Section 1245 property is the depreciable personal property—like machinery, equipment, and furniture—that you have used in your business for over one year. It’s a subclass of section 1231 property, but unlike other 1231 property, gain on the sale of 1245 property must be recaptured as ordinary income to the extent that depreciation was claimed on the property. This ordinary income is referred to as section 1245 recapture.

Key Takeaways:

- While less common, 1245 property also includes amortizable intangibles, like goodwill.

- 1245 property is a subset of 1231 property, which is all property used in the ordinary course of your business.

- A loss on the sale of 1245 property is a 1231 loss and is treated the same as a loss on any other 1231 property.

Categories of Section 1245 Property

Common Examples | |

|---|---|

Section 1245 Property | Depreciable machinery, equipment, vehicles, and furniture |

Section 1250 Property | Depreciable buildings |

Other Section 1231 Property | Non-depreciable assets like land |

If you’re unfamiliar with the section 1231 rules for property, you can read our guide on Section 1231 Property & Its Taxation.

It’s important to distinguish 1245 assets from other 1231 assets because the gain on the sale of 1245 assets is subject to section 1245 recapture, discussed below.

Less Common Types of 1245 Property

The vast majority of 1245 assets are machinery, equipment, vehicles, and similar assets. However, there are a few other types of assets that qualify under section 1245.

- Nonresidential real property purchased from 1981 through 1986

- Intangible assets purchased vs created, like goodwill on the purchase of a business

- Structures with the single purpose of housing livestock (including poultry) or their produce

- Greenhouses used for the commercial production of plants or mushrooms

- Storage facilities, but not buildings, for the distribution of petroleum or petroleum products

- Railroad grading or tunnel bore assets

Assets That Are Not 1245 Property

Section 1245 property excludes the following:

- Assets owned for one year or less

- Intangible assets created, like copyrights and patents

- Inventory or assets held for resale

- Capital assets, including personal-use assets and assets held as an investment

How Section 1245 Property Is Taxed

Losses on the sale of 1245 assets are treated as section 1231 losses. Meanwhile, gains on the sale of 1245 assets must be split between section 1231 gains and section 1245 recapture.

- The 1231 gain portion is netted with other 1231 gains and losses.

- The 1245 recapture portion is taxed as ordinary income.

How to Calculate Section 1245 Recapture

Section 1245 recapture is the part of the gain on the sale of 1245 property that is attributable to the accumulated depreciation claimed on the asset.

Step 1: Calculate Adjusted Basis of 1245 Asset Sold

The adjusted basis of the 1245 asset sold is its original cost minus the depreciation expense deducted over the life of the asset, called accumulated depreciation (A/D).

Step 2: Calculate the Gain or Loss

The gain or loss is calculated by subtracting the adjusted basis of the 1245 asset from the sales price.

Step 3: Calculate the 1245 Recapture

If step 2 resulted in a loss, then there is no 1245 recapture and the loss is a 1231 loss and should be combined with all other 1231 gains and losses to determine your net 1231 gain or loss.

However, if step 2 resulted in a gain, 1245 recapture is the greater of the gain or accumulated depreciation.

1245 recapture = lesser of

- Sales Price − Adjusted Basis or

- Accumulated Depreciation

The 1245 recapture is ordinary income. Any gain in excess of the 1245 recapture is 1231 gain and must be combined with all other 1231 gains to determine the net 1231 gain or loss.

Let’s assume that ABC Partnership sold the following assets owned for over one year in 2024.

(table)

- First, we calculate the adjusted basis of each asset:

- Machinery A adjusted basis = $35,000 − $32,000 = $3,000

- Equipment B adjusted basis = $20,000 − $1,000 = $19,000

- Furniture C adjusted basis = $5,000 − $2,800 = $2,200

- Next, we calculate the gain or loss on the sale of each asset:

- Machinery A: $10,000 − $3,000 = $7,000 Gain

- Equipment B: $25,000 − $19,000 = $6,000 Gain

- Furniture C: $1,000 − $2,200 = $1,200 Loss

- The loss on Furniture C is a 1231 loss. We must calculate 1245 recapture on the gains from Machinery A and Equipment B as the lesser of the A/D or gain:

- Machinery A 1245 Recapture = $7,000 (total gain)

- Equipment B 1245 Recapture = $1,000 (A/D)

- The remaining gain of $5,000 on Equipment B is 1231 gain.

Here is a summary of the resulting gains and losses on our three assets:

Description | Total Gain or (Loss) | 1245 Recapture | 1231 Gain or (Loss) |

|---|---|---|---|

Machinery A | $7,000 | $7,000 | None |

Equipment B | $6,000 | $1,000 | $5,000 |

Furniture C | ($1,200) | None | ($1,200) |

Total Section 1245 Recapture | $8,000 | ||

Net Section 1231 Gain | $3,800 |

Takeaways:

- The 1245 recapture of $8,000 is ordinary income and will be taxed at the ordinary income tax rate of ABC Partnership’s partners.

- The net 1231 gain of $3,800 will be taxed at the partner’s capital gains rates, which are lower than their ordinary tax rates.

How to Report the Sale of Section 1245 Property

The sale of section 1245 assets is reported on Form 4797.

- The sale of assets at a loss is reported in Part I.

- The sale of assets at a gain is reported in Part III.

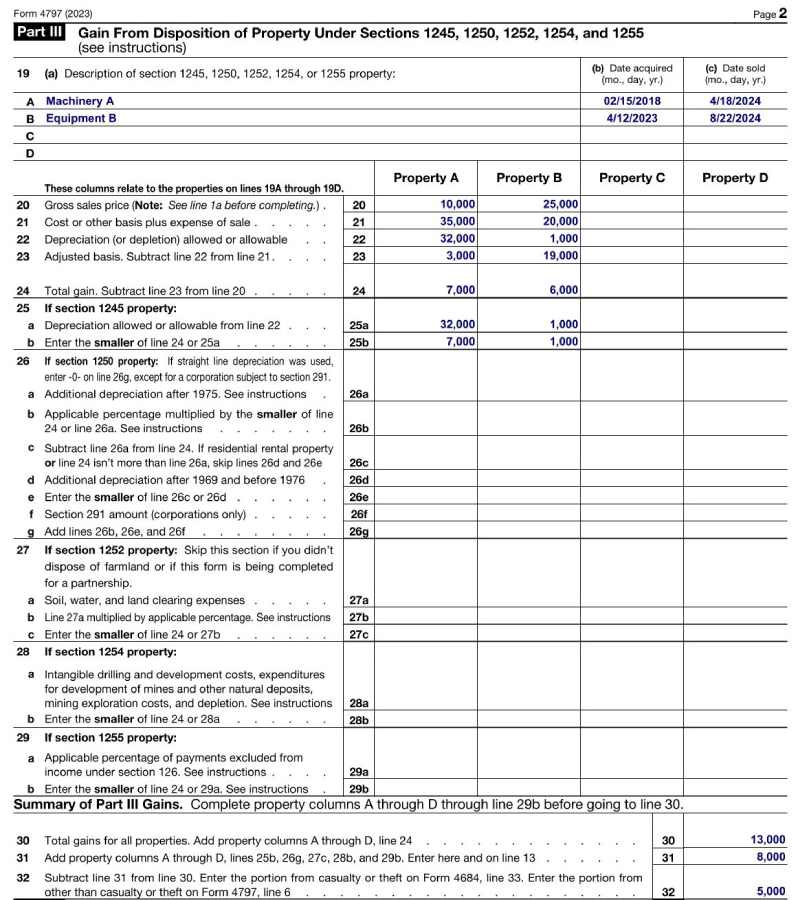

Form 4797 Page 2

Since Part III flows into Part I, it’s best to start there. Below is Form 4797, Part III, completed for the two assets sold at a gain in our example above:

Form 4797 Part III

Section 1245 recapture is calculated for each asset on line 25 and then summarized on line 31. It’s then subtracted from the total gain on line 30 to arrive at the section 1231 gain, which is then transferred to Part I, line 6. The recapture shown on line 31 is transferred to Part II, line 13, and combined with any other ordinary-income gains.

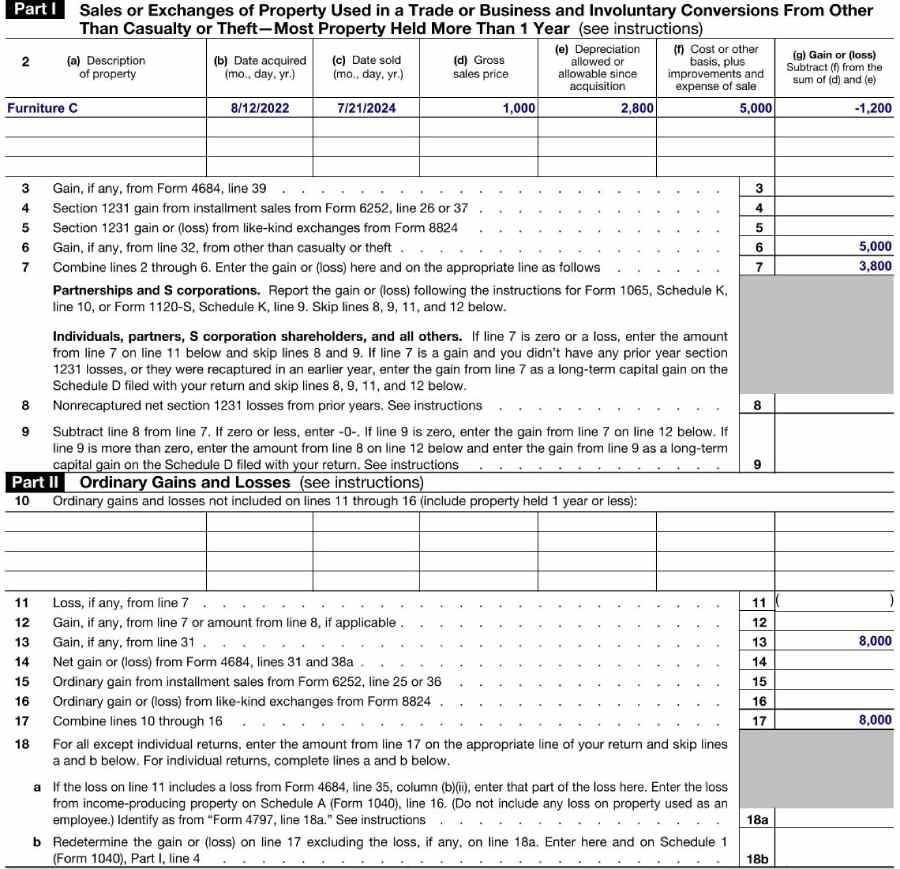

Form 4797 Page 1

In addition to transferring the amounts from Lines 31 and 32 to page 1, we must report the 1231 asset sold at a loss on line 2. Here is page 1 of the Form 4797 completed with the information from our example:

Form 4797 Parts I and II

The net section 1231 gain from our example is shown on line 7 and the section 1245 recapture is shown on line 17. These amounts flow to various places on the tax return depending on the type of taxable entity.

Entity | Form 4797, Line 7 (Net 1231 Gain) | Form 4797, Line 17 (1245 Recapture) |

|---|---|---|

Schedule C Business | Form 1040, Schedule D, Line 11 | Form 1040, Schedule 1, Part I, Line 4 |

Partnership | Form 1065, Schedule K, Line 10 | Form 1065, Page 1, Line 6 |

S Corporation | Form 1120-S, Schedule K, Line 9 | Form 1120-S, Page 1, Line 4 |

C Corporation | Form 1120, Schedule D, Line 11 | Form 1120, Page 1, Line 9 |

Frequently Asked Questions (FAQs)

Section 1250 property is depreciable real property, whereas section 1245 property is depreciable personal property. Both 1250 and 1245 property are assets used in your business for more than one year.

Yes, a car used in your business for more than one year is section 1245 property.

Yes, goodwill is a purchased intangible defined in code section 197 and thus can be amortized by the taxpayer over 15 years. Since it can be amortized, it is section 1245 property.

Bottom Line

Section 1245 property is generally the depreciable personal property owned for more than one year and used in your business. Unlike other 1231 assets, the gain on 1245 assets must be split between 1245 recapture and 1231 gain.