Our article provides Form 8027 instructions by section, from basic business information to the amounts of tips to be allocated. The form is used to report food and beverage sales, report tips declared by employees, and identify any additional allocation of tips by the employer. It must be completed by large food or beverage establishments, which are defined as establishments where tipping is customary and where over 10 employees were employed on an average day during the previous year.

It’s unclear why the IRS describes Form 8027 as applying to “large” restaurants and bars. Large is defined as averaging more than 80 employee hours per day, including both untipped and tipped employees plus managers. This means that Form 8027 actually applies to fairly small establishments as well.

Key Takeaways:

- Form 8027 allocates tips to restaurant employees when reported tips are less than 8% of sales.

- Fast food restaurants are not required to file Form 8027 as their employees are not traditionally tipped by customers.

- Separate Forms 8027 must be completed for each food and beverage business location.

- No payment of tax is due with Form 8027.

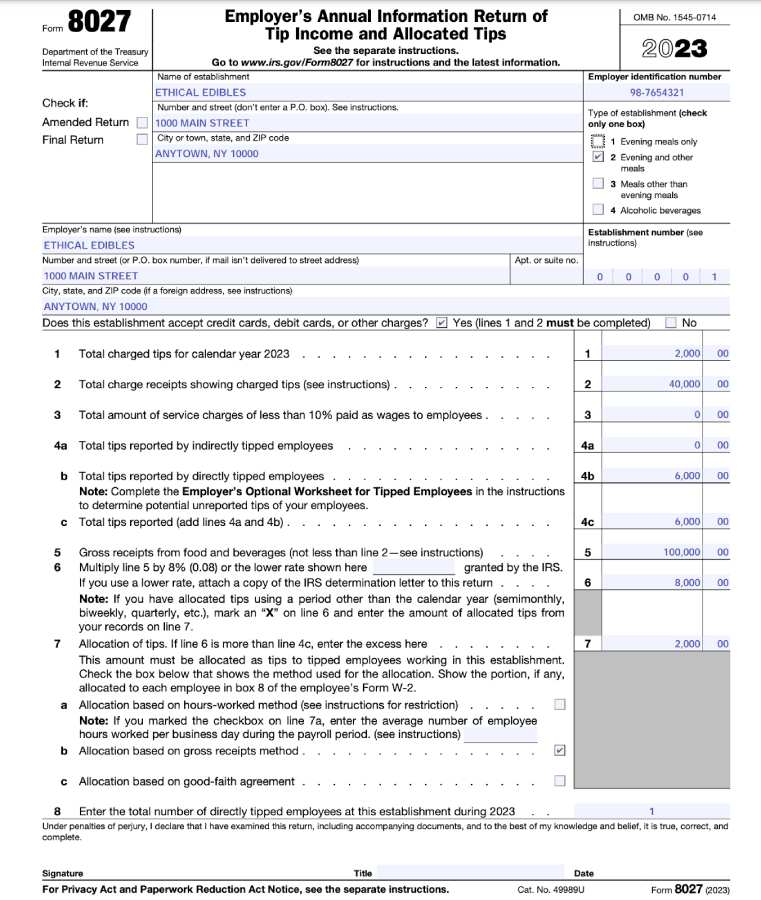

To assist with the population of Form 8027, a sample completed form has been provided below.

Ethical Edibles had the following sales and tip information for 2023. Ethical Edibles does not participate in tip pooling for bartenders, bussers, or any other members of support staff and does not add service charges to customer bills, so zero was input on line 3.

Fact summary:

- Total 2023 sales: $100,000

- Total 2023 credit card receipts included in sales: $40,000

- Total 2023 credit card tips: $2,000

- Total 2023 tips (cash and credit card) reported by employee: $6,000

- Total number of tipped employees: 11

Sample Completed Form 8027

Basic Business Information

Before completing line 1, some basic business information must be provided on Form 8027. Start by filling out the form with the following information:

- Name of business: Provide the name here by which the business is known to the public.

- Number and street/city, town, state, ZIP: Input the restaurant address that customers use to visit the business. This may be a different address than your mailing address. Remember, a separate Form 8027 is required for each location.

- Employer Identification Number (EIN): Enter the federal EIN provided to you by the IRS and provided on the W-2s issued to your employees and used on any other payroll tax forms.

- Type of establishment: Check the box that best describes the type of meals generally served at your business.

- Employer’s name: The legal name of the business should be input here. The name should match the EIN provided previously.

- Number and street/city, town, state, ZIP: This information should be the same as the address information provided previously unless your mailing address (including PO boxes) is different.

- Establishment number: Input an arbitrary 5-digit number of your choosing. Separate food and beverage business locations should have separate establishment numbers; use the same establishment number for each respective entity every year. If a business closes, establishment numbers should not be reused.

- Confirm if this establishment accepts credit cards: Check the appropriate box relating to your business’ acceptance of credit card payments.

You’ll also need to check the box shown if you’re preparing an amended Form 8027. Be sure to round your dollar amounts to the nearest dollar.

Line 1: Credit Card Tips

On line 1, input the total tips left on credit cards during the year. Exclude service charges, which are mandatory fees that are added to a customer’s bill. In contrast, tips are discretionary. Businesses that don’t accept credit cards can put zero on this line.

Line 2: Credit Card Sales

Input the total of customer sales made on credit cards during the year on this line, and exclude sales for carryout service or sales with a service charge of 10% or more. Room service does not count as a carryout sale. Sales tax is excluded.

Line 3: Reportable Service Charges

On line 3, input the total amount of service charges of less than 10% that were assessed on customer bills and paid and distributed to employees. Tips are not service charges.

Line 4a: Employee Indirect Tips

Indirect tips are ones that are received by the employee through secondary receipt. An example of secondary receipt would be an employee who receives tips through a tip pool. Dishwashers, bus boys, and cooks may be recipients of indirect tips. Use line 4b for employees who get both direct and indirect tips and direct tips.

Line 4b: Employee Direct Tips Direct tips are paid directly by the customer to the employee, even if those tips are subsequently included in a tip pool.

The IRS’s Form 8027 instructions include the Employer’s Optional Worksheet for Tipped Employees (page 9 in the 2023 version) that can be used to estimate the amount of tips that employees may have received but not reported. Employers may choose to complete the worksheet because under audit, the employer could be held responsible for unpaid Social Security and Medicare taxes. If the amount of unreported tips can be estimated, the employer can help mitigate that risk.

Line 4c: Total Employee Tips

Sum the total of lines 4a and 4b to arrive at the total amount of employee tips on line 4c. Since Ethical Edibles did not have any indirect tips, the $6,000 reported on line 4b is the same as what was reported on line 4c.

Line 5: Gross Receipts

The total gross receipts for the year should be input here. Gross receipts should include cash sales, credit sales, and the value of food or beverages that were provided to customers free of charge. Neither sales tax nor sales for nonfood or beverage items (e.g., t-shirts and accessories with a restaurant logo) should be included in gross receipts.

If food or beverages are provided as an add-on to another product service as part of a bundle, you will need to estimate the value of the food and beverages bundled in the packages and include that value in line 5 gross receipts. For Ethical Edibles, the total gross receipts were $100,000.

Line 6: Minimum Expected Tip Amount

The IRS expects that the amount of tips reported on line 4c be at least 8% of the gross receipts reported on line 5. The IRS has permitted rates of less than 8% to be used in this calculation, but those permissions are granted on a case-by-case basis, and must be supported by an IRS determination letter. Multiply line 5 by 0.08 (or by the IRS granted rate) and input the result on line 6. For Ethical Edibles, the minimum expected tip amount at the 8% rate was $8,000.

To petition the IRS for a rate lower than 8%, submit your request to the IRS’s National Tip Reporting Compliance Program Manager. The address and the required components of the petition can be found in the IRS’s Form 8027 instructions. The request cannot be for a rate of less than 2%.

Line 7: Amount of Tips to Be Allocated

If the amount of reported tips falls below 8% of gross receipts, the IRS expects the difference to be allocated to the employees on their W-2 and for Social Security and Medicare taxes to be paid accordingly.

Tip allocation is done using the “hours worked” or “gross receipts” method of allocation, reported on lines 7a and 7b, respectively.

- To use the “hours worked” method, the business location must have fewer than 25 full-time equivalent employees during a payroll period.

- Ethical Edibles reported tips using the gross receipts method of allocation. Using this method, the minimum expected tip amount calculated and shown on line 6 is $8,000. The reported tip amount shown on line 4c is $6,000, leaving a shortfall of $2,000 to be allocated to Ethical Edibles’ employees.

Purpose of Form 8027

Form 8027 confirms that bar and restaurant employees are reporting tips of at least 8% of restaurant sales. If the reported tips are less than 8%, Form 8027 calculates the shortfall and requires employers to choose the method they will use to allocate the additional required tips to employees.

For example, if employees reported total tips for the year that equaled 5% of sales, the employer would then need to allocate an additional 3% of sales as tips to its employees to meet the IRS minimum requirement for declared tips.

No Form 8027 needs to be filed for food and beverage businesses that are defined as any one of the following:

- Fast food restaurant A fast food restaurant is one where food and drink is purchased at a window or counter and then carried elsewhere to be eaten. The place the food is carried to can be on the premises.

- Establishment where tipping is not customary

- Business where 95% of total sales (other than carryout) had a service charge of 10% or more

Filing Form 8027

Before submission, Form 8027 must be signed and dated by an authorized party. The following items are important to note with respect to filing:

- Paper filed Forms 8027 are due the last day of February for the previous calendar year (or the next business day following a weekend or holiday). Electronic returns are due on March 31 for the previous calendar year (or the next business day following a weekend or holiday). An electronically filed Form 8027 can be submitted through a payroll service provider or through one of the best payroll tax software.

- Form 8027 can be extended for 30 days by completing and submitting Form 8809 by the original due date of Form 8027. As no formal approval letter will be provided by the IRS, you’ll need to retain proof that you submitted the extension. If an extension was requested, Form 8809 should be attached to Form 8027 when it is filed.

- You also must file Form 8027-T if you have multiple locations—and thus multiple forms 8027. No Form 8027-T is required if you file electronically.

Frequently Asked Questions (FAQs)

Form 8027 must be filed for each US location of a food or beverage establishment where tipping is customary and more than 10 full-time equivalent employees—tipped and nontipped—were employed in the previous calendar year.

Not filing Form 8027 could result in a failure to file penalty. Failure to file penalties for informational returns can run from $60 to $630 for each required filing. These penalty amounts are modified from time to time by the IRS.

Cash tips are reported by large food or beverage establishments through Form 8027 for purposes of tip allocation. They should also be included on each tipped employee’s Form W-2 issue from the employer. These tips should also be included on the employee’s personal income tax return.

Bottom Line

Form 8027 is used by large food or beverage establishments to calculate the amount of tips that need to be allocated to employees to meet the minimum standard of 8% of sales. Separate forms should be filed for each restaurant location. No tax is due with the filings.