Artificial intelligence (AI) is slowly reshaping the landscape of the accountancy profession and accounting industry. AI pushes accountants to embrace a more strategic and data-driven role in business management, rather than the traditional routine and mundane tasks.

Though AI poses a threat to job security in other fields, accounting professionals have nothing to worry about because AI—no matter how intelligent it gets—can’t replace the human element of providing accounting, advisory, and assurance services. It cannot beat the years of real-life experience that an accountant possesses in dealing with clients, handling transactions, and solving accounting issues.

AI Trends in Accounting

The rise of AI created a lot of mixed views among accounting professionals. Some saw AI as a tool to eliminate repetitive tasks, while others grew concerned about data privacy.

Here are some AI trends that continue to redefine the accounting profession.

Focusing on Strategy Over Routine

Accounting is the process of data gathering, reorganization, analysis, and presentation. With AI, accountants can reduce the time needed to gather and reorganize data and focus more on analysis.

Here’s how the Big 4 accounting firms are using AI to their advantage:

- Ernst & Young (EY) is integrating AI into its auditing processes by using machine learning to perform advanced pattern recognition and utilize the brain power of AI to convert unstructured data (e.g., contracts and invoices) to structured data (e.g., data presented in tabular form).

- PricewaterhouseCoopers (PwC) uses generative AI to boost productivity, especially in developing IT systems.

- Deloitte uses the power of AI to automate document review and improve existing workflows, allowing professionals to extract information from documents and recognize patterns.

- KPMG uses AI to develop customized client solutions while being ethical, client-driven, and value-driven.

Redefining the Accountant’s Job Description

Companies that embrace AI in their processes can expect accountants to shift to a more active role in sharing accounting expertise and advisory, rather than being stuck on mundane tasks. This is because they will have more time to analyze data and evaluate business performance with the help of AI and its data analysis capabilities.

Role | Eliminated or Reduced by AI | Enhanced by AI | Made Possible by AI |

|---|---|---|---|

Data Entry |

|

|

|

Financial Reporting |

|

|

|

Tax |

|

|

|

Audit |

|

|

|

Budgeting |

|

|

|

Will AI Replace Accountants?

No, AI won’t replace accountants. Rather, accountants with expertise in generative AI and machine learning will have a significant advantage over those without it. The accountancy profession is constantly evolving and has stood the test of time since the 13th century. Since then, accounting has evolved from merely bookkeeping to something more profound and valuable for businesses.

With AI, accountants can expect processes to be more streamlined and efficient. They can also expect a reduction in manual processes and faster information processing, which would usually require hours of manual work.

Using AI in Accounting

AI has a lot of potential in accounting. It can be an assistant that can perform mundane and repetitive tasks or a research aid that can perform advanced calculations and dig deeper into large data sets easily.

1. Automating Processes

AI can help accountants automate and simplify processes. For example, if you copy-paste bank statement information into an AI tool like ChatGPT, the tool can convert the data into a structured format that you can paste into Excel.

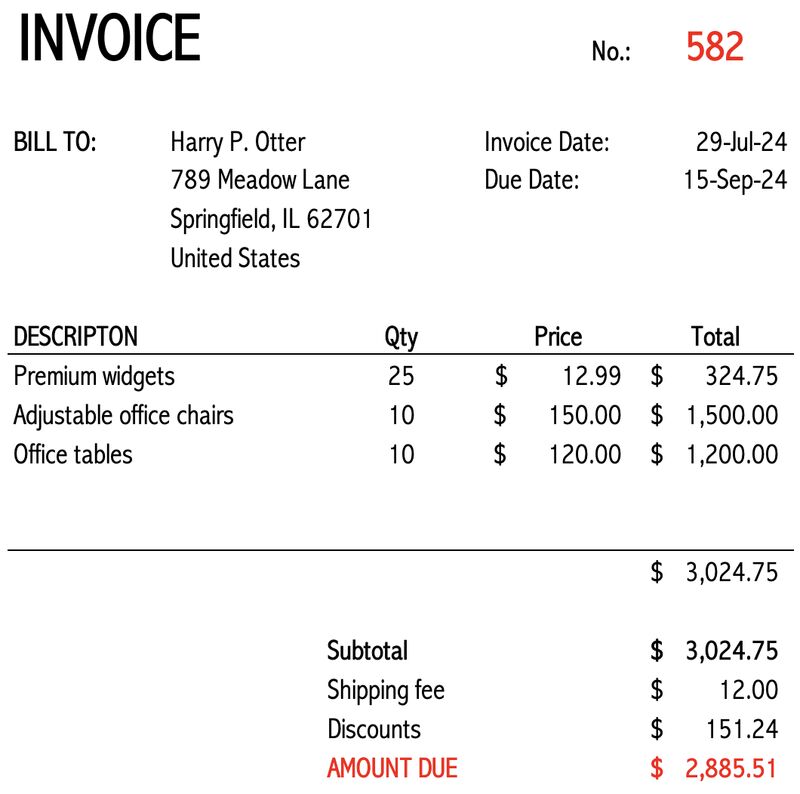

Moreover, AI can write emails for sending invoices or payment reminders, which can help save time. Let’s look at an example of how ChatGPT ChatGPT Plus is used in all examples in this article. can write an email based on a sample invoice.

Here’s ChatGPT’s response:

Subject: Invoice No. 582 – [Your Company Name]

Dear Harry P. Otter,I hope you are doing well. Please find attached Invoice No. 582 for the recent purchase of premium widgets, adjustable office chairs, and office tables.

Invoice Details:

- Invoice Date: 29-Jul-24

- Due Date: 15-Sep-24

- Amount Due: $2,885.51

We kindly request that payment be made by the due date mentioned above.

If you have any questions regarding the invoice or need further assistance, please do not hesitate to reach out.

Thank you for your business and prompt attention to this invoice.

Best regards,

[Your Name]

[Your Company Name]

[Your Contact Information]

Advanced Techniques for Process Automation Using AI

Aside from making emails, AI can do the following:

- Perform intelligent document processing by using optical character recognition and natural language processing to extract, process, and match information from contracts, invoices, and other documents

- Create automated dynamic pricing systems that use market conditions, competitor pricing, and consumer behavior to adjust prices in real-time

- Automate dynamic expense categorization that uses machine learning to match similar expenses based on past transactions

- Conduct audit trail analysis to spot anomalies and discrepancies without manual intervention

- Perform risk assessment that informs users of internal and external risks and helps users create mitigation strategies

2. Detecting Fraud

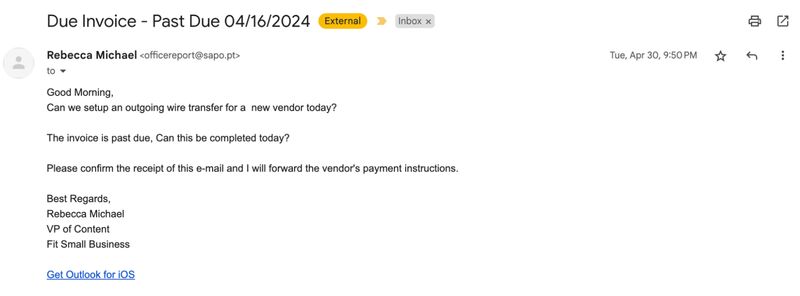

Accountants can use AI’s power to detect fraud and prevent fraudsters from stealing the company’s data. To illustrate, we asked ChatGPT to inspect an email that we suspect is fraudulent.

Here’s what ChatGPT came back with:

Here are some insights into the email that might suggest it is fraudulent:

- Unusual Sender Email: The email originates from a suspicious domain (sapo.pt), which is not associated with the company’s official email domain.

- Urgency Tactic: The email creates a sense of urgency by claiming the invoice is past due and pushing for an immediate wire transfer, a common phishing strategy.

- Strange Request: The request for an “outgoing wire transfer for a new vendor” is unusual, especially coming from someone in a content-related position (VP of Content), raising red flags.

- Grammatical Errors: The email contains grammatical errors and informal phrasing, which are uncommon in professional business communication.

- Lack of Specific Invoice Details: The email fails to provide critical details such as the vendor name, invoice number, or amount due, making it vague and suspicious.

- Suspicious Request for Confirmation: The email asks for a confirmation of receipt before providing the vendor’s payment instructions, a tactic often used by fraudsters to verify the recipient’s engagement.

- Potential Phishing Attempt: The combination of a suspicious domain, urgency, unusual financial request, and vague details strongly suggests that this email may be a phishing attempt.

Though ChatGPT didn’t conclude that the email was fraudulent, it gave convincing insights that the email was highly suspicious. In the workplace, these kinds of insights can help accountants make individual decisions on their own, which could improve productivity and efficiency at work.

Advanced Methods for Fraud Detection Using AI

Beyond inspecting suspicious emails, AI can offer a wide range of capabilities. But as fraud becomes complex, fraud detection via AI also becomes complex as it involves creating custom AI-enabled or AI-powered solutions that can detect fraud, such as:

- Anomaly detection: AI can detect anomalies in large data sets through machine learning. It uses machine learning to understand the structure and pattern of the data, which enables it to detect unusual patterns as they occur.

- For example, the company usually spends $500 to $1,500 using the company credit card. AI may flag a transaction as fraudulent if the transaction amount is $2,000.

- Predictive modeling: Through machine learning, AI can recognize patterns and trends based on past data and create a specific set of criteria that it predicts as fraud.

- Let’s assume that in the past, AI has learned that purchases above $500 made from 1 a.m. to 3 a.m. are usually fraudulent. Based on these criteria, a purchase amounting to $501 made at 1:01 a.m. will be flagged as fraudulent.

- Behavioral analysis: AI can analyze and monitor behavioral patterns based on several data points like dates, times, time spent, actions, etc.

- Say the company’s CFO logged in to the company’s system at 11:50 p.m., which is already outside working hours. AI can detect this unusual login time but may not potentially flag it as fraudulent. However, if the CFO withdraws a large amount of money outside working hours, AI can flag this transaction as fraudulent and alert another employee about this unauthorized withdrawal.

3. Analyzing Financial Statements & Information

Analyzing financial statements and information requires a lot of calculations. It can be done using Excel, but the accountant will still need to enter formulas manually for financial ratio analysis and other statistical modeling or calculations. But with AI, you can skip the manual calculations. Whether you want a DuPont or correlation analysis, AI can do it in less than a minute.

To illustrate, here’s a sample income statement. We’ll ask ChatGPT to perform cost-volume-profit and trend analysis.

2021 (USD) | 2022 (USD) | 2023 (USD) | |

|---|---|---|---|

Revenue: | |||

Sales Revenue | 2,000,000 | 2,500,000 | 2,800,000 |

Other Income | 50,000 | 60,000 | 70,000 |

Total Revenue | 2,050,000 | 2,560,000 | 2,870,000 |

Expenses: | |||

Cost of Goods Sold (COGS) | (1,200,000) | (1,450,000) | (1,650,000) |

Selling, General & Administrative Expenses | (400,000) | (450,000) | (500,000) |

Depreciation and Amortization | (100,000) | (110,000) | (120,000) |

Interest Expense | (20,000) | (25,000) | (30,000) |

Total Expenses | (1,720,000) | (2,035,000) | (2,300,000) |

Net Operating Income | 330,000 | 525,000 | 570,000 |

Other Comprehensive Income: | |||

Unrealized Gains (Losses) on Investments | 10,000 | (5,000) | 15,000 |

Foreign Currency Translation Adjustments | 5,000 | 7,000 | (10,000) |

Total Other Comprehensive Income | 15,000 | 2,000 | 5,000 |

Comprehensive Income | 345,000 | 527,000 | 575,000 |

This is what ChatGPT responded with:

Cost-Volume-Profit (CVP) Analysis

- Contribution Margin Ratio:

- 2021: 40%

- 2022: 42%

- 2023: 41%

- Break-Even Point in Sales:

- The break-even point decreased slightly in 2022 due to the increased contribution margin but remained stable in 2023.

- Operating Leverage:

- The company’s operating leverage increased in 2022, indicating a higher sensitivity of operating income to changes in sales. This leverage slightly stabilized in 2023.

Analysis:

- The company improved its contribution margin from 2021 to 2022, which suggests better control over variable costs or an increase in selling prices. However, the margin slightly dipped in 2023, potentially due to increased costs.

- The break-even point in sales decreased in 2022, reflecting higher profitability, but the stability in 2023 indicates that the company maintained its cost structure effectively.

- Higher operating leverage in 2022 indicates the company was more profitable but also more sensitive to changes in sales volume. This stabilized in 2023, suggesting a balanced approach to cost management and sales growth.

Trend Analysis

- Revenue Growth:

- Consistent growth in sales revenue year-over-year, indicating strong market presence and effective sales strategies.

- Expense Control:

- The growth rate of COGS is slightly lower than sales revenue, reflecting improved cost management.

- SG&A expenses grew at a slower rate than revenue, highlighting operational efficiency.

- Profitability:

- Net operating income increased significantly in 2022 but slowed in 2023. The trend suggests that while the company became more profitable, it needs to maintain or improve cost management strategies to sustain profitability.

Overall, the company demonstrates solid revenue growth, effective cost control, and strong profitability, though the slight dip in contribution margin in 2023 suggests some pressure on costs that need to be monitored.

In my opinion, ChatGPT’s analysis above is too generalized. So, when you ask AI tools to analyze data for you, take it with a grain of salt. It’s good to have these quick insights, but I highly recommend you do a deep dive into data based on ChatGPT’s findings.

However, since AI tools like ChatGPT are relatively new, it’s expected that they won’t provide the best and most accurate answer to your questions, which is why consulting an experienced accountant can provide you with a richer analysis. AI tools still need a lot of development before they can produce human-like analysis.

4. Cleaning & Summarizing Data

Another use of AI is summarizing and cleaning data—and these two tasks are time-consuming if performed manually. With AI, you can organize data into a machine-readable format or present it in a clean manner.

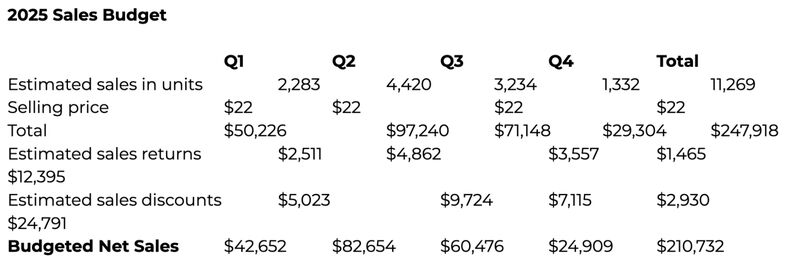

Let’s look at the messy budget below as an example.

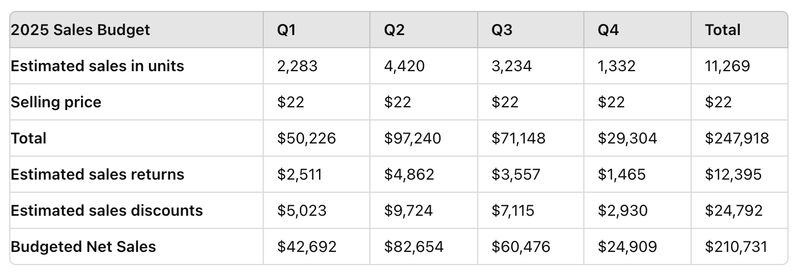

It would take a couple of minutes for an expert Excel user to clean the data above, whereas ChatGPT can fix this budget in just a few seconds. Let’s also ask ChatGPT to summarize the budget for users with little knowledge of accounting.

Here’s ChatGPT’s response:

- The company plans to sell 11,269 units in 2025, with sales spread across the four quarters, peaking in Q2.

- Revenue is projected to reach $247,918, with a noticeable dip in the last quarter, possibly due to seasonal factors.

- The budget anticipates $12,395 in product returns and $24,792 in customer discounts, which will lower the total revenue.

- After accounting for returns and discounts, the expected net sales for the year are $210,731.

In my opinion, ChatGPT’s ability to clean and summarize data is a big help for accountants. It saves them from hours of data cleaning that could’ve been used for more important tasks, such as data analysis and problem-solving.

5. Using Quantitative Techniques

Accountants engaged in advisory services often dip their toes in statistics and probability to provide forecasts and estimates to clients. With the help of AI, accountants can easily create statistical models and analyze large datasets. AI enhances the accuracy and efficiency of complex calculations, enabling accountants to focus more on interpreting information and relaying these insights to clients.

To illustrate, we’ll ask ChatGPT to help us decide how to allocate scarce resources.

“We produce two products, Anemo and Hydro. Anemo requires one hour of baking and three hours of finishing, while Hydro needs four hours of baking and two hours of finishing. We have a weekly capacity of 1,600 hours for baking and 2,400 hours for finishing. The market demand for each product is 20,000 units. The contribution margin is $25 per unit for Anemo and $22 per unit for Hydro. By using linear programming, how many units of Anemo and Hydro should we produce to get the highest contribution margin?”

This is what ChatGPT came back with:

To solve this problem using linear programming, we’ll follow these steps:1. Define the Decision Variables:

Let:

- x1 = the number of units of Anemo produced

- x2 = the number of units of Hydro produced

2. Formulate the Objective Function:

The objective is to maximize the total contribution margin. The contribution margins for Anemo and Hydro are $25 and $22 per unit, respectively. So, the objective function is:

Maximize Z = 25x1 + 22x2

3. Write Down the Constraints:

The problem involves constraints based on the production capacities for baking and finishing.

- Baking Time Constraint:Anemo requires 1 hour of baking per unit, and Hydro requires 4 hours of baking per unit. The total available baking time is 1,600 hours.

1x1 + 4x2 ≤ 1600

- Finishing Time Constraint:Anemo requires 3 hours of finishing per unit, and Hydro requires 2 hours of finishing per unit. The total available finishing time is 2,400 hours.

3x1 + 2x2 ≤ 2400

- Demand Constraints:The market demand for each product is 20,000 units.

x1 ≤ 20000

x2 ≤ 20000

- Non-negativity Constraints:Both x1x_1x1 and x2x_2x2 must be non-negative.

x1 ≥ 0, x2 ≥ 0

4. Set Up the Linear Programming Problem:

Now, we need to solve the following linear programming problem:

Maximize Z = 25x1 + 22x2

Subject to:

1x1 + 4x2 ≤ 1600

3x1 + 2x2 ≤ 2400

x1 ≤ 20000, x2 ≤ 20000

x1 ≥ 0, x2 ≥ 0

5. Solve the Linear Programming Problem:

I’ll now solve this problem using the method of linear programming.

Let me calculate the optimal solution for you.

The optimal solution is to produce:

- 640 units of Anemo

- 240 units of Hydro

This will result in the highest possible contribution margin of $21,280, computed as follows:

CM = (640 units × $25) + (240 units × $22) = $21,280

If I were to advise the client based on the calculations above, I would recommend allocating more resources to Anemo than Hydro. Additionally, considering that the total production capacity is limited to 880 units (640 Anemo units + 240 Hydro units) against a market demand of 20,000 units, I would advise the client to invest in additional ovens and finishers to significantly scale up production capacity and better meet the substantial market demand.

If we were to compute that manually, it would require the use of logarithmic functions and the rules of inequality. Not all accountants are mathematicians, and it would take time to do these calculations by hand. But with AI, accountants can skip the math and jump straight to analysis where their forte lies.

Frequently Asked Questions (FAQs)

Accountants are using AI to reduce or eliminate repetitive and manual tasks, such as transaction data entry, expense categorization, invoice matching, and data processing.

No, and AI will never replace accountants. As a matter of fact, AI will make the work of accountants lighter and more efficient. With the help of AI in calculations, accountants can focus more on analysis and strategy.

All Big 4 accounting firms (EY, PwC, KPMG, and Deloitte) are using AI and have invested in using AI-assisted solutions.

Machine learning is the most suitable type of AI for accounting and finance because it gets smarter the more it learns from past data. With enough information, it mimics the human brain by using algorithms to predict behaviors and patterns.

Bottom Line

AI is a disruptive technology that revolutionized how businesses and accountants work. Through AI, accountants can now focus more on strategy and analysis and let AI do the grunt work for them. It also enables accountants to perform complex calculations easily and provide the best service to their clients.