An accounts payable (A/P) aging report shows all unpaid vendor invoices grouped by the number of days they’re overdue, if any. Bookkeepers use it to ensure all liabilities to vendors and suppliers are timely paid and reviewing the report is an accounts payable best practice. It’ll segregate total payables per age group and per customer, and the typical age grouping is: current (not overdue), 0 to 30 days, 31 to 60 days, 61 to 90 days, and over 90 days.

Summer Savings: Get 70% off QuickBooks for 3 months. Ends July 31th. |

|

When & How To Generate an A/P Aging Report

You should generate an A/P aging report at least once a month or whenever you’re paying your vendors. If you do things manually, then you have to gather data from your A/P subsidiary journals and reconstruct the data in a spreadsheet file. By using QuickBooks Online, you can generate a detailed or summarized A/P aging report with one click by selecting Reports in the left-hand menu bar.

How To Read an A/P Aging Report

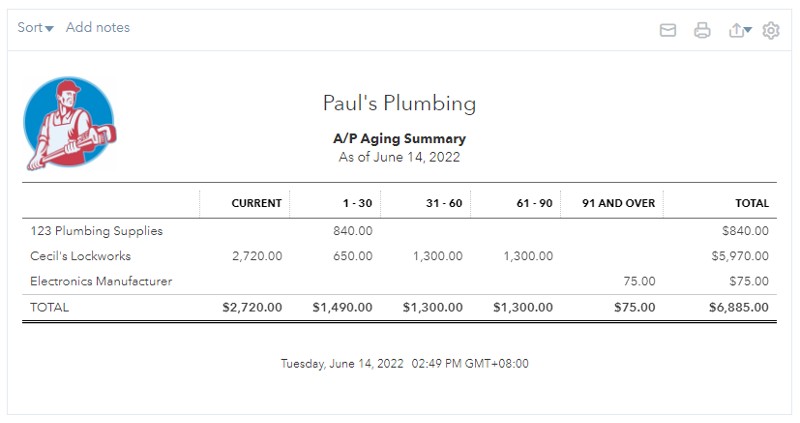

The image below shows an A/P aging summary report that presents the total balance per vendor, segregated by age group. It tells you how much you owe each vendor but doesn’t show the exact invoices that need to be paid.

Summarized A/P Aging Report from QuickBooks Online

If you want to see the overall status of your liabilities, a summarized A/P aging report gives you a snapshot of your payables. The best use of the summarized report is for cash flow planning purposes, especially when cash flow is poor and you need to decide which vendors to pay with a limited amount of cash.

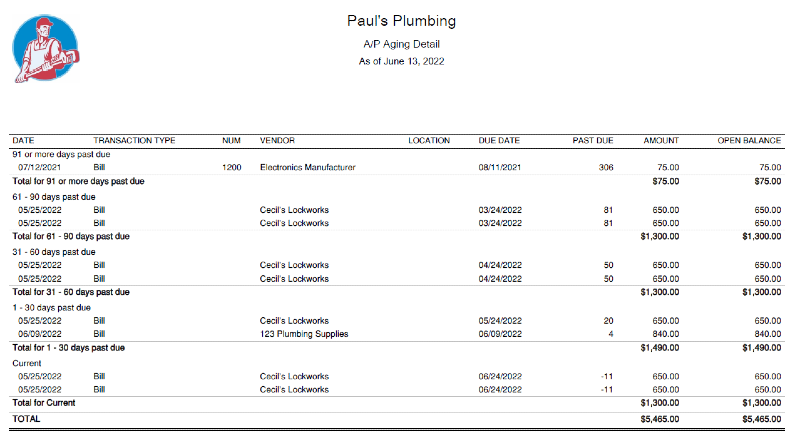

Detailed A/P Aging Report from QuickBooks Online

The detailed A/P aging report shows a list of invoices per customer and per age group. In the sample report above, the oldest bill that remains unpaid as of report date is a bill from Electronics Manufacturer for $75. By reviewing our A/P aging detail, we know that we should make the $75 to Electronics Manufacturer a high priority since this debt might soon go to collections.

How To Use the A/P Aging Report To Manage Vendor Payments

In a perfect world where we always have the cash we need, we wouldn’t need an A/P aging report—we would simply pay all of our bills on time. Unfortunately, in the real world, we sometimes need to choose which vendors get paid and which can wait. The A/P aging report can be extremely useful in allocating limited cash to vendors by following a few recommendations:

- Determine the maximum amount of cash you have available to pay vendors. Be sure to set aside enough cash for upcoming payroll and payroll taxes, which we recommend to pay before vendors. Then, decide how to divide your available cash among your outstanding bills.

- Give the 91 days and over column the most attention as these debts are getting really old, so those vendors may stop selling to you.

- Acknowledge the hard truth that not all vendors are of equal importance to you. While you eventually hope to pay all your debts, are there any vendors you can’t live without? For instance, if you get the majority of your materials from a single vendor, they should be given priority.

Bottom Line

The accounts payable aging report is extremely useful when you’re short on cash and you need to decide which vendors to pay. It can also be helpful to see the total bills that need to be paid in the near future for cash planning purposes.