A Dun & Bradstreet credit report, or D&B credit report for short, provides a snapshot of how a business handles its debt payments. Its primary purpose is to provide potential creditors and business partners insight into how a company will likely handle its payments moving forward and its overall financial health.

Information commonly included with a Dun & Bradstreet credit report includes data on past payment history, bankruptcies, lawsuits, liens, and other public filings. This data is then used as the basis for various credit scores designed to reflect the company’s risk of certain types of behavior, such as its likelihood of going bankrupt or being delinquent on payments in a given timeframe.

How a D&B Credit Report Works

D&B collects data from different public and private data sources. This can include public records data from various county and state entities, which often reveal things like contact information and general business data that may have been required when you filed for necessary state licenses or permits. Finally, individual lenders, creditors, and vendors can also report your payment information to credit bureaus like D&B.

The data compiled is then used to create a variety of scores and ratings on a credit report to demonstrate the financial well-being of your business. Your business profile is publicly available, and your creditworthiness can be evaluated by creditors, partners, or vendors who may be interested in working with you. Numerous report types are available, and the information included will differ depending on your choice of report.

Types & Costs of Reports

Report Type | Cost |

|---|---|

D&B Credit Insights Free | $0 |

D&B Credit Insights Basic | $49 per month |

D&B Credit Insights Plus | $149 per month |

Business Information Report™ Snapshot | $139 per year |

Business Information Report™ On Demand | $189.99 per year |

D&B Credit Evaluator Plus |

- D&B Credit Insights Free: $0 for alerts that monitor changes in your credit profile while highlighting potential risks or opportunities. This product includes PAYDEX®, delinquency, and failure Score. Also included is a summary of basic company information and legal events.

- D&B Credit Insights Basic: $49 monthly for 24/7 monitoring and access to PAYDEX®, delinquency score, failure score, maximum credit recommendation, and D&B rating. This report includes detailed insights based on the historical trends of your business’s credit score and ratings, along with comprehensive legal events details, including lawsuits, liens, judgments, and UCC filings.

- D&B Credit Insights Plus: $149 per month for all of the features in Basic, plus dark web monitoring for up to five business email addresses and the ability to compare your business scores against up to five other companies and to provide the company with various financial statements so that they may be validated and included with your business credit report.

- Business Information Report™ Snapshot: $139.99 a year to view another US or Canadian company’s detailed business credit report, which is available online for up to 12 months. Included is a company’s PAYDEX® score along with five other D&B scores and ratings. You’ll also be able to view company information and payment history.

- Business Information Report™ On Demand: $189.99 annually for unlimited access to view another company’s business credit file in real-time for up to 12 months. Included are D&B scores that provide insight into potential defaulted payments or the likelihood of financial strain. Alerts for changes to the company’s credit file are also available for up to 12 months.

- D&B Credit Evaluator Plus: $61.99 for a single report, although you can get a volume discount if you purchase five or more at the same time. This product allows you to view credit information for your suppliers, vendors, customers, and other business partners so that you can determine any potential risk. This can help with decisions like determining how much credit to extend, what payment terms should be, and whether there are any potential legal risks due to pending litigation.

Key Features of D&B Reports

There are many elements to decipher when reading a D&B credit report. Here are some key features to look out for.

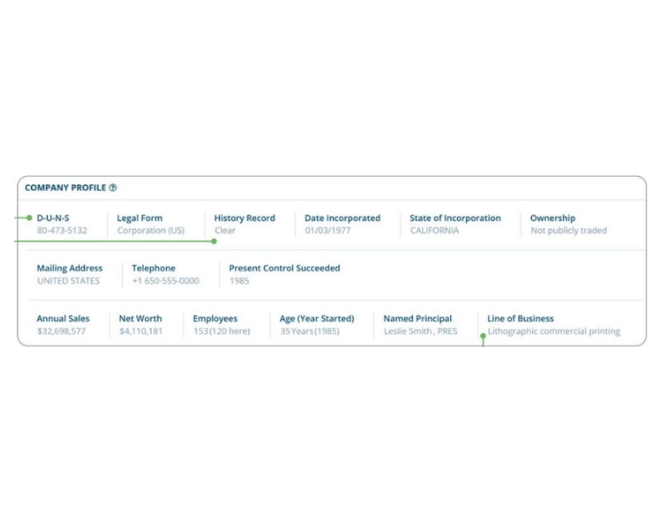

Company Profile

The company profile section summarizes key company details such as your DUNS Number, contact information, industry classification, and business structure. It can be utilized to verify and assess your business by lenders, partners, or vendors.

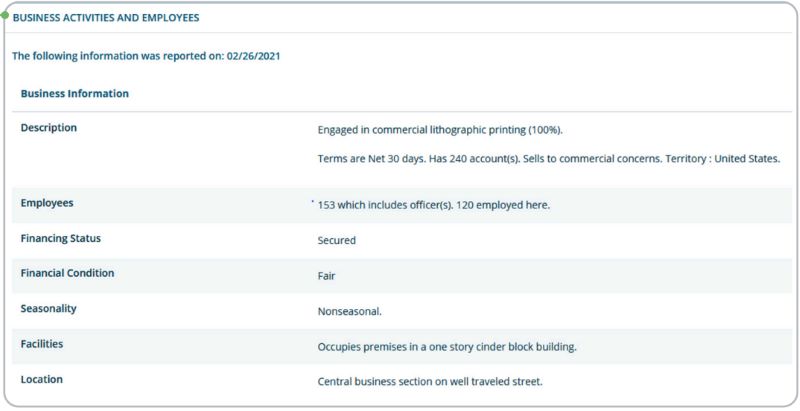

Business Activities

This section is attached to the company profile and includes information regarding your business description, number of employees, financial status and condition, payment terms, seasonality, and location and facilities.

Business Activities section of a D&B profile. (Source: Dun & Bradstreet)

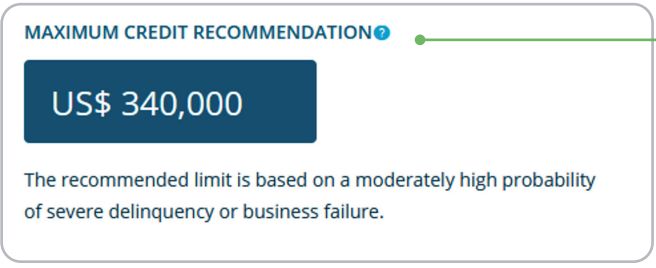

Risk Assessment

Scores provided by D&B are evaluated by several factors used to determine the potential risk and creditworthiness of a business. In measuring overall business risk, there are five scores, ranging from low to high, along with insight provided by D&B as to the present and future financial strength of your business.

Risk assessment section of D&B profile. (Source: Dun & Bradstreet)

Also included is D&B’s Maximum Credit Recommendation, which is the suggested maximum amount of credit to be extended to your business.

Maximum credit recommendation of a D&B profile. (Source: Dun & Bradstreet)

Report Scores

There are five ways in which D&B measures your score:

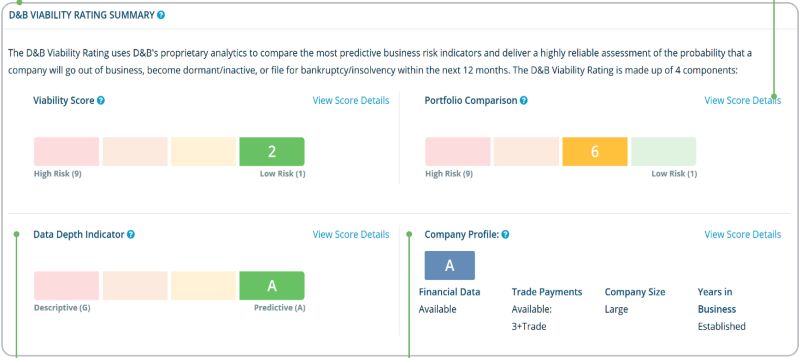

A viability rating is based on the risk that a company will no longer be in business, file for bankruptcy, or become inactive within a 12-month period. The rating is made up of four components—including viability score (scores ranging from 1 to 9; 1 being the lowest risk), portfolio comparison (scores also ranging from 1 to 9; 1 being the best in comparison), data depth indicator (scores ranging from A to M), and company profile (scores ranging from A to Z).

Viability rating scoring model. (Source: Dun & Bradstreet)

The D&B Delinquency score ranges from 1 to 100 and represents the probability that a company will be delinquent in making payments, generally 90 days or later.

D&B Delinquency Score model. (Source: Dun & Bradstreet)

The D&B failure score ranges from 1 to 100 (1 being the highest risk) and determines the likelihood that creditors won’t receive payment if a company fails, including filing for bankruptcy or going out of business.

D&B Failure score model. (Source: Dun & Bradstreet)

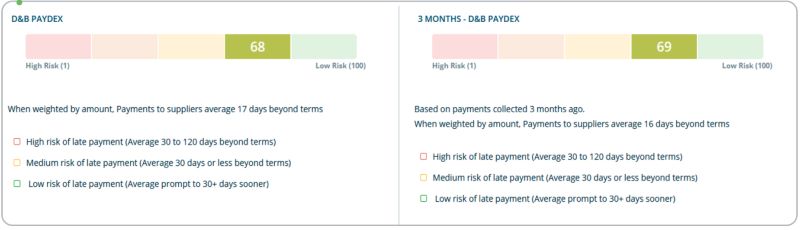

A PAYDEX® score is calculated by the performance of a business’s payment history over the past two years. The score ranges from 1 to 100 (1 being the worst, and 100 being the best) and is commonly used by creditors to assess creditworthiness.

PAYDEX® score model. (Source: Dun & Bradstreet)

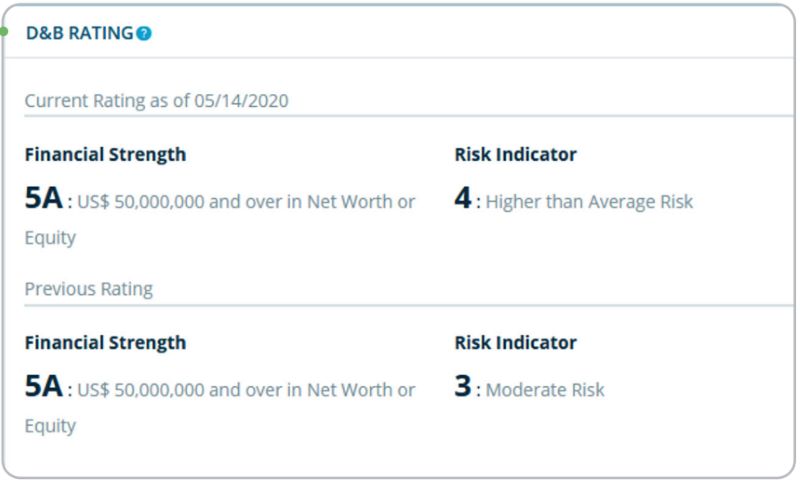

A D&B rating is an average of a company’s historical financial performance inclusive of payment history, business age and size, and other financial information. The rating is shown as an alphanumeric figure, representative of financial strength and a risk indicator.

D&B rating model. (Source: Dun & Bradstreet)

Trade Payments

The trade payments section summarizes payment history to other partners. It indicates evidence of payment behavior such as past-due amounts and total days of past-due payments. Also noted are the types of trade accounts and the total value of each tradeline.

Trade Payments section of a D&B profile. (Source: Dun & Bradstreet)

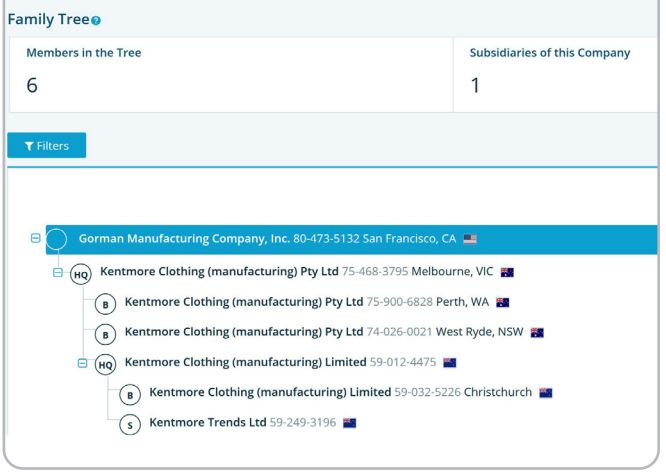

Ownership

This section provides an overview of the ownership chart, which displays relationships between different companies in the D&B database.

This can be utilized to assess potential risk across a family tree alongside providing a global overview of the majority-owned subsidiaries and their relationships.

Ownership section of a D&B profile. (Source: Dun & Bradstreet)

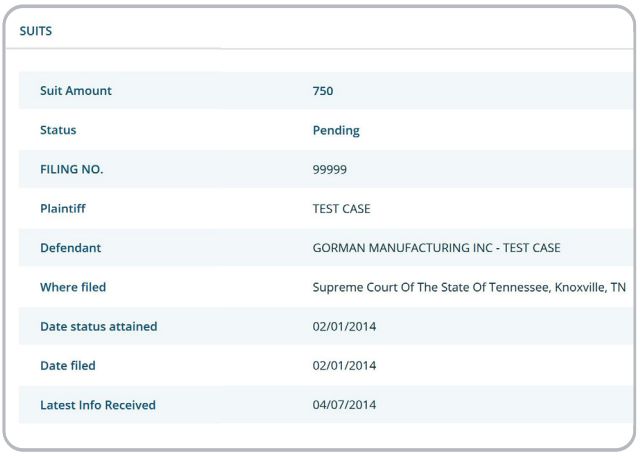

Legal Events

The legal events section reports any legal activity that could impact the financial stability of your business, such as bankruptcy filings, judgments, liens, lawsuits, and UCC filings.

Legal Events section of a D&B profile. (Source: Dun & Bradstreet)

Details regarding any legal events are summarized as demonstrated in the example below:

Example of legal events summary. (Source: Dun & Bradstreet)

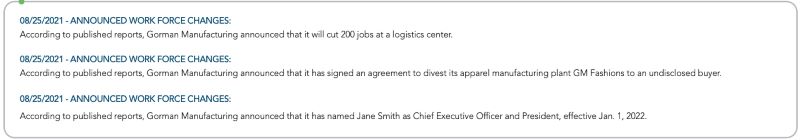

Special Events

The Special Events section presents the latest developments of a business, such as changes in ownership, operations, and earnings announcements, if applicable.

Special Events section of a D&B profile. (Source: Dun & Bradstreet)

Financials

Depending on the company, documentation—such as balance sheets, cash flow records, and profit and loss statements among other financial reports—can be accessed via a D&B credit report.

Financial section of a D&B profile. (Source: Dun & Bradstreet)

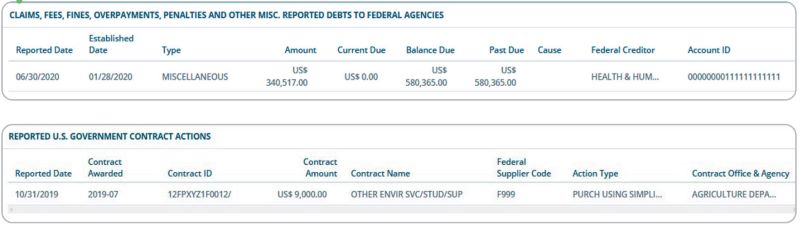

Federal Information

This section supplies information regarding dealings with the US Government (including exclusions) and highlights any activity such as contracts, debts, or assistance.

Federal Information section of a D&B profile. (Source: Dun & Bradstreet)

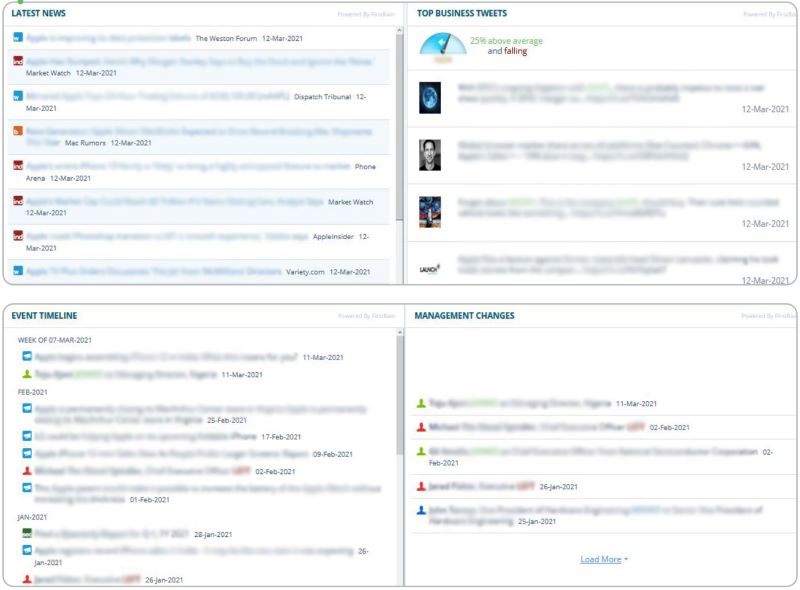

Web & Social

The Web & Social section generally reports on the latest news and any publications that may reference your business. This is useful in painting a picture to anyone researching your company or assisting in the explanation of potential risks.

Web & Social section of a D&B profile. (Source: Dun & Bradstreet)

Pros & Cons of the Dun & Bradstreet Credit Report

| PROS | CONS |

|---|---|

| Is a popular and trusted source | Can be costly, especially for small businesses |

| Is required from lenders and for government contracts | Requires you to get a DUNS number, which can take up to 30 days |

| Helps you monitor and build credit for your business | Requires you to maintain your business profile, which can be costly |

Who Is a D&B Credit Report Right For?

Not only is a business credit report accessible to lenders or partners, but it also allows you to demonstrate your creditworthiness and later use it to your advantage. This includes leveraging your profile for better lending terms, payment schedules, etc.

It may be for you if you are a business:

- Looking to build its credit profile: Your company can establish business credit with a D&B credit profile, even if you currently have little to none.

- Seeking financing opportunities: Lenders often utilize a D&B credit report to determine the creditworthiness of a business. Your demonstrated financial history can be a great benefactor toward approval and is generally part of small business loan requirements.

- Working with vendors often: Vendors or other partners can reference your established payment history, which provides you with leverage to negotiate better terms.

How to Get a D&B Report

D&B credit reports are accessible to all businesses and can be obtained from the D&B website.

- Step 1: Get a DUNS number. This can then be used to apply for or access a report. You can use D&B’s DUNS Number Lookup tool to check if you already have a DUNS number or apply for one if needed. You’ll need this number to search for a company, whether it be your own or the company whose report you’re looking to access.

- Step 2: Select your report type. If you’re looking to obtain a free report, you can get started with D&B’s Credit Insights report, which has options to upgrade your report at various price points. Descriptions of each report along with their cost are listed under each product type.

- Step 3: Choose your desired product, and add it to the cart. You’ll then proceed to the checkout where you can select your payment options and complete the purchase. Once the transaction is complete, your D&B credit report will be available to view online.

Alternatives to a D&B Report

While the Dun & Bradstreet credit report is one of the most trusted financial resources, there are other options available that can provide you with similar metrics and insights.

- Equifax reports have scores of 224 to 580, which include business credit risk score, business payment index score, and business failure score. Similar to D&B, Equifax collects data on financial information, payment history, and public records.

- Experian is the largest credit bureau, and its credit reports include a score of 0 to 100, measured by its Intelliscore Plus model. This factors in collection and payment history, filings for bankruptcy, and financial information. No self-reported data is allowed in contrast to D&B credit reports.

- Transunion is another major credit bureau, offering various solutions to help business owners measure and identify risk. Risk categories covered include credit, insurance, employment, and tenant risk for rental vacancies. The company also has additional risk products to help manage your credit portfolio, acquire customers, prevent fraud, and much more.

- FICO® SBSS℠ score is measured by data from all three credit bureaus (i.e., D&B, Equifax, Experian) and has a score range of 0 to 300. It can utilize both personal and business credit data, in part with other financial information. To qualify, most SBA lenders require a minimum score of 160 to 165.

Frequently Asked Questions (FAQs)

A D&B PAYDEX® score is one of the more common types of credit scores reviewed by lenders, and a score of 80 or above is typically considered favorable. Scores range from a low of 0 to a high of 100 but keep in mind that the credit score is often just one of several factors that can determine whether you get approved or denied for a loan.

Yes. D&B Credit Insights provides a free credit report that you can utilize to check your scores and monitor any changes.

If you believe there may be an error on your report, use the D-U-N-S Manager form or contact Dun & Bradstreet directly. Since potential creditors and vendors may evaluate your D&B report in setting terms and conditions, it’s critical that you correct any errors as quickly as possible to avoid any adverse action.

Bottom Line

A Dun & Bradstreet Credit Report uses data collected from your business history to provide scores that determine your business’s creditworthiness. The report is utilized by creditors and partners to determine the history and reliability of your business. It is a useful tool for getting a small business loan, monitoring your credit, or leveraging your credibility for better terms.