An employee stock ownership plan (ESOP) is a qualified defined-contribution employee benefit plan that provides the employees of a business an ownership interest in that business. An ESOP is used by employers to either reward employees or as an exit strategy from business ownership. If owned by an ESOP, the business can receive great tax benefits.

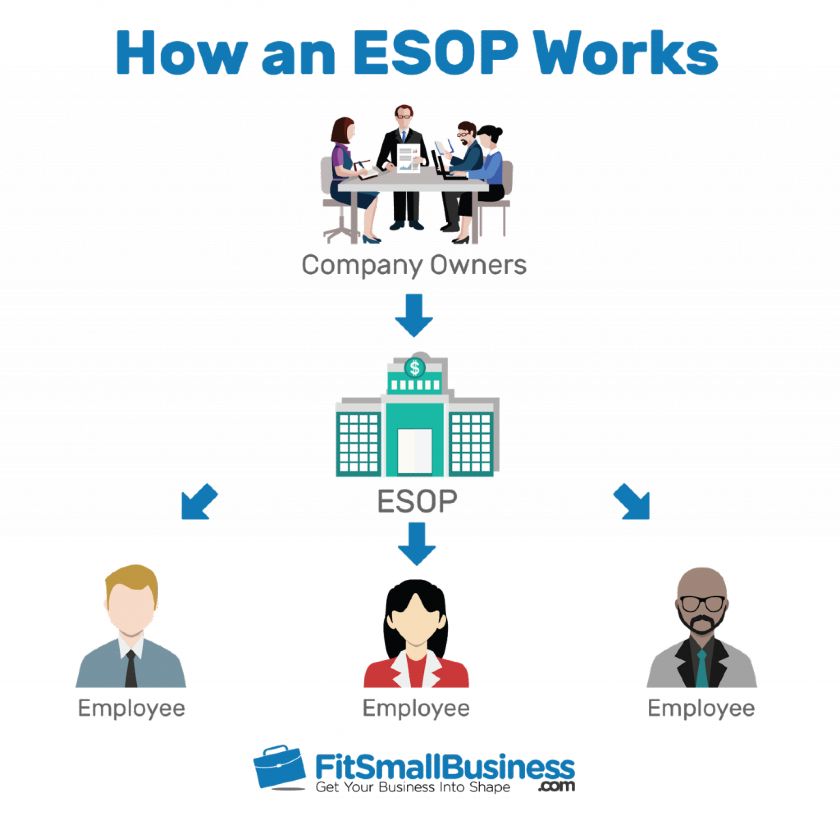

How an ESOP Works

An ESOP is an employee benefit plan that’s established by the owners of a company. Using an ESOP, the plan either borrows funds or receives contributions from the company, which are used to purchase shares in the business. This allows business owners to transfer full or partial ownership of their company to employees and enjoy numerous tax benefits.

When business owners establish an ESOP as a retirement benefit for their employees, they use a plan document to outline the structure of a plan and its governing policies. They also appoint a trustee or committee to oversee the plan in accordance with the plan document. One of the company’s employees is usually appointed to represent employees’ interests.

When a plan document is structured for an ESOP, it often includes certain limits or restrictions. Business owners can transfer full or partial ownership of their company to employees with either voting or nonvoting shares. Using this structure, business owners can keep control of the company until the ESOP buys all of their shares.

ESOP Benefits for Employees

An ESOP is a great benefit for eligible employees. ESOP eligibility is outlined in the plan document. According to the IRS, the maximum age an employer can impose to be eligible for an ESOP is 21 and employees must be eligible for the ESOP within a year of joining the company. An employer can restrict eligibility to employees with two years of service but only if the plan has immediate vesting.

One of the biggest ESOP benefits for employees is that an ESOP enables employees to accumulate shares in the business without contributing any of their own money. Instead, the company makes contributions every year that are used to buy shares or to repay a loan that was used to buy shares.

“The main use of employee ownership is business transition. An owner (or owners) can sell to a third party (sometimes) or just gradually take money out of the company and shut it down, but neither of these preserves the legacy the owner has worked so hard to build. By using an ESOP, the company can continue, and the owner can play any role they want going forward. The owner gets a fair price and can defer taxation on the gain by reinvesting in other securities.”— Corey Rosen, Founder, National Center for Employee Ownership

Rosen went on to say that “owners don’t have to sell all at once. They can sell out some now and some later, or one owner can sell and another not. But ESOPs only work for companies that have enough profit to purchase the shares and still run the business, and they generally are not worth doing in companies under about 20 employees because of the costs and complexity.”

Types of ESOPs

There are three main types of ESOPs that employers can use to transfer full or partial ownership of a company to their employees. The plan document governs the plan including the plan type. Most of this article focuses on unleveraged ESOPs as the most straightforward type of plan, but there are other types as well.

The three primary types of ESOPs are:

1. Unleveraged ESOPs

Unleveraged ESOPs are the most basic type of ESOP and the focus for most of the rest of this article. Using an unleveraged ESOP, a company makes periodic contributions to the plan, which are then used to buy shares in the company from current owners.

An unleveraged ESOP is ideal for business owners who want to be bought out over time. These plans are also great ways to reward employees who stay with the company over extended periods of time instead of the employees who are with the company at a single point in time.

2. Leveraged ESOPs

In a leveraged ESOP, a plan takes out one or more loans from a bank or other lender. These borrowed funds are used to buy shares in the company from its current owners. The company then makes regular contributions to the ESOP which are used to repay the loans.

Leveraged ESOPs are also very common and are usually a much better option for business owners who want to be bought out quickly. Using a leveraged ESOP, these business owners can structure a loan for the ESOP to buy large numbers of shares in the company all at once rather than in little pieces over time.

3. Issuance ESOPs

Issuance ESOPs are the least common form of ESOP. A company using an issuance ESOP makes regular contributions to the plan comprised of newly issued shares of company stock rather than cash.

An issuance ESOP is a great choice for business owners who don’t want to contribute profits to the plan but instead want to issue new shares to the plan. Using this structure, current owners of the business have their ownership shares diluted over time as the number of outstanding shares increases.

ESOP Benefits for Business Owners

ESOPs are especially beneficial for companies whose owners want to worry about finding a buyer for their business. Instead, business owners can use an ESOP to create a built-in buyer for their company. ESOPs are also a great feature to help attract talented employees and to reward long-time employees for their service.

Some scenarios when ESOPs are useful include:

- Attracting talented employees: An ESOP is a great benefit that doesn’t cost employees anything to participate, which is a powerful recruiting tool

- Rewarding employees with stock: If you have employees that have been with your business for years, an employee stock plan is a terrific way to reward them for their service

- Eventually transferring control of a business: ESOPs allow business owners to create a built-in buyer for the company

- Low-cost benefit to employees: Employees don’t have to pay to participate in an ESOP, unlike in a 401(k) where part of their contributions are used to pay plan expenses; instead, businesses cover the costs of an ESOP and make the contributions to buy company stock from the current business owners

Using an ESOP, business owners can make contributions to the plan each year that are tax-deductible up to 25 percent of the company’s payroll. Business owners can also have the ESOP borrow money to buy shares in their business.

“Employers of private companies should consider the costs to establish and administer an ESOP. There are benefits, including increased productivity, that must be considered. ESOP advantages include employee ownership and increased productivity. They’re also a flexible way to sell all or part of a business. Disadvantages include diluted ownership and tax implications for participants who need to sell their shares prematurely.”— Levar Haffoney, Principal, Fayohne Advisors

One of the biggest benefits of an ESOP for small business owners is tax treatment. If your business is structured as a C-corporation, any profits paid to the ESOP as dividends are tax-deductible to the company. Once an ESOP owns 100 percent of a business, the business is exempt from corporate income taxes.

When Not to Use an ESOP

ESOPs are a great benefit for many small businesses, but they aren’t always good to use. ESOPs often don’t work for very large companies that cost too much to buy, super small businesses with few employees or businesses that have trouble retaining employees.

Some cases when an ESOP may not be helpful are:

- Large valuable companies: Very large or publicly-traded companies are often too valuable for ESOPs to purchase even over time

- Very small companies: Super small businesses with low revenue or few employees often aren’t worth the cost of setting up an ESOP

- Multigenerational businesses: If you have a company that has been family-controlled for generations, you may want to make sure that stock ownership stays within the family

- Retirement asset businesses: If you’re depending on the sale of your business to finance your retirement an ESOP may not be a good choice because it uses company profits to finance a buyout

One of the biggest ESOP benefits is tax treatment. Using an ESOP, businesses can make contributions to the plan that are tax-deductible for the employer. This allows business owners to reward employees while also reducing their tax burden. For more information on the benefits of ESOPs, be sure to check out the Pros & Cons section below.

How ESOP Vesting Works

Employers offering ESOPs choose the schedule for vesting shares that employees own through an ESOP. Vesting schedules are outlined in the plan document, and if you leave the company before you’re fully vested, you forfeit some stock. The IRS requires that employees be fully vested after no longer than six years depending on the type of vesting.

Under Section 411 of the Internal Revenue Code, employers who use ESOP vesting can choose from two different types of vesting schedule. Under graded vesting, employees are vested in even amounts over several years, but they must be fully vested within 6 years. Employees with a cliff vesting schedule vest all at once within no more than 3 years.

ESOP Vesting Minimum Requirements

Employees whose plans are subject to ESOP vesting schedules may vest faster than these minimum requirements, but according to IRS rules, they can’t vest slower. It’s also worth noting that vesting does not occur for each year individually but all at once. For example, if an employee covered by cliff vesting leaves in the fourth year, he or she gets to keep 100 percent of his or her stock holdings in the ESOP — not just their stock purchased within the first 2 years.

ESOP Immediate Vesting

There are minimum vesting requirements that businesses must meet to use an ESOP. However, business owners can include faster vesting schedules in their plan document. Some ESOPs immediately vest stock owned by employees through an ESOP. Those shares can be sold at any time or kept if an employee leaves the plan.

ESOP Tax Benefits

ESOP taxes for employees are very low. Employees don’t pay any taxes on employer contributions to the plan, and there’s no tax implication as the employees accumulate ownership through the ESOP. The only taxes that employees pay in an ESOP are on profit distributions, and individual retirement account (IRA)-eligible participants can sometimes roll distributions into an IRA to grow tax-free.

Employee ESOP tax considerations include:

- No taxes on employer contributions: Employer contributions of cash or stock are tax-deductible to the employer up to 25 percent of the company’s total payroll; contributions also aren’t taxable to employees

- No taxes on contributions to repay ESOP loans: If your ESOP borrows money to buy shares in the business, contributions used to repay the loan are not taxable for employees; they’re also tax-deductible for employers

- No taxes on accumulated ownership percentage: As employees build ownership in the business through the ESOP, there are no taxes on this increased ownership

- Taxes on profit distributions: Employee distributions from an ESOP are taxable but may be taxed as capital gains instead of income or rolled into an IRA with all taxes deferred

ESOP distributions are subject to some of the same rules as IRA distributions. This means that in addition to income or capital gains taxes on ESOP distributions, employees may also be subject to a 10 percent penalty if they take distributions before age 59 1/2.

ESOP Tax Benefits for Small Business Owners

ESOPs offer numerous tax benefits for small business owners. Using an ESOP, employers can contribute either cash or stock which is tax-deductible for the company. The biggest tax advantage of an ESOP is that if a business is fully owned by an ESOP, then it is exempt from corporate income tax.

In addition to tax-deductible ESOP contributions, business owners can also get additional tax benefits from selling their stock to an ESOP. For example, business owners can often defer capital gains from their sale of stock to an ESOP, once the plan owns more than 30 percent of the company. To do this, company owners must reinvest any money they earn when the ESOP buys their shares.

ESOP Rules

If your employer offers an ESOP, there are certain rules that need to be followed to ensure that your plan isn’t disqualified. When structuring an ESOP, employers must offer vesting schedules that meet certain minimum standards. Businesses must also be sure to enroll all employees who become eligible for the plan.

If you have an ESOP through work, be sure that your employer is following these rules carefully in their administration of the plan. Failure to follow these rules can cause your plan to be disqualified or your employer to incur penalties.

ESOP Rules for Business Owners

In order to use an ESOP, employees need to ensure that their employers are following certain ESOP rules. For example, business owners must enroll all eligible employees. Employer ESOP contributions are also limited based on a company’s revenue. Contributions are capped at 30 percent of earnings before interest, taxes, and depreciation amortization (EBITDA).

Some important ESOP rules to follow include:

- ESOP contribution limits: Employer contributions to an ESOP can’t exceed 30 percent of EBITDA

- Enroll all eligible employees: Employees who are eligible for an ESOP can’t be excluded unless they opt-out

- Follow vesting guidelines: If you include an ESOP vesting schedule in your plan document be sure to follow it just like a 401(k) vesting schedule

- Pay ESOP taxes: There are taxes on employee ESOP distributions, but employer contributions are tax-deductible up to 25 percent of the company’s payroll

- Employee representation: An ESOP must have a trustee appointed to represent the interests of employee participants

- Meet ESOP vesting requirements: Employers can use either cliff or graded vesting, but employees must be vested after no longer than a 3-year cliff or 6-year graded vesting period; for more information, be sure to check out the How ESOP Vesting Works section above

If you work for a company that offers an ESOP, it’s critical that your employer follow ESOP rules. If your employer violates these rules, your plan can encounter penalties or unexpected tax liability. This is why it’s important that employees choose someone knowledgeable and trustworthy to represent their interests in the ESOP.

ESOP Costs

ESOPs can be very expensive to set up and administer. However, one of the biggest ESOP advantages for employees is that they pay almost none of the costs. The biggest cost that employees may incur from an ESOP is that their stock ownership plan may take the place of cash bonuses or profit sharing.

ESOPs are expensive but have almost no direct cost for employees. However, as an owner, the plan eats into potential dividends or value of ownership. Businesses also pay the costs of recordkeeping, financial advisors who help structure the transaction, and costs for contributions. The costs must all be paid before either the company owners or the ESOP get profit distributions from the company.

Some ESOP costs include:

- Setup costs: $75,000+

Businesses must pay legal fees and appraisal costs to set up an ESOP, which drastically increase the first-year costs of the plan

- Ongoing administration: $20,000+ annually

Maintaining an ESOP requires annual reviews as well as representation by a trustee whose job is to protect plan participants

- Recordkeeping: $2,000 to $5,000 plus $25 to $50 per employee

Details records must be kept of contributions to the plan as well as stock purchases and allocations and vesting for each employee

- Contributions: Discretionary for employer

Most employers set up ESOPs with regular contributions each year for a set period of time, but ESOP contributions are decided by the employer

- Taxes: None

ESOP contributions are tax-deductible up to 25 percent of total payroll and aren’t taxable to employees. Employee distributions are taxable, but those taxes can often be deferred if employees roll their distributions into an IRA.

- Financial advisor fees: 1 to 3% of transaction size

This cost is optional, but many employers retain financial advisors to guide and structure buyouts with ESOPs

While employees don’t pay these costs directly, it’s important to be aware of how they work. As an ESOP builds assets and owns more of the company, more of these costs will be borne indirectly by employees as shareholders in the company. Understanding these costs is also important for employees to ensure that the plan is run properly and for their benefit.

ESOP vs. ESPP

In an employee stock purchase plan (ESPP), employees contribute to the plan through salary deductions similar to a 401(k). Those contributions are then used to purchase stock in their employing company, often at a discount. Unlike ESPPs, ESOPs don’t have employee contributions. Instead, employers make tax-deductible contributions to buy company owners’ stock for the plan.

Employees don’t get a choice between an ESOP or an ESPP. Instead, an employer chooses one and sets it up. However, employers are better off using an ESPP if they want to incentivize employee saving and have employees pay them for part of the company, rather than financing their own buyout with an ESOP.

Employers who choose an ESPP should also be willing to accept lower plan participation since ESPPs require contributions from employees or be willing to sell only a part of their company. Using an ESOP, company owners essentially have to contribute the money for their employees to buy their companies, but they can control the pace and structure of their company sale.

Pros & Cons of an ESOP

ESOPs are a great benefit for employees. Employees get to build an ownership stake in a business with almost no personal costs. Costs are high but are borne almost entirely by the business. However, business owners also get to make tax-deductible contributions and can use an ESOP to attract very talented employees.

Pros of an ESOP

For employees, the advantages of an ESOP are numerous. Employees get free shares in the company which they can later sell. Employees can also eventually take over running the company when the buyout is complete. ESOPs are also great recruiting tools for employers, but the biggest benefit of an ESOP for business owners is tax treatment.

Some ESOP pros include:

- No taxes for employees: There are no taxes on ESOP plan contributions – only on distributions which may be deferred if you roll into IRA

- No cost to employees: Employees pay none of the costs of an ESOP, unlike a 401(k) where some of their contributions are used to cover plan administration costs

- Built-in buyout: Employees who have access to an ESOP plan don’t have to wonder if or when they may be able to buy the business — it’s all set up for them

- Employees can eventually take over the business: After an ESOP completes a buyout of a company, the employees can take over management of the business

- Tax-deductible contributions: ESOP contributions are tax-deductible for business owners, which helps them reduce their tax liability

- Great for attracting other top employees: If your employer offers an ESOP plan, they can use it to recruit other strong employees to help grow your business and build the value of the company, part of which you will own

Cons of an ESOP

There are virtually no ESOP drawbacks for employees except that their ESOP may take the place of cash bonuses or profit sharing. Employees also may not have any way to protect their investment in the company if their plan doesn’t give them the ability to make management decisions for the company. The biggest drawback for ESOPs is the high cost for employers.

Some cons of an ESOP plan include:

- Employees may not have control: Even though employees will be invested in a business through their stock plan, their plan may not grant them any rights to make decisions for the company, making it difficult or impossible for employees to protect their investment

- Have to make sure business is run for benefit of the plan: Owners of businesses with stock plans owe a fiduciary duty to their shareholders including the plan, which means that they must run the company for the plan’s benefit and can’t take too much compensation

- Expensive for employers: ESOPs are very expensive for businesses to implement and administer

4 Steps for Business Owners to Set Up an ESOP

Setting up an ESOP doesn’t typically require any input from employees — employers decide whether to set up an ESOP and employees have the option to participate. If your employer does offer an ESOP, it’s up to you to familiarize yourself with enrollment qualifications and make sure that you enroll when you’re eligible.

For business owners, however, there are several steps that you’ll need to take to set up and use an ESOP. In order to set up an ESOP plan, you’ll want to work with an attorney for a company that specializes in designing and implementing plans. You’ll also need to make sure all eligible employees are enrolled and that you make contributions to the plan.

The four steps for business owners to set up an ESOP are:

1. Employer Chooses an ESOP Provider

Setting up an ESOP requires hiring a lawyer and appointing a trustee to represent the employees in the plan. While some business owners can set up ESOPs using their attorney and financial advisor, it can be a good idea to use a specialty company to help set up an ESOP.

A few good providers that can help business owners set up an ESOP plan include:

1. Principal Financial

Principal Financial is a large financial services company that provides advising services to large institutions. One of Principal’s specialties is in providing employee benefits including 401(k)s, insurance plans, and ESOPs.

Principal is a great provider for businesses that offer other employee benefits in addition to employee stock plans. The provider is also great for business owners who need help with succession planning or insurance needs.

2. E-Trade

E-Trade is known as a discount online brokerage firm. The company offers cost-effective trading platforms for many types of accounts including IRAs, simplified employee pension plans (SEPs), and Solo 401(k)s. However, E-Trade has also expanded their offerings to include many employee benefit plans like ESOPs.

Businesses looking for a cost-effective provider for their employee stock plan should consider working with E-Trade. E-Trade is also an ideal ESOP provider for companies or business owners that already have an account with E-Trade.

3. Greenberg Traurig

Greenberg Traurig is a huge international law firm. The firm is extremely reputable and very knowledgeable in many areas of law including employer-sponsored retirement plans subject to the Employee Retirement Income Security Act of 1974 (ERISA).

Greenberg Traurig is a great law firm for midsized businesses who want to work with a high-quality law firm to set up their ESOP. Business owners who work with Greenberg Traurig can expect great legal advice if they can absorb the high cost.

2. Draft & Adopt ESOP Document

Once you choose a provider, businesses must work with their attorney or ESOP provider to prepare an ESOP document. ESOP plan documents outline information about the plan including eligibility criteria and employee vesting schedules. The plan document must also designate a trustee to represent employees in the plan.

3. Enroll ESOP Eligible Employees

After the ESOP plan document is drafted and adopted, employers need to enroll all employees who are eligible to participate in the ESOP. Qualifications for participation are outlined in the plan document, and employers must be careful not to exclude any employees who are eligible for the plan.

4. Make Cash or Stock ESOP Contributions

When the plan document has been formed and employees have been enrolled, the last thing left for employers to do is to administer their ESOP. This can be done by having the ESOP borrow money to purchase stock in their company and then making tax-deductible contributions to repay the loan. Alternatively, employers can contribute stock directly to the ESOP or contribute cash which is used to purchase their shares.

If you choose to use a leveraged ESOP these steps are basically the same except for the actual administration of a plan. Under a typical unleveraged ESOP, a company makes contributions that are used to purchase shares over time. In a leveraged ESOP, the process is reversed as the plan borrows money to buy shares and the company makes contributions over time to repay the loan.

ESOP Frequently Asked Questions (FAQs)

If you still have questions about ESOPs after reading this article, here are some of the frequently asked questions about ESOPs. If you still don’t see an answer to your question, you’re welcome to post it in the comment section.

Is an ESOP the Same as a 401(k)?

An ESOP is very different from a 401(k). In a 401(k), employees contribute through salary deductions which they invest in stocks, bonds, or mutual funds. They may also receive employer matching or profit-sharing contributions. An ESOP is a 401(a) plan that gradually shifts ownership in a company to its employees.

What Is an ESOP Distribution?

An ESOP distribution is a withdrawal that employees take from their ESOP accounts after they vest. ESOP distributions are usually taxed as ordinary income but can be taxed as capital gains in some cases. ESOP distribution taxes can also sometimes be deferred if the employee rolls their distributions into an IRA.

What Is an ESOP Vesting Period?

An ESOP vesting period is a timeframe that employees must wait until their stock in their employing company vests. ESOP vesting is similar to 401(k) vesting schedules, which are outlined in plan documents and can force employees to give up part of their stock if they leave before they’re fully vested.

What Is a Leveraged ESOP?

A leveraged ESOP is an ESOP that takes out a loan in order to purchase company stock from the business owners. Under a leveraged ESOP, employer contributions are used to repay the ESOP loan over time. However, employer contributions are still tax-deductible up to 25 percent of total payroll.

The Bottom Line

ESPPs are great benefits that some businesses offer to their employees. ESOPs have virtually no cost for employees and are a great recruiting tool. Business owners looking to sell their business over time should consider an ESOP for financing their own buyout through tax-deductible contributions.

Some business owners want to provide retirement benefits to their employees without giving up stock in their company. Using other types of retirement plans, business owners can incentivize employee saving or offer profit-sharing.