Double Declining Balance Method: Formula & Free Template

This article is part of a larger series on Bookkeeping.

The double declining balance (DDB) method (also called 200% declining balance method or 200DB) computes higher depreciation expense in the earlier years and then declines as it goes nearer the end of the useful life. It is called “double declining” because the depreciation rate is twice the straight-line rate. The double declining balance method formula is illustrated below:

DDB Rate | = | 200% | x | 1 |

Useful Life |

Summer Savings: Get 70% off QuickBooks for 3 months. Ends July 31th. |

|

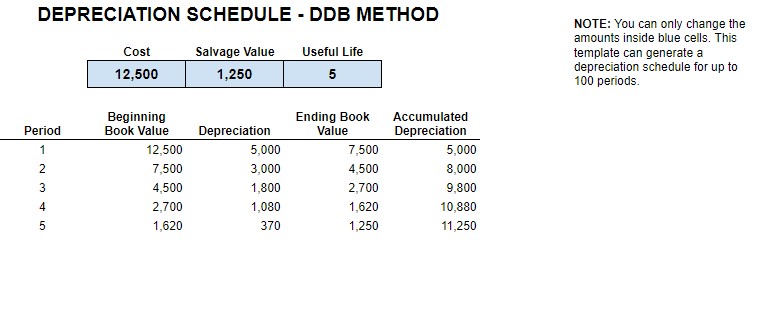

Free Double Declining Balance Depreciation Template (Calculator)

Thank you for downloading this template!

You’re one step closer to making depreciation calculation easier. Visit QuickBooks Online now and get 50% off for three months plus a free guided setup.

To use the template above, all you need to do is modify the cells in blue, and Excel will automatically generate a depreciation schedule for you. Depreciation is just one aspect of small business bookkeeping. If you need expert bookkeeping assistance, Bench can help you get your books in order while you focus on what’s important for your business. Visit Bench now to get started. Pricing starts at $299 per month.

KEY TAKEAWAYS

- Depreciation expense under the double declining balance method is higher in the earlier years than in later years.

- The DDB method is best for manufacturing companies using heavy machinery and equipment.

- The DDB method is an allowed depreciation method in the modified accelerated cost recovery system (MACRS) depreciation system of the IRS.

How To Calculate Double Declining Balance Depreciation

Start by computing the DDB rate, which remains constant throughout the useful life of the fixed asset. However, depreciation expense in the succeeding years declines because we multiply the DDB rate by the undepreciated basis, or book value, of the asset. Read on for our step-by-step guide.

In illustrating how the DDB method works, we’ll use this depreciation schedule:

DEPRECIATION SCHEDULE - DOUBLE DECLINING BALANCE METHOD | ||||

|---|---|---|---|---|

Year | Beginning Book Value | Depreciation Rate | Depreciation Expense | Ending Book Value |

The double declining rate is twice the straight-line rate. Let’s take a look at the straight-line rate formula:

Straight-line Rate | = | 1 |

Useful Life |

In the formula, the useful life is an accounting estimate of the number of years a fixed asset will be used for operations. Since our DDB rate is just twice the straight-line rate, our formula for the DDB rate would be:

Double Declining Rate | = | 1 | x | 200% |

Useful Life |

The current year depreciation is the portion of a fixed asset’s cost that we deduct against current year profit and loss. The accounting concept behind depreciation is that an asset produces revenue over an estimated number of years; therefore, the cost of the asset should be deducted over those same estimated years.

Current Year Depreciation Expense = Beginning Book Value x DDB Rate

The beginning book value is the cost of the fixed asset less any depreciation claimed in prior periods. For the first year, book value will just equal cost. Under the DDB method, we don’t consider the salvage value in computing annual depreciation charges. Instead, we simply keep deducting depreciation until we reach the salvage value.

The ending book value is the beginning book value less current year depreciation. Remember that when we roll forward the ending book value to the next accounting period, it becomes the beginning book value.

Repeat steps 2 and 3 until the ending book value is less than the salvage value. Recompute depreciation expense for that year by moving to step 4.

If the beginning book value is equal (or almost equal) with the salvage value, don’t apply the DDB rate. Instead, compute the difference between the beginning book value and salvage value to compute the depreciation expense.

Double Declining Balance Method Example

Let’s illustrate in detail how the DDB method works. Let’s assume that FitBuilders, a fictitious construction company, purchased a fixed asset worth $12,500 on Jan. 1, 2022. The company estimates that its useful life will be five years and its salvage value at the end of its useful life would be $1,250.

Before we start computing our depreciation estimates, let’s first grab the depreciation schedule we provided earlier. Then, let’s create five rows below our headings and enter the year per row. Since our useful life is five years, indicate years 2022 through 2026 in each row.

DEPRECIATION SCHEDULE - DOUBLE DECLINING BALANCE METHOD | ||||

|---|---|---|---|---|

Year | Beginning Book Value | Depreciation Rate | Depreciation Expense | Ending Book Value |

2022 | ||||

2023 | ||||

2024 | ||||

2025 | ||||

2026 | ||||

Let’s use the formula we discussed earlier. Our DDB rate is twice the straight-line rate.

DDB Rate = (1 ÷ 5 years) x 200% = 40%

Let’s enter the DDB rate in the first four years only because we will not use it in the last year. We can also enter our beginning book value as of 2022.

DEPRECIATION SCHEDULE - DOUBLE DECLINING BALANCE METHOD | ||||

|---|---|---|---|---|

Year | Beginning Book Value | Depreciation Rate | Depreciation Expense | Ending Book Value |

2022 | $ 12,500 | 40% | ||

2023 | 40% | |||

2024 | 40% | |||

2025 | 40% | |||

2026 | ||||

Now that we have a beginning value and DDB rate, we can fill up the 2022 depreciation expense column.

Current Year Depreciation Expense = $12,500 x 40% = $5,000

DEPRECIATION SCHEDULE - DOUBLE DECLINING BALANCE METHOD | ||||

|---|---|---|---|---|

Year | Beginning Book Value | Depreciation Rate | Depreciation Expense | Ending Book Value |

2022 | $ 12,500 | 40% | $ 5,000 | |

Our ending book value is the beginning book value less depreciation expense. It is also our roll-forward amount in the next period.

DEPRECIATION SCHEDULE - DOUBLE DECLINING BALANCE METHOD | ||||

|---|---|---|---|---|

Year | Beginning Book Value | Depreciation Rate | Depreciation Expense | Ending Book Value |

2022 | $ 12,500 | 40% | $ 5,000 | $ 7,500 |

2023 | 7,500 | |||

The ending book value in 2022 is $7,500 (12,500 – 5,000). When making this schedule, double-check the accuracy of your computations because if the ending book value of the previous year is wrong, all succeeding book values, depreciation expenses, and accumulated depreciation will be incorrect as well.

Let’s complete our depreciation schedule until 2025 before we complete our final year depreciation.

DEPRECIATION SCHEDULE - DOUBLE DECLINING BALANCE METHOD | ||||

|---|---|---|---|---|

Year | Beginning Book Value | Depreciation Rate | Depreciation Expense | Ending Book Value |

2022 | $ 12,500 | 40% | $ 5,000 | $ 7,500 |

2023 | 7,500 | 40% | 3,000 | 4,500 |

2024 | 4,500 | 40% | 1,800 | 2,700 |

2025 | 2,700 | 40% | 1,080 | 1,620 |

2026 | 1,620 | 1,250 | ||

FitBuilders estimates that the residual or salvage value at the end of the fixed asset’s life is $1,250. That’s why we placed that amount in the Ending Book Value column. Since we already have an ending book value, let’s squeeze in the 2026 depreciation expense by deducting $1,250 from $1,620. Our depreciation expense in the final year is $370.

DEPRECIATION SCHEDULE - DOUBLE DECLINING BALANCE METHOD | ||||

|---|---|---|---|---|

Year | Beginning Book Value | Depreciation Rate | Depreciation Expense | Ending Book Value |

2022 | $ 12,500 | 40% | $ 5,000 | $ 7,500 |

2023 | 7,500 | 40% | 3,000 | 4,500 |

2024 | 4,500 | 40% | 1,800 | 2,700 |

2025 | 2,700 | 40% | 1,080 | 1,620 |

2026 | 1,620 | 370 | 1,250 | |

Understanding the Double Declining Balance Method

The double declining balance method accelerates depreciation charges instead of allocating it evenly throughout the asset’s useful life. Proponents of this method argue that fixed assets have optimum functionality when they are brand new and a higher depreciation charge makes sense to match the fixed assets’ efficiency.

But as time goes by, the fixed asset may experience problems due to wear and tear, which would result in repairs and maintenance costs. That’s why depreciation expense is lower in the later years because of the fixed asset’s decreased efficiency and high maintenance cost.

Double Declining Balance Depreciation Expense Over Time

In the step chart above, we can see the huge step from the first point to the second point because depreciation expense in the first year is high. But as time goes by, depreciation expense decreases. This concept behind the DDB method matches the principle that newly purchased fixed assets are more efficient in the earlier years than in the later years.

Hence, it is only sensible to charge higher depreciation in the earlier years. But due to wear and tear, the fixed asset loses value and efficiency, and this instance matches why it’s also sensible to charge lower depreciation in the later or final years.

If you want to learn more about fixed asset accounting as a whole, then head to our guide on what fixed asset accounting is, where we discuss the four important things you need to know. Also, if you want to know the other essential bookkeeping tasks aside from fixed asset accounting, you can read our piece on what bookkeeping is and what a bookkeeper does.

Why & When To Use the Double Declining Balance Method

Frequently Asked Questions (FAQs)

What is depreciation?

Depreciation is an allocation of an asset’s cost over its useful life. Since it’s difficult to determine the exact decline in an asset’s value every year, depreciation accounting uses estimates, such as determining useful life, and allocations to report depreciation expense in the income statement.

What are other accelerated depreciation methods?

Aside from DDB, sum-of-the-years digits and MACRS are other examples of accelerated depreciation methods. They also report higher depreciation in earlier years and lower depreciation in later years.

Is double declining balance the same as MACRS?

No, not exactly the same. The MACRS method for short-lived assets uses the double declining balance method but shifts to the straight line (S/L) method once S/L depreciation is higher than DDB depreciation for the remaining life. Meanwhile, long-lived assets use the straight line method for MACRS.

How to calculate the double declining balance rate?

You can calculate the double declining rate by dividing 1 by the asset’s life—which gives you the straight-line rate—and then multiplying that rate by 2.

Bottom Line

The double declining balance method of depreciation reports higher depreciation charges in earlier years than in later years. The higher depreciation in earlier years matches the fixed asset’s ability to perform at optimum efficiency, while lower depreciation in later years matches higher maintenance costs. However, computing the double declining depreciation is very systematic. It’s ideal to have accounting software that can calculate depreciation automatically.