A business bank statement is a document that shows the transactions you made within a specific period. Typically, it covers one month and contains information about your business checking or savings account. Transaction details are listed in the statement, displaying your deposits and withdrawals, including purchases made using the business account’s debit card.

Key takeaways

- A business bank statement has different parts, which may include the bank information, business information, account information, statement period, account summary, transaction summary, and bank messages.

- Financial institutions provide bank statements to their customers in the form of a paper copy, which is delivered by mail, or an electronic copy, which is viewed on an online account or sent through email.

- Business bank statements offer business owners plenty of benefits, such as helping them track their finances, reconcile their accounts, catch errors and fraud early, gain spending insight, complete tax paperwork, and fulfill requirements when they apply for financing.

Parts of a Business Bank Statement (With Example)

Business bank statements vary for every financial institution, but you can find similar information from all of them. Below is a business bank statement sample that you can review to familiarize yourself with the different parts.

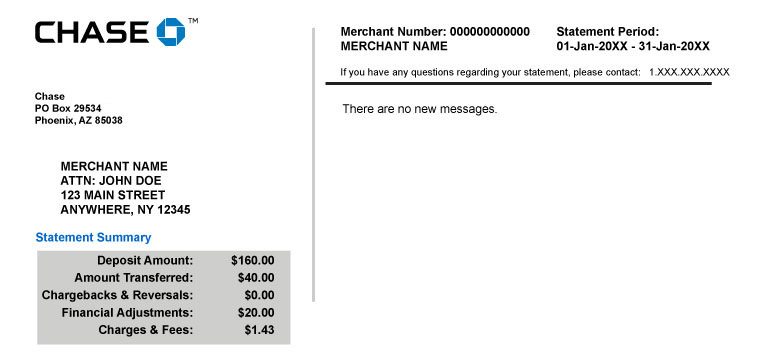

Sample bank statement from Chase (Source: Chase)

When you open your bank statement, you may see the following information.

Bank Information

This section includes the financial institution’s name, address, contact details, website address, and phone number. In the business bank statement example above, you can find Chase’s bank information on the upper left side of the page.

Business Information

This contains details about your business name, address, and contact number. In this example, you can find your business information right below Chase’s bank information.

Account Information

The section covers the type of account you opened with the bank, which includes the business account name and number. The account information in this example is found on the upper right side of the page.

Statement Period

This will tell you the specific date range of the bank statement. In this case, the statement period is from January 1, 20xx to January 31, 20xx.

Account Summary

The section displays your account’s beginning and ending balance, including the total deposits (credits) and withdrawals (debits) made for a particular statement period. Generally, the account summary is found at the top of the bank statement after the account information.

In our business bank statement example, the account summary is referred to as a statement summary. We can find the total amount of the deposits, transfers, chargebacks and reversals, financial adjustments, and charges and fees.

Transaction Summary

This lists each transaction you made within the statement period. It will occupy the most space in a bank statement. The transactions are listed in chronological order and will include the date, transaction description, reference codes, transaction amount, and balance after the transaction. The transaction description will often provide detailed information on the type of transaction you made.

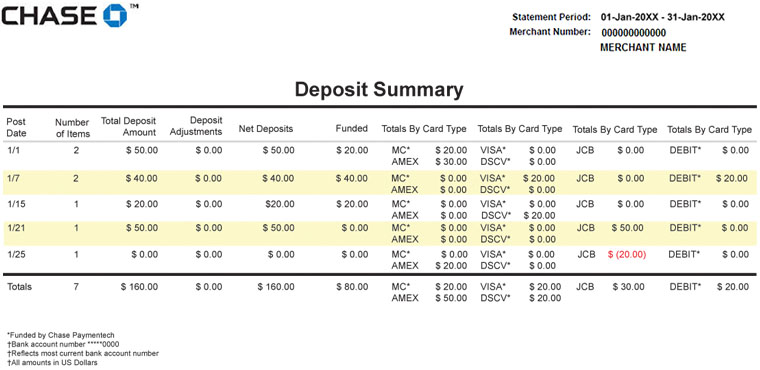

From the example below, you can see the deposit summary, funding summary, and credit card summary sections. Under the deposit summary, a record of all your deposit transactions per card type can be seen. You can also view the different deposit amounts made per transaction date, including the item number, deposit adjustments, and net deposits.

Sample deposit summary from Chase (Source: Chase)

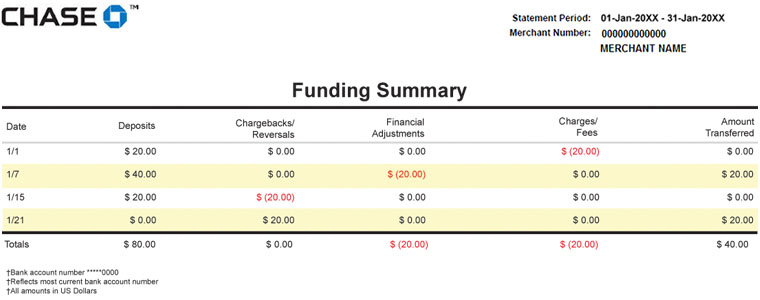

In the funding summary section below, you can view the transaction date, deposit amount, chargebacks and reversals, financial adjustments, charges and fees, and transferred amounts.

Sample funding summary from Chase (Source: Chase)

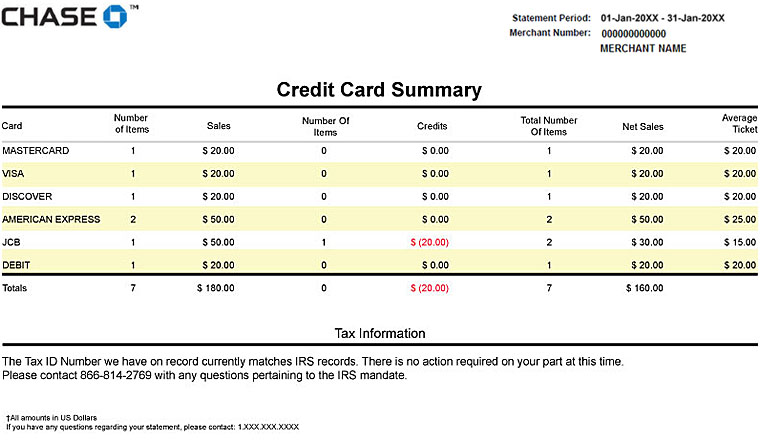

The credit card summary section below displays information that includes the breakdown of sales per card type, sales amount, number of items, credits, and net sales.

Sample credit card summary from Chase (Source: Chase)

Bank Messages

These can be included by some financial institutions, where news and important reminders are announced.

Business bank statements will vary for each bank. It is best to contact your business banking representative if you have further questions about the details of your statement.

Types of Business Bank Statements

You can access your business account bank statements in two ways. Financial institutions send a statement each month in paper or electronic form:

- Paper bank statements are sent to the address per your bank record. Some users prefer to receive a physical copy of a printed statement, but this comes at a cost, which varies depending on the bank. Sometimes, enrolling in electronic statements can help you avoid paying a monthly service fee.

- Electronic bank statements (e-statements )can be accessed online after logging in with your username and password. You can download and print your electronic business bank statement if you need a physical copy. E-statements are often free, and some banks may waive your monthly service fees if you enroll in e-statements, which helps account holders save more.

Benefits Offered By Business Bank Statements

- Track finances: As a small business owner, you need to monitor your business funds often, especially how much money is coming in and going out. Through business bank statements, you can track the payments made by your business and customers.

- Perform account reconciliation: Business owners can check the accuracy of their books through bank statements. Reconciling your account by comparing the figures on the bank statements against your bookkeeping records helps you correct any discrepancies.

- Spot errors and detect fraud: Mistakes can happen, so regularly reviewing your business bank statements is crucial. There may be instances when unauthorized transactions and, worse, fraudulent incidents appear. You can immediately report those transactions to the bank to avoid the situation in the future.

- Gain financial spending insight for budgeting: Checking your statement helps you control your spending effectively. Seeing the amount of money leaving your account informs you how much money you must allocate for bills and other regular expenses, which makes it easy to create a budget.

- Complete tax paperwork: Filing tax returns are required for all businesses, and bank statements aid in completing tax forms correctly. You can refer to the statements to ensure the information you provide on the tax forms is accurate.

- Fulfill requirements for loan applications: Among the common lender requirements is for businesses to submit their bank statements so that lenders can assess if the borrower has enough funds to pay back the loan and can meet their financial obligations.

Related resources:

Frequently Asked Questions (FAQs)

Yes, business bank statements can be presented as proof of income if they show the regular payments made by customers, as bank statements provide information on the income and payment history of the business. However, in most cases, you will need tax documents as well for proof of income.

The easiest way to obtain bank statements is by logging into your online account and downloading the statement. If you sign up for paperless banking, you can get notifications of when your new statement is ready for viewing. Some banks will mail you monthly statements, although there can be a fee for this service.

Bank statements contain a list of the user’s banking transactions and are sent by a financial provider. Meanwhile, account statements summarize the purchases and payments between businesses and are sent by another company.

Typically, lenders request business checking and savings account bank statements from loan applicants. You will usually need annual tax and profit and loss statements as well.

Yes, keeping a record of business bank statements helps you provide accurate information to lenders if you apply for financing. It will also help you assess your business performance, plan your budget, generate financial reports, and comply with tax return filing.

Bottom Line

If you are a small business owner, business bank statements can help you gauge your past performance, conduct a financial forecast, and determine how much you spend and save to manage your business spending better. Further, they allow you to detect fraud early and accomplish lender requirements when applying for loans.