The federal funds rate is the rate that’s charged when a bank lends funds to another bank. This can occur if a bank needs money to satisfy reserve requirements The requirements ensure that the bank can meet its liabilities if it receives a large number of withdrawal requests. set by federal regulations. While the federal funds rate describes the rate banks charge one another, it plays a large role in US monetary policy and has significant implications for consumers and small business owners. It can impact stock market performance and the rates you see on loans and depository accounts, like checking and savings accounts.

How the Federal Funds Interest Rate Is Determined

The federal funds interest rate is determined by the Federal Open Market Committee (FOMC), which typically meets at least eight times per year. One purpose of these meetings is to figure out what changes in monetary policy to make to help the US economy grow—such as whether to raise the federal funds rate, lower it, or leave it unchanged.

A wide variety of economic and financial conditions is reviewed before a decision is made; but in general, changes to the federal funds rate are typically done with the following goals:

For Lowering the Federal Funds Rate

This is typically done to stimulate economic growth and/or fight rising unemployment. Lowering the federal funds rate creates a cycle that makes it more affordable to borrow money, which ultimately encourages consumers to spend more. Additional spending by consumers can help companies recognize more revenue, giving them an even greater ability to hire more employees and invest in additional growth.

For some banks and lenders, offering lower interest rates as a result of a reduction in the federal funds rate can also lead to adjustments in eligibility criteria making it easier for consumers to get approved for loans. If you’re looking for a small business loan, you may find it easier to get credit policy exceptions on common loan requirements.

For Raising the Federal Funds Rate

An increase in the federal funds rate is often done to slow down an economy that’s growing too rapidly, especially if it’s deemed to be at an unsustainable rate. It can also be done to fight inflation, a potential outcome of a previous decrease of the federal funds rate. Increasing the federal funds rate makes it more expensive to borrow money, which discourages spending by both consumers and business owners, instead encouraging them to save more.

For Leaving the Federal Funds Rate Unchanged

If the FOMC determines that the US economy is stable, it can decide to leave the federal funds rate unchanged until the next regularly scheduled meeting.

How the Federal Funds Impacts Banks

Federal regulations dictate the amount of reserves a bank must have in order to increase the likelihood that it can meet a surge in withdrawal requests. Typically, the amount of reserves required would be based on the amount of deposits it has or a ratio of certain net transactions. For example, if a bank has $500 million in deposits from its customers with a 10% reserve requirement, it can lend $450 million as long as it retains at least $50 million to cover the possibility that customers may want to withdraw those funds.

If a bank does not have sufficient funds to meet reserve requirements, it can seek out funding from another bank that has excess reserves. Banks with excess funding can lend it to other banks overnight, charging only the federal funds rate.

How the Federal Funds Rate Impacts the Market

As a consumer and small business owner, changes to the federal funds rate can affect stock market performance and the rates you get on loans and depository accounts. Below is a table summarizing the typical impact you’ll see in each of these areas.

Change in Federal Funds Rate | Expected Impact on Stock Market Performance | Expected Impact on Interest Rate of Loans | Expected Impact of Interest Rate on Depository Accounts |

|---|---|---|---|

Increase | Decreases in share prices | Increases | Increases |

Decrease | Increases in share prices | Decreases | Decreases |

Unchanged | No changes | No changes | No changes |

Stock Market

When the Fed lowers the federal funds rate, it makes borrowing money less costly to businesses. With more affordable access to capital, investors can see this as a chance for additional growth, something that can yield a more positive outlook for the company, and thus, a higher share price for publicly traded companies.

Loans

The interest rate on loans typically corresponds to how much it costs for banks to borrow money. As the Fed raises rates, that added cost is passed on to borrowers. Similarly, as rates decrease, borrowers will see lower interest rates on a wide range of loans.

Depository Accounts

Checking, savings, and Certificates of Deposit (CDs) are common types of depository accounts that see an increase in rates when the federal funds rate goes up. Since a bank’s ability to issue loans is typically at least partially dependent on the amount of deposits it has, it usually offers a higher interest rate to attract more customers if the federal funds rate has also increased. By encouraging customers to deposit additional funds, banks can have a greater ability to issue loans, something that can be even more profitable due to the higher interest rates it can subsequently charge.

Historical Changes to the Federal Funds Rate

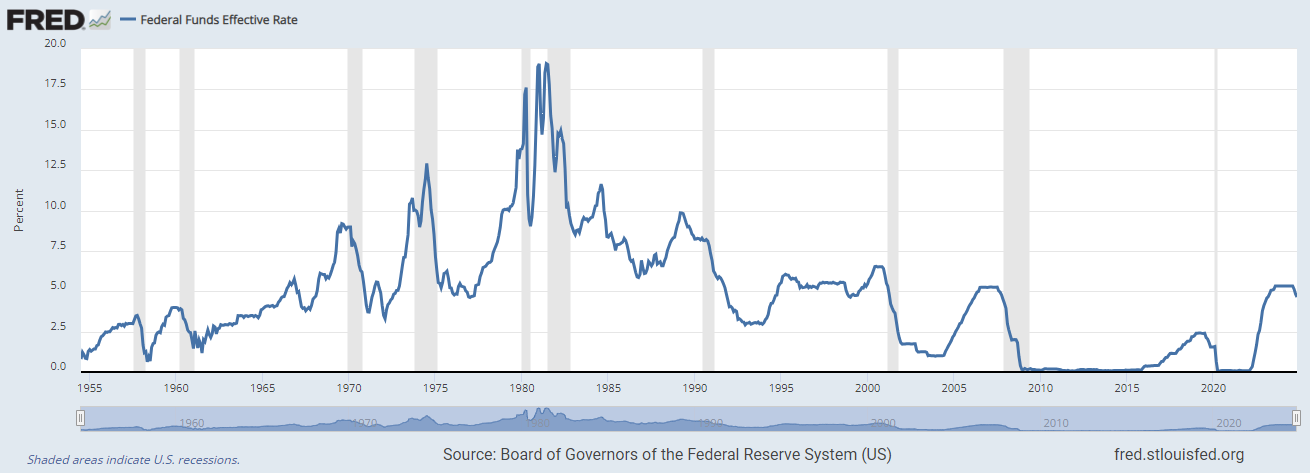

The federal funds rate has fluctuated over time in response to changes in the US economy. It reached a high of nearly 20% in the 1980s, to a low of effectively 0% around 2008. Below is a chart taken from the Federal Reserve Bank of St. Louis showing these historical changes.

Changes in the federal funds rate going back to the 1950s. (Source: Federal Reserve Bank of St. Louis)

Frequently Asked Questions (FAQs)

Yes. The federal funds rate is what banks charge each other to borrow money. Interest rates typically refer to the rates consumers and small businesses receive when they apply for loans.

In general, it can change eight or more times per year. The FOMC has eight regularly scheduled meetings per year where it evaluates any necessary changes to support the continued growth of the US economy.

The federal funds rate is typically changed to support the long-term sustainable growth of the US economy. Decreases in the rate encourage consumer spending and make it less costly to borrow money, while increases in the rate encourage consumers to save.

Bottom Line

When banks need to borrow money from each other, the rate that’s charged is the federal funds rate. However, the federal funds rate also affects consumers and small business owners. This rate can change as much as eight or more times per year depending on what the Fed determines to be the best course of action to support sustainable growth of the US economy. If you’re considering getting a small business loan and suspect the federal funds rate may change, you can adjust your timeline to potentially get a more competitive interest rate.