Editor’s Note: This article focuses on the big-picture 1231 issues. It excludes details and exceptions that rarely make a difference and only serve to overly complicate things. It is intended for small business owners trying to understand how the tax is calculated on their asset sales, so if you’re a tax pro researching the nuances of 1231 or studying for an exam, this article might not be for you.

Section 1231 property are tangible assets used in your business’s operation and held for more than one year. Common examples of 1231 assets are your office building, the land it sits on, office equipment, and manufacturing equipment. Assets used in a long-term rental activity are also 1231 assets—including houses, buildings, furniture, and similar rental assets. Section 1231 assets exclude assets held as investments and inventory.

It’s important to label your 1231 assets properly because their disposal is taxed differently than other assets. Generally, if all your 1231 disposals during the year result in a net gain, that gain is taxed as a capital gain. If all your 1231 disposals during the year result in a net loss, that loss is taxed as an ordinary loss, which allows you to use it to offset ordinary income.

A little later in this article, I’ll illustrate this taxation with a comprehensive example that shows how a portion of the gain on 1231 assets can be taxed at a lower tax rate than your ordinary income.

Key Takeaways

- Section 1231 gains must be recaptured and taxed as ordinary income to the extent there were 1231 losses deducted as ordinary in the prior five years.

- Section 1245 property is a subset of 1231 property and is depreciable personal property used in your business.

- Section 1250 property is another subset of 1231 property and is the depreciable real property used in your business.

Categories of Section 1231 Property

Section 1231 property can be split into these subcategories:

- Depreciable assets other than buildings: Furniture, equipment, machinery, vehicles, and similar assets used in your business are also 1231 property but can be further classified as Section 1245 property.

- Buildings: Buildings used in your business are 1231 property but can be further classified as Section 1250 property.

- Land: Land is the third major category of 1231 property, but it has no further code section to describe it, so we’ll call it “other 1231 property.”

Categories of 1231 Assets | |||

|---|---|---|---|

Section 1245 Assets | Section 1250 Assets | Other 1231 Assets | |

Common examples | Depreciable furniture and equipment | Depreciable buildings | Land |

The importance of breaking down your Section 1231 property into 1245 property, 1250 property, and other 1231 property is when calculating the tax on any gain from the sale of any of these assets. For instance, Section 1245 property excludes gain derived from accumulated depreciation from being 1231 gain but instead classifies that portion of the gain as ordinary income. We’ll talk more about that later in the taxation section.

For taxes, property is classified based on its purpose—not on what the asset is. For instance, a car can be either 1231 property, a capital asset, or inventory, depending on why a taxpayer owns it.

- Car as 1231 property: If the taxpayer uses the car as a shuttle bus for employees, it is used in the ordinary course of the business and is a 1231 asset.

- Car as a Capital asset: If the taxpayer bought the car to use personally or to hold with the hope it will increase in value over time, the car is a capital asset.

- Car as Inventory: If the taxpayer bought the car intending to resell it quickly, the car is inventory.

Taxation of Section 1231 Property

Analyze Each 1231 Transaction

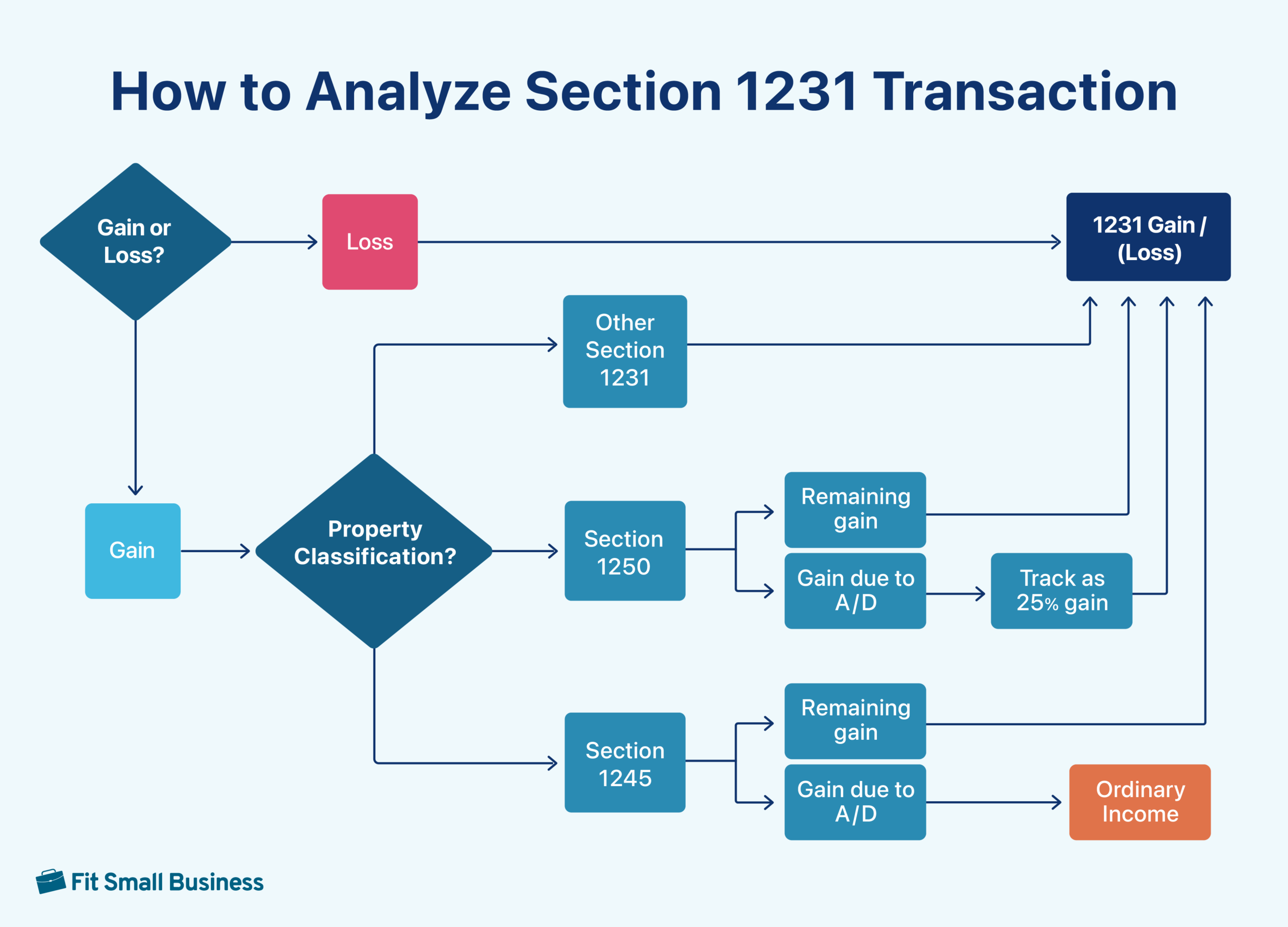

The first step in determining the tax on the disposal of 1231 property during the year is to analyze each asset disposal. You will determine whether the entire gain or loss is a 1231 gain or loss—or if the gain must be further analyzed to determine if some part of the gain might be ordinary income instead of 1231 gain.

Here are the basic rules to consider during this step:

- Loss on the disposal of any type of 1231 property is a 1231 loss

- Gain on the disposal of “Other 1231 Assets” is a 1231 gain

- Gain on the disposal of 1245 or 1250 must be further analyzed to determine the 1231 portion

To illustrate the process of analyzing the 1231 property disposals, let’s assume a taxpayer disposed of the following assets during the year. All assets were owned for more than a year and used in the business.

Asset Description | Cost | A/D | Adj. Basis | Proceeds | Gain/(Loss) | Character of Gain/Loss |

|---|---|---|---|---|---|---|

Land #1 (other 1231 property) | $150,000 | N/A | $150,000 | $200,000 | $50,000 | Section 1231 Gain |

Land #2 (other 1231 property) | $80,000 | N/A | $80,000 | $50,000 | ($30,000) | Section 1231 Loss |

Equipment (1245 property) | $30,000 | $10,000 | $20,000 | $15,000 | ($5,000) | Section 1231 Loss |

Machinery (1245 property) | $45,000 | $45,000 | -0- | $15,000 | $15,000 | Further analysis needed |

Furniture (1245 property) | $10,000 | $10,000 | -0- | $12,000 | $12,000 | Further analysis needed |

Maintenance Shop (1250 property) | $125,000 | $25,000 | $100,000 | $80,000 | ($20,000) | Section 1231 Loss |

Warehouse (1250 property) | $500,000 | $150,000 | $350,000 | $575,000 | $225,000 | Further analysis needed |

Total gain/loss | $247,000 |

Land #2, Equipment, and Maintenance Shop were all sold at a loss. Losses are always treated as 1231 losses, so these can be added to our 1231 “bucket” without any further analysis. Once we’ve analyzed all of our transactions, we can say either of the following:

- If the 1231 bucket is an overall gain, then we’ll treat it as capital

- If the 1231 bucket is an overall loss, then we’ll treat it as an ordinary loss

Analyze Section 1245 Gains

Remember, 1245 property is depreciable machinery, equipment, furniture, or similar items used in your business. When you dispose of 1245 for a gain, that gain must be separated into two components:

- 1231 gain: The portion of the gain that occurs because you sold the asset for more than you paid for it. This gain will be added to our 1231 bucket.

- Ordinary income: The portion of the gain that occurs because you’ve reduced the basis in the asset by accumulated depreciation. This portion of the gain is referred to as “1245 Recapture” by tax pros. This 1245 recapture goes on the tax return as ordinary income and is not added to the 1231 bucket.

Let’s analyze the two 1245 assets that were sold at a gain to separate that gain into the 1231 gain and the ordinary income.

Machinery | Furniture | |

|---|---|---|

Gain due to A/D (ordinary income) | $15,000 | $10,000 |

Gain due to selling price greater than cost (1231 gain) | -0- | $2,000 |

Total gain | $15,000 | $12,000 |

- Machinery: The machinery was fully depreciated with both a cost and A/D of $45,000. Since it was sold for less than its original cost, the entire gain is due to accumulated depreciation. Therefore, the entire gain of $15,000 is ordinary income—or 1245 recapture in tax lingo.

- Furniture: The furniture was purchased for $10,000 and fully depreciated. It was sold for $12,000, which is $2,000 more than its original purchase price. Therefore, $2,000 of the gain is a 1231 gain, and the remaining $10,000 is due to A/D and is ordinary income (1245 recapture).

Analyze Section 1250 Gains

Section 1250 property is any depreciable building used in your business. Similar to 1245 gains, the gain on the disposal of buildings must be separated into two components:

- 1231 gain: As with 1245 property, only the portion of the gain attributable to the selling price being in excess of the purchase price is treated as a typical 1231 gain and added to the 1231 bucket.

- 1231 gain @25%: The portion of the gain on 1250 property that is due to the A/D is also considered a 1231 gain. This portion of the gain is called “Unrecaptured Section 1250 Gain” in tax lingo. It is added to the 1231 bucket but will be subject to a maximum 25% capital gains tax instead of the typical 20% capital gains tax.

Let’s analyze the Warehouse in our example, which is the only 1250 asset sold at a gain.

Warehouse | |

|---|---|

Gain due to A/D (1231 gain @25%) | $150,000 |

Gain due to selling price greater than cost (1231 gain) | $75,000 |

Total gain | $225,000 |

The Warehouse was purchased for $500,000 and sold for $575,000. Therefore, $75,000 of the gain is because the building was sold for more than its cost, and that portion is treated as a typical 1231 gain. The other $150,000 of gain is due to the $150,000 of A/D. This amount is also treated as a 1231 gain but is subject to the special maximum capital gains rate of 25%.

Compile Your Gains and Losses

Now that each transaction has been analyzed, you can compile your gains and losses. Any amounts from Section 1245 property treated as ordinary income should be reported as ordinary income on Form 4797. All other gains and losses get included in our 1231 bucket.

Let’s separate our total gains and losses from the asset disposals into what gets 1) reported as ordinary income on Form 4797; and 2) included in our 1231 bucket.

Form 4797 | 1231 Bucket | |

|---|---|---|

Land #1 (other 1231 property) | $50,000 | |

Land #2 (other 1231 property) | ($30,000) | |

Equipment (1245 property) | ($5,000) | |

Machinery (1245 property) | $15,000 | -0- |

Furniture (1245 property) | $10,000 | $2,000 |

Maintenance shop (1250 property) | ($20,000) | |

Warehouse (1250 property) | $75,000 $150,000 (max 25% tax rate) | |

Total gains | $25,000 | $222,000 |

Notice that the total gain of $247,000 has remained the same as in our example data. What we’ve accomplished by analyzing the individual transactions is to determine that $25,000 of the gain is not 1231 gain and must be reported as ordinary income on Form 4797. We also found that $150,000 of the 1231 gain will be subject to a maximum capital gains rate of 25% instead of the typical 20%.

Calculate the Tax on 1231 Gains

- If the 1231 bucket is negative, that entire negative amount will be treated as an ordinary loss and reported on Form 4797.

- If the 1231 bucket is positive, the entire positive amount will be treated as a capital gain.

To wrap up our example, let’s assume the taxpayer has an ordinary marginal tax rate of 35%, which will make their maximum capital gains rate 20%.

Ordinary Income | Capital Gains (25%) | Capital Gains | |

|---|---|---|---|

Gain | $25,000 | $150,000 | $72,000 |

Tax rate | 35% | 25% | 20% |

Tax | $8,750 | $37,500 | $14,400 |

To wrap up our example, let’s assume the taxpayer has an ordinary marginal tax rate of 35%, which will make their maximum capital gains rate 20%.

What Are Nonrecaptured Section 1231 Losses and Section 1231 Recapture?

Nonrecaptured 1231 losses are created by deducting 1231 losses as ordinary losses. If within five years of creating a nonrecaptured 1231 loss the taxpayer has a 1231 gain, then that gain must be taxed as ordinary income instead of capital. This conversion of 1231 gain from capital to ordinary income is called Section 1231 Recapture.

In our example above, we implicitly assumed that there were no nonrecaptured section 1231 losses outstanding from the prior five years.

Assume a taxpayer had the following 1231 gains and losses for 2019 through 2024:

Year | 1231 Gain/(Loss) |

|---|---|

2020 | ($100,000) |

2021 | ($50,000) |

2022 | $70,000 |

2023 | $40,000 |

2024 | $60,000 |

In 2020 and 2021, the 1231 losses are deducted as ordinary and generate nonrecaptured section 1231 losses:

Gain/(Loss) | Nonrecaptured 1231 Losses | Nonrecaptured 1231 Losses (Balance) | |

|---|---|---|---|

2020 | ($100,000) | $100,000 | $100,000 |

2021 | ($50,000) | $50,000 | $150,000 |

In 2022 and 2023, the section 1231 gains of $110,000 must be treated as ordinary income because of the nonrecaptured 1231 losses.

Gain/(Loss) | 1231 Recapture | Nonrecaptured 1231 Losses | Nonrecaptured 1231 Losses (Balance) |

|---|---|---|---|

2020 | ($100,000) | $100,000 | $100,000 |

2021 | ($50,000) | $50,000 | $150,000 |

2022 | $70,000 | $70,000 | $80,000 |

2023 | $40,000 | $40,000 | $40,000 |

In 2024, $40,000 of the 1231 gain will have to be treated as ordinary 1231 recapture. The remaining $20,000 of gain can be treated as capital because all the nonrecaptured 1231 losses from 2020 and 2021 have been recaptured.

Gain/(Loss) | 1231 Gain (Capital) | 1231 Recapture (Ordinary) | Nonrecaptured 1231 Losses | Nonrecaptured 1231 Balance | |

|---|---|---|---|---|---|

2020 | ($100,000) | $100,000 | $100,000 | ||

2021 | ($50,000) | $50,000 | $150,000 | ||

2022 | $70,000 | $70,000 | $80,000 | ||

2023 | $40,000 | $40,000 | $40,000 | ||

2024 | $60,000 | $20,000 | $40,000 | -0- |

Frequently Asked Questions (FAQs)

Section 1245 property is a subset of section 1231 property. Both are assets used in a business, but 1245 property is specifically depreciable personal property (not real property) used in a business.

Machinery, equipment, and furniture are examples of Section 1245 property, which are depreciable personal property (not real property) used in a business.

Before treating a current-year 1231 gain as a capital gain, taxpayers must look back five years for any instances where they deducted 1231 losses as ordinary income (called nonrecaptured 1231 losses). Current 1231 gains must be treated as ordinary to the extent any 1231 losses were deducted as ordinary income in the prior five years.

Bottom Line

Gains and losses from 1231 assets receive very favorable tax treatment. If your business has an overall 1231 gain, the gain is taxed at the lower capital gains tax rates. If your business has an overall 1231 loss, the loss is treated as ordinary and can offset income taxed at the higher ordinary tax rates. However, there are a few important exceptions to watch for, like 1231 and 1245 recapture.