A mortgage loan-level pricing adjustment (LLPA) is an adjustment to the costs involved with getting a home loan. LLPAs are usually based on the characteristics of a loan—such as the loan amount, property type, down payment amount, credit score, and occupancy type. The amount of the adjustment can vary based on the loan program and the lender you’re working with.

LLPAs often come in the form of an additional fee to reflect the added risk level of a certain characteristic of your loan. However, LLPA credits also exist to reduce certain loan costs. Being aware of LLPAs can help you save money, as you may be able to adjust the characteristics of your loan application such that certain LLPA fees are reduced or eliminated. Similarly, you may also be able to have certain LLPA credits applied to your loan.

Types of Loans With LLPAs

Mortgage LLPAs can be applied to many different types of loans. In some cases, the same LLPAs may be applied universally to all loans of a particular type. Mortgage lenders issuing conventional home loans, for instance, often use the standardized Fannie Mae LLPA matrix. Lenders issuing portfolio loans, on the other hand, may utilize their own internal LLPA adjustments.

How LLPAs Are Determined

Mortgage LLPAs can be a percentage of the amount you’re borrowing or a flat dollar amount. LLPAs are typically risk-based—in other words, certain loan characteristics that indicate a greater risk of default may have added costs in the form of an LLPA.

You can think of it like a car insurance premium where drivers with certain characteristics, such as a history of being in accidents, may have higher costs associated with their insurance premiums because they have a greater likelihood of filing an insurance claim.

Mortgage LLPAs work similarly. If you view the Fannie Mae LLPA matrix above, you’ll see that many of the added costs are associated with loans that demonstrate a greater risk of default and financial loss for lenders. Low credit scores and properties with less equity, for instance, are associated with greater LLPA costs.

Example of Mortgage Loan-level Pricing Adjustments

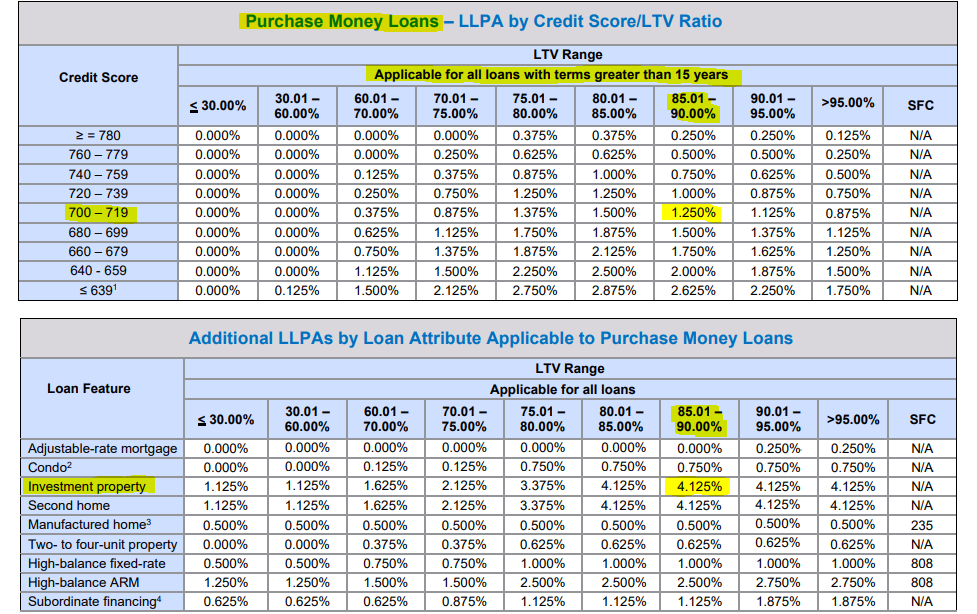

To illustrate how you would determine the LLPAs that would apply to a loan, let’s take a conventional mortgage application with the following characteristics and a lender using the Fannie Mae LLPA matrix shown below:

- Purchase loan with a sales price of $340,000

- Requested loan amount of $300,000 (12% down payment, or an 88% loan-to-value (LTV) ratio)

- Loan term of 30 years

- Borrower credit score of 710

- Intended use of the property being purchased is rental/investment property

Using the Fannie Mae LLPA pricing matrix, we can see that two LLPAs would apply. Note that we’ve highlighted portions of the image of the tables below to correspond with the relevant bolded loan characteristics above:

- Credit score/LTV LLPA: $3,750 (calculated by taking 1.25% × the loan amount of $300,000)

- Loan feature/LTV LLPA: $12,375 (calculated by taking 4.125% × the loan amount of $300,000)

Thus, the total added costs to this loan would be $16,125.

A portion of page 2 of the Fannie Mae LLPA matrix dated March 20, 2024. (Source: Fannie Mae)

Common Mortgage LLPA Costs

Since LLPAs can vary by lender and loan program, it’s not feasible to create a list of all possible types of pricing adjustments. However, below is a list of the most common types of LLPAs, along with brief explanations of what they are.

The LTV ratio shows the loan amount in relation to the value of the property. It’s another way to show how much equity a borrower has in the property being financed. Borrowers with more equity, or lower LTV ratios, demonstrate a lower level of risk as they have a greater ability to sell the property for a net gain in the event of financial distress. Similarly, if a bank does have to foreclose on the property, there is a greater likelihood it can recoup its financial losses.

Credit scores are meant to be an indicator of a borrower’s likelihood of defaulting on debt. Personal scores typically range from 300 to 850, with scores above 720 generally being regarded as good. Borrowers with lower or bad credit scores are viewed as more likely to miss a payment, and because of this, they should expect to have to pay additional LLPA fees to reflect this increased risk.

Less complex property types, such as single-family homes, represent a lower level of risk for lenders. By contrast, more complex properties, such as condominiums and planned unit developments (PUDs), may have certain nuances—like bylaws, homeowner association budget reserves, and covenants, conditions & restrictions (CC&Rs)—that can make a property more vulnerable to becoming financially distressed.

Owner-occupied properties are generally regarded as a lower level of risk for a lender. One train of thought for this is that a homeowner is less likely to abandon the property they’re currently living in. By contrast, vacation homes and investment properties are seen as greater risk as they are not a homeowner’s primary source of shelter.

Loans with longer repayment terms generally represent a greater risk of default due to the increased period in which a borrower’s income could be impacted. As a result, longer repayment terms may carry added LLPAs and fees to reflect this increased level of risk to the lender.

Many lenders view adjustable-rate mortgages (ARMs) as more risky than fixed-rate mortgages. This is because interest rates on ARMs can be increased, something that may create financial hardship for the borrower and increase the likelihood of default.

Subordinate financing means there is another mortgage or other type of lien against the property. The holder of this second lien must agree to be placed in second position—and being placed in a secondary position is significant because, in the event of a default, any proceeds that are recouped will go first to the primary lien holder until they are fully paid. As a result, secondary and tertiary lienholders become less likely to receive proceeds.

A cash-out refinance is a transaction in which a borrower wishes to convert their home equity into funds they can use for other purposes. It usually involves getting a new mortgage with a balance greater than the one being paid off. Certain other transactions may also be classified as a cash-out refinance, such as if the borrower wishes to pay off non-mortgage debt like credit cards or auto loans.

Mortgage LLPA Credits & Waivers

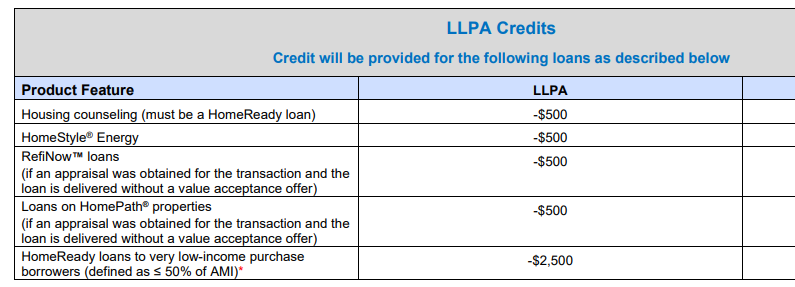

Not all LLPAs are an added cost to a loan. Certain loan characteristics can act as credits to reduce your loan’s closing costs. The program you choose may also entitle you to waivers of LLPAs that might otherwise apply.

Below is a screenshot showing credits that could apply to a conventional mortgage loan being sold to Fannie Mae.

A portion of page 6 of the Fannie Mae Loan-level pricing matrix shows certain available credits. (Source: Fannie Mae)

How You Can Save Money with LLPAs

LLPAs may not always be clearly disclosed or discussed with you, but you can always ask. Being aware of LLPAs can end up saving you a significant amount of money, especially if you are near the threshold of a lower tier of pricing for a particular loan characteristic. By cutting back on costs, you’ll be able to more easily afford financing, a major step in getting a small business loan.

Below are two examples of the impact small adjustments to your credit score or down payment amount could have on your closing costs.

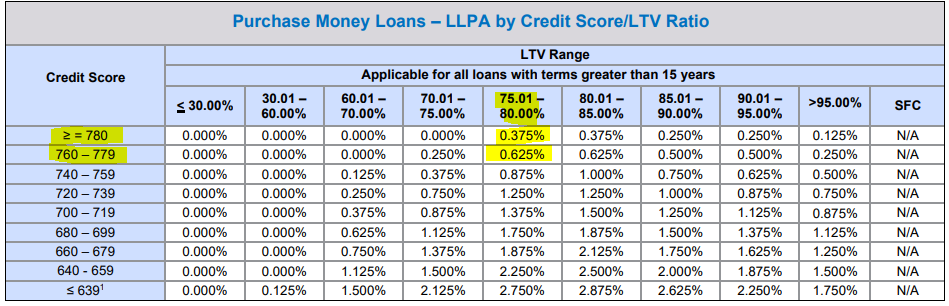

1. Increase Your Credit Score

Let’s take a 30-year purchase loan with a requested loan amount of $400,000 for an investment property and a borrower with a 20% down payment. Using the Fannie Mae LLPA pricing matrix as an example, we can see that a borrower with a 778 credit score would have an additional 0.625% of the loan amount added to their closing costs. A borrower with a 780 credit score, on the other hand, would only have an additional 0.375% added.

In other words, the borrower with a 780 credit score would be paying 0.25% less and saving $1,000 in costs (calculated as 0.25% × the loan amount of $400,000)

The credit/LTV pricing adjustments section of the Fannie Mae Loan-level pricing matrix for purchase loans (Source: Fannie Mae)

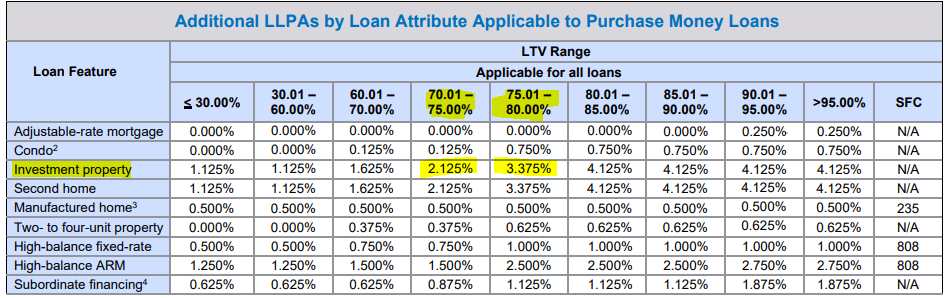

2. Use a Larger Down Payment

As another example of how being knowledgeable about LLPAs can save you money, let’s compare borrowers with slightly different down payment amounts. We’ll assume the same $400,000 loan amount and intended use as an investment property, and then compare the costs associated with a borrower who makes a 25% down payment with one who makes a 20% down payment.

Using the Fannie Mae pricing matrix below, we see that the borrower with a 25% down payment would pay an additional 2.125% of the loan amount in fees, while the borrower with a 20% down payment would pay 3.375%.

That’s a difference of 1.25% which would result in a savings of $5,000 for the borrower who makes the larger down payment (calculated as 1.25% × the loan amount of $400,000).

The loan feature/LTV pricing adjustments section of the Fannie Mae pricing matrix (Source: Fannie Mae)

Frequently Asked Questions (FAQs)

No, LLPAs do not directly affect the interest rate or the monthly payments on your loan. They may, however, increase your loan’s annual percentage rate (APR), a figure meant to illustrate the total cost of a loan when fees are considered.

LLPAs typically come in the form of a flat dollar amount or as a percentage of the loan amount. For example, an LLPA of 0.125% would equate to $500 on a loan amount of $400,000, calculated as 0.125% multiplied by $400,000.

This varies by loan program, type, and lender. Common LLPAs, however, include things like your down payment, LTV ratio, credit score, property type, occupancy of the property, and loan amount.

Bottom Line

Mortgage loan-level pricing adjustments are typically fees that are applied based on certain characteristics of your loan. However, LLPAs can also come in the form of credits. The type and amount of LLPAs can vary by lender and loan program, and being knowledgeable about how they work can help you reduce your closing costs.