Managing accounts payable (A/P) requires finding the balance between validating and approving bills, paying them on time, and maintaining enough cash for daily operations. Managing A/P is one of the most important tasks of a bookkeeper. We list 14 accounts payable best practices—from entering bills immediately and contacting vendors for discrepancies, to attaching invoices and receipts to transactions and comparing payment terms to industry standards. We also offer tips to assess the efficiency of your A/P management system through reports and ratios.

1. Enter Bills As Soon As You Receive Them

As soon as you receive a bill, you should record it immediately in your accounts payable software—don’t wait until you’re ready to pay it. Programs with A/P functions, like QuickBooks Online, can help organize, enter, and process your bills. In the Vendors section of QuickBooks Online, you can view all the bills per vendor, including their status, outstanding balance, and type.

2. Input Invoice Numbers

When you receive bills from suppliers, always be sure to accurately enter the invoice number in your system. Your accounting software will then enter this reference number automatically on any check that’s written to pay the bill. The system should also warn you if you try to enter a duplicate invoice number. Without this safeguard, it’s very easy to pay an invoice twice, especially if a vendor sends you two copies, such as one paper copy and one by email.

3. Input as Much Information as Possible From Supplier Invoices

The goal when inputting an invoice is to never have to pull a copy of the paper invoice again. Enter all the details available on the invoice and don’t summarize multiple line items. By completing all the fields, you’re making an electronic record of the paper invoice that can be used to summarize purchases information in any number of ways as needed to analyze your operations.

4. Match Bills to Purchase Orders

A purchase order (PO) is a document businesses send to a supplier to order goods. Once the supplier ships the goods, they’ll issue the business an invoice or bill. Before paying any bills, you should match the items, quantity, and price on the invoice to the PO to make sure you’re paying for exactly what you ordered.

5. Design a Process for Bill Approval Before Payment

In a small business setup, the approver of a bill can be the owner. The accountant should present the PO and invoice in a voucher package for the review and approval of the owner. The information in the voucher package should match before the owner approves the bill for payment.

In larger companies, the voucher package includes a receiving report—a document that describes the goods delivered. By matching the PO, invoice, and receiving report, the approver can determine if the bill is valid, accurate in amount and description, and not fictitious.

6. Contact Vendors for Discrepancies

If vendor bills don’t match with approved POs, you should contact the vendor to investigate the difference. Work quickly to resolve the matter before the due date as you should never pay a bill you know is incorrect.

7. Review the Accounts Payable Aging Report

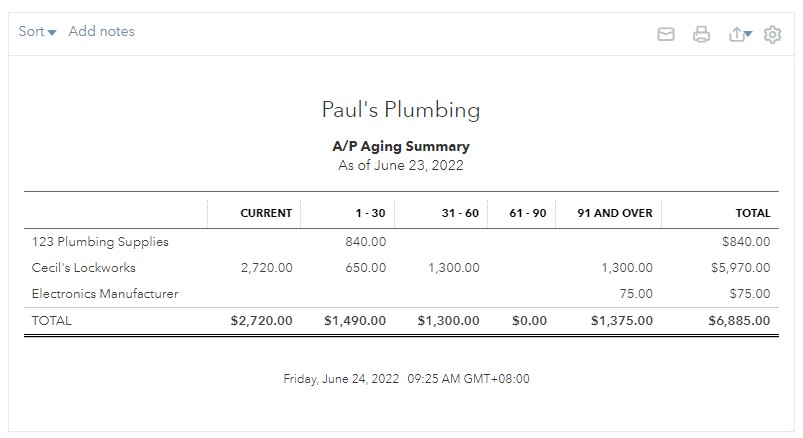

The A/P aging report shows you a list of outstanding bills classified into age groups. You should generate a report weekly. Ideally, an A/P aging report should have no overdue accounts. However, if cash flow is tight, you may have to choose which overdue bills to pay and which ones will have to be late. The A/P aging report is a great tool for these decisions since all outstanding bills can be viewed in one report. You can generate this report using accounting software, such as QuickBooks Online.

Accounts Payable Aging Summary on QuickBooks Online

Read our tutorial on how to generate an A/P Aging Report in QuickBooks Online. You can choose between a summarized and a detailed report.

8. Utilize a New Vendor Checklist

Before processing vendor billings for the first time, having a vendor checklist can help you remember the necessary information to collect before paying the bill. The checklist should include:

- Any contracts

- Contact information (and contact person)

- Special payment instructions

- W-9

- Certificate of Insurance if required

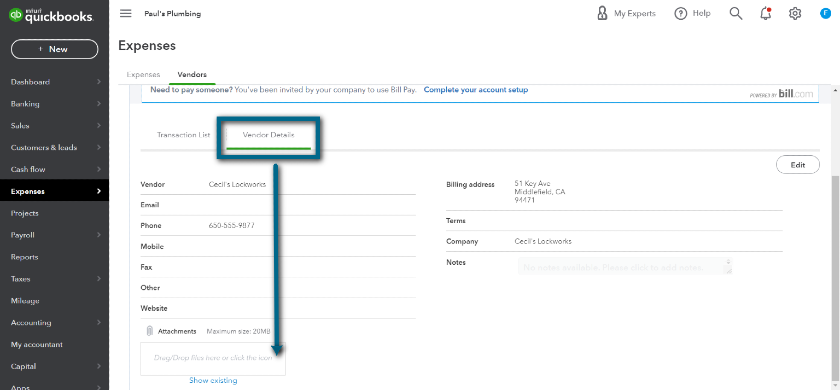

You can create an electronic file of the checklist and attach it to the vendor’s details section in your accounting software. In QuickBooks Online, you can upload files as attachments to each vendor. At the bottom of the page, you’ll see a box that says “Drag/Drop files here or click the icon.” Here, you can drag and drop the checklist and vendor documents or click this section to open the file explorer.

Attaching Files in Vendor Records

Before entering into transactions with vendors, you may want to onboard them first to get to know them. Check out our vendor onboarding best practices to get you started.

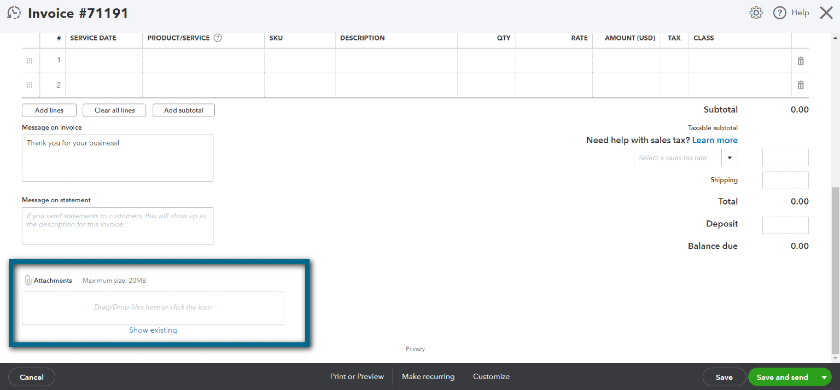

9. Attach Invoices & Receipts to Transactions in Accounting Software

One of the benefits of using accounting software programs is that you can keep accounting data in one place. In accounting software programs like QuickBooks Online, you can upload scanned versions of paper invoices and bills as supporting information for electronic records.

If questions ever arise regarding a transaction, you can view the source document with one click. Dedicated receipt scanning features help you scan receipts easily and optical character recognition (OCR) functions will input readable data into fields automatically.

As shown below, receipts can be dragged to attach them to the invoice screen in QuickBooks Online.

Attaching scanned receipts and documents on QuickBooks Online

10. Avoid Paying Bills Earlier Than Necessary

If your suppliers give you a 15-day payment term, you can choose to pay as late as the 15th day. In accounts payable management, your goal is to settle obligations near the due date so that you can use your cash for other purposes. Also, it allows additional flexibility in case of an unexpected event requiring additional cash that might take priority over paying the bill.

11. Take Advantage of Early Payment Discounts

Meanwhile, if offered by your vendors, consider taking advantage of early payment discounts whenever possible. You can pay your debt early to get a discount of around 1 to 5 percent. If you’re in a tight cash position, you might even want to consider utilizing a line of credit for quick cash to get the discount. Take note that this will depend upon the amount of the discount, the interest rate paid on the line of credit, and how soon you anticipate being able to pay off the line of credit.

12. Record Days Payable Outstanding and A/P Turnover

Days payable outstanding (DPO) is the average number of days it takes to pay your bills. Ideally, your days payable outstanding should be equal to the average payment terms your vendors provide. This would mean that, on average, you pay your bills on their due date. If your DPO is less than that, you’re paying your bills sooner than necessary. On the contrary, a higher DPO means that you are, on average, paying your bills late—which is probably causing you to pay late fees and penalties.

An alternative to DPO is A/P turnover, which shows the number of times you’ve paid vendors during the year. You can compute A/P turnover by dividing total purchases with average A/P. A high A/P turnover means that you’re paying vendors quickly while a low A/P turnover means you’re lagging behind. Remember that a high A/P turnover isn’t always a positive trait as it might mean you’re paying bills before they’re due.

13. Track Payments for 1099-NEC

You’re required to provide a Form 1099-NEC to certain contractors that you pay over $600 during the year. You should identify the contractors requiring 1099s at the beginning of the year so that payments can be tracked as they’re made. Most accounting software has an option to select in vendor setup that indicates if they’re a 1099 contractor.

14. Compare Your Payment Terms to Industry Standards

You should compare the payment terms prevalent in your industry to the payment terms being offered by your current vendors. You’re at a substantial disadvantage if most of your competitors are given 30 days to pay (net 30), but you usually receive only 10 (net 10). If that’s the case, you might ask your vendor for better payment terms or consider a different vendor with a better payment term.

Another thing to consider is your payment history. If you always pay your bills late, don’t expect your vendors to give you longer payment terms. However, if you’ve proven to be a good debtor, you can haggle with your vendor and come to an agreement for a better payment term.

Bottom Line

Proper A/P management involves paying vendors on time, ensuring that enough cash is available for payments, and accurate bill processing. The involvement of the owner in reviewing and approving bills is crucial to ensure that the business is paying for liabilities on time and for the right amount. By applying accounts payable best practices in your small business, you can achieve a balance between paying vendors and managing cash without risking working capital deficiency.