A CD ladder is a series of four or more CDs ranging from a three-month term to a five-year term—imagine one CD on each rung of a literal ladder constantly moving up and earning interest when it reaches the top at maturity. CD laddering provides more liquidity than putting all your savings in a single-term CD, as it splits a large deposit into smaller CDs at different rates and terms.

Staggering terms in a CD ladder will ensure a CD is maturing every three months. If the shortest-term CD you open is a one-year CD, then you will be in a 12-month rotation instead of three months. The shortest-term CD determines the maturity rotation of your assets.

Live Oak Bank is a great option for building a business CD ladder. It offers term lengths from three months to five years, with short-term CD rates ranging from 3.00% to 4.20%. Visit Live Oak Bank for more information.

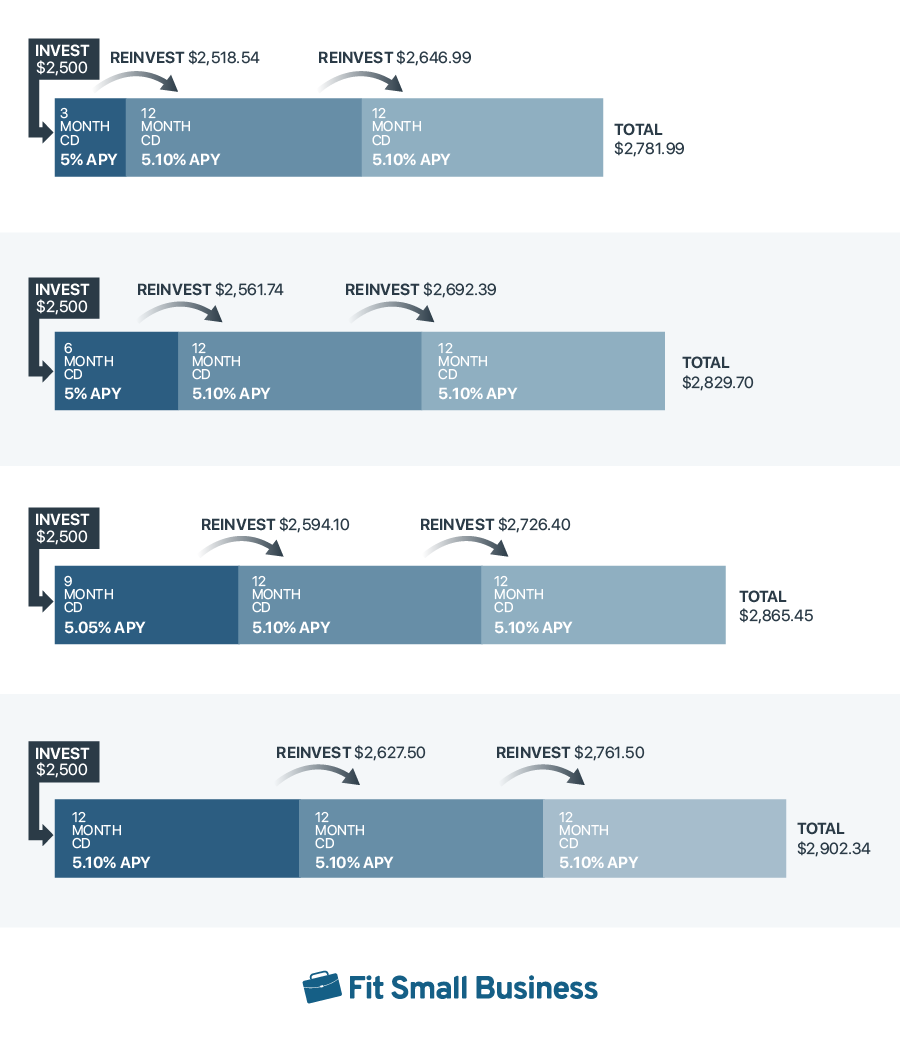

Business CD Ladder Example

The example below shows a four-CD ladder starting at three months and working up to 12 months. When each certificate of deposit matures, it is cashed out and reinvested in a 12-month CD. This ensures you have a CD maturing every three months. You can see how the original investment was $10,000. After two maturities, the cash-out amount is $1,379.48 higher than when it started.

Many business owners build CD ladders to take advantage of high interest rates without being locked into a long-term investment. When the CD is mature, you can allow it to roll over staying in the same program, or cash it out and reinvest it in a different CD term or rate. The key to making this work effectively is ensuring the CDs don’t have simultaneous maturity dates. This way, you’re always in a three-month asset rotation

• This three-month asset rotation is based on the example graphic shown above.

• The asset rotation is based on the shortest-term CD you have the CD ladder built around. If the shortest term is a six-month CD, then you will be in a six-month rotation; one year would be a 12-month rotation; and five years would be a 60-month rotation.

.

How to Build a Business CD Ladder

Building a CD ladder involves five main steps.

Step 1: Determine How Much You Want to Invest

CDs have strict maturity dates. Once you deposit your funds into a CD, the funds will be unavailable for withdrawal until the maturity date. The best way to determine how much you can invest is based on your monthly expenses. If you have your CDs on a three-month rotation, ensure you have enough liquid assets to last for three to six months.

If you need to access a CD before maturity, then you will pay a high penalty. Early withdrawal penalties can range from 90 to 365 days’ worth of interest. Do the math before opening your CDs to see what you can afford to invest.

Step 2: Decide How Many CDs You Want to Open

Decide how many CDs you feel comfortable managing. Generally, four is the minimum amount if you want to stay in the three-month rotation cycle. Opening too many CDs will make them difficult to track. When you open them, it’s a good idea to set up electronic reminders so that you never miss a maturity date.

Step 3: Choose the Maturity Terms of Each Business CD

Once you have the CD investment total in mind and know how many CDs you want to open, you can decide how you want to split it out. You can do an even or an uneven split.

- An even split means each CD would have the same amount deposited in it.

Example of a $20,000 investment with an even split | |

|---|---|

Three-month CD | $5,000 |

Six-month CD | $5,000 |

Nine-month CD | $5,000 |

12-month CD | $5,000 |

- An uneven split may be needed if you want to keep a majority of funds available at the earliest maturity. For instance, creating a plan like the one below will ensure you have at least $8,000 available every three months.

Example of a $20,000 investment with an uneven split | |

|---|---|

Three-month CD | $8,000 |

Six-month CD | $5,000 |

Nine-month CD | $4,000 |

12-month CD | $3,000 |

Step 4: Open the Business CDs

Once you have the details worked out on the CDs, it’s time to get them open. If you bank with a local branch, you can meet with a customer service representative to get the accounts open. If you use an online-only financial institution, you can open the CDs online and fund them electronically.

Step 5: Watch Maturity Dates and Reinvest or Cash in Liquid Assets

When you open your CDs, it’s a great idea to set up reminders so that you don’t forget to check on them during the maturity period alongside watching special rate promotions on different term CDs. Most banks offer a grace period of 7 to 10 days, so you can make changes on a matured CD during that time. If you don’t make changes, some banks will automatically allow a CD to roll over. If rates are lower and the CD rolls over, you are locked into the current interest rate for the term of the CD.

Pros & Cons of Building a CD Ladder

| PROS | CONS |

|---|---|

| Businesses may reach financial goals | Taking a CD out of rotation can cause the maturity dates to get out of sync |

| Increased liquidity | Interest rates may change with each renewal or reinvestment |

| Higher interest rate than a standard savings account | Multiple maturity dates to keep track of |

| Funds available at more frequent intervals | Longer terms don’t always mean higher interest rates |

| Low investment risk | |

CD Ladder Alternatives

Those who don’t want to lock their funds in a timed deposit may feel more comfortable with some alternative investment products.

Interest-earning Checking Account

Many banks offer small business checking accounts that are interest-bearing. With a checking account, your funds are available year-round. As long as you don’t go below the minimum balance you should be able to make a withdrawal with no problems. We recommend Bluevine, as it offers up to 4.25% APY on qualifying balances. You can learn more about it through our Bluevine business checking review.

Retirement Account

Many retirement accounts allow you to make deposits each year. Some plans are 401(k)s, Individual Retirement Accounts (IRAs), and Roth IRAs. If your main goal is to save for retirement, this may be a good option. Since these are business funds, check with your accountant for proper instructions before making this type of deposit.

Investment Account

These accounts come with a measure of risk. If you’re considering an investment account, meet with a financial advisor to ensure you understand the risk involved and how aggressive you need to be to make the desired return. Some options are stocks, bonds, and mutual funds.

Savings Account

A savings account is another safe option, as you can make withdrawals at any time of the month as needed. You will need to check with your bank to see if there is a limit to the amount of times you can withdraw without incurring a fee. For our recommendations, see our roundup of the best business savings accounts.

Money Market Account (MMA)

MMAs are a good place to store excess reserves. Many banks offer tiered MMAs based on the balance—the higher your balance, the higher tier you qualify for, and the higher interest rate you earn. MMAs are a low-risk way to earn interest while maintaining access to your funds by check or debit. Our article on how a business MMA works can help you decide whether an MMA fits the bill.

Frequently Asked Questions (FAQs)

Building a CD ladder allows you to earn a higher interest rate for agreeing to keep your funds on deposit for a certain length of time. Staggering the terms will stagger the maturity dates, which gives the business a constant cycle of funds coming to maturity and available to draw from.

Putting CDs on a ladder cycle gives the business owner a set schedule, so they’ll know when funds will become available. This allows them to plan for larger purchases and make withdrawals from a CD in the event of a financial setback. CDs generally pay higher interest rates, so having a CD ladder strategy is a good investment for businesses with cash reserves.

A CD is a timed deposit with a set maturity date. Funds are deposited into the certificate with the account holder agreeing not to make a withdrawal until the maturity passes and the CD is in the grace period. This is generally a higher interest-earning product compared with a standard business savings account. CDs are great for businesses with liquid assets that are not needed immediately.

A CD is a timed deposit where the entire balance is frozen for the term of the CD, so if you make an emergency withdrawal from a single CD, it will come with a high penalty. Meanwhile, CD ladders are built from single CDs with different maturity dates. This would generally include a minimum of four CDs however many businesses add more.

Bottom Line

Building a CD ladder is an excellent way to earn higher interest with a low-risk investment, and a properly structured CD ladder will keep your liquid assets available and in constant rotation if you stagger the maturity dates. This method of investing will allow you to earn more interest than a regular savings account. Determining how much of your reserves you have available to deposit in a CD ladder will require some calculation, and by doing this, you will ensure you have enough funding available for daily expenses and plenty of working capital until the next CD maturity date rolls around.