 | $27,601 | $34,296 |

Total SE Tax for Couple | $55,202 | $34,296 | |

By living in a community property state and allocating 100% of the QJC income to Alice, the couple saved $20,906 ($55,202 – $34,296) in self-employment tax. The drawback to this allocation is that Aaron did not pay any money into the Social Security system and might have few benefits upon retirement.

If Alice and Aaron’s business had net income of $30,000 in 2024 (well below the $168,200 wage base), the self-employment tax assessed would be the same whether or not the income was reported on one Schedule C for one spouse or on two Schedule C’s using the QJV structure.

Disregarding the Qualified Joint Venture Election

Availing oneself of the QJV rules is useful for those who wish to avoid the administrative burden of partnership filing. However, for those who live in non-community property states and don’t have the flexibility of tax treatment choice that residents of community property states have, accepting the partnership tax treatment might be beneficial in some circumstances.

In a partnership, income can be allocated in the way that the partner-spouses see fit. With that in mind, if one spouse already has wages from another source that exceeds the Social Security wage base, the couple could save taxes by allocating the income from the jointly owned business primarily to that spouse.

That spouse will have already paid the maximum amount of Social Security tax from their other job, so the additional income would incur additional Medicare tax, but it would not incur the additional Social Security tax that would be generated if borne by both spouses.

Frequently Asked Questions (FAQs)

The main QJV benefit is that the spouse/owners don’t have to file a partnership tax return.

It depends. An LLC is registered with the state and therefore does not meet the IRS’ definition of an “unincorporated business”. As such, an LLC is generally not considered a QJV. There are exceptions in some cases for a spousal-owned LLC where the spouses reside in a community property state and meet the other criteria for a QJV.

A married couple that materially participates in their rental property business may have their entity qualified as a QJV if the general QJV criteria are met.

Bottom Line

A qualified joint venture is a convenient option for married couples who jointly own and operate a business. However, certain criteria must be met to qualify. QJV classification simplifies the tax filing process by reporting the income directly on the owner’s joint tax return instead of filing a partnership return.