A cash disbursement journal (CDJ) is a specialized accounting journal used to record all cash payments in one place.

Cash Disbursement Journal: Definition & Sample Entries

A CDJ helps bookkeepers track outgoing cash transactions efficiently, eliminating the need for repetitive entries in the general journal (GJ). Instead of posting each payment separately, it summarizes all disbursements at the end of the accounting period and records them as a single compound entry in the GJ. This process streamlines bookkeeping, reduces redundancy, and keeps financial records organized.

Free cash disbursement journal template

It’s essential to have a Google account to use this template. Click Copy in Google Sheets, and you’ll be redirected to the file. In the File menu, select Make a copy to save a file to your drive.

Below, I’ll discuss how you can use Google Sheets’ table feature to track all cash payments. If you want to learn now, jump to the CDJ via Google Sheets section.

Using the cash disbursement journal

As mentioned above, the CDJ streamlines the recording of all cash disbursements. As long as there is an outflow of cash, it should be recorded in the CDJ.

Without a CDJ, the GJ will look like this:

GENERAL JOURNAL | |||

|---|---|---|---|

Date | Account | Debit | Credit |

Jan 1 | Supplies expense | 250 | |

Cash | 250 | ||

Jan 2 | Shipping fees | 65 | |

Cash | 65 | ||

Jan 2 | Equipment | 2,000 | |

Cash | 2,000 | ||

Jan 3 | Loan payable - National Bank | 3,000 | |

Interest expense | 80 | ||

Cash | 3,080 | ||

Jan 3 | Utilities | 70 | |

Cash | 70 | ||

Imagine being the bookkeeper responsible for recording every transaction in the GJ. Now, picture handling at least 100 cash disbursement entries every single day. That’s an avalanche of financial data! Even for a skilled bookkeeper, keeping up with this volume would mean spending well over a month just posting and reconciling cash outflows.

The sheer workload isn’t just demanding — it’s overwhelming. Without additional support or some sort of streamlining in recording, mistakes are inevitable, deadlines pile up, and financial accuracy takes a hit. That’s where the CDJ comes in. I’ll illustrate what the transactions would look like in a CDJ.

Understanding the parts of the CDJ

In its most basic form, the cash disbursement journal should at least have the following columns:

CASH DISBURSEMENT JOURNAL | |||||||

|---|---|---|---|---|---|---|---|

Date | Ref. No. | Payee | Account Debited | Amount | Post. Ref. | Others, Dr. (Cr.) | Notes |

- Date: The date should be when the transaction occurred, not when it was recorded.

- Ref. No.: It is short for “reference number,” which pertains to any number that can vouch for the entry (e.g., check number, invoice number, or transaction ID).

- Payee: The payee is the individual or business receiving the payment.

- Account Debited: This refers to the expense or asset account that receives the charge when a payment is made.

- Amount: This is the amount of cash disbursement.

- Post. Ref.: It is short for “posting reference,” which connects each transaction in the CDJ to its corresponding account in the general ledger (GL). The number in this column is the account number from the Chart of Accounts that matches the account debited for the transaction.

- Others, Dr. (Cr.): This column is used when a single transaction affects multiple accounts.

- Others, Dr. (Debit): This records additional debits beyond the main account debited column, such as interest expenses when paying off a loan.

- Others, Cr. (Credit): This records additional credits, though it’s less common in a CDJ since most entries involve cash payments.

- Notes: These are memos or descriptions relevant to the transaction. They provide additional information that can shed light on the nature of the transaction. While this is an optional field, I highly encourage you to fill this out when the CDJ entry is out of the ordinary.

Making entries in the CDJ

Now that I’ve explained the columns in the CDJ, I’ll show you how to make entries. For quick reference, I’ve included transaction data per entry so that you don’t have to revisit the GJ above.

Note: I’ll skip the reference number column for brevity.

Jan 1: Purchased $250 worth of supplies from Macy’s Emporium

CASH DISBURSEMENT JOURNAL | |||||||

|---|---|---|---|---|---|---|---|

Date | Ref. No. | Payee | Account Debited | Amount | Post. Ref. | Others, Dr. (Cr.) | Notes |

Jan 1 | Macy’s Emporium | Supplies | 250 | 1305 | |||

- The company purchased supplies from Macy’s Emporium (Payee).

- In the Account Debited column, the company specified which account was charged (Supplies).

- To make posting easier, the Post Ref. column should include the account number from the Chart of Accounts. In this example, I used 1305 for the supplies account, but in your business, you should refer to your own chart of accounts and use the number assigned to that account.

Jan 2: Paid $65 for FedEx shipping for goods sold to Max Jones, a customer from New York

CASH DISBURSEMENT JOURNAL | |||||||

|---|---|---|---|---|---|---|---|

Date | Ref. No. | Payee | Account Debited | Amount | Post. Ref. | Others, Dr. (Cr.) | Notes |

Jan 1 | Macy’s Emporium | Supplies | 250 | 1305 | |||

Jan 2 | FedEx | Shipping | 65 | 6022 | |||

- Why is the payee FedEx and not Max Jones? If you pay close attention, the company paid FedEx for the shipping to Max Jones.

- The posting reference number 6022 is just for the sake of illustration.

Jan 2: Reimbursed Justin Lim, the company’s marketing officer, who purchased a work laptop from Greg’s Gadgets for $2,000 because he used his personal credit card for the purchase

CASH DISBURSEMENT JOURNAL | |||||||

|---|---|---|---|---|---|---|---|

Date | Ref. No. | Payee | Account Debited | Amount | Post. Ref. | Others, Dr. (Cr.) | Notes |

Jan 1 | Macy’s Emporium | Supplies | 250 | 1305 | |||

Jan 2 | FedEx | Shipping | 65 | 6022 | |||

Jan 2 | Justin Lim | Equipment | 2,000 | 1801 | |||

- If you thought Greg’s Gadgets should be the payee, nice try! I made this scenario a bit tricky to reflect how real accounting transactions can work. While the laptop was purchased from Greg’s Gadgets, the company didn’t pay the seller. Since the company is reimbursing Justin, he is the correct payee in this transaction.

- The posting reference number 1801 is just for the sake of illustration.

Jan 3: Paid $3,080 amortization to National Bank, inclusive of $80 interest

CASH DISBURSEMENT JOURNAL | |||||||

|---|---|---|---|---|---|---|---|

Date | Ref. No. | Payee | Account Debited | Amount | Post. Ref. | Others, Dr. (Cr.) | Notes |

Jan 1 | Macy’s Emporium | Supplies | 250 | 1305 | |||

Jan 2 | FedEx | Shipping | 65 | 6022 | |||

Jan 2 | Justin Lim | Equipment | 2,000 | 1801 | |||

Jan 3 | National Bank | Loan Payable | 3,000 | 2801 | 80 | Interest, $80 | |

- Why does the Amount column show $3,000 instead of $3,080? That’s because the payment to National Bank includes two components: the principal and the interest. The $3,000 principal is recorded as a debit to Loan Payable, while the $80 interest is recorded in the Others, Dr. column as Interest Expense.

- The posting reference number 2801 is just for the sake of illustration.

Jan 3: Paid City Gas $70 for monthly gas bill

CASH DISBURSEMENT JOURNAL | |||||||

|---|---|---|---|---|---|---|---|

Date | Ref. No. | Payee | Account Debited | Amount | Post. Ref. | Others, Dr. (Cr.) | Notes |

Jan 1 | Macy’s Emporium | Supplies | 250 | 1305 | |||

Jan 2 | FedEx | Shipping | 65 | 6022 | |||

Jan 2 | Justin Lim | Equipment | 2,000 | 1801 | |||

Jan 3 | National Bank | Loan Payable | 3,000 | 2801 | 80 | Interest, $80 | |

Jan 3 | City Gas | Utilities | 70 | 5601 | |||

- The posting reference number 5601 is just for the sake of illustration.

Summarizing CDJ entries

Assuming all CDJ entries ended on Jan. 3, the next thing you need to do is foot the totals.

CASH DISBURSEMENT JOURNAL | |||||||

|---|---|---|---|---|---|---|---|

Date | Ref. No. | Payee | Account Debited | Amount | Post. Ref. | Others, Dr. (Cr.) | Notes |

Jan 1 | Macy’s Emporium | Supplies | 250 | 1305 | |||

Jan 2 | FedEx | Shipping | 65 | 6022 | |||

Jan 2 | Justin Lim | Equipment | 2,000 | 1801 | |||

Jan 3 | National Bank | Loan Payable | 3,000 | 2801 | 80 | Interest, $80 | |

Jan 3 | City Gas | Utilities | 70 | 5601 | |||

5,385 | 80 | ||||||

In total, the amount of cash disbursements is $5,465 ($5,385 + $80). Now, it’s time to record the single compound entry in the GJ.

GENERAL JOURNAL | |||

|---|---|---|---|

Date | Account | Debit | Credit |

Jan 1 | Supplies expense | 250 | |

Shipping | 65 | ||

Equipment | 2,000 | ||

Loan payable | 3,000 | ||

Interest expense | 80 | ||

Utilities | 70 | ||

Cash | 5,465 | ||

(To record total cash disbursements) | |||

The entry above is clean and streamlined, making it easier to post transactions in the GL later.

Cash disbursement journal via Google Sheets

Google Sheets is a free and versatile spreadsheet tool that competes with Microsoft Excel. Its biggest advantage is that while it’s free for Google users, it still offers essential and even advanced formulas. I used Google Sheets for the template above because it is accessible and ensures a consistent user experience, regardless of the version.

Tables in Google Sheets

Tables in Google Sheets got a major glow-up, now offering powerful filtering and sorting features that let you control what data you see — no pivot tables required. I know pivot tables can be a headache for some, so it’s a relief that the table feature alone does the job for the simple manipulations in my CDJ template.

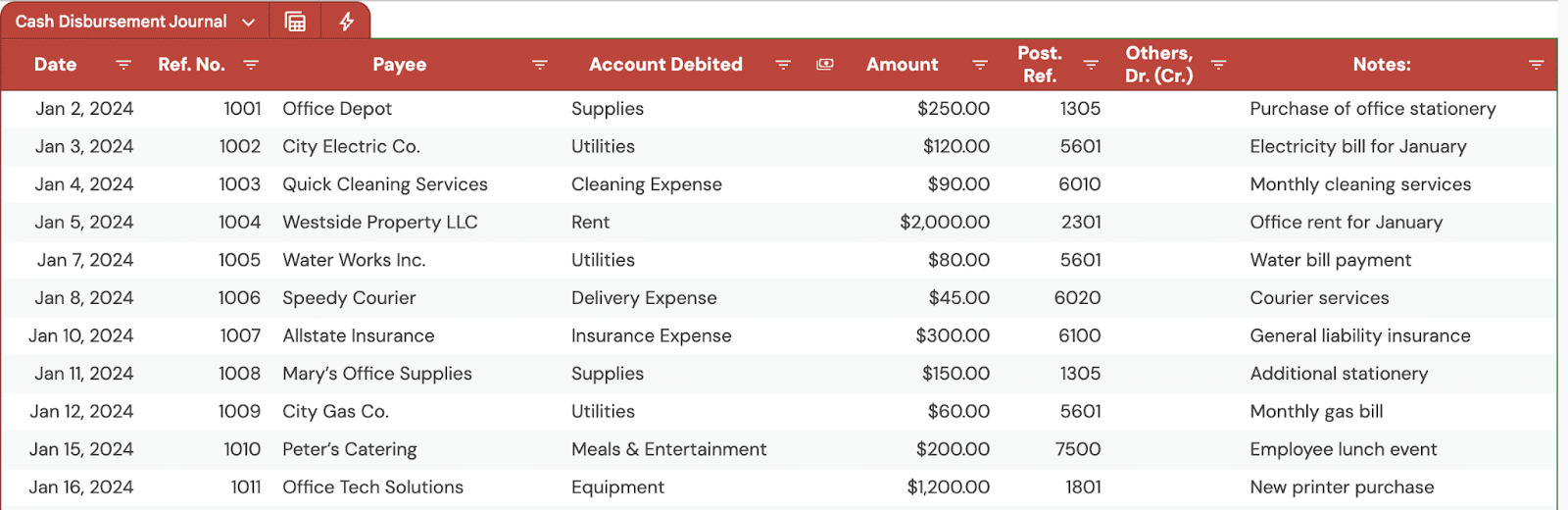

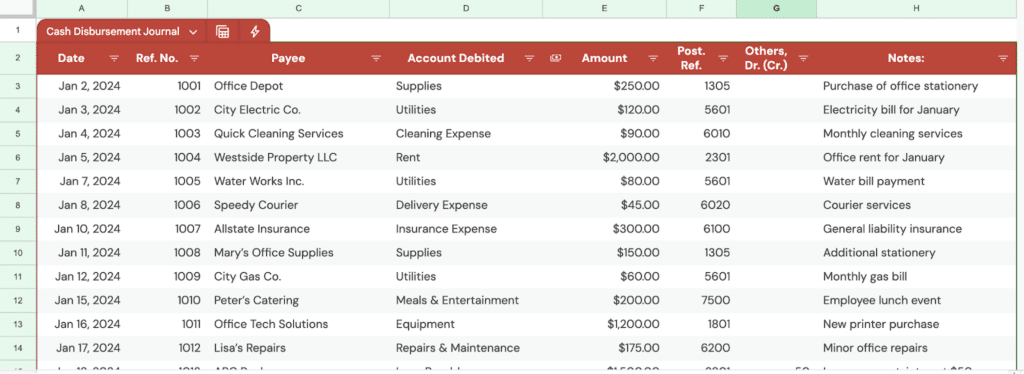

My cash disbursement journal template on Google Sheets

The format I used in the template is similar to the one I used in the examples. The advantage of Google Sheets is that it can help you track items easily with filters, groups, and views.

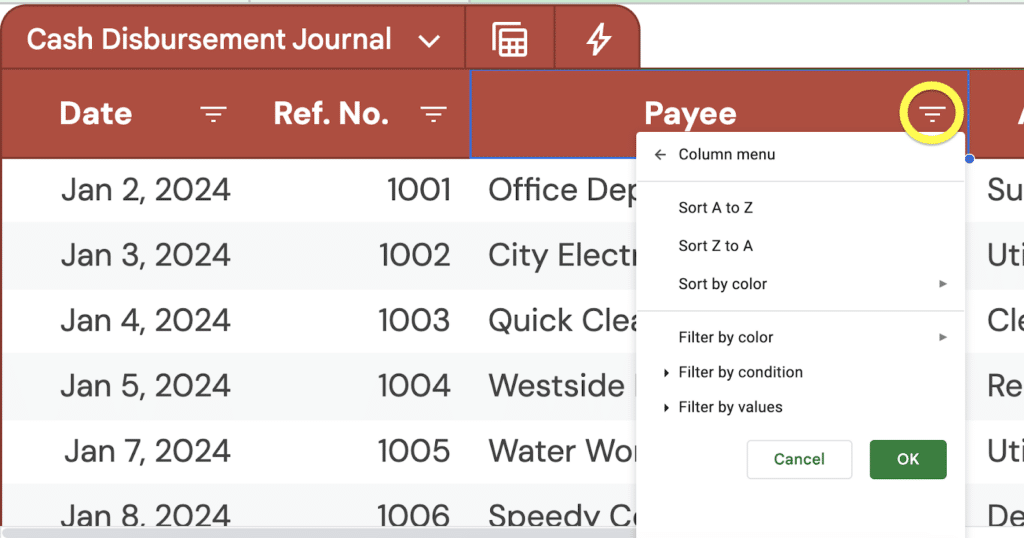

Filter and sort

Filtering and sorting are easy. Just click the funnel icon in the column you want to filter or sort, then choose your preferred method, as shown in the image below.

Filtering and sorting on my CDJ template on Google Sheets

While filters are great, I no longer find them the best way to filter data. In the next section, I’ll teach you a better way.

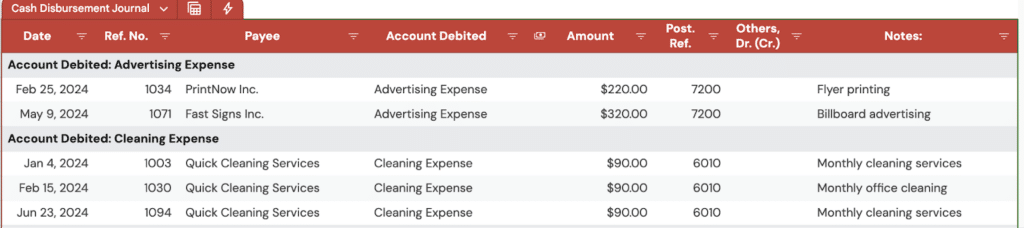

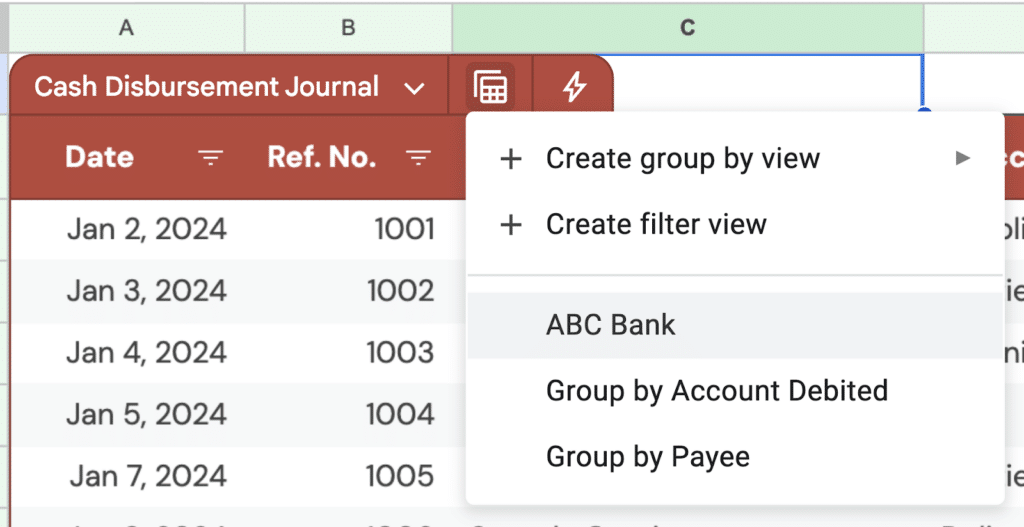

Group and filter views

In a table, you can either group by view or create a filter view, depending on how you want to organize your data.

- Grouping by view allows you to categorize and collapse rows based on shared values, making it easier to navigate large datasets.

- Creating a filter view lets you apply custom filters without affecting other users, so you can focus on specific data while keeping the original table intact.

Both options give you more control over how your information is displayed, making data management smoother and more efficient. To create a group or filter view, click the Calculator icon beside the table name.

In the image below, you’ll see the group-by-view feature in action. I created a group by Account Debited view so that I can see all transactions per account.

Group by Account Debited on my CDJ template on Google Sheets

Grouping organizes transactions based on the column you choose, allowing you to see related entries together in a structured view.

Now, let’s move on to filter views. They work just like the regular filter feature I mentioned earlier, but with one key advantage — you can save them. This means you don’t have to repeatedly adjust filter conditions every time you need a specific view.

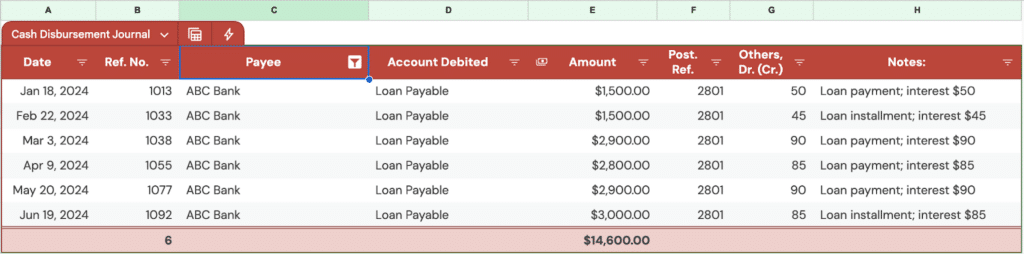

Filter view on my CDJ template on Google Sheets

In the image above, I filtered the table to show only ABC Bank. The main advantage of this is that I can easily access this view by clicking the Calculator icon and selecting the saved view (see image below).

Accessing all saved views on my CDJ template on Google Sheets

Using the template

The fictitious data in the sheet is just for presentation. Feel free to delete it when you’re ready for actual tracking, or experiment with it without worrying about making mistakes.

As you start using the template, you can keep adding new entries at the bottom of the table. Use filters to shorten the view and focus on a specific month or quarter, or take advantage of views and groups for a more structured way to analyze your data.

If you plan to use this template long-term, I highly recommend creating separate sheets for each year to keep your records organized and manageable.

Frequently asked questions (FAQs)

A cash disbursement journal tracks a business’s cash payments, including expenses, loan payments, vendor purchases, and reimbursements. It records details such as date, payee, amount, account debited, and payment method, which ensures accurate tracking of outgoing cash flow.

In QuickBooks, the cash disbursement journal isn’t a standalone feature but is reflected in check registers, vendor payment reports, and the expenses tab. Modern accounting software eliminates the need for traditional manual records, focusing on streamlining the recording process for efficiency and accuracy.

Bottom line

While a cash disbursement journal isn’t exactly modern with accounting software taking over, it’s still a handy tool for businesses preferring manual tracking, extra verification before posting to the GL, or a simple way to monitor cash outflows without relying entirely on software. It’s especially useful for small businesses or startups that aren’t fully automated yet but still need a structured way to keep tabs on their spending.