Aside from being affordably priced, the best payroll software for small business users calculates employee wages and deductions accurately and pays and files payroll taxes automatically. Most offer unlimited pay runs, paid time off (PTO) tracking, two-day direct deposits, employee self-service portals, and access to employee benefits.

To find the ideal payroll software for small business owners, we evaluated more than a dozen solutions and narrowed the list down to our top nine recommendations:

- Gusto: Best overall small business payroll software

- QuickBooks Payroll: Best for QuickBooks accounting users and contractor payments

- Rippling: Best all-in-one HR, payroll, IT, and expense management system

- Square Payroll: Best for small restaurants, retail shops, and Square POS users

- OnPay: Best for simple to niche payroll needs

- Paychex Flex: Best for startups needing dedicated payroll support

- ADP Run: Best for rapidly scaling small businesses

- Homebase: Best for small companies (up to 20 employees) that hire hourly workers

- Patriot Payroll: Best for mom-and-pop businesses that want a low-cost DIY option

Summer Savings: Get 70% off QuickBooks for 3 months. Ends July 31th. |

|

Best Payroll Software for Small Businesses Compared

Our Score (out of 5) | Starter Monthly Pricing | Contractor Payroll Plan | ||

|---|---|---|---|---|

| 4.81 | $6 per employee + $40 base fee | $6 per worker + $35 monthly | |

| 4.53 | 50% off base fees for the first three months | $5 per employee + $45 base fee | $15 monthly for 20 workers + $2 for each additional contractor |

4.51 | One month free | Included in payroll add-on | ||

| 4.51 | ✕ | $6 per employee + $35 base fee | $6 per worker monthly |

| 4.44 | ✕ | $6 per employee + $40 monthly | Included in payroll plan |

| 4.31 | Three months free | $5 per employee + $39 base fee | Included in payroll plan |

| 4.09 | Three months free | Included in payroll plan | |

| 4.09 | ✕ | Included in payroll plan | |

| 4.03 | ✕ | Included in payroll plan | |

Looking for more than just payroll tools? Consider a professional employer organization (PEO) service like Justworks. It tops our list of best PEOs for small businesses and covers everything from recruiting to retiring. For $59 per employee monthly, it handles payroll in multiple states, assumes tax liability, and takes HR worries off your hands.

Why You Can Trust Fit Small Business

I have over five years of experience evaluating payroll and HR software for Fit Small Business and 10 years of experience in human resources and handling HR systems. As a result, I am deeply familiar with the needs of business owners and the HR solutions available on the market.

See our full methodology below.

- Five-plus years evaluating HR and payroll systems

- Strict, unbiased editorial policy

- Evaluated alongside 17 HR solutions across 38 data points

- Regularly updated and fact-checked

Gusto: Best Overall Payroll Software for Small Business Users

Pros

- It has unlimited and automatic pay runs.

- It provides access to Gusto brokered health plans with zero administration fees (pay only for premiums).

- It has financial wellness tools available via Gusto Wallet.

- It supports international contractor payments in more than 120 countries.

Cons

- Health insurance is only available in 38 states and Washington, D.C.

- Time tracking, next-day direct deposits, performance reviews, and multistate payroll are available only in higher tiers.

- It has no dedicated payroll specialist.

- Priority phone support is reserved for the Premium plan (costs extra for the Plus plan).

Overview

Who should use it:

Gusto ranks high among its competitors as its payroll and HR features enable small businesses to operate with the amenities that some larger companies offer. It supports multiple pay schedules and can pay employees via the Gusto Wallet app, direct deposits, and checks you print yourself. Job postings, applicant tracking, and offer letter templates are also available to streamline hiring processes. Gusto even notifies each new hire so that they can complete the required paperwork.

Why we like it:

Aside from Gusto’s wide range of HR tools, its automatic payroll calculations and user-friendly interface make running Gusto payroll easy for those with minimal knowledge of paying workers. If you plan to expand your business and are unsure how to handle state regulations, Gusto can assist in registering your company in 50 states. It even supports global contractor payments in more than 120 countries, while its Gusto Global product provides employer of record (EOR) services to hire and pay international workers in India and Canada (as of this writing).

Gusto plans

- Simple: $40 base fee + $6 per employee monthly

- Plus: $80 base fee + $12 per employee monthly

- Premium: Custom-priced

- Contractor-only payroll plan: $35 base fee + $6 per contractor monthly (for businesses that only pay contract workers)

Add-ons

- State payroll tax registration: Pricing varies per state

- HR advisory services for Plus plan only: $8 per employee monthly (this is included for free in the Premium tier)

- International contractor payments in over 120 countries: Custom-priced

- Gusto Global (EOR services): $699 per employee monthly ($599 per employee monthly until 12/312024)

- R&D tax credits: 15% of identified tax credits

- Health insurance and other benefits: Pricing varies by benefit

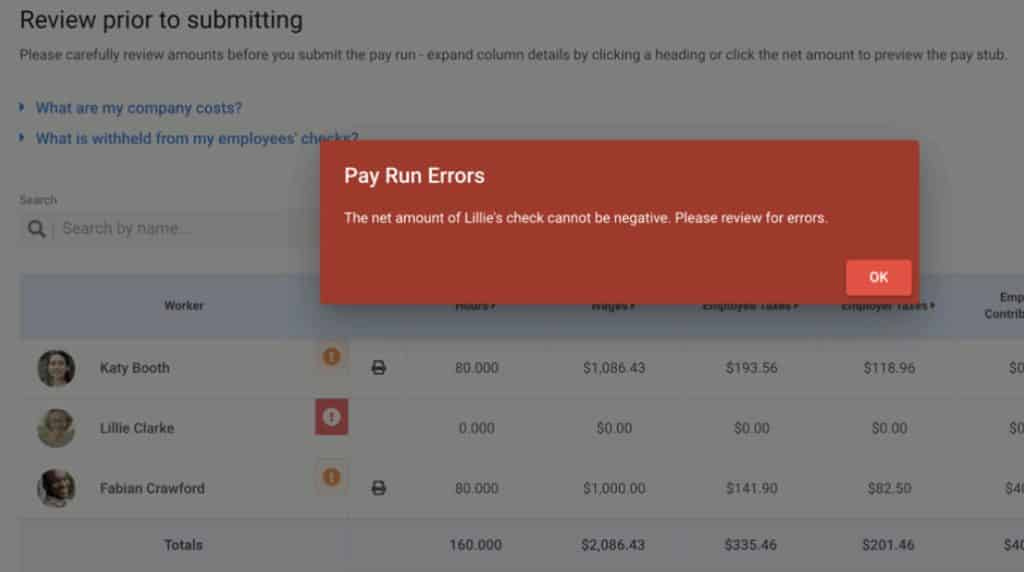

Gusto lets you add employee time data and additional earnings like bonuses directly into its payroll solution. (Source: Gusto)

- Simple-to-use payroll interface allows you to process payroll in three steps and view or edit employee hours, time off and overtime details, deductions, and earnings on one page.

- Free Gusto Wallet app comes with financial management tools, so your employees can track finances, identify budgets for expenses, split paychecks into different accounts, and automatically set aside money every payday as savings.

- Gusto calculates, withholds, and pays taxes at the federal, state, and local levels automatically. It files payroll taxes on all levels, unlike QuickBooks Payroll, which requires you to upgrade to its higher tiers for automated local tax filings.

- Garnishment payment services included all Gusto plans, which let it deduct and send child support payments in 49 states (except South Carolina). Providers, such as Paychex, offer this in its higher tiers or as a paid add-on, while others (like QuickBooks Payroll) only handle garnishment payment deductions.

Multilocation business owners might find Gusto a bit pricey because they’ll have to upgrade to at least its Plus plan to unlock multiple state pay runs. If you have a limited budget, any of the payroll software for small companies on our list can handle your multistate payroll needs (although Patriot Payroll charges $12 monthly for each additional state tax filing).

If offering benefits is important to you, note that Gusto’s health plans are unavailable in Alabama, Alaska, Hawaii, Louisiana, Mississippi, Montana, Nebraska, North Dakota, Rhode Island, South Dakota, West Virginia, and Wyoming (as of this writing). For health insurance that covers all US states, consider any providers in this guide (except Patriot Payroll and Homebase, as neither offers benefits).

QuickBooks Payroll: Best for QuickBooks Users and Contractor Payments

Pros

- It integrates seamlessly with QuickBooks accounting software.

- It has unlimited and automatic pay runs.

- It has an affordable plan for processing contractor payments.

- Tax penalty protection covers all tax filing mistakes, regardless of who made the error.

Cons

- Automated local tax filings and time tracking are available only in higher tiers.

- It doesn’t have mobile apps for employee self-service (offers a workforce portal you can access online).

- Tax penalty guarantee is offered in the highest plan; lower tiers get an accuracy guarantee that only covers mistakes made by QuickBooks representatives.

Overview

Who should use it:

QuickBooks Payroll is the best option for most QuickBooks accounting users. It integrates seamlessly—you access it within the same system with the click of a button—and all information flows throughout both systems (you don’t have to enter twice). Payroll runs are made easy with automatic pay calculation and tax payment/filing features. Plus, its affordable contractor payment plan is ideal for budget-constrained small companies that only hire and pay contract workers.

Why we like it:

Unlike most of the other providers in this guide, QuickBooks Payroll’s standard direct deposit timeline is a next-day option. However, it can also handle same-day direct deposits if you get one of its higher tiers. QuickBooks is also the only small business payroll software we reviewed that provides both tax accuracy and tax penalty protection programs. However, if you want advanced HR tools to manage performance reviews and learning courses, consider Rippling, ADP, and Paychex.

QuickBooks Payroll plans

- Payroll Core: $45 base fee + $5 per employee monthly

- Payroll Premium: $75 base fee + $8 per employee monthly

- Payroll Elite: $125 base fee + $10 per employee monthly

- Contractor payments package: $15 monthly for 20 workers + $2 for each additional contractor

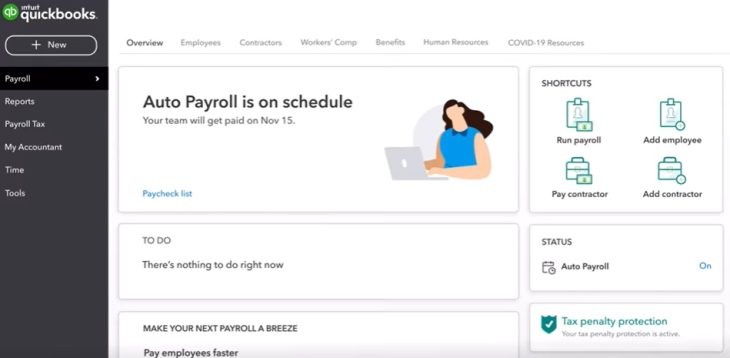

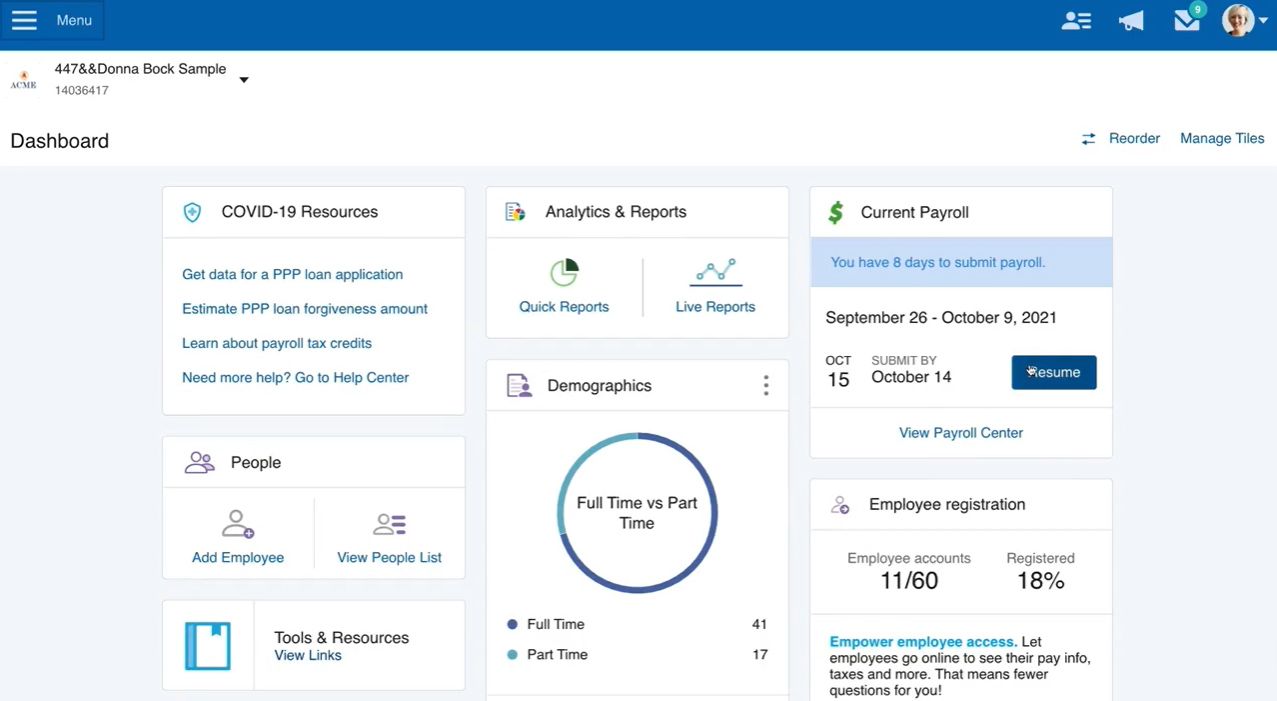

Aside from a “to-do” list, QuickBooks Payroll’s main dashboard contains shortcuts for running payroll and adding employees. (Source: QuickBooks Payroll)

- QuickBooks Payroll contractor payments package is the cheapest among our list of top payroll software for small business owners. For $15 per month, you can process payments for up to 20 workers—with Square Payroll, paying 20 contractors will cost $120 per month (computed as $6 × 20 workers = $120).

- QuickBooks will cover the penalty and interest for any payroll tax error for up to $25,000 a year, regardless of who made the mistake. Note that you must purchase its Elite plan to have your errors covered. No other providers on our list will cover mistakes you make under any circumstance.

QuickBooks Payroll doesn’t have the job posting and hiring tools that Rippling, Gusto, Homebase, Paychex Flex, and ADP Run offer. While its contractor payment plan includes next-day direct deposits, it lacks Square Payroll’s flexible options that allow you to pay contract workers via check, direct deposit, or its Cash App.

Rippling: Best All-in-One HR, Payroll, IT, and Expense Management Software

Pros

- Modular HR, payroll, expense management, and IT features integrate with each other.

- PEO services can be easily switched on and off.

- It offers global payroll and EOR services for hiring and paying international workers.

- It can integrate with over 500 business software.

Cons

- Pricing isn’t all transparent.

- You have to purchase its workforce management platform, Rippling Unity, before you can buy its other modules.

- HR help desk option with phone and email support costs extra.

- It can get pricey as you add more features.

Overview

Who should use it:

What makes Rippling a good payroll option for businesses is its modular solutions that allow you to choose the HR and payroll tools you need. It even has an expense management module, as well as an IT tool to monitor business software access and company computer devices. This saves you time from managing separate systems to handle employee expense claims and manage company-assigned apps and computers.

Why we like it:

Rippling stands out from the rest given its feature-rich platform, global payroll capabilities, and PEO and EOR services. Its customizable workflows and automation tools allow you to streamline various HR tasks, from sending reports to assigning tasks. While its workforce management platform is a must-purchase, the cost of adding full-service payroll is still affordable. However, it isn’t as cost-effective as most of the payroll software in this guide, such as Square Payroll and Patriot Payroll.

Rippling works with you to create a custom package that fits your needs. Monthly fees start at $8 per employee. However, you have to purchase its core workforce management platform, Rippling Unity, before getting any of its modules.

For an HR payroll platform with time-tracking, software integrations, onboarding, and offboarding tools, we were quoted a monthly fee of $35 + $8 per employee. You can choose to add Rippling’s IT tools to manage business apps and computer devices for $8 per employee, per module monthly. Benefits administration services are also available, but pricing varies depending on the insurance broker.

Here are some of its add-on tools and services:

- Global payroll: $20 per employee or contractor monthly*

- EOR services: $599 per employee monthly*

- PEO services: Custom-priced

- HR help desk: Custom-priced

- Benefits administration: Custom-priced

- Expense management: Custom-priced

- Headcount planning: Custom-priced

- Learning management: Custom-priced

- Performance reviews: Custom-priced

- Applicant tracking: Custom-priced

*Pricing is based on a quote we received

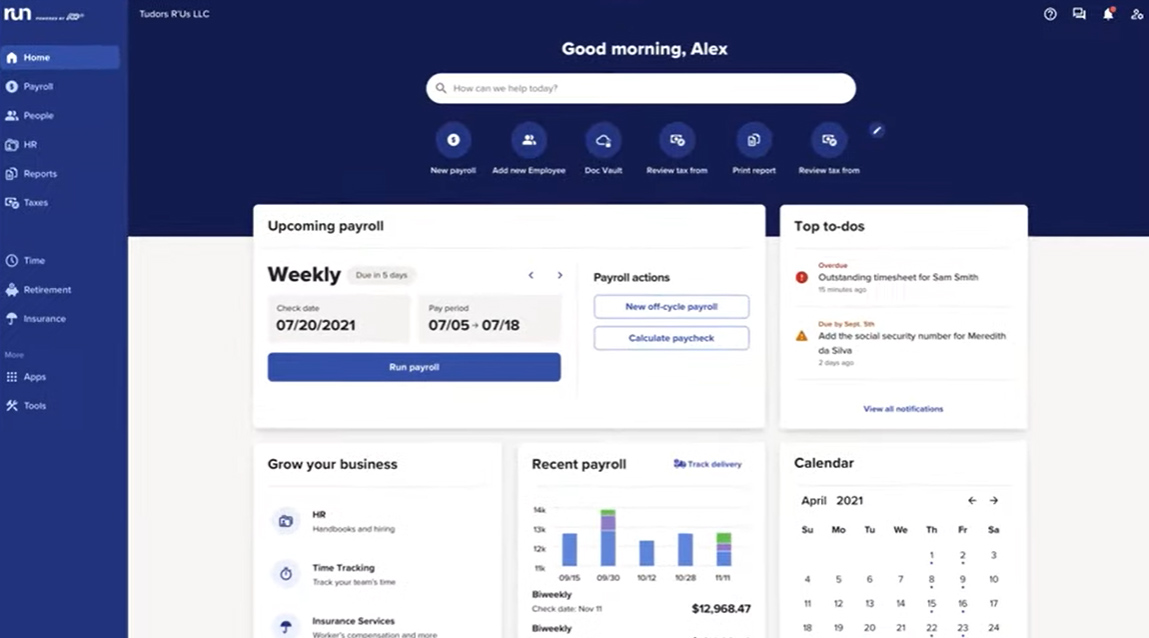

Rippling claims that it can run payroll in as fast as 90 seconds (Source: Rippling)

- Rippling pulls your last payroll numbers automatically when you begin processing a new payroll cycle, so you can compare the two easily. It helps you identify any obvious errors quickly to prevent you from having to backtrack to correct them later.

- Aside from assigning computer units and business apps that employees have access to, Rippling can easily disable software access and remotely lock computers. Rippling even stores your unassigned computer units in its warehouse, and you can check the inventory through its system. None of the providers we reviewed have similar IT features.

- Unlike ADP and Paychex, you can turn Rippling’s PEO services off from your account if you decide that you no longer need them. This allows you to immediately start using its HR software without contacting its support team to enable software access.

- Customizable workflows require no coding experience, as they come with if-then logic to automate processes.

Rippling’s feature-rich HR payroll platform may be too much for small businesses that only need basic pay processing tools. If you don’t require robust software integrations and advanced HR functionalities, try Patriot Payroll. It has all the essential tools you need to run payroll and is more affordable than Rippling ($37 + $4 per employee monthly vs $35 + $8 per employee monthly) and the other providers on our list.

Square Payroll: Best for Small Restaurants, Retail Shops, & Square POS Users

Pros

- It offers flat pricing with an affordable contractor plan.

- It connects easily with Square POS.

- It has 2- and 4-day direct deposits, including an instant payment option via the Cash App.

- It has unlimited and automatic payroll.

Cons

- Instant payments require you to store funds in an online Square balance account.

- Health insurance and access to HR experts are paid add-ons.

- It lacks hiring and performance review tools.

- Square Payroll only integrates with QuickBooks Online.

Overview

Who should use it:

Square Payroll is the best choice for restaurants and small retailers that are already using Square’s POS system. The integration between the two Square products makes it easy to import online timecards from Square POS into its payroll tool for pay processing. Its tip reporting features also allow you to record tip amounts, deduct taxes, and report them on your tax forms.

Why we like it:

With Square Payroll, you can run payroll as often as needed at no extra cost (unlike big-name providers like ADP that charge per pay run). It files quarterly and annual taxes and can assist you in correcting payroll-related documents that were submitted incorrectly. This is crucial for small businesses that need help managing the intricacies of amending payroll reports submitted to local authorities.

Square Payroll plans

- Pay employees and contractors: $35 base fee + $6 per employee monthly

- Pay contractors only: $6 per person monthly

Add-ons

- Health, retirement, and workers’ comp plans: Custom-priced

- Employee handbook builder: Custom-priced

- Direct access to certified HR experts: Custom-priced

- Mail paper copies of W2s/1099s: $3 per mailed form annually (digital delivery of Form W2s and 1099s is free)

- Payroll amendment service: Custom-priced

- Includes help in correcting errors in reported tax forms and payroll documents, such as amending federal employer identification number (FEIN) tax account issues and correcting an employee’s name or Social Security number

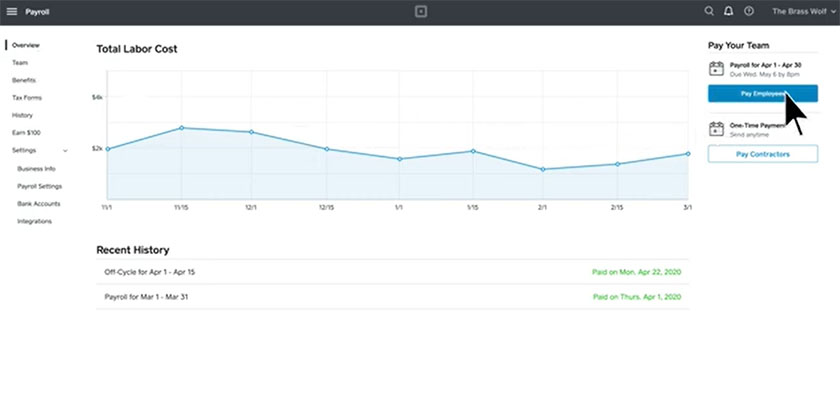

Aside from letting you run payroll, Square Payroll’s main dashboard shows your pay run history and an overview of your total labor costs. (Source: Square Payroll)

- Square Payroll’s contractor-only plan may not be as affordable as QuickBooks Payroll, but it lets you pay contract workers instantly via its Cash App.

- Integration with Square POS allows for direct tracking of employee work hours and tips on its dashboard and easy importing of attendance and tip data into Square Payroll to pay workers.

- Square Payroll’s paid amendment service includes adding missing payroll history from a previous payroll provider that was not submitted on time. It also covers amendments for contractors that should have been reported as W-2 employees and vice versa.

Similar to QuickBooks Payroll, Square Payroll doesn’t have a wide range of HR solutions. Rippling is a great choice if you want an all-in-one HR payroll software. It can even process employee expense reimbursements and has IT tools to manage business apps and devices.

For contractor-only businesses with a handful of workers and only needing direct deposit payments, we recommend QuickBooks Payroll’s contractor payment plan, as it is more affordable. QuickBooks will charge you $15 monthly for 20 workers + $2 for each additional worker, whereas Square will bill you $6 per contractor monthly.

OnPay: Best for Simple to Niche Payroll Runs

Pros

- It can file Form 943 (for agricultural companies).

- It has multiple payment options, such as direct deposits, manual checks, and debit cards.

- It has an affordably priced plan.

- It has 6 levels of permissions for controlling user and software access.

Cons

- It lacks automatic pay runs.

- It doesn’t have live phone support on weekends.

- It has limited third-party software integrations.

- Time tracking is available through partner systems.

Overview

Who should use it:

OnPay can handle the payroll requirements of various businesses (like restaurants and bars) and organizations, such as churches and nonprofits. For those with special tax requirements like agricultural businesses, OnPay offers automated tax payments and filings of Form 943.

Why we like it:

It may not offer multiple payroll plans with varying payroll and HR tools, but OnPay’s flat pricing makes it easy to manage payroll software costs. You only need to account for changes to your employee headcount and won’t have to worry about upgrading to higher tiers to access additional tools—all of OnPay’s features are included in its plan.

- Unlike many of the small business payroll software in this guide, OnPay only offers one plan. For $40 + $6 per employee monthly, you are granted access to all of its HR, payroll, benefits, and onboarding features.

OnPay is equipped with smart alerts that notify you of missing time entries and other pay run errors. (Source: OnPay)

- OnPay helps ensure payroll compliance with its alerts for pay run errors and incomplete tasks. It also has an in-app address helper, which shows a list of Google-verified addresses as you manually type a street address. You can choose an address option, and OnPay will automatically populate the address fields based on your selection. This saves you time from manually updating an employee’s personal address or worksite location.

- Compared to some of the providers in this guide, like Gusto and Square Payroll, creating custom reports is easier with OnPay given its drag-and-drop interface. You can arrange columns in any order, add or remove over 50 data points, and set up filters.

- Aside from phone, chat, and email support, OnPay can guide you through pay processing if you need help. The provider even assists new clients in setting up their accounts, migrating employee information, and customizing integrations with accounting and time-tracking solutions.

If you require payroll assistance from OnPay’s support team on a weekend, you won’t be able to contact them via phone. It only provides email support on Saturdays and Sundays. ADP Run and Paychex Flex are great choices if you need 24/7 support. Paychex Flex even offers a dedicated payroll specialist to its small business clients.

In addition, OnPay’s HR functionalities are basic. While it has offer letters and automated onboarding workflows, it doesn’t post your open jobs like Gusto, Rippling, Paychex Flex, and ADP Run do. Time-tracking and scheduling tools are also available only through its integration with When I Work, Deputy, and QuickBooks Time. This is unlike Homebase, which has time tracking and staff scheduling as its core functionalities.

Paychex Flex: Best for Startups & Small Companies Needing Dedicated Payroll Support

Pros

- It has flexible plans.

- It has an unlimited and automatic payroll.

- It has dedicated payroll support.

- It has a wide suite of HR tools (such as recruiting, time tracking, and learning management).

Cons

- Pricing isn’t all transparent.

- Access to learning management and state unemployment insurance (SUI) services is available only in higher tiers.

- Time tracking, benefits, recruiting, and document management are paid add-ons.

Overview

Who should use it:

Paychex has solutions suited for different business sizes. Its Paychex Solo package includes payroll, startup/incorporation services, and access to retirement plan options, making it a suitable solution for one-person businesses. It also offers Paychex Flex as its main payroll platform, which comes with several tiers flexible enough to cater to companies of different sizes. A dedicated specialist is even on hand to help you with your payroll concerns.

Why we like it:

Similar to Rippling and ADP Run, Paychex provides more than just payroll tools and tax filing services. It provides hiring services, access to business insurance plans, and PEO services. With its multiple payment options, employees can receive their salaries via direct deposits, pay cards, and paychecks you print yourself. Paychex can also sign paper checks on your behalf if you need it.

Paychex Flex plans

- Essentials: $39 base fee + $5 per employee

- Select: Custom-priced

- Pro: Custom-priced

- Enterprise: Custom-priced

Paychex Plan for Solopreneurs and the Self-employed

- Paychex Solo: Custom-priced

Paychex Flex’s dashboard provides easy access to reports, pay runs, and employee lists. (Source: Paychex)

- It has an option to submit payroll via phone to your designated payroll specialist.

- Paychex Voice Assist offers a hands-off experience in processing, reviewing, updating, and submitting payroll. This voice-activated tool, which works on any Google Assistant-compatible device, comes with built-in verification and artificial intelligence (AI) solutions for user authentication. You can start a new pay period, make adjustments, or continue a pay run that’s already in progress—without having to log in to your Paychex Flex account manually.

- Reduce payroll discrepancies with Paychex Pre-check, which allows your employees to review their payroll in advance.

- It offers check signing and logo services if you require them.

Budget-constrained small business owners may find Paychex Flex a bit expensive given its add-on fees for time tracking and document management—solutions that most of the providers in this guide offer at no extra cost or in higher tiers. Unlike Square Payroll and QuickBooks Payroll, it doesn’t have a low-cost contractor-only payroll plan.

ADP Run: Best for Scaling Businesses That Need Flexible Plans

Pros

- It offers multiple plans to choose from.

- It has automatic pay runs.

- Its built-in compliance tools can flag potential errors.

- It offers global payroll and PEO services.

Cons

- Pricing isn’t transparent.

- Applicant tracking, salary benchmarks, and learning management reserved for higher plans.

- Benefits, time tracking, and workers' compensation are add-on products.

Overview

Who should use it:

ADP stands out with its extensive selection of HR and payroll products. Businesses with plans to grow can choose from its multiple tiers and HR tools to manage employees. Small companies with up to 49 employees can start with ADP Run to pay workers and then upgrade to ADP Workforce Now if they have over 50 workers or ADP TotalSource for PEO services.

Why we like it:

Aside from payroll and tax management, ADP Run comes with new hire reporting, background checks, learning management, and job posting (via ZipRecruiter) tools. Its higher tiers include extra HR support and handholding that you don’t get with your typical small business payroll software like Square Payroll (unless you pay for it). ADP also makes it easy to transition from one plan to the next if your company scales and you need additional HR tools.

ADP Run plans

- Essential: Custom-priced

- Enhanced: $81.66 per weekly pay run to pay 25 workers + $1.89 per additional worker*

- Complete: Custom-priced

- HR Pro: Custom-priced

*Pricing is based on a quote we received for a business with 25 weekly-paid employees

ADP Run’s dashboard shows payroll analytics, important notifications, and pay processing tasks. (Source: ADP)

- With ADP Run, you can pay your employees via direct deposit and paychecks and through the Wisely Direct Debit Card. It also offers secure paychecks with check signing and stuffing services. Unlike Paychex, ADP will even deliver the sealed envelopes containing employee paychecks to your office so that you can distribute these to your staff.

- ADP supports certified payroll reporting, enabling you to provide weekly payroll reports required by the US Department of Labor for contractors working on federally funded projects.

Time tracking is a paid add-on to ADP Run’s payroll plans. If you don’t want to pay extra or upgrade to a higher tier, consider Square Payroll and Homebase.

ADP also charges fees per pay run and employee, which makes it an expensive option if you process payroll weekly. For unlimited pay runs, consider any of the providers on our list.

Homebase Payroll: Best for Very Small Businesses Employing Hourly Workers

Pros

- The main Homebase platform has a free plan for one-location businesses with up to 20 employees.

- The free plan comes with scheduling, time-tracking, and employee messaging tools.

- It has unlimited and automatic pay runs.

Cons

- Homebase Payroll is a paid add-on; you can’t purchase it without signing up for one of Homebase’s time-tracking and scheduling plans.

- It lacks benefits management features.

- It can get pricey if you have more than 20 workers.

Overview

Who should use it:

Homebase Payroll is a paid add-on to Homebase, which has a suite of time tracking, scheduling, and hiring tools. By combining its payroll module and Homebase’s free plan for one-location businesses with up to 20 employees, small companies with only a handful of workers can use Homebase to pay employees, track staff attendance, and manage work shifts. For a monthly fee of $39 + $6 per employee, this plan combination is less expensive than most on our list, such as Gusto, which requires you to upgrade to its higher tiers to get both time tracking and payroll features.

Why we like it:

Combining Homebase’s time tracking plans with its payroll add-on makes it easy to review timesheets and run payroll. With just a few clicks, Homebase converts attendance data into the payroll information you need to process worker payments. It also offers unlimited and automatic pay runs, payroll tax filing services, and compliance tools to ensure accurate computations and payouts based on federal, state, and local labor laws.

You can also enhance Homebase’s capabilities by upgrading to the main platform’s paid plans. Depending on the package selected, you can add job postings, applicant tracking, PTO management, and new hire onboarding tools to Homebase’s HR payroll software.

Homebase Payroll plan*

- $39 base fee + $6 per employee monthly

*Requires subscription to its time tracking and scheduling software. Homebase has a free plan for one-location businesses (with up to 20 employees).

Homebase time tracking and scheduling plans

- Basic: Free for one location with up to 20 employees

- Essentials: $24.95 per location monthly for unlimited employees

- Plus: $59.95 per location monthly for unlimited employees

- All-in-One: $99.95 per location monthly for unlimited employees

With Homebase Payroll, you can process payroll in three easy clicks. (Source: Homebase)

- Homebase’s platform is equipped with the required meal breaks and rest periods for different states, with data gathered from the US Department of Labor. This allows you to manage break rules for your workforce, compute over-break minutes for payroll deduction, and stay up-to-date with any changes to break-related regulations.

- The in-app messaging tool, which is available in Homebase’s free plan, allows you to communicate with your team in real time. This helps you share company updates, alert employees of schedule changes, and send reminders.

- Scheduling employee work shifts is easy with Homebase’s drag-and-drop scheduler. Best of all, this feature is included in Homebase’s free plan.

Budget-constrained businesses with plans to add more locations or grow their workforce may find Homebase and its payroll add-on expensive. Even if you have the financial resources to pay for both Homebase’s main platform and Homebase Payroll, the software’s HR features aren’t flexible enough to handle complex employee management processes, such as tracking performance reviews, training courses, and compensation plans.

For fast-growing startups, consider Paychex Flex and ADP Run. Both offer flexible HR payroll plans that can fit the needs of small to large businesses. Rippling is also a good option because it has modular tools you can mix and match—provided you get its core workforce management platform, Rippling Unity.

Patriot Payroll: Best for Mom-and-Pop Businesses That Want a Low-cost DIY Option

Pros

- It is affordable.

- Multiple plans include full-service payroll and a do-it-yourself (DIY) tax filing option.

- It has unlimited pay runs.

- It connects easily with other Patriot products (such as accounting, time tracking, and HR documents).

Cons

- Multistate tax filings and time tracking cost extra.

- It lacks benefits options.

- Standard lead time for direct deposits is four days; 2-day direct deposits are reserved for qualified clients.

Overview

Who should use it:

Patriot Software offers an inexpensive solution for paying employees and contract workers. For mom-and-pop business owners who prefer to handle payroll tax filings themselves can use Patriot Payroll’s basic tier, which costs only $17 monthly + $4 per employee—a viable option if you have a handful of employees.

Why we like it:

Patriot Payroll offers a flexible option that others in this guide don’t: a choice between full-service payroll and a more affordable DIY version. Both come with unlimited payroll runs, multiple pay rates, automated PTO accrual calculations, and customizable deductions and contributions. You can pay employees through direct deposit or manual checks, and if you choose its full-service plan, Patriot will pay and file all federal, state, and local taxes. It even has add-on solutions for tracking employee attendance and managing employee information.

Patriot Payroll plans

- Basic Payroll with DIY tax filings: $17 base fee + $4 per employee monthly

- Full Service Payroll: $37 base fee + $4 per employee monthly

Add-ons

- Multistate tax filings: $12 monthly for each additional state

- 1099 e-filings (for Basic Payroll subscribers only): $20 for up to five 1099 e-filings; an additional $2 per 1099 is required for six to 35 filings (no additional charge for 36 or more)

- Time tracking: $6 + $2 per employee monthly

- HR/employee data management tools: $6 + $2 per employee monthly

- Accounting: $20 monthly for the basic option; $30 monthly for the premium version

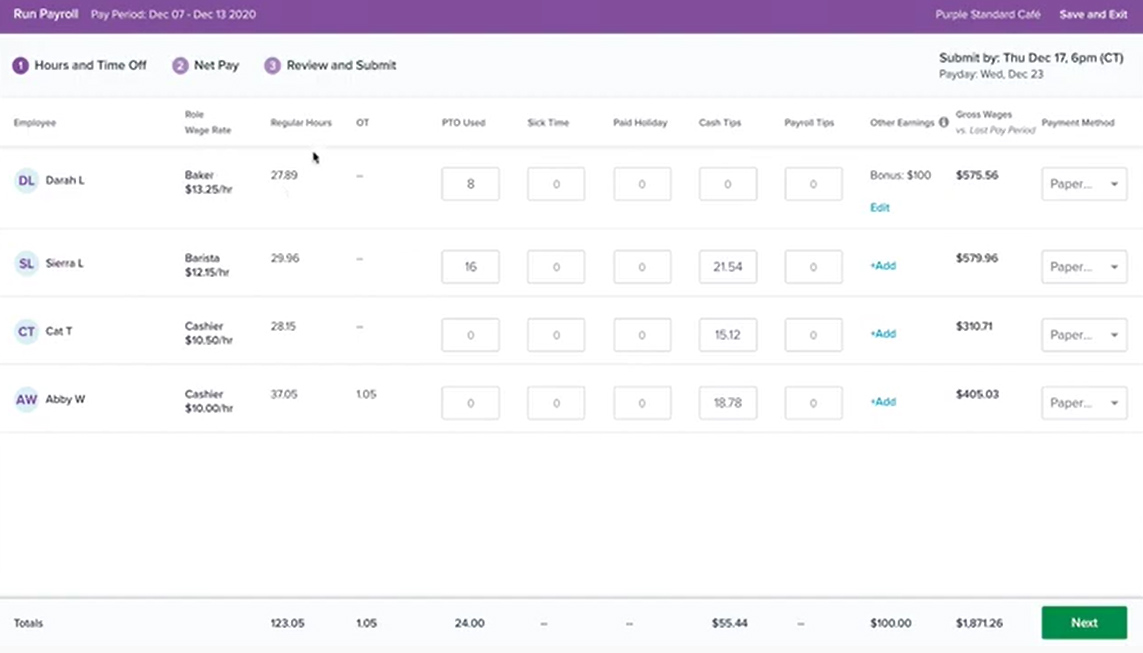

Patriot Payroll has a three-step pay run process. (Source: Patriot Payroll)

- Patriot allows employee hourly pay changes during pay runs. You don’t need to cancel the payroll or leave the system’s pay processing page to make the salary updates.

- With its Net to Gross Payroll tool, you simply input the bonus amounts you want your employees to receive, and Patriot Payroll will automatically gross it up for taxes. This saves you time and helps prevent errors from manually calculating grossed-up bonus data for payroll tax processing.

Patriot Payroll only offers its two-day direct deposit feature to qualified clients. If you want fast direct deposits, we recommend QuickBooks Payroll (its basic plan comes with next-day options) and Square Payroll (its Cash App feature lets you pay employees instantly).

For companies with business locations in several states, Patriot can handle multistate pay runs but charges a $12 fee for each additional state tax filing. If you don’t want to pay extra, consider the other payroll providers on our list (except Gusto as it offers multi-state pay runs in higher tiers).

For more payroll software options, check out our buyer’s guide on the best payroll services to help you find a payroll software or service that fits your business’s needs.

How We Chose the Top Payroll Software

We checked and compared the best small business payroll software across industries; most of them offer many of the same basic payroll tools with certain nuances in features, such as same-day vs two-day direct deposit or unlimited pay runs vs limited pay runs. Generally, the top payroll software offers direct deposit, tax filing, and year-end tax report preparation. Some even provide benefits and HR support.

Click through the tabs below for a more detailed breakdown of our evaluation criteria:

20% of Overall Score

We checked to see if the provider has transparent pricing, zero setup fees, and multiple plan options with unlimited pay runs. Those priced at $50 or less per employee monthly were also given extra points.

20% of Overall Score

We gave priority to those that offer multiple pay options, two-day direct deposits, tax payments and filings, year-end reporting (W-2s and 1099s), and a penalty-free tax guarantee.

20% of Overall Score

Payroll service and software should be simple to set up, customizable, and have a user-friendly interface. We also looked at whether the provider offers live support and integration options with online tools that most small and medium businesses (SMBs) use, such as accounting, time tracking, and scheduling software.

15% of Overall Score

Online onboarding, which means giving employees the option to fill out forms like W-4s electronically, is the top criterion, followed by state new hire reporting and the availability of a self-service portal where employees can view pay stubs, edit information, and access forms. Extra points were also given to providers that offer expert HR support, benefits options, time tracking, and health insurance plans that cover all US states.

15% of Overall Score

In this criterion, we assess whether the software’s ease of use, pricing, and the width and depth of its payroll and HR tools are ideal for SMBs.

5% of Overall Score

We considered user reviews, including those of our competitors, based on a 5-star scale; any option with an average of 4-plus stars is ideal. Also, any software with 1,000-plus reviews on any third-party site is preferred.

5% of Overall Score

Preference was given to software with built-in basic payroll reports and customization options.

Keeping track of payroll trends will help your business adapt to potential changes that may impact business operations. Here are some payroll trends and statistics you need to know this year.

- Payroll runs: The most common pay period in the US is biweekly pay runs, according to the Bureau of Labor Statistics (BLS) Current Employment Statistics (CES) study. Nearly half of the survey respondents, which belong to around 122,000 businesses and government agencies, pay their workers every two weeks or biweekly. The second most common pay frequency is weekly, followed by semi-monthly and monthly.

- Payment options: The 2023 “Getting Paid in America” survey conducted by the American Payroll Association shows that over 95% of employees are paid through direct deposit. This signifies the continued popularity of digital payments, reducing the risk of payroll fraud.

- Pay rates: Many workers want higher wages from their employers, according to the 2023 “Getting Paid in America” survey. 73% of the survey respondents want competitive wages over better health benefits.

Small Business Payroll Frequently Asked Questions (FAQs)

A payroll system can accurately calculate employee wages (such as salaries, overtime, and deductions for required payroll taxes) and pay workers either through direct deposits, pay cards, or paychecks. Many payroll providers also offer tax payment and filing services. Others even provide access to basic HR tools like time and PTO tracking, allowing you to easily capture employee attendance data for pay processing.

The best payroll software for small business users should meet your budgetary needs while providing the essential tools you need to compute and process employee payments and payroll taxes.

A payroll software can cost anywhere from $30 to $50 per employee monthly. You should expect to pay more if you want additional functionalities like time tracking, employee benefits, and HR advisory services.

Basic HR tools like employee data management, PTO and time tracking, and new hire onboarding are essential as these help small businesses streamline day-to-day HR tasks. Having access to benefits plans and benefits administration tools is also important. These allow you to manage workers comp, health insurance, and other employee benefits through your payroll software.

Aside from calculating earnings and deductions, payroll processing software for small business users help automate processes given its workflow and compliance tools. This helps you save time, enables you to manage payroll easily, and ensures you remain compliant with federal regulations and labor laws.

Bottom Line

Small businesses need reliable payroll software to save time and money. Most providers calculate wages, offer direct deposit, and pay taxes. However, you should consider your budget limitations and business needs. Small companies can benefit from features such as automated tax payments, year-end report filing, and unlimited payroll runs.

We found that Gusto offers all the features that most small businesses need at a competitive price. Users find it very easy to use and navigate, and the software is widely used in different industries. Sign up for a Gusto plan today.